Adoption of Virtual Data Room (VDR) in mergers and acquisitions improves cost-effectiveness

Abstract

Document security, access security, user interface and accessibility are the key capabilities in Virtual Data Room (VDR). Cost savings, reduction in process time, compliance and transparency are going to be the key factors that can overcome security concerns in VDR. The market is also driven during scenarios such as bankruptcy, clinical studies, due diligence and IPO & Exits.

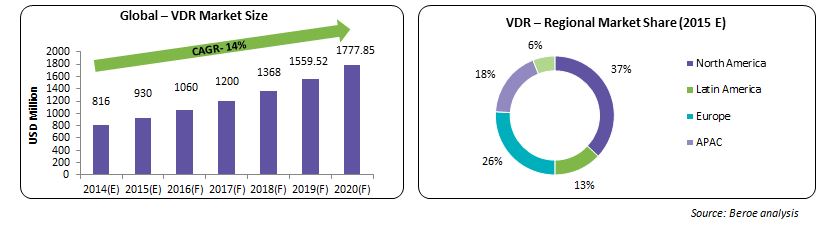

Virtual Data Room market is growing at a CAGR of 14 percent; Asia Pacific is the fastest growing market with an estimated CAGR of 20 percent from 2014 through 2020.

What is Virtual Data Room (VDR)?

It is an online repository of information which is used to store and share documents. This application is mainly used in various business cycles such as bankruptcy, clinical studies, due diligence, mergers & acquisitions, private equity and organizational restructuring.

Virtual Data Room market overview

- The market size of Virtual Data Room was ~$816 million in 2014, and it is expected to reach $1,777.85 million by 2020, with a CAGR of 14 percent

- North America has the largest market share. Asia Pacific is the fastest growing market, with an estimated CAGR of 20 percent between 2013 and 2017

- According to a research conducted by Drooms (the study surveyed 100 professionals and managers of the European economy), Virtual Data Room is being used for 35 percent of all critical corporate transactions, such as commercial real estate sales, and mergers and acquisitions

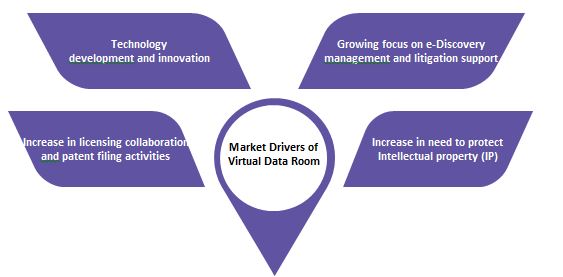

Virtual Data Room Market Drivers:

What are the factors that contribute to the increased usage of VDRs in the M&A process?

- The advanced capabilities such as Document Security, Access Security and User Interface of VDR have created powerful platforms on which mergers and acquisitions can be easily managed. The Virtual Data Room application is not just used for due diligence processes rather the platform has often become a medium for conducting the entire deal cycle

- Audit trail functions can help to track the documents uploaded by different parties, which would assist enterprises to profile and rank potential buyers, based on their level of interest and it will indicate the most frequently accessed documents

- Other important functions of VDR – editing of documents, different levels of secure access for different stakeholders, intelligent file indexing, search function and Q&A function

Virtual Data Room providers have transformed the due diligence process for mergers and acquisitions

- In the past 10 years, Virtual Data Room solution providers have transformed the due diligence process for M&A deals and related transactions within the financial and legal sectors

- Support for different file formats and Q&A discussion options has reduced complexities associated with the deal process and have contributed to the reduction of overheads and time

- Virtual Data Room providers use 256-bit and 512-bit encryption to secure confidential data of their buyers. Banks could leverage the benefits of data rooms for their day-to-day business activities. They can use them as corporate repositories and for information sharing

- VDR solutions are used for decision-making amongst banks, law firms and within corporate and enterprise organizations. They also play dominant roles in M&A deals

- The above mentioned improvements in VDR technology will enable great flexibility in sharing and providing access to confidential files on cloud storage

- Ever changing legislations and economic recovery is likely to result in more M&A transactions. The advancements in VDR are expected to increase the cost effectiveness of M&A transactions to drive higher returns

Challenges associated with VDRs

Offline data security - breach

- Data security is an important challenge associated with VDRs in the current scenario. Since this application is used to share confidential information, it requires maximum grade security such as 128-Bit SSL Encryption, 256-Bit SSL Encryption, Dynamic Watermarks and Virus Scanning

Cyber Security

- Cyber security is a major concern for Virtual Data Room service providers and buyers involved in M&A process due to confidential information such as pre-IPO due diligence reviews, bankruptcies and restructurings, audits, proprietary intellectual property and fundraising initiatives

- Buyers face cyber security threats such as viruses, trojan horses, phishing and various forms of advanced persistent threats. Therefore, there is an increasing need to implement innovative and sophisticated technologies to protect against various security threats, especially to reduce vulnerability in business segments

Mitigation

- VDR providers should ensure the availability of the following functional capabilities:

- Strong username and password control to prevent unauthorized users from gaining access

- End-to-end encryption using Secure Sockets Layer (SSL)

- Document encryption

- Deterrence features such as watermarking all documents on the computer screen to prevent photographing or printing of sensitive data

- Enhancing current functionalities of VDR:

- Improvised drag and drop functionality: State-of the-art platforms help in creating structures on computer with folders and sub-folders which can be used for uploading the information quickly and easily to the data room

- Creating Index with extensive data room management on behalf of the buyer: An experienced provider should be chosen who can provide an index template

- Advanced admin and access control: Allowing administrators to set different levels of access to different users will ensure an easily traceable audit record and increase data rooms’ integrity

Technology Trends in VDR

- Over the last five years, the use of VDRs has rapidly increased. Clients are using VDRs much earlier in the transaction lifecycle and are also leveraging them internally between advisers and transacting company (Seller Side Company) to prepare documents before initiating discussions with potential investors or bidders

- VDRs have extensively evolved over the years and have slowly transitioned the way we work by offering tools to facilitate content management, workflow, collaboration and analytics

- Advanced security, customizable workflows and intuitive user interfaces in today’s systems are more focused on improving the end users’ experience

- VDR providers have also embraced the mobile market by offering native or browser responsive UIs. Five years ago, before the rapid advancement of today’s browsers, VDRs were limited in what they could offer in terms of plug ‘n’ play for the end user

- The experience was cumbersome for users since they require special plug-ins to view or upload content. Improvements in browser technology with the introduction of HTML5 have enabled Virtual Data Room providers to evolve their platforms into a user friendly, plug-in free platform without compromising on security

Conclusion

- Mergers and acquisitions are one of the major driving factors for the increase in Virtual Data Room market as it allows enterprises to reduce overheads such as travelling and legal process expenses, and save time on complex processes

- VDR suppliers ensure high level of security services to all of their buyers through technologies such as Advanced Encryption Standards (AES) and data backup services. This has reassured buyers to procure Virtual Data Room services during mergers and acquisitions

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe