Plastic Bag Ban in Europe—New Opportunities in Sustainable Packaging

Abstract

Europe uses 90 billion single-use plastic bags every year, of which 8 billion end up in landfills. Plastic bags take five seconds to produce, are used for five minutes on average but take 450 years to naturally degrade. Globally, plastic bags make up 12 percent of beach litter. During 2015, the European Commission issued the EU plastic bags directive to reduce single-use plastic bag use from 200 per person to 80 per person by 2020 and to 40 per person by 2025. The Commission required an action plan individually from each of its 28 member countries regarding their move to achieve single-use plastic bag reduction targets. Ban of plastic bag, tax levy, and charging customers a recycling fee were among strategies adopted by the EU countries. The plastic bag ban has brought many alternatives into the market. However, bio based and bio degradables were the choice of Italy, France, Bulgaria, Sweden, Latvia, and Lithuania. By 2025, 72 billion plastic bags must be converted into bio based/degradables to achieve EU’s plastic bag reduction target. This has kick-started the growth of the sustainable packaging market in Europe. BASF, Arkema, Novamont, DSM, and Ercos were among the few European bio based/degradable plastic resin manufacturers who benefited and continue to benefit from the European plastic-bag ban by including new bio based/degradable products into their portfolio. Through the single-use plastic bag ban, EU is attempting to make all its packaging recyclable by 2030. This article explains how switching to bio plastic is no more an option, but a mandate. It is important for companies to strategize their bio plastic sourcing activity, to be prepared for the market switch, and to handle the future supply constraints of bio plastics considering the increasing demand. The article addresses bio plastic innovations driven by the plastic bag ban in Europe and how it influences the growth of sustainable packaging across globe.

Bio Plastics Market Overview

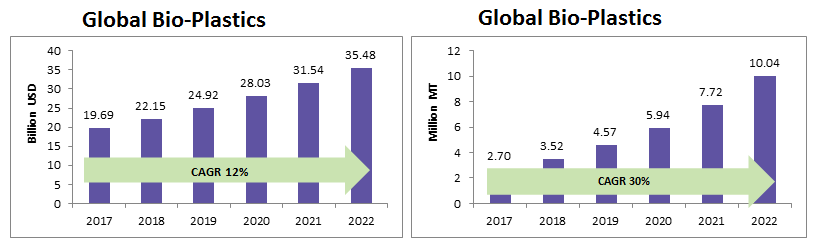

Are bio plastics as costly as they were a demi-decade back? In terms of volume, the global bio plastic market, is growing higher than bio plastic market in terms of value, with the price fall of bio plastics in recent times. Globally, bio plastics have replaced 6.8 percent of plastic consumption in 2017 and are expected to replace up to 10 percent of plastic consumption by 2022.

Increasing environmental awareness, customer preference, government regulation, material innovations, and brand’s sustainable initiatives are the major growth drivers of sustainable packaging products. The increasing demand for bio plastics has increased the capacity utilization rates of bio plastic manufacturing companies as the major reason for bio-plastics becoming affordable.

Regulations in developed regions play a vital role in bio plastics growth. In 2015, European commission issued the EU plastic bags directive to reduce single-use plastic bag usage from 200 per person to 80 per person by 2020 and to 40 per person by 2025.

Impact of EU Plastic bag ban Derivative

France, Belgium, and Austria have completely banned single-use plastic bags. Denmark, Bulgaria, Malta, and Romania have imposed taxes, whereas a majority of European counties like Ireland, Finland, Italy, Germany, Belgium, UK, the Netherlands, Estonia, Greece, Slovakia, Poland, Czech Republic, and Luxembourg have started to charge a recycling fee from buyers.

Cyprus, Croatia, Latvia, and Slovenia are expected to implement their plastic bag reduction strategy by 2019. Supermarkets of Bulgaria and Sweden have taken initiatives to reduce plastic usage by collecting a fee per bag, before their governments formulated the strategy.

The Europe plastic bag derivate move has allowed countries to switch to plastic alternatives and bio plastics have witnessed a growth in Europe with 40 percent global market share. The region is also known for bio plastics innovation with the presence of bio plastic giants like BASF, Arkema, Novamont, DSM, FP International, etc.

Europe the Innovation Hub of Bio Plastics

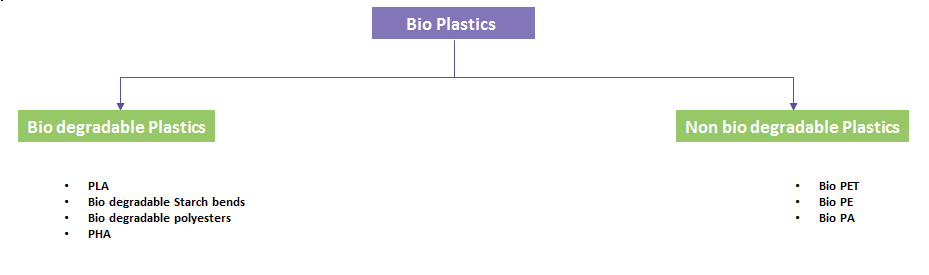

Bio plastics are classified into biodegradable and bio-based non-biodegradable. The bio-based non-biodegradable plastic market is witnessing higher growth than the biodegradable plastic market due to its high mechanical strength and recyclable properties.

Bio PET holds 92 percent of non-bio degradable market. PLA holds the major market share of bio degradable market with 38 percent followed by starch blends and PHA each holding ~20 percent of the market share.

Packaging industry is the major consumer of bio plastics with 58 percent market share as on 2017. Europe holds 18 percent of the bio plastics market share followed by North America with 16 percent market share on the production front. Though APAC has the major production capacity in bio plastics, Europe is the major innovation hub.

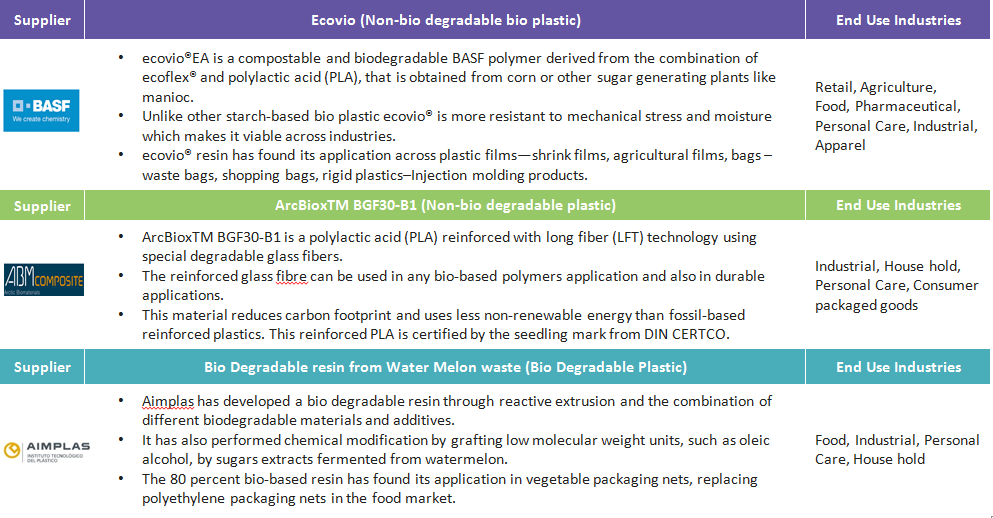

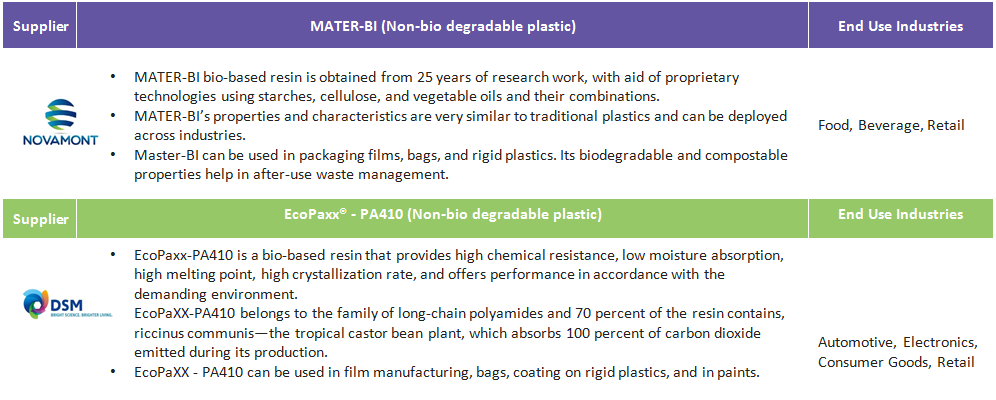

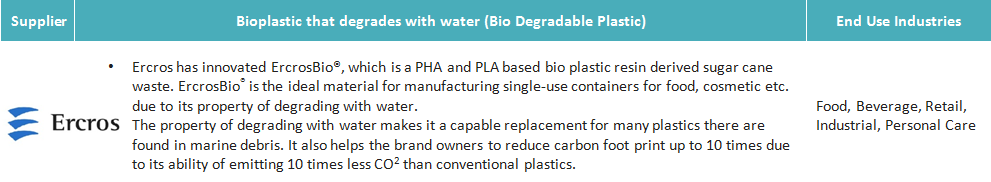

European bio plastics suppliers mainly strive towards developing new technologies to manufacture biodegradable packaging material from various easily available natural resources. Suppliers making large investments in research and development to develop innovative products to gain a competitive advantage in the market. Major bio plastic resin innovations in Europe from the introduction of plastic bag ban are highlighted below.

European Bio Plastic Resin Innovations

How Bio Plastics went from Single-use to Packaging in Europe?

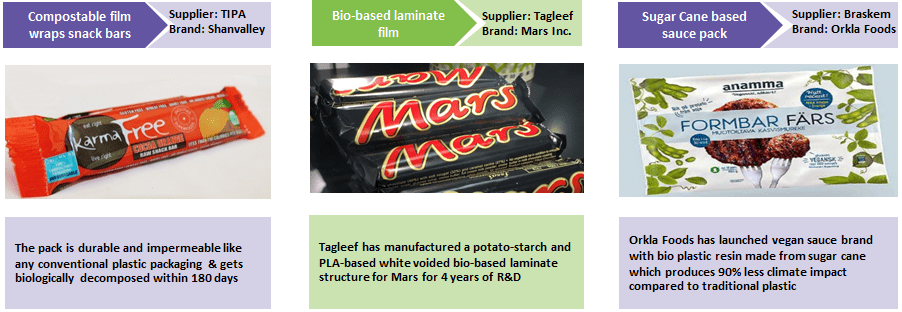

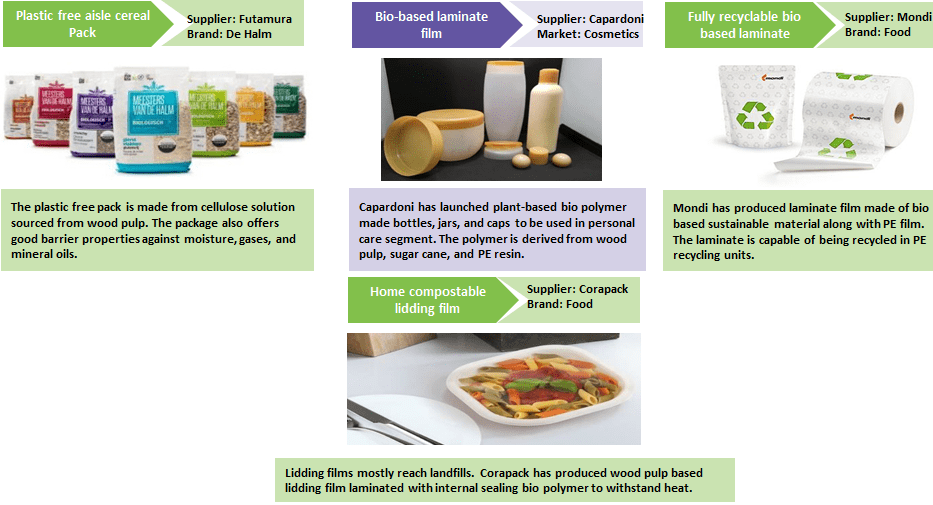

European companies across industries have set sustainability goals and chose sustainable packaging to achieve its sustainability goal by taking advantage of growing bio plastics innovations in the region.

Companies have invested in sustainable packaging to differentiate their products from others in a way appealing to its customers and gradually, brands have visualized the penetration of bio plastics from single-use bags to their product packages. Below are a few examples of how European brands used bio plastics in their product packaging.

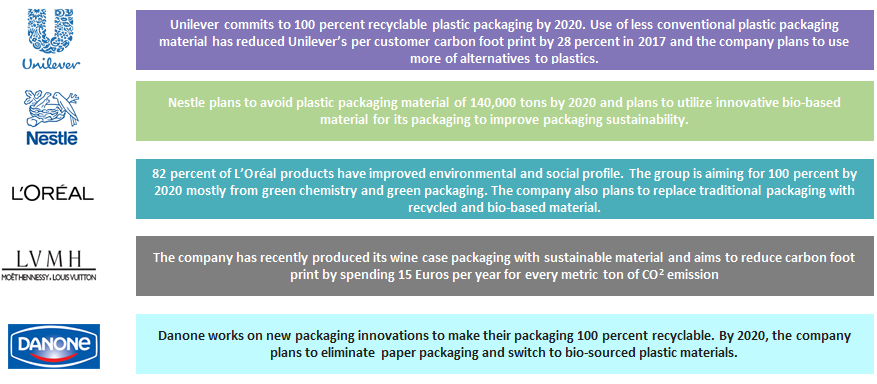

Future sustainability packaging goals from European Brands

European brands have strategized their future sustainable packaging goals. The sustainable packaging targets adopted by European brand promises further growth opportunities for bio plastics in Europe. Few of the sustainability packaging goals of major European companies are mentioned below,

Conclusion

The single-use plastic bag ban by European Union has led to innovation in the bio plastics resin market in Europe. Brands across industries have made bio plastic innovations penetrate their product’s packaging to achieve their sustainability goals.

Should NAFTA be next to implement such bans for the growth of sustainable packaging in North America? However, even before NAFTA’s involvement, brands across North America decided with their sustainability targets and started using bio-based packaging innovations to compete with their European counterparts.

Ohio-based P&G have planned to reduce plastic packaging consumption by 20 percent by increasing the use of bio plastics and to make 90 percent of their packaging recyclable by 2020. Georgia-based Coca Cola has started using PET resin made from 30 percent plant material to reduce its carbon footprint. This proves that the rest of the world has not waited for a regulatory ban and has started competing with sustainability goals through bio packaging.

References

http://europa.eu/rapid/press-release_IP-18-3927_en.htm

ttps://www.onyalife.com/reusable-bags/eu-moves-to-reduce-plastic-bag-use-across-28-countries/

http://www.greenworld.nyc/the-great-pacific-garbage-patch/

https://www.planete-energies.com/en/medias/close/france-s-single-use-plastic-bag-regulation

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe