Locking sugar prices at spread-out intervals provide cost savings for buyers

Abstract

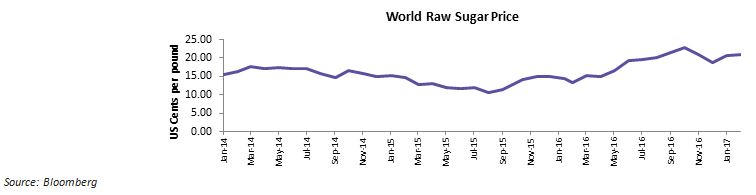

Sugar is highly volatile commodity and its production and consumption in major producing countries determines the global sugar price. Since the start of 2015/16, global sugar price is trending upwards because of the impact of El Nino. Average raw sugar price in this season is 16.85 US cents / pound, an increase of 26 percent from the average price of 2014/15. Similarly, during the upcoming season, 2016/17 sugar price is expected to rally upwards and possibility of average price to reach 20.60 US cents / pound, an increase of 54 percent from 2014/15 is very high. This huge increase is attributed to El Nino that severely reduced the sugarcane output in India and Thailand. Though this situation is sweet for the producers, it is a bitter situation for consumers especially from Beverage and Confectionary industry where spend on sugar is significantly high.

This article discusses the impact of El Nino on sugar output in Brazil, India and Thailand, Asian countries’ sugar policies, expected increase in export demand in Brazil and best locking period for procuring sugar to minimize the cost for bulk buyers.

Global Sugar Supply – Demand Pattern

The 2016/17 new sugar season is going to be a sweet year for sugar mills and traders while it is not expected to be favorable for bulk consumers such as beverage companies, biscuit manufacturers and other large scale consumers. Continuous increase in sugar price since the start of 2015/16 is the reason for this mixed situation among the producers and consumers.

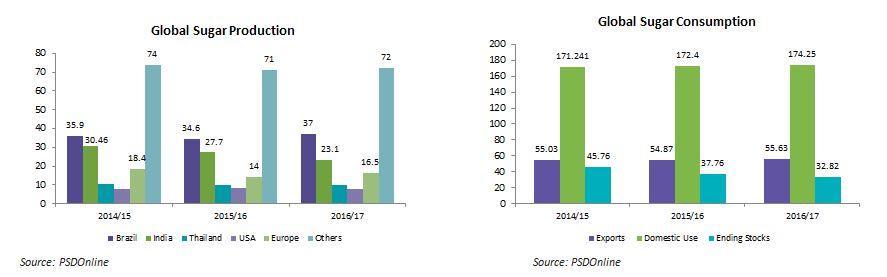

Global sugar production is forecasted to reach 169.4 million metric tons in 2016/17 which is a 3 percent increase from previous year because of the Increase in production in Central America, South America, African countries and European countries. However, this percentage of increase is low because of decrease in sugar production by 8 percent in India, 2 percent in the U.S. and 2 percent in China compared to 2015/16. This decrease in sugar production is the impact of poor weather condition that prevailed in 2015 and reduced sugarcane production, especially in the Asian countries. The present situation of increased consumption and decreased production is expected to increase the global sugar price.

Global sugar supply in 2016/17 is expected to be around 262.7 million metric tons and this total supply will be sufficient to meet the growing consumption. However, the ending stock will witness a 13 percent decrease from 2015/16. Opening stock of sugar for 2017/18 will be ~ 28.6 percent less from 2014/15.

Rising sugar production in Brazil

Present Brazilian sugar season is witnessing increased sugarcane diversion to sugar production. Nearly 45.66 percent of sugarcane produced till 1st September was diverted to manufacture sugar as against 41.78 percent for the same period in 2015/16. This 9 percent increase of sugarcane diversion towards sugar production has increased the sugar output from South and Central region by 17 percent from 2015/16 contributing to 3 percent rise in global sugar production.

In contrast, total ethanol production decreased by 0.09 percent from 58.22 percent in 2015/16 to 54.34 percent in present season owing to drop in sugarcane supply. In addition, increasing sugar production is also because of the decrease in yield of ethanol compared to the yield of sugar from sugarcane.

Increasing Exports from Brazil

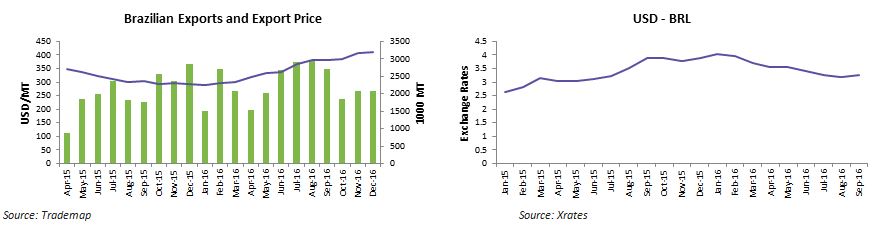

In 2016/17, till December, exports increased by 13 percent as against the same period in 2015/16. However, the rate of exports slowed down since July owing to the appreciation of Brazilian real. Growing international demand for Brazilian sugar along with slowness in exports is increasing export price -- 8 percent increase in Brazilian export price was recorded in July from June.

As the Brazilian sugar production and exports has a great impact on the global sugar price, the present situation in the country along with the supply shortage of sugar in Asian countries is expected to raise the global price. Hence locking the price in a correct month for 2016/17 season can slightly decrease the cost of procurement.

Asian sugar production to decrease in 2016/17

India and Thailand are the two largest countries in Asia to produce and export sugar. El Nino in 2015 damaged sugarcane crop severely in India and Thailand. In India, major growing states such as Maharashtra and Karnataka, where the sugarcane crop is rain-fed, were greatly influenced by dry weather patterns. The crop is, however, irrigated in Tamil Nadu and Uttar Pradesh.

Similarly, in Thailand exports are expected to be stable despite the expected increase in sugar production by 4 percent from 2015/16. This is due to the anticipated increase of sugar consumption in households and industries by 2 percent from previous year. In addition, sugarcane earmarked for ethanol production is also forecasted to reduce to 1.3 million tons owing to the increasing global sugar price. In 2016/17, operations in 25 new sugar mills are most likely to increase the total sugar milling capacity of the country. However, exports are not expected to increase and this could lead to the demand for Brazilian sugar to go up.

Sugar policies in Asian countries

India: Imports are regulated by 40 percent of import duty and exports are restricted by 20 percent duty. To bring down the sugar price, Government of India have advised sugar mills to keep only 24 percent of their stock by end of October.

Thailand: Change in the Thailand sugar policy can be expected in few weeks. This new sugar policy will aim to reduce the sugar shortage problem in upcoming years by three quota system for exports, exports by private mills and domestic consumption. Though not in short run, in long run, revised policy will benefit Thailand’s sugar industry.

In this shortage situation, India is expected to become net importer of sugar owing to the shortage in supply of sugarcane. The drop in sugar production of the two leading producers of Asia will drive the global sugar price during 2016/17. Therefore, revising the procurement strategy could benefit the bulk buyers to some extent.

Global sugar price and impact on bulk buyers

Large buyers of sugar such as Coca-Cola, PepsiCo, Britannia and Cadbury across the world are facing increased cost of production due to increase in sugar price by more than 30 percent since October 2015. Despite negotiations between millers and buyers, large players have decided to revise their marketing strategies by removing the bundling and discount promotions to maintain their revenue and net profit in 2016/17 financial year.

Sugar locking period

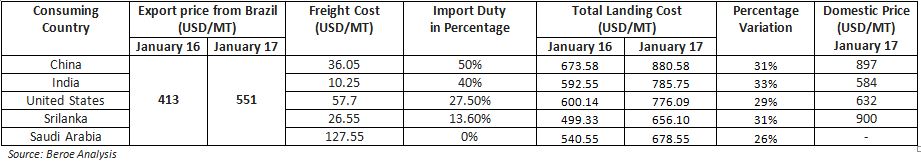

Domestic price in all major consuming countries are expected to increase in 2016/17 due to the rise in ICE #5 and ICE#11 prices. At present, viability of imports of sugar into major sugar consuming countries is decreasing due to the simultaneous rise in Brazil’s export price and consuming country’s domestic sugar price.

In 2016/17 season, rise in demand for Brazilian sugar can be anticipated due to the decrease in Indian and Thailand sugar exports. For example, 40 percent of imported sugar in Sri Lanka is from India. This percentage share of India can drop and increased imports from Brazil will satisfy Sri Lanka’s sugar consumption in 2016/17.

As imports from Brazil will be less viable in 2016/17 season and domestic price will increase to three years high, locking sugar contract in a particular month will be comparatively profitable for bulk buyers.

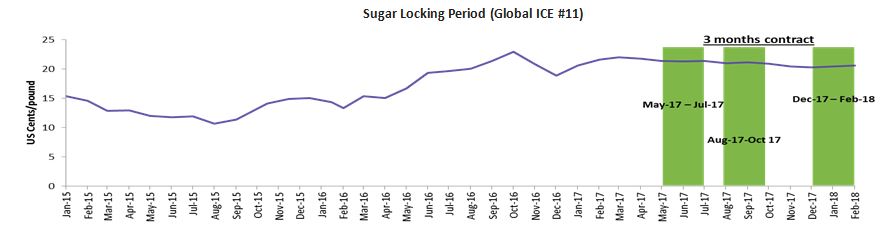

Locking Period

Conclusion

In 2016/17, global sugar price is expected to rally between 20 -22 US cents/pounds. Locking the price of sugar during August or December will benefit bulk buyers by providing cost savings.

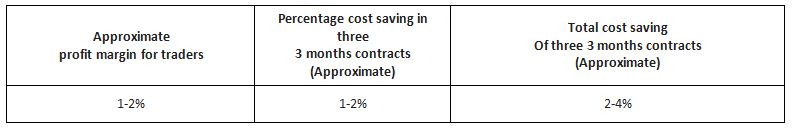

In the above forecast, three 3 months contracts can be adopted to achieve maximum returns: three 3 months gives 2-4 percent of cost saving compared to spot buying. Hence it is recommended for the bulk buyers to make contract-based procurement with 3 months contract.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe