What drives the surfactants prices? The Years Ahead

Abstract

Surfactants—one of the key derivatives in the petrochemical value chain—is known for its versatility and is widely used across various industries. Its physical properties along with its impact on the total cost of production have positioned it as a critical expense for supply chain managers in the home and personal care production process. In the recent past, the surfactants value chain witnessed few notable events, like the supply rationalization in China post environmental regulatory, increased tariffs by the U.S. for imports from China, and lower palm and crude oil prices. These factors have influenced surfactant prices directly and indirectly, resulting in price volatility.

The purpose of this article is to provide an overview of the factors that influenced surfactant supplier pricing in recent times and to highlight possible key price driving factors in the near future.

What influenced the surfactant pricing in the past?

1. Feedstock Supply Volatility:

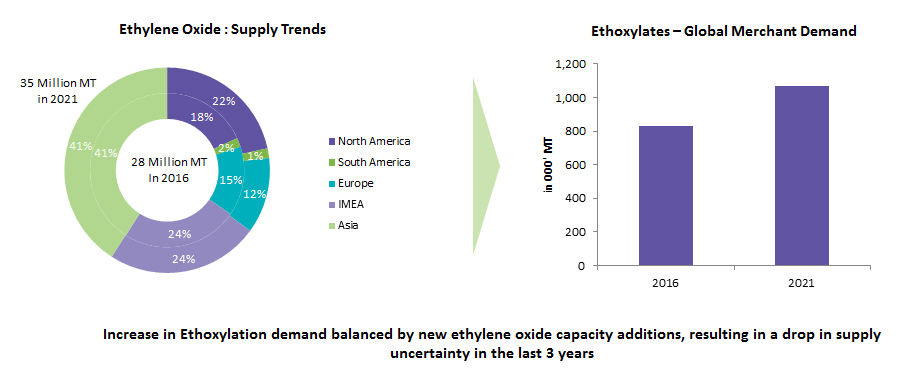

Ethylene Oxide—the raw material in the surfactant production process—has been a key driver for surfactant pricing from 2010 to 2015. The global ethylene oxide market experienced a period of volatile supply in the recent past owing to a low production scenario and cross industry demand (polymer production) for the base raw material, Ethylene. This resulted in sluggish growth in the end surfactants production. The overall global ethoxylates supply deficit was estimated at around 5 million MT in 2016, primarily driven by Asia, which had a supply deficit of around 3 million MT. The steady increase in the supply of Ethylene Oxide in the global market from 0.4 million MT in 2005 to 5 million MT in 2018 contributed to the installation of new ethoxylation plants in the last four years. This is evident from the installation of around nine ethoxylation plants with a production capacity of 730,000 MT of surfactants in China after 2014

2. Feedstock Prices

| Region | Asia | Europe | US |

| Supplier Profit Margins | 8-10% | 10-15% | 10-20% |

3. Alternative Chemistry

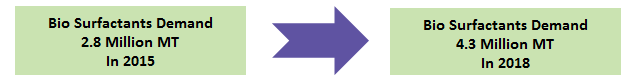

Stricter environmental regulations in both the European and Chinese markets have resulted in a rationalization of synthetic surfactants supply and also favored a shift towards bio-surfactants or plant-based surfactants.

Technological advancement and innovation have resulted in an increase in the shelf life and cleaning properties of the bio-based surfactants, in line with synthetic surfactants. For instance, glucose-based surfactants are likely to replicate almost all key properties of the traditional surfactants, thereby increasing its preference among the plant-based surfactants in personal care products. The significant increase in the preference of raw materials have also influenced the pricing of the surfactants during 2015-2018.

What will influence surfactants pricing in the near future?

The surfactants industry is set to stabilize during the next two years (2019-2020) after experiencing a major shift in the feedstock dynamics, technological innovation, and customer preferences in the recent past.

- As the industry evolved, the prices were mainly driven by various factors based on the industry maturity. Prior to 2010, the prices of surfactants were primarily driven by demand trends and the wide use of detergents and personal hygiene products in emerging economies.

- Post 2010, the emergence of new technology, environmental regulations, capacity expansion in both raw materials and surfactants, innovations, and bio based raw materials have all influenced surfactant prices over and above the raw material prices.

- In 2018, surfactants prices declined, irrespective of higher crude oil prices during Q3. Suppliers were not able to increase their prices parallel to that of raw materials due to competition and the reluctance of buyers to quote against the raw materials trend in a balanced market scenario.

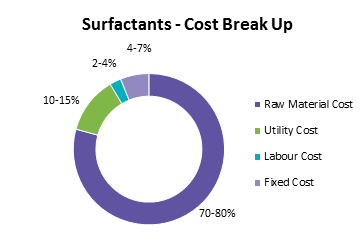

Going forward, the scope for adequate supply, lower raw material prices, and a much diminished scope for innovation in the synthetic surfactants market may encourage buyers to opt for a raw material based pricing scenario. This may increase the scope for the relevance of raw materials in surfactants pricing across all sourcing regions for the next 1-2 years.

Conclusion

Surfactants prices were driven by various factors, limiting the impact of raw material prices during the first half of this decade. However, moving forward, raw materials are expected to be a key influencer of surfactant pricing. Increased competition and narrowing margins in the Consumer Packaged Goods (CPG) segments may encourage surfactant suppliers to transfer the cost benefits associated with raw material prices to downstream buyers.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe