When can pulp prices be expected to subside?

Wood pulp is a major raw material used for virgin paper-based packaging. Hence, price movements in the pulp market have a major impact on the prices of tissues, paper, carton board, and containerboard. The pulp market has been witnessing an unprecedented surge in prices due to gaps in supply and demand at the global level. Some of the major factors that have impacted the prices include logistics challenges, high freight costs, low operational rates at mills, and high demand. However, the market outlook is expected to change with an anticipated decline in wood pulp prices. This study provides insights into future pulp prices in the global market.

Factors Impacting Pulp Prices:

The prices started to mount in the early months of 2022, mainly because of truckers’ protests in Canada and the spread of the omicron variant of COVID-19. Owing to these factors, pulp producers witnessed a shortage of labor and drivers for the shipment of pulp from their mills to buyers. These events triggered supply shortages across the global market. The supply availability in contract, spot, and resale markets had reduced, which helped pulp producers implement large-scale monthly price hikes of about $100/tonne during the summer of 2022. This was further accompanied by high demand across end-user industries. Thus, buyers had to accept the price hikes and did not resist the price hike situation. Earlier, the increase in pulp prices had also helped buyers to implement hikes for their end-products, since it supported their attempts at price hikes. However, as the pulp prices increased further, it became unsustainable for buyers, as high input costs impacted their profit margins. The major factors impacting pulp prices are

-

Container shortages for shipment – There have been shortages of containers for pulp shipment in many regions, especially in Latin and Central America. The shortage of containers for pulp shipment is likely to persist through Q1 2023 in Latin and Central America, as many containers are lying idle in North America. Thus, container and shipment rates are especially high for import-dependent countries that are impacted by high container rates. Thus, global buyers faced long shipment delays. Asian buyers were unable to procure their shipments in due time, which led to inventory shortages and high demand in the past months of 2022 (first half of 2022). However, the impact of container shortages is expected to have a lesser impact on pulp prices in the coming 2–3 months, as pulp prices are expected to decline in the region as the demand is expected to decline in the global market along with strong resistance from buyers against high pulp prices

-

High freight costs – Most major pulp suppliers had been struggling with high road freight costs. Road freight costs had increased owing to a lack of truckers and drivers for road and train transportation. The shipments to the buyer locations had become expensive for the producers, and hence, suppliers had pushed for price hikes. In addition, because the inventory levels at the producers’ end were low, producers pushed for high prices for buyers who were willing to pay premium prices to secure their order requests.

-

Armed conflict between Russia and Ukraine – The conflict in Ukraine did not have much impact on the pulp market. However, due to sanctions on Russia, the shipments of wood and pulp from Russia to European countries were restricted, thereby adding pressure to other hardwood pulp suppliers in the already tight supply European market. In addition, the demand for eucalyptus pulp (BEK) had increased since it was sourced as an alternative to Russian-sourced birch. These combined factors had led to a further surge in prices in Europe. However, in the coming months, fluctuating energy prices are expected to impact pulp production and costs, as sanctions have led to an increase in energy prices, thereby impacting the operations for pulp production. With Russia planning to increase energy prices in Europe, the prices of pulp and paper are expected to be affected as well. The prices and production of pulp, paper, and board are expected to be affected by rising energy prices in the coming months; therefore, some suppliers are charging energy charges over the standard RISI prices.

-

Lockdown in China – With China being the major buyer location for the wood pulp market, any disruption in the Chinese market will have a ripple effect on the global (especially North American) pulp market. Since many regions in China have been under lockdown restrictions due to their Zero-COVID Policy, the shipment of pulp from ports to mills and buyers has been disrupted, leading to a supply shortage situation. However, since August 2022, the demand for wood pulp has started to decline because the demand for paper and board has reduced owing to lockdown restrictions. Thus, the pressure from Asian buyers to reduce prices is expected to increase. With a dip in shipment to China, the supply in other regions is expected to increase, which will also lead to price drop conditions in other regions.

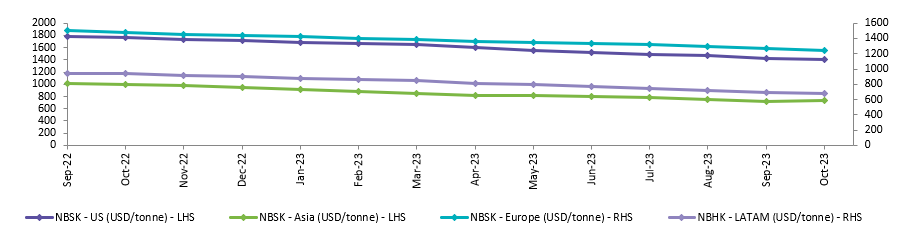

Pulp Price Dynamics:

| Region | Expected Price Outlook | Next 3 months Price Outlook | Next 4-6 months Price Outlook |

|---|---|---|---|

| US |

|

Decrease | Decrease |

| Europe |

|

Stable and then Decrease | Decrease |

| APAC |

|

Decrease | Decrease |

| LATAM |

|

Stable and then Decrease | Decrease |

Conclusion:

Thus, pulp prices are expected to decline globally. Prices for softwood pulp are expected to witness a decline in September in North America and Asia, as the pressure from buyers is expected to increase. In addition, prices are expected to decrease with the expected increase in supply levels. However, prices are expected to remain stable for another month in Europe and Latin America, as the demand is expected to remain steady.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe