Procuring sugar surfactants is a cleaner and greener alternative to synthetic surfactants

Abstract

Surfactants are used in several industries such as pharmaceuticals, cosmetics, agrochemicals, personal care, textile processing, and paints. Commercially, most of the surfactants are manufactured from petrochemical sources which are non-biodegradable. They remain in the environment for long periods of time; some of them up to 100 years. The harmful effects and increasing stringent regulations of biodegradability have triggered interest and use of bio-based surfactants derived from renewable raw materials such as oleochemicals. Bio-based surfactants especially sugar surfactants such as Alkyl Polyglucosides continue to gain market share as CPG industry considers sustainability as a major contributor to competitive advantage. Hence it is important to understand the opportunities and challenges in procurement of sugar surfactants.

This article discusses sugar feedstock availability, supply coverage, cost competitiveness compared to petrochemical-based surfactants, cleaning efficiency, environment regulations and production technology of bio-based sugar surfactants.

Introduction to Surfactants

Surfactants are compounds that lower the surface tension between two liquids or liquid and solid. Their properties such as detergency, emulsification, dispersion, stabilization, and foaming have vast applications in a variety of industries of which home care, personal care and cosmetics are the major industries.

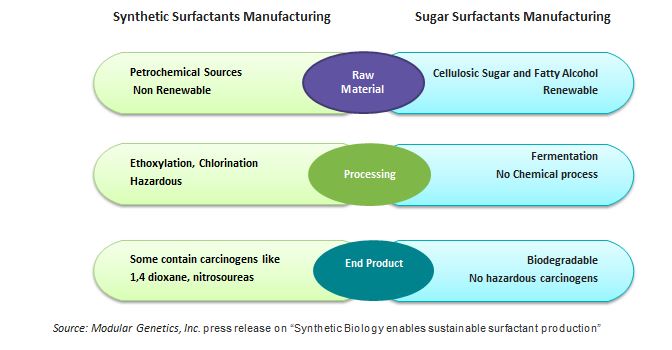

Surfactants are either synthetic (derived from petrochemical sources) or biodegradable (derived from vegetable or sugar-based sources). Conventional surfactants are synthetic surfactants based on sulfates. However, growing concerns with regard to biodegradability and hazardous chemical manufacturing processes have led to stringent environmental regulations on sulfate-based products. The regulations on environmental impact and toxic substances are very stringent especially in Europe and North America, the major markets for surfactants consumption especially by home and personal care industries. Hence, the CPG industry is starting to explore biosurfactants due to their less toxicity levels and green profile of the production process. Apart from adhering to environmental regulations, the CPG industry is also looking at bio-based surfactants as a sustainability opportunity to gain competitive advantage.

How is the Market?

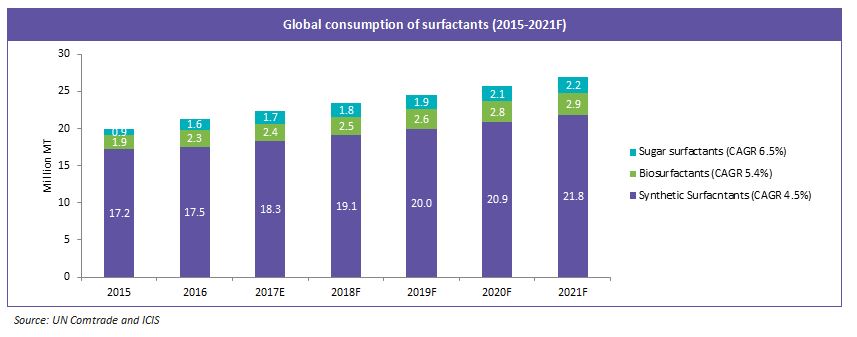

Global surfactants consumption is estimated to be 17.5 million MT in 2016 and is estimated to grow at a CAGR of 4.5 percent till 2021. Biosurfactants contribute about 20 to 30 percent of the global surfactants consumption with an estimated ~3.9 million MT in 2016. They are expected to grow at a CAGR of 5.4 percent till 2021 due to strong demand from personal care industry. Increased consumer awareness towards environmentally safe products has led to the organic personal care industry market size to grow over $8.5 million business in 2015.

Europe is the major regional market with around 40 percent of the global biosurfactants consumption. Sugar surfactants are a major category in biosurfactants contributing around 30 to 40 percent of biosurfactants consumption.

Growing importance for Sugar Surfactants

Biosurfactants which are of vegetable origin are usually unsuitable with conditioning ingredients, polymer additives and other conventional synthetic surfactants if used as co-surfactants. Compared to sugar surfactants, other bio-surfactants face issues with shelf life, foam quality, stability, quantity, appearance and other visual characteristics that the conventional synthetic surfactants exhibit. Hence, the development of new formulations using sugar-based surfactants is expected to be the future of the surfactant industry.

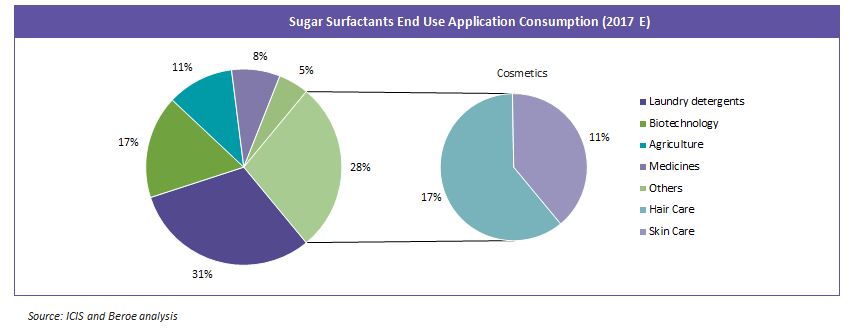

Superior cleaning efficiency and low irritability is the major demand driver

One of the major drivers for biosurfactants is the increased consumer awareness toward environmentally friendly products. However, consumers are not willing to sacrifice on the cleaning efficiency and sensory characteristics of detergents and other personal care products. Also the current trend of moving to liquid laundry detergents from bars and powder is well supported as sugar surfactants are best suited for liquid applications.

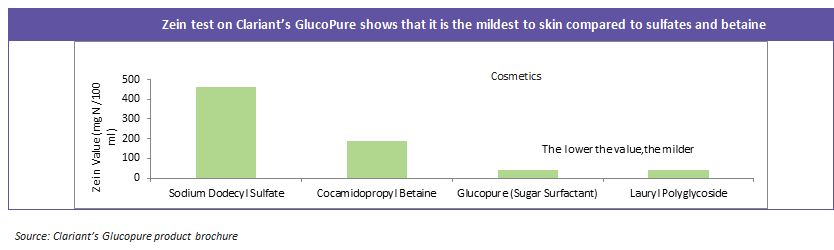

Sugar surfactants have superior foaming and excellent washing capability with high surface activity. They are also proven to be milder to skin compared to traditional surfactants such as sulfates and betaines.

Supply Coverage

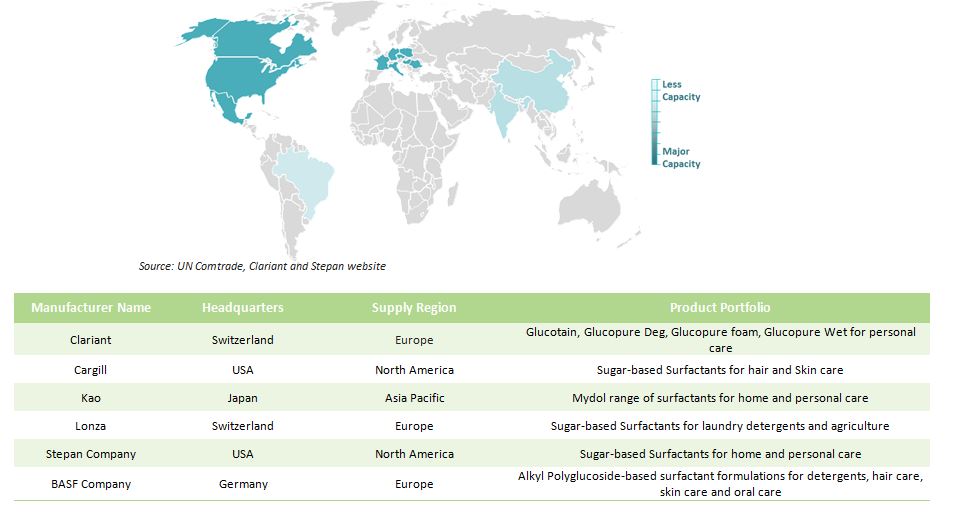

Europe has the largest production capacity for sugar surfactants followed by North America. Asia pacific has a significant presence of household and personal care industries and as China and India are the major sugarcane producing regions, sugar surfactants industry is expected to gain traction in the future.

Brazil is the world’s largest producer of sugarcane and a large number of personal care and cosmetic companies are focusing on market penetration in Latin America. Hence sugar surfactant supply is expected to boom in Latin America.

Manufacturing process eases regulatory compliance

Stringent environmental regulations on biodegradability, pollution control laws and pressure to adopt environmentally friendly production procedures are the major restraints on the surfactant industry. The regulations are strict especially in Europe and China has a new environmental policy in place which allows only certain amount of emissions from chemical process, leading to threat of sulfate-based surfactant plant shut down in future. Hence moving towards sugar-based surfactants eases regulatory compliance and makes procurement less complex as the environmental regulations for import and export of surfactants is eliminated. For example, Clariant’s GlucoPure range of sugar surfactants has already been certified under RSPO and Eco safe. In spite of energy efficient manufacturing process, the cost of sugar surfactants is still high compared to conventional surfactants.

Cost effectiveness compared to petrochemical-based surfactants

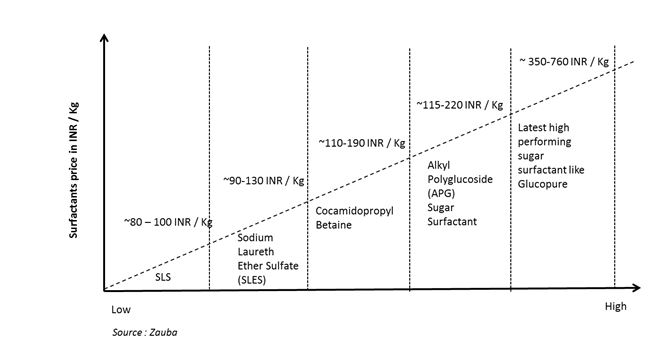

One of the major challenges to procurement is that synthetic surfactants are relatively inexpensive compared to sugar surfactants. However, the consistent feedstock price fluctuation is a major concern for petrochemical-based surfactants. This is the area where sugar surfactants can take advantage as sugar cane prices majorly depend on the agricultural cycle and weather conditions. These are easy to forecast compared to market dynamics forecast of petrochemicals.

As sugar-based surfactants gain momentum, there is a possibility in the future to align with traditional surfactants price as the cost of production of sugar surfactants is less compared to synthetic surfactants. Suppliers such as Kao Corporation are investing heavily in R&D to develop economical sugar-based surfactant products.

Feedstock availability

Sugar surfactants are derived from cellulosic sugar or glucose from sugar cane, corn starch and other renewable carbohydrate sources combined with fatty alcohols derived from coconut or palm oil. Europe, the major market for sugar surfactants, currently depends on India and China for majority of the sugar cane feedstock. However, Europe’s sugar production quota will be scrapped from October 2017 and the sugar beet production is expected to grow by 7 percent through 2017 to 2018 and 14 percent by 2021. The increase in feedstock capacity will lead to reduced imports and capacity from India and China may be utilized for the Asia pacific market where the sugar surfactants demand is growing due to the increase in application base.

However, as the consumption of sugar surfactants increase in the long run, the availability of feedstock will become a question. Certain new technologies using bacteria and microorganisms to synthesize glucose are coming up, however, the question of scalability is still not addressed.

Conclusion

As the CPG industry is moving towards sustainability as the key to long term competitive advantage, the surfactant industry is focusing on eco-innovation and greener chemical ingredients. The green profile of sugar surfactants combined with excellent cleaning performance is definitely a welcome package of surfactants for home and personal care industry. However, the high price of sugar surfactants is still a major procurement challenge.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe

D