Relationship-based Pricing (RBP) Solutions in Financial Institutions

Abstract

- In order to switch from a product-centric to a customer-centric pricing policy, financial institutions (FIs) use relationship-based pricing strategies. A successful adoption of relationship-based pricing can be achieved by implementing an RBP technology solution that tracks customer behavior, analyzes the data, and uses the resulting insights to devise a pricing strategy.

- It helps to reduce challenges around customer retention and revenue leakage. It provides a holistic view of customer relationships and facilitates a focused sales approach to existing customers.

- In this article, we will discuss the RBP solution in detail.

Introduction

- To achieve optimum benefits in terms of higher revenues and improved margins, FIs are focusing on building a strong relationship with customers and are developing innovative business models.

- With changing customer expectations, FIs are looking at new ways to recognize and capitalize on customer individuality, understanding that each customer’s needs are different.

- According to McKinsey, banks with a sophisticated pricing strategy can add 6 to 15 percent to their revenue and also deepen relationships with their customers.

- FIs are extending the concept of individualized service by offering customized pricing based on the customer’s relationship with the FI. Pricing is determined on a customer's potential to generate revenue for the FI.

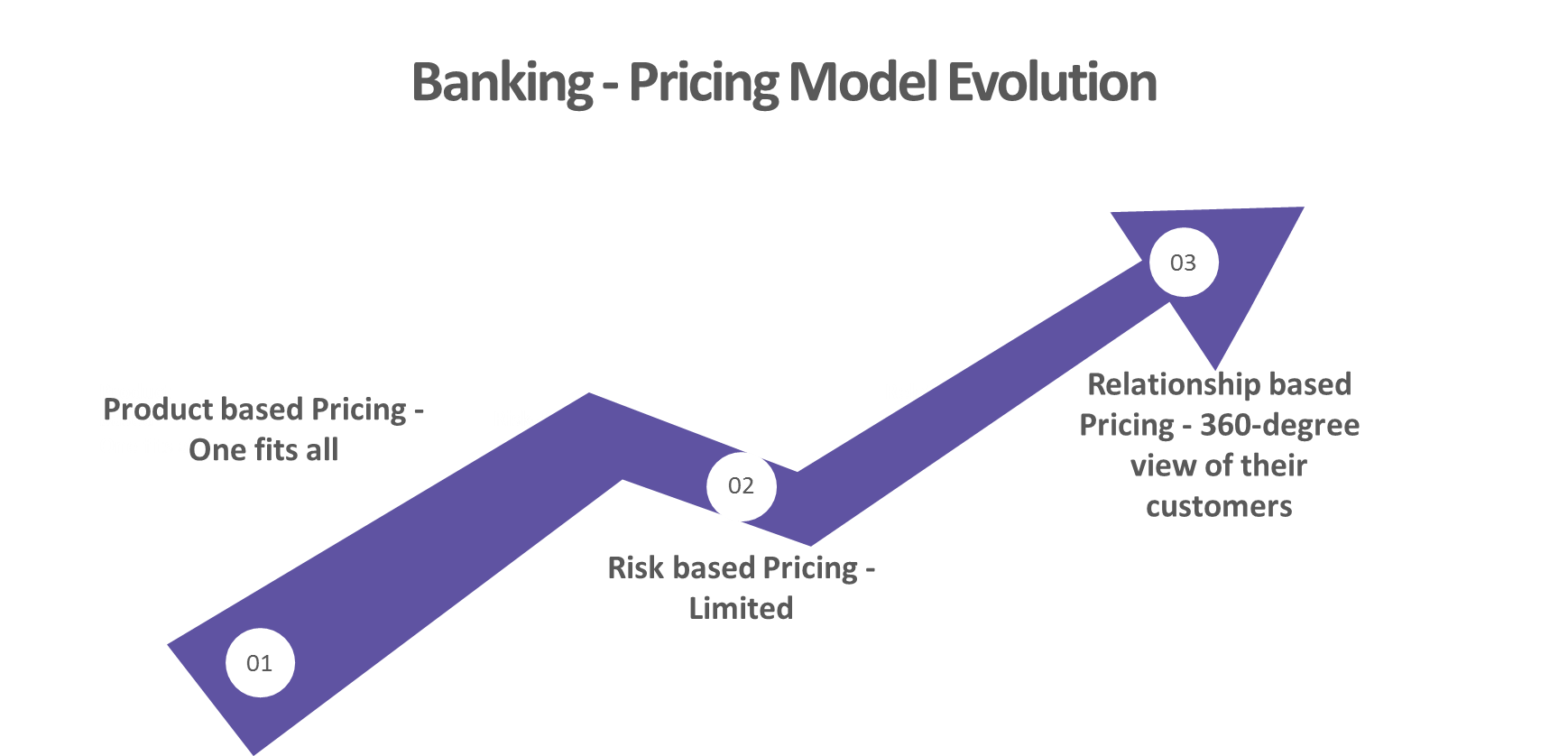

RBP Solution to Support this Shift in Customer-Centric Strategy

- A relationship-based pricing framework helps financial institutions cut through product silos and enable centralized pricing. Through sophisticated rule-based pricing engines, RBP solutions will take care of the pricing and billing functions of any product.

- Pricing can be based on multiple parameters, such as the overall business the customer does with a bank or the types of services he/she procures.

- It helps financial institutions to understand their customer behavior, analyze the data, and use the resulting insights to devise strategy for pricing.

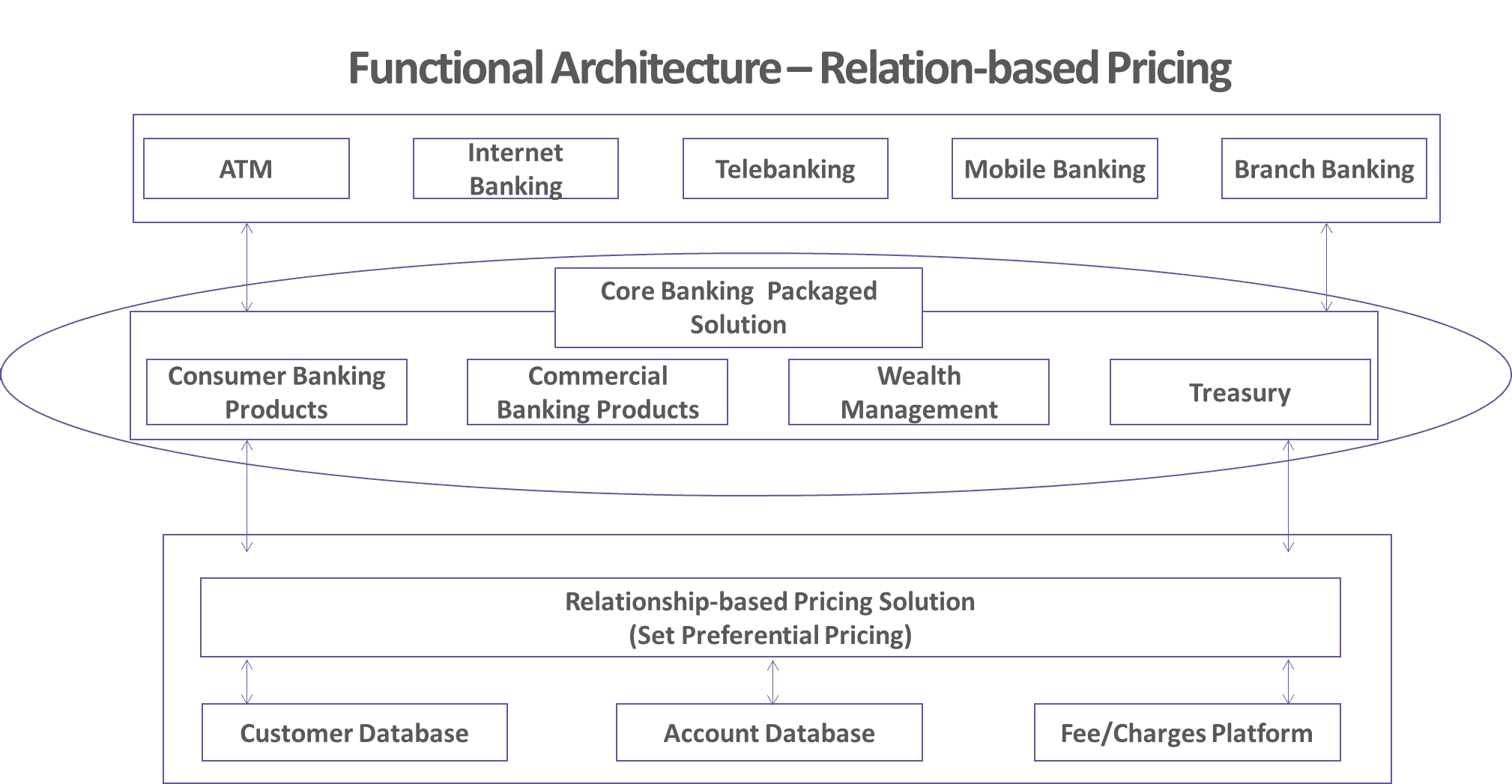

- RBP solution (also known as Set Preferential Pricing) is the backend system that consists of customer database, account database, and fee/charges platform.

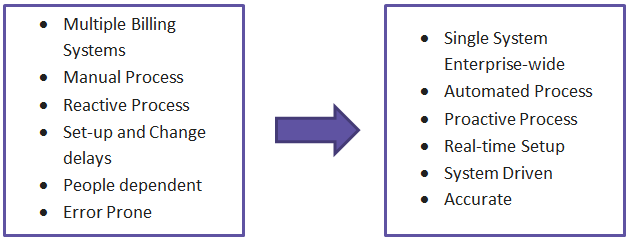

Siloed Banking Infrastructure vs. RBP Solution

Core Capabilities of Relationship-based Pricing Solution

- Provide financial institution with a 360-degree view of customers.

- An RBP solution comes with real-time profitability simulators and dashboards, powered by analytics, which helps track profitability after the offer is made to the customer, thus reducing instances of revenue leakage.

- Simplify real-time application of relationship-based pricing across complex multi-geography or multi-entity account hierarchies.

- Delivers scenario analysis that enables firms to predict the profitability of existing deals and map pricing versus customer profitability.

- Provides end-to-end visibility regarding a myriad of factors and parameters influencing each deal, such as payment rates, revenue, expenses, potential losses, and net income.

Pre-requisites for implementing an RBP Solution

- RBP systems (across all channels – branch, website, mobile, and social media) should have an enterprise-wide, 360-degree approach that spans asset classes, customer segments, and geographies.

- Effective customer segmentation is the initial step for an organization while considering RBP strategy. This starts with the examination of past customer behavior, generating predictions using various modelling techniques, gauging their profitability and segmenting them appropriately. After completing the segmentation process, an organization will be in a position to design a strategy that can look at their relationship.

- Integrated systems provide a single view of customers. Financial institutions should be able to identify who are their profitable customers and how they perform in terms of revenues and profits based on both historical and future transactions. To achieve this, customer analytics needs to be improved and systems need to capture the data at a single place and provide information that is useful.

Challenges while Implementing RBP Solutions

- Integration of Siloed Systems: Most financial institutions have multiple product lines that are supported by siloed systems. It is very challenging to achieve integration to arrive at customer data insights. The current technology infrastructure also limits a firm’s ability to bundle products and target pricing strategies at customer segments.

- Data Mining and Cleansing: In most firms, customer data will be available in multiple legacy systems and it is difficult to get it in a comparable form (RBP solution requires real-time accurate customer data). Due to this constraint, systems are not able to generate a consolidated view of customers.

- Manual spreadsheet model: Legacy pricing solutions are manual and based on spread sheet models, which will not have information about existing customer’s relationships and prevent the financial institution from managing pricing at an enterprise level.

- Pricing optimization (a core component of the relationship-based model) is difficult to achieve in legacy pricing solutions. It is complicated by lack of integration between pricing applications and other core systems, such as funds transfer pricing, Basel regulatory capital, and profitability applications.

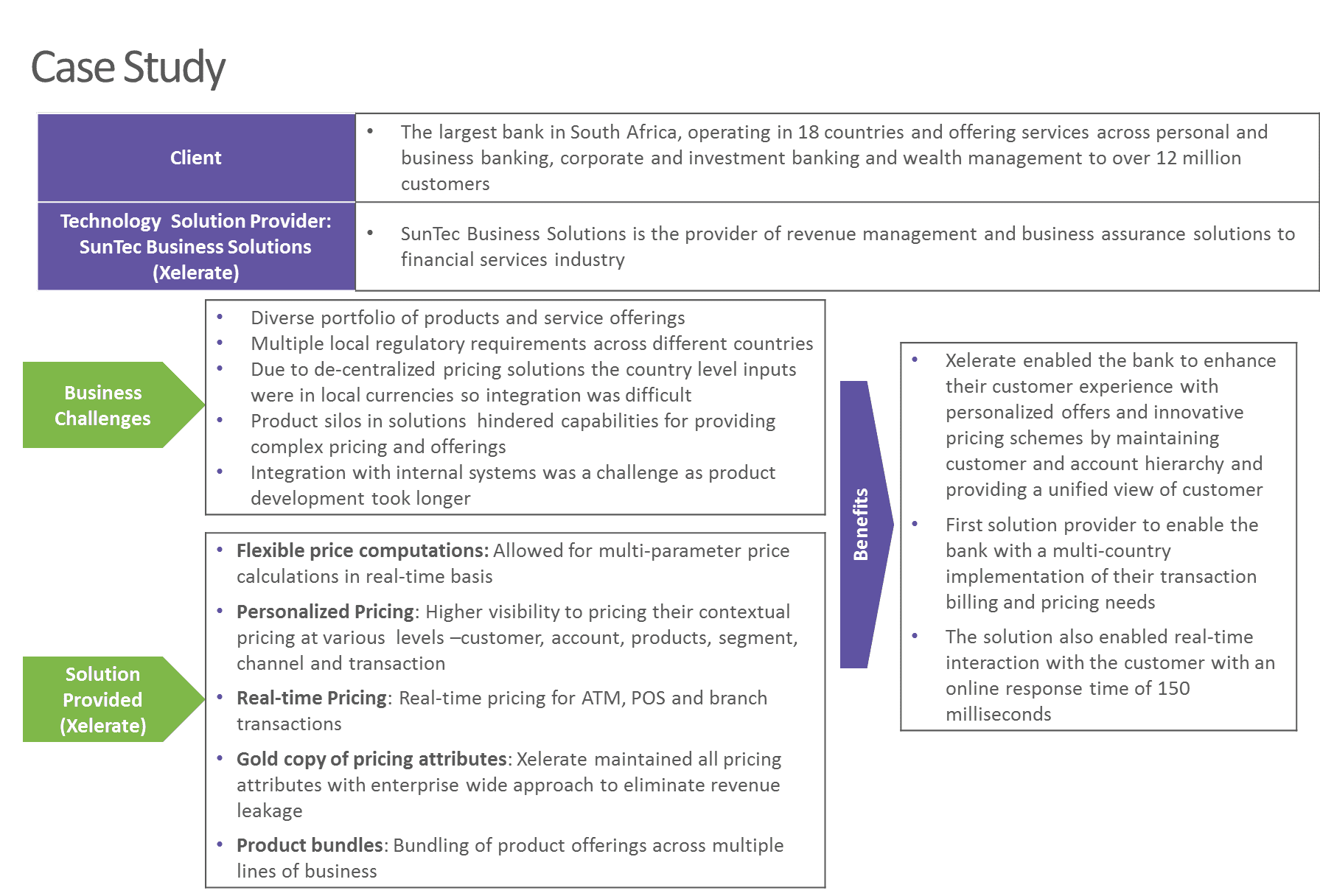

Potential Suppliers who Offer a Relationship-based Pricing Solution

|

Company Name |

Product Name |

Headquarters |

|

Finastra |

Fusion Revenue Management |

London, United Kingdom |

|

Zafin Labs |

Client Offer Management, Billing Management |

Ontario, Canada |

|

Oracle |

Revenue Management and Billing |

California, United States |

|

Infor |

Infor Complete Billing System |

New York, United States |

|

FIS Global |

IBS Relationship Value Management |

Florida, United States |

|

SunTec Business Solutions |

Xelerate |

Pennsylvania, United States |

Conclusion

- For the financial institution, the cost of acquiring a new customer is far higher than retaining an existing one. Effective pricing and bundling can result in cross-selling and higher revenue.

- To monitor and analyze customer behavior, an RBP solution is the preferred option for financial institutions. Institutions might face challenges while implementing RBP solutions due to the presence of customer data in multiple disparate systems posing integration challenges.

- Engaging with technology solution providers will help FIs overcome the integration challenge and help in the development of an RBP solution.

- With successful implementation of an RBP solution, financial institutions can gain maximum benefits in terms of higher revenue, better stickiness of assets, and customer loyalty.

References

https://blogs.oracle.com/financialservices/relationship-pricing-the-key-to-valuing-your-customers

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe