Procurement Strategy:Rare Earth Metals

Abstract:

The rare earth elements (REE) are 17 metallic elements, including fifteen lanthanides in the periodic table and scandium and yttrium. REE are necessary components of more than 200 products across a wide range of applications, especially high-tech consumer products such as cellular telephones, computer hard drives, electric and hybrid vehicles, and flat-screen monitors and televisions. Significant defense applications include electronic displays, guidance systems, lasers, and radar and sonar systems. Although the amount of REE used in a product may not be a significant portion of that product by weight, value, or volume, the REE can be necessary for the device to function.

The 17 rare-earth elements are cerium (Ce), dysprosium (Dy), erbium (Er), europium (Eu), gadolinium (Gd), holmium (Ho), lanthanum (La), lutetium (Lu), neodymium (Nd), praseodymium (Pr), promethium (Pm), samarium (Sm), scandium (Sc), terbium (Tb), thulium (Tm), ytterbium (Yb), and yttrium (Y)

|

Key Highlights |

|

Introduction

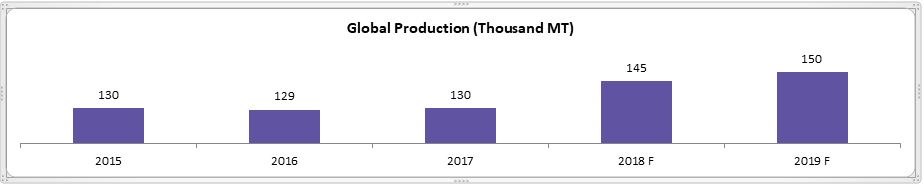

The global REE market was estimated at 145,000 MT in 2018, driven by the demand for magnets in automobiles and energy generation—sectors that significantly contribute to the growth of this market during the forecast period. Although global consumption increased, prices for yttrium metal and oxide remained nearly unchanged in 2018 given an abundance of supply.

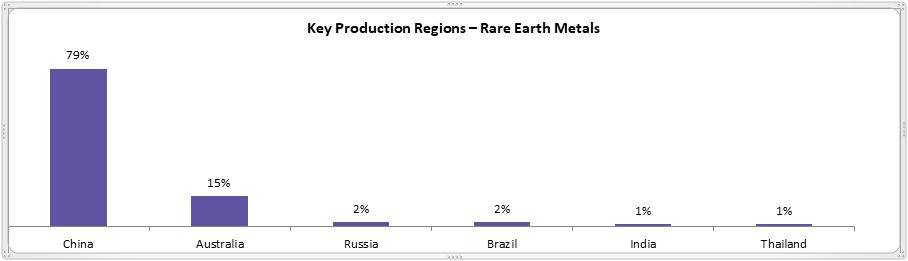

- Inconsistencies in rare earth metal supply and demand are significant restraints to the growth of the global rare earth metals market during the forecast period. Because the majority of the global rare earth production capacity is in China, it is becoming difficult for other countries to rely more on China, causing huge trading disturbances.

- As the future structure of the REE industry becomes clearer largely because of Chinese reforms, the demand outlook is becoming increasingly strong. Demand growth is underpinned by government policies (notably of China and India) that are pushing to reduce the pollution associated with carbon emissions and that are promoting clean, energy-efficient technology.

- In China, consolidation efforts at midyear to stem illegal production activity were reported to have bolstered the prices of some rare-earth materials; however, by year end, producers in China were suspending production and lowering prices given low demand.

- Rare earths are relatively abundant in the Earth’s crust, but minable concentrations are less common than for most other ores. The resources are primarily in four geologic environments: carbonatites and monazite-xenotime-bearing placer deposits (sources of production for LREM), alkaline igneous systems, and ion-adsorption clay deposits.

Rare Earth Metals – Market Outlook

Demand for rare earth magnets is high in Asia Pacific given the rise in demand for high earth magnets in manufacturing industries such as automotive and electronics. In addition to China, demand for rare earth magnets is also high in other Asia Pacific countries given the expansion of the wind power industry. However, demand for rare earth magnets in other regions, such as North America, is saturated because of the nonavailability of REE and a ban on their export from China.

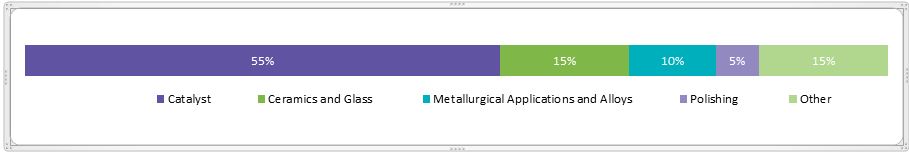

During the forecast period, magnets held the dominant market share for both volume and revenue. This segment grows at a cumulative average growth rate of more than 8.2 percent for revenue and 7.2 percent for market volume. The catalysts application segment has the second-largest market share in the global rare earth metals market for both volume and revenue. In 2016, the catalysts application segment contributed more than a 23-percent share of the global rare earth metals market.

The leading end uses of yttrium are in ceramics, metallurgy, and phosphors. In ceramic applications, yttrium compounds are used in abrasives, bearings and seals, high-temperature refractories for continuous-casting nozzles, jet-engine coatings, oxygen sensors in automobile engines, and wear-resistant and corrosion-resistant cutting tools.

In metallurgical applications, yttrium is used as a grain-refining additive and deoxidizer. Yttrium is also used in heating-element alloys, high-temperature superconductors, and superalloys. In electronics, yttrium-iron garnets are components in microwave radar and control high-frequency signals, among others.

The expanding use of europium in the production of blue and red phosphors, broadly used in all smartphones, televisions, and flat displays, is anticipated to boost demand for the product during the forecast period. Catalysts and permanent magnet application sections are likewise anticipated to witness quick development attributable to expanding applications in automotive and semiconductors.

|

Catalyst |

La, Ce, Pr, Nd |

Automobiles: Petroleum refinery, automotive catalysts, diesel additive Water treatment |

|

Ceramics and Glass |

La, Ce, Pr, Nd, Gd, Er, Ho |

Polishing: Colorants; Clean energy: Fuel cells; Electronics: Capacitors, sensors, semiconductors |

|

Metals and Alloys |

La, Ce, Pr, Nd, Sm |

NiMH batteries’ super alloy, Al–Mg alloy steel |

|

Polishing |

La, Ce, Eu, Tb, Y |

Agriculture: Fertilizer; Polishing: Pigments; Nuclear health: Medical tracers |

|

Magnets |

Pr, Nd, Gd, Tb, Dy |

Electronics: Motors and generators, hard disk drives, microphones, speakers; Health: MRI, defense applications |

|

Phosphor |

La, Ce, Eu, Tb, Y |

Lighting: Lasers, light-emitting diodes, fluorescent lamps; Electronics: Flat displays; Health: X-ray imaging |

Price Outlook

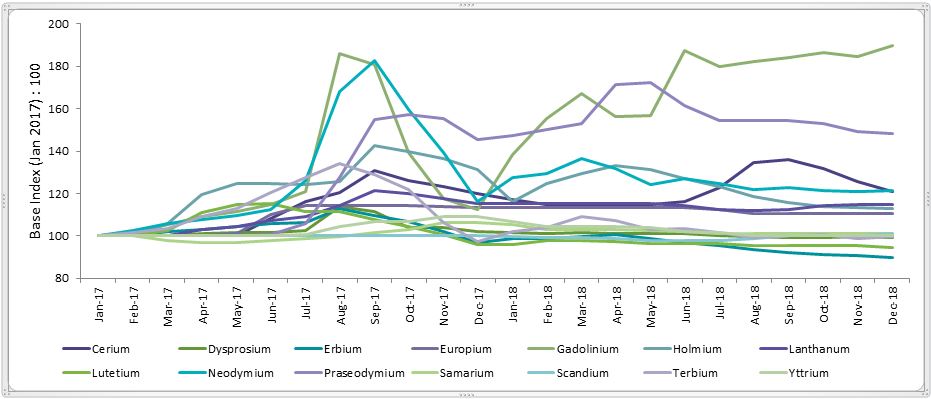

Of the 17 REE, some have proven to be rarer than others. Neodymium and praseodymium (NdPr)—two metals that are instrumental to the rapidly expanding green energy and electric vehicle (EV) sectors—saw the largest demand and price movements in 2018. Demand for the metals, which are used to make high-strength magnets for wind turbines and EV engines, are expected to grow as more EVs are manufactured and as clean-energy strategies are adopted.

Increased demand has understandably raised interest in these metals, creating a number of significant developments in 2018. These developments include a boost in production and exploration, output halts, REE recycling, potential tariffs, and political tensions.

Sourcing Practices and Contract Model

Most of the supply of rare earth elements is from authorized and third-party distributors through short- and medium-term contracts. Entering into short-term contracts is advised when buying metals because prices are volatile and, hence, consumers can take advantage of price declines to schedule large purchases and build inventories.

Types of Contracts

- Short-term contracts usually range from spot purchases to contract terms up to two to three months for lower volumes.

- Long-term contracts are 6–24 months in duration with fixed and hedged metal prices for larger volumes. Price clauses are provided in the contract to offset price fluctuations.

- Authorized dealers and distributors of rare earth markers distribute to customers for low volume on short- and medium-term bases.

- Authorized dealers and distributors: ~50–70 percent of the supply

- Third-party distributors with warehouses have varieties of grades of different markers to cater to various end users on spot and short-term contract bases.

- Third-party distributors: ~20–30 percent of the supply

- End users with large requirements buy directly from rare earth metals markers through long-term contracts and have price clauses to offset price fluctuations.

- Direct supply to end users: ~10–20 percent of the supply

- End users with low metal volumes procure from authorized and third-party distributors.

|

Risk Factors |

Spot/Short- Medium-term Contracts |

Long-term Contracts |

|

Risk from fluctuations in supplier pricing |

Low |

High |

|

Supply chain risk |

Medium |

Medium |

|

Risk of overpaying |

Low |

High |

|

Risk of incurring excessive administrative and procurement costs |

Low |

High |

Procurement Strategies

|

Strategy |

Comments |

Impact on Profit Margins |

|

Procurement through bids |

Suppliers invite bids to sell metals when they possess a large quantity of metals in stock. Possession of the metal is then transferred to the highest bidder. Bids are normally valid for 30 days. Some suppliers manage bids for as long as 60 to 90 days. Depending on the complexity of the bid, the bid process may take from one day to one month. |

Medium |

|

Contracts with suppliers (Long Term) |

Buyers enter into long-term contracts with metals suppliers. Contract prices are fixed on a monthly basis with a discount to the current price of metals. The discount is usually 10–30 percent depending on the range of the business, quality, and payment structure. Buyers who have been associated with a particular supplier for a long time will have bargaining power (though not very strong) with respect to pricing contracts. |

Low-Medium |

|

Short-term Contracts |

Buyers enter into short-term contracts with suppliers. Suppliers fix the price on a weekly/monthly basis (given high volatility), benchmarking it against current market prices. The buyer’s bargaining power will be very low when entering into short-term contracts with new suppliers. |

Medium-High |

Contract and Payment Terms

|

Terms/Documents |

Descriptions |

|

Time for Supply |

A fixed date is generally quoted for delivery and the supplier uses reasonable endeavors to complete the delivery. Failure to deliver within the stipulated time will be subject to liquidated damages at a previously agreed-on percentage. |

|

Quality and Testing |

Inspections and tests are generally undertaken in accordance with the company’s standard practices. These tests are included in the quoted price. Additional tests required by the client may result in an increase in the contract price. |

|

Packaging |

Packing is generally part of the contract price. Packing provided by the company may be returnable based on the semi. The type of packaging used varies with the mode of the semi. |

|

Limitation of Liability |

A company’s liability is generally limited to a predetermined amount in case of any damage from defective goods or product failure, but liability will not be limited to any loss incurred from a direct or indirect cause of negligence on the part of the company or its agents. |

|

Prices and Contract Price Adjustment |

Prices quoted by the supplier are generally based on factors like material cost, labor, freight, insurance, duties, and others. The price quoted is typically adjusted for factors such as raw materials or electricity through explicit statements in the agreement prior to the date of the quoted delivery. |

|

Payment |

Payment terms have to be met during a stipulated period of 30–60 days through the issuance of a written invoice by the supplier. If the purchaser defaults on a payment, he or she can be charged a penalty amounting to a set interest rate over and above the rate fixed. The credit period for payments can vary depending on the supplier–buyer relations and order quantities. |

|

Delivery |

Goods are normally supplied at customers’ manufacturing facility for large quantities and given the nature of the products. However, smaller customers may have to buy through local distribution channels when the quantity and the product complexity are low. In the latter case, special delivery arrangements to the client location can be made on request, and all carriage and insurance costs are included in the purchaser’s account. |

Conclusion

- Global contracts with third-party distributors – Low volume buyers are advised to focus on sourcing from third-party distributors and not direct sourcing or authorized distributors. Engaging with third-party distributors may increase the scope for discounts and a steady supply.

- Negotiation power is low – Negotiation power is low for both large- and small-volume buyers. Large-volume buyers prefer to engage with tier 2 suppliers to optimize their buying power.

- Long term contracts are preferred – Long-term contracts (longer than two years) are preferred because of an anticipated scenario of high volatility of supply. Long-term forward contracts may increase the scope for discounts relative to spot and short-term contracts.

Recommended Reads:

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe