Regulatory affairs outsourcing gathers steam as compliance and regulatory norms become stringent

Abstract

Pharmaceutical market being a highly regulated market, the regulatory affairs department acts as an interface between the company and regulatory authorities. It coordinates with the development, manufacturing, marketing and clinical research units within the organization.

The evolving regulatory environment through the years with respect to the dynamic and strict regulations across the globe presents both challenges as well as opportunities for the drug makers. In recent years, there have been many revisions with respect to the post-market monitoring, including pharmacovigilance. This is due to the increased awareness of drug safety among the public and also the heavy compensation involved for failing to adhere with the FDA policies across regions. This article focuses on the recent trends and insights in the regulatory landscape.

Introduction

The regulatory affairs outsourcing market is expanding and is expected to reach $5.7 billion by 2023 at a CAGR of 11.5 percent during the forecast time frame from 2015 to 2023. Outsourcing of clinical trial application and product registration segment is on the rise, with spend on this particular segment expected to grow significantly considering the number of products in the pipeline.

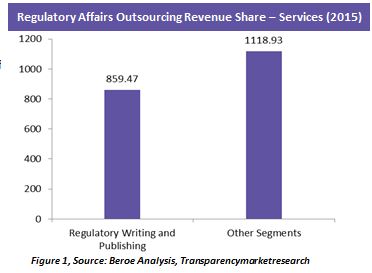

Currently, regulatory writing and publishing contributes to the majority of the outsourcing market (Figure 1). This is because, submission of accurate regulatory paperwork and meeting the timelines are critical. Mandates with respect to Clinical Data Transparency (EMA Policy 70) are reshaping the Regulatory Writing landscape. To comply with these mandates, pharma and biotech has to produce research summaries of clinical study reports and submission documents suitable for all the geographies and publish their clinical study information publicly.

Regional Outlook

The recent guidelines on multi-regional clinical trials (MRCTs) aim to improve the acceptance of regulatory submissions by multiple regulatory authorities globally. This increases the possibility of submitting the MAA (Marketing Authorization Applications) to multiple regulatory authorities in different regions simultaneously, thus gaining market reach faster.

The markets of Brazil, China, India and Russia are widely sought after for outsourcing and they come with their own set of regulations. A 2016 survey among the buyers reveals that the outsourcing of projects has decreased to these emerging countries in comparison to the previous years, despite the low costs and increased manpower in these markets.

Quality and regulatory compliance remain the two top issues. Intellectual property concerns come next while it was not much of an issue previously. Despite the constraints, the outsourcing market is expected to grow at 5.8 percent CAGR in Asia Pacific and 11.1 percent CAGR in Latin America from 2015 to 2023. This growth can in turn be attributed to the maintenance of the regulatory data across the globe with the help of regional service providers.

Outsourcing Trends

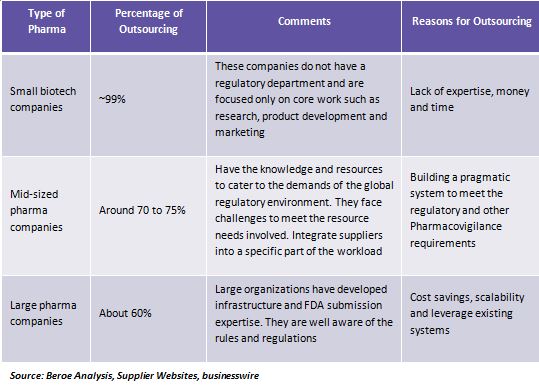

Regulatory outsourcing promotes efficiency, can leverage technology, and helps a pharma company focus on crucial areas. Uncertainty with respect to FTE, timeliness and huge volumes of data warrants outsourcing of this category. Surveys state that top pharma companies outsource about 55 percent of regulatory support service and very little of the regulatory strategy services. Cost-efficient outsourcing activities attract pharma to shift from expensive in-house regulatory maintenance.

Recently Takeda handed over its regulatory affairs work to PRA Health Sciences for clinical development services. This will add flexibility and allow Takeda to reduce their costs and focus on their core areas.

Supplier trends

Several large CROs are looking forward to acquire small size CROs to scale up their operations and offer diverse specialized regulatory services with high efficiency. IT/BPOs cater to both technical and large FTE requirements and hence are preferred by the buyers for easy data handling. Recent trends suggest that CROs are tying up with players offering cloud technologies and social media to gain access to real time data. Use of digital technologies allows improved accuracy of patient contributed data during and after trials. Wearable sensors, remote monitoring devices, and mobile apps help understand how patients are responding to therapies in real time, making it easy for data collection and FDA submissions.

Outsourcing drivers and KPIs

While cost remains an issue, experience, scalability, timeliness and quality continue to be fundamental drivers in engaging with a CRO and key to a strong partnership in outsourcing. “At the end of the day,” stresses Connelly (Katie Connelly, Vice President, Strategic Resourcing and Operations at PAREXEL), “if we’re meeting timeliness and quality metrics and the products are in a state of compliance, then we can confidently say we are supporting the commercial success of our client”.

Communication also plays an important role in partnering with a CRO, as the information flow between a CRO and a buyer is considered to be challenging, especially in case of sub-contracting. Technology also acts as key differentiators, as electronic submissions are trending, and a platform to accomplish this is important. Pharma and biotech companies are still in a nascent stage of using social media platforms to collect safety data but the spike in people using it will make it a better way of gathering and monitoring such data.

Conclusion

Day to day maintenance activities such as labelling, manufacturing changes, renewals and regulatory compliance are low risk and strategic, but very critical to a company’s bottom line. Therefore, the regulatory departments of various pharma are under a lot of pressure to reduce the time-to-market. Thus the outsourcing trend is expected to shift more towards technology and may also lead to emergence of new functional service providers and specialists in this area not only with respect to product development, but also for post marketing surveillance.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe