Change in industry applications of sodium lauryl sulphate to benefit liquid detergents market in India

Abstract:

Indian detergent market is majorly dominated by powders and solids. Off late, this market has been witnessing an increased usage of liquid detergent, which started to take away the share of solids and powders. The liquid detergent market is expected to grow 10 percent annually in terms of market value till 2019. While the shift towards liquid detergents is obvious, the question lies with the availability of raw materials. One of the major raw materials used in the production of liquid detergent is sodium lauryl sulphate which accounts for more than 30 percent of the total raw material consumed.

This article discusses the trends in Indian detergent market and the shift towards liquid detergents. The focus is on the availability of the raw material, sodium lauryl sulphate in India. With demand from liquid detergents growing, it is important to understand if there is enough sodium lauryl sulphate capacity to support this demand. It also helps to understand the way the end use applications would impact sodium lauryl sulphate in future.

Detergent market in India:

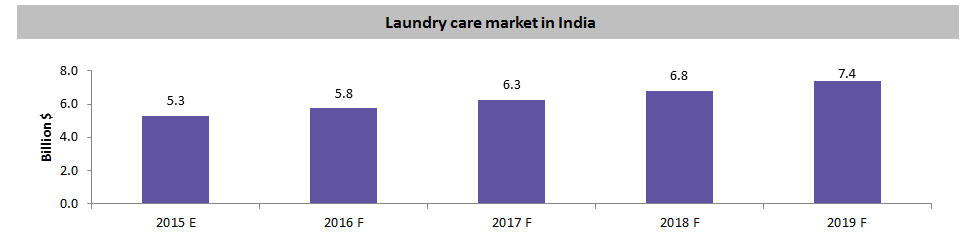

Home care segment in India consists of laundry care, dish wash, surface cleaner and air care in which laundry care market is expected to hold more than 69 percent of total home care segment. In 2015, it is estimated that the detergent market in India will be around $5.3 billion. The detergent market is expected to grow at a CAGR of 8.7 percent annually till 2019, majorly driven by the convenience of usage, increased purchasing power, aggressive advertising and increased penetration of washing machines.

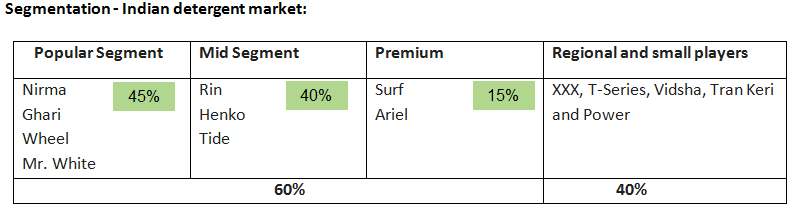

Detergent market is divided into solids, powders and liquids with a major share of around 80 percent for solids and powders followed by liquids with 20 percent. Major players in detergent market are P&G, HUL, Nirma, Rohit surfactants and Henkel which contribute to 60 percent of the overall market followed by the regional players.

Growth of liquid detergents in India:

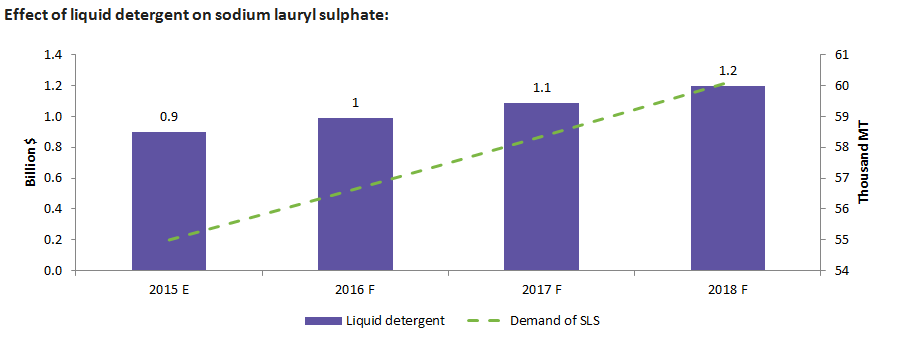

In 2015, liquid detergent market accounted for ~$0.9 billion, the fastest growing segment in laundry care market in India with CAGR of 10 percent annually till 2019. The liquid detergents market started during 2013 with the launch of Surf Excel liquid by Hindustan Unilever. The major reason for the exponential growth of liquid detergents is due to the increased penetration of washing machine, increased advertising on the liquid detergents and ease of use which is more effective than powder and soap.

Currently, 10 percent of all Indian households own a washing machine and the market is expected to grow at a CAGR of 11 percent annually till 2018. Major raw materials used in the production of detergents are surfactants with linear alkyl benzene sulphate and sodium lauryl sulphate being the key surfactants.

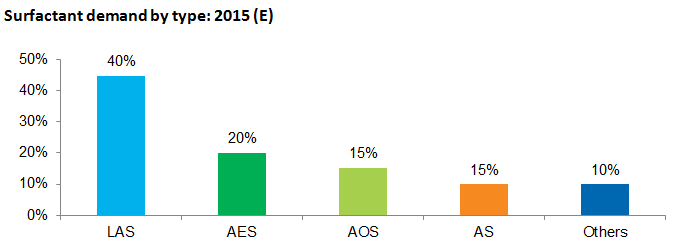

Surfactant is the key material used in the production of detergents; major surfactants are linear alkyl benzene sulphate, sodium lauryl sulphate (SLS) and sodium lauryl ether sulphate (SLES). Linear alkyl benzene sulphate holds 40 percent of the overall surfactant market followed by SLS and SLES with 35 percent, majorly used in applications such as detergents, dish wash and personal care industries. Laundry detergent applications in India consume more than 60 percent of the overall surfactants. Sodium lauryl sulphate is used as a cleansing agent in personal care products and detergents. Its functional properties include exceptional lather and lending density to products. SLS is widely used in various applications by changing the concentration of the product, for example, dish wash liquid will have more concentrated SLS than in shampoos.

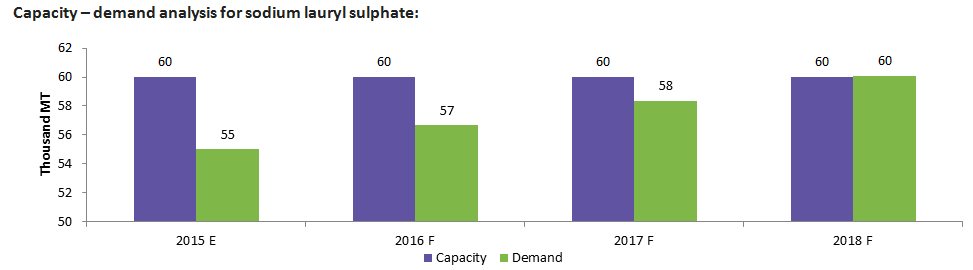

In India, overall capacity of SLS and SLES is close to 200 KMT as of 2015. Out of this, 130 KMT is for SLES and 60 KMT for SLS. Demand for SLS is expected to be about 55 KMT in 2015 and is poised to grow at a CAGR of ~3 percent for the next 3 years. Currently, there is enough capacity available in the market to satisfy the growth of its demand. However, enough capacity addition is needed to satisfy the demand in future; else the market will depend on the imports in future.

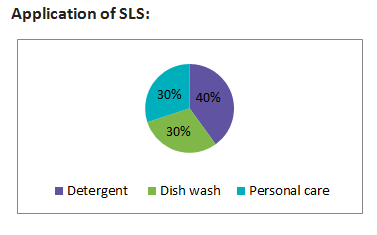

In India, nearly 40 percent of SLS is used in detergent manufacturing followed by its application in dish wash and personal care industry. The contribution from the personal care industry stands at 30 percent for industry applications. The decrease in use of SLS in personal care industry will make it over supplied in the market but liquid detergent is expected to imbibe the over supplied SLS with its growth in future.

Shift in Industry applications:

A shift is happening in personal care industry with many personal care products coming into the market with the tag of “SLS free product”. There are some detrimental effects in using SLS in personal care products. It tends to remove moisture and make the skin extremely dry. It has been reported that those with sensitive skin may develop a rash or redness in the long run due to the presence of SLS in the products. SLS could also create allergic reaction and cause irritation and dandruff.

Taking note of these side effects, many companies have started to produce SLS free products, thereby affecting the usage of SLS in personal care industry. Since more than 30 percent of SLS is used in personal care products, the demand may come down in future. The changing scenario may shift the use of SLS in manufacturing personal care products to production of liquid detergents in upcoming years.

Liquid detergent is expected to drive the SLS, which is expected to grow at 10 percent till 2018 in terms of market value. SLS demand is expected to have CAGR of 3 to 4 percent annually till 2018.

Conclusion:

As the usage of SLS is shifting from personal care products to liquid detergents, it is expected that the liquid detergent market is expected to drive the SLS market in future. The change is not dynamic because of the slow adoption of SLS free products in the industry. However, in the long term it may have a considerable impact. There are enough SLS capacities available to satisfy the growing demand of liquid detergent in future; supply may majorly come from the unused SLS from personal care industry.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe