U.S. Gelatin Market Tightness in 2022

The overall availability of gelatin is projected to tighten, driven by the increasing use of gelatin to manufacture collagen and the increase in medium and high bloom gelatin usage because of its applications in the pharmaceutical and nutraceutical segments. Demand from these two segments is likely to remain elevated given the rising health-conscious consumption patterns of consumers, which strengthened further because of the pandemic.

Current market figures show that gelatin is still available in the market. However, the U.S. collagen demand is expected to register a CAGR of 6.25 percent between 2022 and 2026, whereas the U.S. gelatin supply growth is expected to record a CAGR of 3.30 percent over the same period. This mismatch between demand and supply growth could pose a potential risk for the availability of gelatin for direct sales in the market as manufacturers tend to consume more gelatin for collagen manufacturing.

Further, feedstock availability is expected to remain tight in the U.S., with both pig and cattle slaughter volumes projected to contract in 2022, thereby tightening pig skin and bovine bone and hide supply in the U.S.

Supply Outlook: U.S. domestic production of gelatin is projected to increase to 66,070 MT in 2022 and is estimated to register a CAGR of 3.40 percent during 2022–2026, driven by the continued increase in demand from the major downstream sectors. By contrast, the total market availability, including imports and exports, is projected to record a CAGR of 3.30 percent over the same period.

The overall availability of low bloom grade gelatin in the U.S. is projected to tighten, driven by the increasing use of gelatin to manufacture collagen and the increase in medium and high bloom gelatin usage supported by elevated demand from rising health-conscious consumption because of the pandemic.

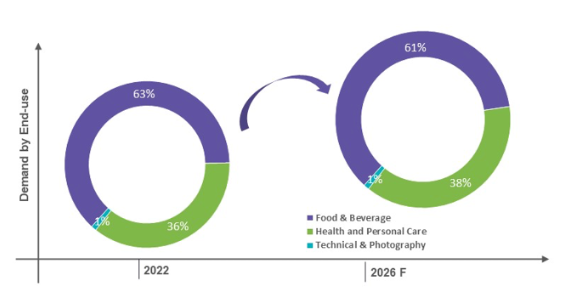

Demand Outlook: the U.S. gelatin market is projected to register a CAGR of 3.3 percent during 2022–2026. The strongest growth is expected from the health and personal care segment, which is projected to grow at 5–6 percent, increasing its market share by capturing 2 percent of the F&B segment by 2026.

Gelatin use for collagen production in the U.S. is projected to witness a significant rise of 10.8 percent Y-o-Y in 2022, with the overall U.S. collagen market demand forecast to witness a strong CAGR of 6.25 percent during 2022–2026, driven by elevated demand from the major downstream sectors.

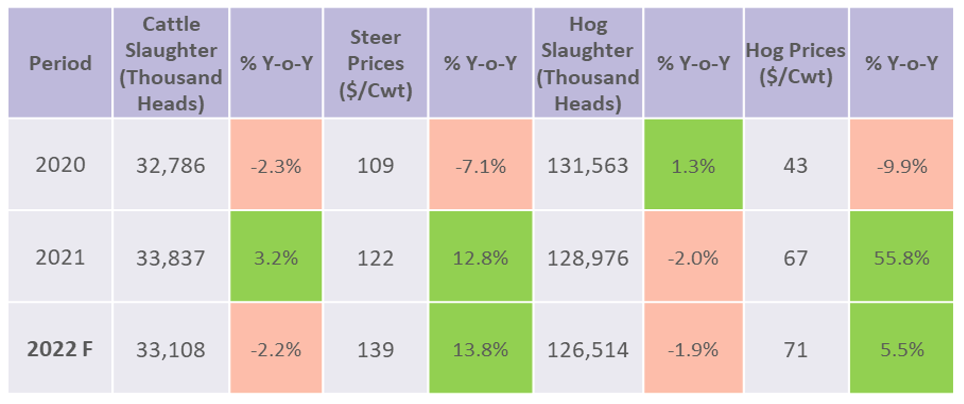

Feedstock Outlook: The U.S. cattle and hog market has been tightening, with slaughter volumes projected to reduce by 2.2 percent and 1.9 percent Y-o-Y in 2022, respectively. A decline in slaughter rates coupled with supply constraints because of the pandemic is estimated to tighten feedstock availability for gelatin in the U.S. (pig skin, bovine hide, and bone).

Feedstock availability for gelatin in the U.S. is anticipated to remain tight in 2022 because of the pandemic, resulting in supply constraints such as trucker shortages and high absenteeism in the meat rendering industry, resulting in lower slaughter rates and high levels of wastage in the meat rendering process.

Global and U.S. Gelatin Market Overview

-

The global gelatin market size was estimated at 545,000 MT in 2021 and is expected to witness a CAGR of 4.5 percent during 2022–2026, driven by rising demand from the downstream food and beverage and pharmaceutical and nutraceutical industries.

-

The food and beverage industry is the major end-use industry of gelatin, contributing ~63 percent to the total end-use application in 2021, followed by the health and personal care industry, which includes the pharmaceutical, nutraceutical, and cosmetic segments. The increasing demand from these two industries is likely to result in rising competition for gelatin use in the coming years.

-

Supply and demand go hand-in-hand in this industry and have no significant gap, with all suppliers operating at ~90–95 percent of their installed capacities to meet the demand.

-

The U.S. gelatin market size is estimated at 94,560 MT for 2021, accounting for a ~18 percent share in the global market, and is projected to register a CAGR of 3.3 percent during 2022–2026.

U.S. Gelatin Market Segmentation and Growth Projections

The U.S. gelatin market is projected to record a CAGR of 3.3 percent during 2022–2026. The strongest growth is anticipated from the health and personal care segment, which is projected to grow at 5–6 percent, resulting in an increase in its market share by capturing 2 percent of the F&B segment by 2026.

Historically, a sudden surge in demand has never occurred in the food or pharmaceutical industries. However, the sharp rise in competition for market share has been attributed to the COVID-19 pandemic, which has led to the change in consumption patterns by end-users. Increased demand for processed food and higher retail consumption of food and beverage for home consumption because of the ongoing pandemic is estimated to support consumption levels from the F&B sector.

Sources: USDA, Company Reports, Research Journals, Beroe Analysis

- Increased demand for processed food and higher retail consumption of food and beverage for home consumption because of the ongoing pandemic is estimated to support consumption levels from the food and beverage segment.

- The surge in health-conscious consumption and growing emphasis on personal care has strengthened because of the pandemic. This is likely to support demand from the cosmetic sector for hair and skin products along with the pharmaceutical sector, where gelatin is used in soft/hard gel capsules, tablets, emulsions, suppositories, or syrups. The high growth observed in the nutraceutical segment is likely to remain supported by rising immunity boosting consumption patterns, such as for nutritional supplements, and growing awareness of general well-being of health.

U.S. Gelatin Feedstock Availability

Feedstock availability for gelatin in the U.S. is anticipated to remain tight in 2022 because of the pandemic, resulting in supply constraints such as trucker shortages and high absenteeism in the meat rendering industry, resulting in lower slaughter rates and high levels of wastage in the meat rendering process.

While hog slaughter is projected to witness two consecutive years of decline in volume, with slaughter projected to fall 1.9 percent Y-o-Y in 2022, the availability of pig skin used as a feedstock to manufacture gelatin is expected to remain tight. Further, cattle slaughter volumes in the U.S. are estimated to contract 2.2 percent Y-o-Y in 2022, which along with disruptions in the meat rendering sector owing to the pandemic is likely to tighten the supply of bovine hide and bone used to produce gelatin.

Benchmark U.S. prices for cattle and hogs are projected to witness inflation in 2022, driven by tight supply, high demand, and surging animal feed costs.

Sources: USDA, Company Reports, Research Journals, Beroe Analysis

U.S. Gelatin and Collagen Market Dynamics

Gelatin use for collagen production in the U.S. is projected to witness a significant rise of 10.8 percent Y-o-Y in 2022, mainly attributed to the elevated levels of demand for collagen from its major downstream sectors that have end-use applications across the healthcare, cosmetics, and food and beverage industries.

Collagen has widespread applications across a diverse range of personal care products and cosmetics because of its moisturizing and skin healing properties, finding usage as an ingredient in baby oils, anti-aging creams, lotions, and cosmetics. Collagen is also used in hair care products as it provides strength to the hair root.

The growing consumer preference for health-conscious consumption augmented by the pandemic has elevated the demand for collagen from the major downstream segments, especially from the nutraceutical segment where health supplements have witnessed surging use coupled with personal care. The overall U.S. collagen market demand is projected to record a strong CAGR of 6.25 percent during 2022–2026.

|

Ammount of Gelatin used for collagen production in the US (Volume-Metric Tons) |

||

|

Period |

Volume (Metric Tons) |

|

|

Realized |

2019 |

16,075 |

|

Realized |

2020 |

16,321 |

|

Realized |

2021 |

17,397 |

|

Forecast |

2022 |

19,271 |

|

Expected CAGR (%) |

2022-2026 |

6.30% |

|

US Collagen Market-Size Demand (Volume-Metric Tons) |

||

|

Period |

Volume (Metric Tons) |

|

|

Realized |

2019 |

30,330 |

|

Realized |

2020 |

31,887 |

|

Realized |

2021 |

34,045 |

|

Forecast |

2022 |

36,224 |

|

Expected CAGR (%) |

2022-2026 |

6.25% |

Low Bloom Gelatin Market Shortage in the U.S.

The COVID-19 pandemic significantly impacted the overall food and beverage industry. The restrictions imposed have resulted in short supply and disruption in the supply chain, hampering the local/domestic players in the market. The demand for products with a high nutritive value, which offers multiple health benefits, increased. Gelatin and collagen are widely used in supplements targeted toward the aging population, thereby, raising the demand for medium and high bloom gelatin, which are used in pharmaceutical and nutraceutical products.

In particular, the demand for collagen-based supplements by the aging population is anticipated to increase, driven by an emphasis on health, immunity, and overall wellness. Moreover, given the increasing health concerns because of the pandemic, consumer focus on food and beverage product labels has increased. This market trend (or benefit territory) triggered food and beverage manufacturers to launch new products and explore new platforms by fortifying their products with gelatin and other collagens, popular among consumers as health-benefiting ingredients. The rising demand for health supplements, in which high and medium bloom gelatin is used, such as in hard/soft gel capsules, tightened availability. In the short term, the pandemic affected the daily operations of gelatin/collagen manufacturing and overall supply because of restrictions on transportation and a shortage of laborers, as well as feedstock availability due to supply disruptions from the slaughter industry in the U.S. However, the pandemic itself was also a reason for the boost in the sales of gelatin and collagen during and post the COVID-19 outbreak, as it attracts attention from health-conscious consumers of different end-products in which collagen is used, such as food, beverages, and nutritional products.

Potential Market Availability in the Future

An increase in collagen usage is causing major market players to reserve more quantities of gelatin for collagen production, as the demand for collagen is slightly higher than gelatin. This situation has resulted in a higher demand growth expectation for collagen and also potentially higher margins for the producers.

Current market figures show that gelatin is still available in the market. However, the U.S. Collagen demand is anticipated to register a CAGR of 6.25 percent between 2022 and 2026, whereas the U.S. gelatin supply growth is expected to record a CAGR of around 3.30 percent during the same period. This mismatch between demand and supply growth could pose a potential risk to the availability of gelatin for direct sales in the market, as manufacturers tend to consume more gelatin for collagen manufacturing.

Although figures vary among producers, as indicative data, the average gross margin of the producers for collagen is 38 percent, whereas it is around 29 percent for gelatin, which would lead to a product mix in favor of more collagen when enough demand exists. Hence the overall availability of low bloom grade gelatin is projected to tighten, driven by the increasing use of gelatin to manufacture collagen and the increase in medium and high bloom gelatin usage because of its applications in the pharmaceutical and nutraceutical segments. Demand from these two segments is likely to remain elevated given the rising health-conscious consumption patterns of consumers, which strengthened further because of the pandemic. Further, feedstock availability is expected to remain tight in the U.S., with both pig and cattle slaughter volumes projected to contract in 2022, thereby tightening pig skin and bovine bone and hide supply in the U.S.

Risk Mitigation Strategies for Procurement

To minimize the supply risk for gelatin sourcing, major buyers in the industry have initiated new action plans, which are being viewed as suitable measures to mitigate risk:

– Engaging with 3+ suppliers as against the previous practice of having contractual engagements with 1–2 suppliers to safeguard supply volumes.

– Strategic planning for 1, 3, and 5 years, with volume projections (for required gelatin type), and communicating this information (with periodic revisions) with the suppliers. Therefore, the suppliers can also have a clear picture of the demand projection for gelatin and invest in capacity accordingly.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe