Rising Construction Labour Challenges in Australia

Australia successfully countered the spread of Covid-19 pandemic, but it was also one of the countries that experienced highest number of days under lockdowns and restrictions. After Australia lifted Covid-19 pandemic related restrictions, the country’s construction market is facing multiple challenges, majorly attributed to labour shortage and skyrocketing construction material prices.

Construction Labour Analysis

Labour Market Insights: Construction sector labour constitute around 9 percent of the total employed labour force in Australia and is almost consistent over the last two decades. As of May 2022, the construction sector labour force is estimated to be at 1.18 million workers, a 1.1 percent increase as compared to Q1 2022, and 1.7% higher as compared to May 2022.

Only during May and June of this year, construction labour levels are at par with pre-Covid levels, whereas total construction volume increased by 2.53% post-Covid.

The skilled labour shortage is likely to rise in the short-term, and is expected to severely impact commercial construction activities across Australia as the newly elected government is focused on infrastructure spending with higher budget allocations for renewable energy projects.

Supply – Demand Scenario: Australian construction labour is hugely dependent on the influx of migrant labour -- however, restrictions due to Covid-19 has created a void in the supply of skilled labour resources that meets the demand.

|

Labor Workforce Snapshot: 2022 E |

Demand–Supply Snapshot: 2022(E) |

Wage Snapshot: 2023(F) |

Insights |

||||

|

Labor Rates $/day |

Y-o-Y Wage Difference |

Labor Supply–Demand Gap |

Risk of Labor Shortage |

Demand–Supply Condition |

Wage Increase (2023(F)) |

Wage Inflation Trend (2023) Compared to Previous Year |

|

|

430-830 |

4-5% |

Demand > Supply |

High |

High Shortage in skilled construction labor |

7-11% |

Increasing |

Labor conditions would be critical with a growing shortage of skilled labor in the construction industry for the next 3 - 5 years |

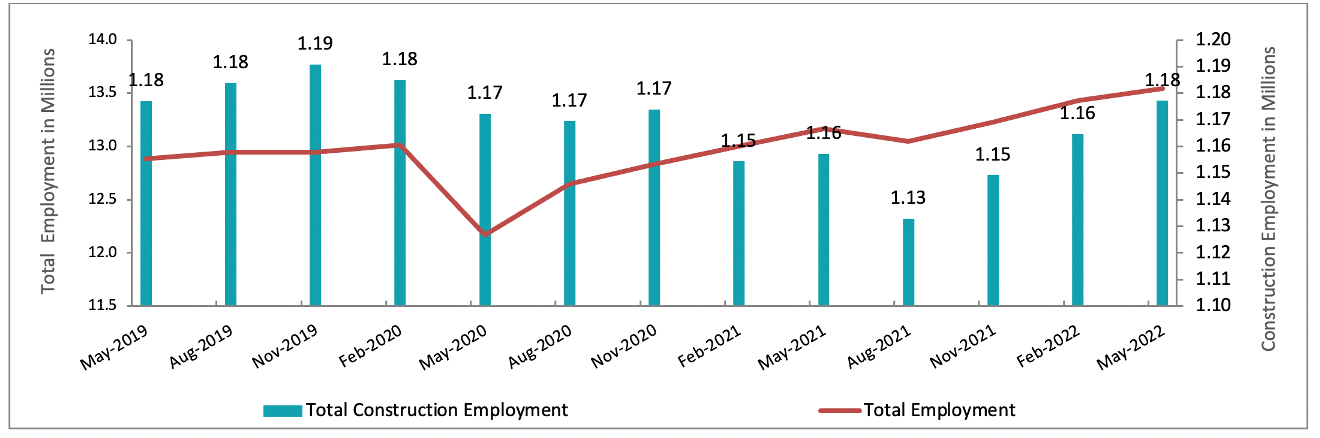

Trend in Construction Labour: In the quarter that ended this May, construction employment in Australia has increased by 1.7% compared to the same quarter of 2021, however during the same duration overall labour employment in Australia has increased by nearly 3% in all the sectors together, which clearly shows a shortfall in construction labour.

Employment in Construction: Since 2021, growth in labour workforce is being witnessed in the entire Australian market. However, the trend of adding new labour is marginally lower in the construction industry than in the other industries. From the start of 2021, labour workforce in all industries put together has increased by 5.5%; in contrast, the construction industry added a mere 0.3%. Whereas, during the same time period, the value of construction activities outgrew by more than 4.7%.

This clearly indicates that the rate of construction labour growth is not matching the growing demand from the construction industry.

Source: Beroe Analysis

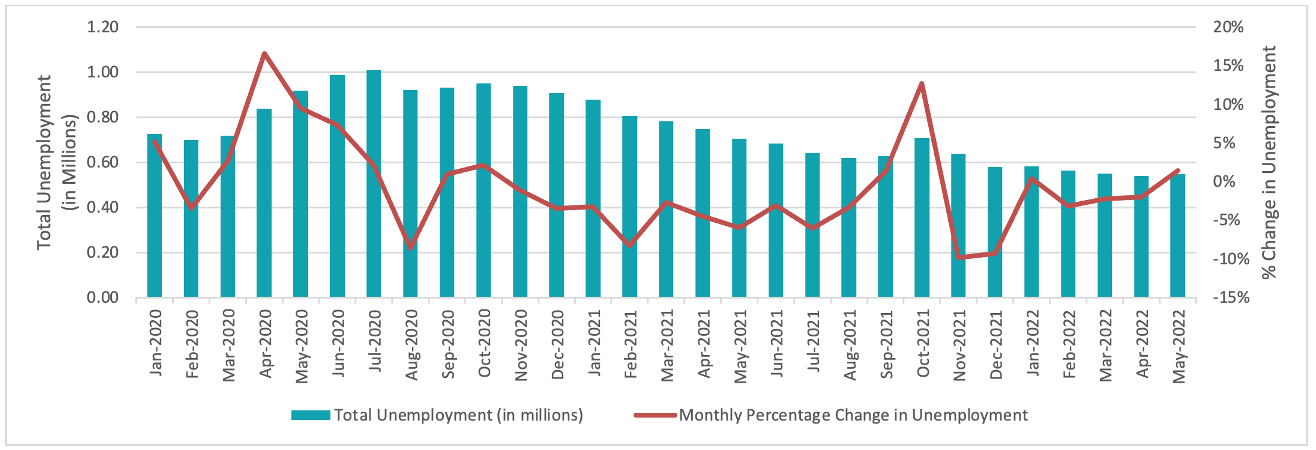

Unemployment: As of May 2022, the overall unemployment rate in Australia stood at 3.9%, which is a record low in the last 50 years, and it is a 1.2% decrease as compared to the same month of 2021. Currently, a peculiar situation arose in the Australian labour market, where workers are more interested to work for limited hours rather than a full working day -- the allotted rations of full work hours are not met by atleast 30% of the workforce, which is jeopardizing the construction output and causing long delays and schedule overruns of construction projects.

Source: Beroe Analysis

Collapse of Construction Companies:

From the start of this year 2022, more than 16 construction firms shut shop. This list includes major builders and construction firms like Probuild, Metricon, etc. The collapse of these companies would have a cascading effect on their sub-contractors and other construction firms, majorly small and medium firms. Most of the boutique construction and consulting companies playing at the regional and city level in Australia have become dormant and are rendering services only for the projects on a survival basis, with no exceptional margins and profits.

As quoted by founders of these firms, the rising construction costs both from material and labour wages could hamper their businesses in the medium to long term, if the current conditions are unaltered. Current labour market conditions are also highly dependent on the moves and motives of the newly elected Government.

Conclusion

Sourcing labour in Australia is never an easy task for any construction firm. A combination of factors such as record inflation, lower levels of mingrant labour post Covid-19, ever-increasing wage rates, and decreasing billable rates have further worsened the conditions of labour market in the Australian construction industry. The situation could further worsen in the coming months.

References and Sources

- Industry expert’s interactions

- Beroe Subscriptions for commodity prices

- https://www.lexology.com/library/detail.aspx?g=9745048a-7c38-47ef-a7ed-866a5505963d

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe