Electricity procurement to become challenging with the impending South African carbon tax

Abstract:

The South African economy will be witnessing a drastic change as the government has proposed to implement carbon tax by 2018 in its budget this year, to reduce the emissions by 13 - 14.5 percent in 2025. This move is expected to have a significant impact on the growth of the economy and particularly on the major industries in the country. Spend on energy, especially on electricity, will play a major role when the carbon tax implementation is done on full swing.

This article skims through the impact of the initial phase of carbon tax and how large scale energy consumers can benefit from self-generation using renewables.

Overview of the carbon tax bill:

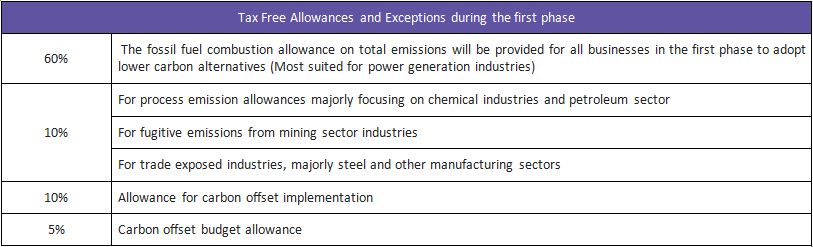

- The Carbon tax is a part of the ambitious plan of the Government to reduce 13 - 14.5 percent greenhouse gas (GHG) reductions by 2025 and 26-33 percent by 2035. The initial phase will be implemented with relaxation in the threshold levels of emissions for calculating tax. The major impactful exemptions are listed below:

- The carbon tax in the drafted bill is R120/ton of CO2 in the initial phase and with the above mentioned allowances and another 5 percent for participating in the 1st phase, a cushion of 60-95 percent allowances are open for the consumers, which will bring the tax between R6 to R48/ton of CO2

- The state-owned utility Eskom, which is the largest emitter in South Africa, has been partially relieved for the initial phase with nearly 70 percent exemption of carbon tax, to ease the burden which will be passed on to the final consumer segment

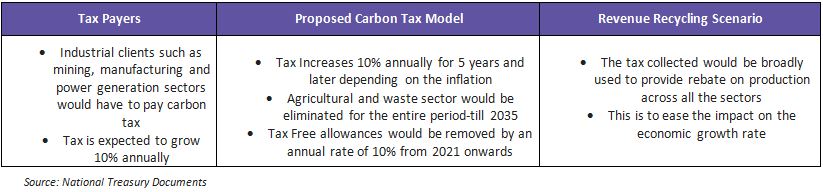

- The Treasury, under the partnership with World Bank has modelled a study on impact and has found that the implementation of carbon tax would reduce the emissions as per the set target, but with a reduction in annual average growth rate of economy by 0.05 to 0.15 percentages. This makes it certain that going forward with carbon tax would the prime focus of the government

Impact on the electricity sector:

- Even though Eskom has been exempted from carbon tax for 70 percent of the total emission for an initial grace period, the electricity costs are set to increase by 2.2 percent from April 2017. After the grace period, when the carbon tax will come into picture, the burden would be directly passed on to the end user

- Eskom, with the present generation fuel mix consisting of 86 percent coal, emits 1.03 tons of CO2 for every megawatt hour of electricity generated; this means a carbon tax of R120/MWh of power generated from coal plants alone

- For energy intensive industries such as mining, chemicals and other manufacturing sectors that have in-house fossil fuel-based generation for power supply and/or for processes, the impact would be significant due to the proposed bill

- The policy has made it clear that investments on the nation’s largest renewable procurement model, REIPPPP, would not help in achieving allowances

Electricity market situation:

1. Growth of renewable energy market with the implementation of REIPPPP

- The Renewable energy procurement program to procure energy from the Independent power producers(REIPPPP) was launched by the Energy Ministry as a part of the Integrated Resource Plan(IRP) 2010-2030

- Procurement of energy is conducted by Eskom with the allocation for production based on bidding for the lowest Feed in Tariff (REFiT), and till now 6327 MW was allocated

- This immense development in renewable energy sector, especially in the solar and wind energy technology has invited many major players, and also regional manufacturers in the renewable industry to set up base in South Africa

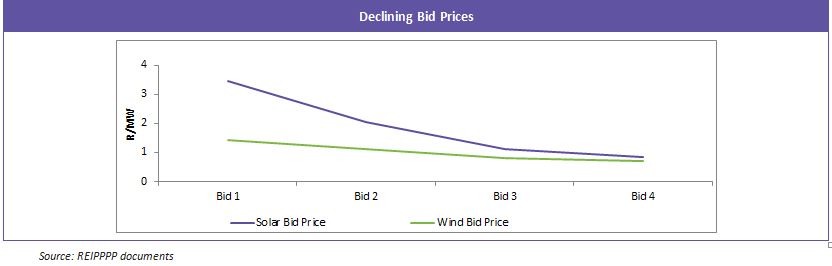

- This has tremendously reduced the cost of the technology and has also helped in bringing up a large pool of skilled labor and high market maturity in the field of renewable energy which is evident from the decline in bid prices in the latest bids

2. Supply Security

- While South Africa has made a commendable growth in the field of renewable energy, its grid development and supply security is yet to improve

- Even though load shedding has declined from 2009, the grid infrastructure needs a ramp up to address the needs of the growing renewable energy generation sector

- The electricity distribution industry is facing difficulties in its maintenance due to financial issues. The maintenance backlog, valued close to 38.6 billion rand, poses a critical risk to supply security

What are the solutions that large consumers can look forward to in South Africa?

1.Self-Generation based on renewables

- The best strategy for large consumers such as cement, mining and chemical industries, whose emissions from process and main activities cannot be downscaled significantly, is to build a self-generation scheme using renewable energy thereby utilizing the potential of a matured South African renewable energy market and offset the process emissions

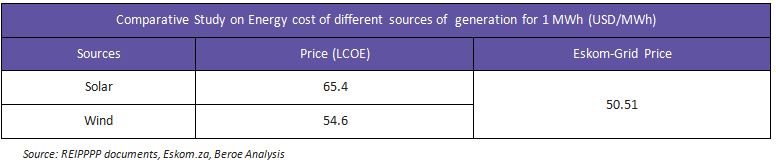

- This quick impact of self-generation is lower since carbon tax on Eskom would take a while to be implemented completely. However, the decline in production cost from renewables, especially from wind and solar which have reached near parity with the grid cost, is an eye opener towards renewable energy based generation

- The capital cost of installation of solar PV and wind power plant has declined drastically in South Africa. It is now $1.87 million and $1.52 million per MW, respectively, by the last bid window allocation of REIPPPP. The average feed in tariff was $65 and $54 per MWh of energy from solar PV and wind technology, respectively

- With self-generation, the industrial consumers would be able to reap additional carbon tax allowances known as carbon offset allowance of 10 percent and carbon budget allowance of 5 percent on the emissions

- The implementation of self-generation model in the long run will benefit the industries with the supply security

2.Procuring Carbon Trading Certificates

- With the implementation of carbon tax, the carbon trading market is expected to boom in South Africa enabling large consumers to procure carbon certificates to offset the emissions

- In the present scenario, carbon trade market is underdeveloped, and carbon offsets would prove highly expensive due to lower competition and availability

Conclusion

- The carbon tax bill in South Africa is still in the draft stage and implementation is expected by 2018. For the entire initial phase, the burden of carbon tax would be lower to ease the economic growth and also for the industries to streamline towards a low carbon strategy

- In the future, the impact on energy along with other commodities would be higher from the second phase of carbon tax implementation

- Investing in carbon offsetting programs such as self-generation would benefit large energy consumers in the long run in terms of supply security and realizing savings from lower carbon tax

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe