PET scores over HDPE to achieve cost savings

Abstract

Personal care packaging segment is highly dominated by HDPE bottles. However, PET bottles are seen as an ideal alternative for HDPE bottles due to advantages such as cost savings and sustainable packaging solutions. The article throws light upon the ongoing trends in PET penetration in the personal care segment while highlighting the various opportunities and challenges for this trend, it also discusses the potential impact on the supply base.

Introduction

- Personal care market is expected to grow at a rate of 4-5 percent CAGR over the next 5 years due to increased beauty care awareness among the middle class families with high disposable income

- Global PET bottles market is expected to grow at a strong rate of 6-7 percent CAGR over the next 5 years, predominantly driven by increasing demand from end use industries such as beverages, home care, and personal care

- PET is the fastest growing personal care packaging format with an expected CAGR of 8-9 percent (2016-21). This growth is driven by consumer preference, product light weight and high recycling rate for PET. However, HDPE is seen to have higher preference due to its better rigidity and barrier properties

- Personal care products generally use multiple plastic packaging solutions such as bottles, sachets and glasses based on the nature of products, and consumer preferences. Bottles constitute about 53 percent of the packaging used for personal care products comprising of PET and HDPE resins, of which 71 percent is made with HDPE

Imminent challenges with HDPE

HDPE is the most commonly used material for packaging personal care products especially in lotions, body wash, shampoo, and conditioner. This is primarily due to the enhanced barrier properties, improved shelf life and consumer preference.

The increased rigidity of HDPE and also the high opacity has driven the need for improving the transparency and other light weight options. The colors used in HDPE resins are also limited which limits the design flexibility. However, the major challenges for HDPE lie in its cost competency against substitutes, and also the added sustainability concerns.

Cost pressure

Personal care industry is highly competitive and brand owners are always on the lookout to adopt cost-effective packaging solutions without compromising the existing product features. Packaging is feeling the pinch of this trend, where rigid plastic packaging products are increasingly moving towards cost efficient package formats such as flexible pouches and blisters. The high cost of HDPE has driven the move towards alternate cost- effective resin types such as PET.

Sustainability concerns

The rate of land fill for HDPE is high compared to other plastic packaging materials. HDPE, given its non-biodegradable nature, poses a serious environmental threat and it is therefore forcing the players to adopt sustainable packaging solutions.

Since HDPE bottles are 100 percent recyclable, they require intensive processing techniques to achieve desired purity with increased operational costs than PET. Apart from this, they are also heavier and use more raw material which ultimately results in increased carbon footprint.

Major brand owners such as P&G, L’Oreal, and Unilever have announced that they would significantly increase and in some cases double the current tonnage of Post-consumer recycled (PCR) resin in their packaging by 2020 for which PET would be a desirable resin type.

For example, Unilever is committed to make 100 percent of its plastic packaging from reusable or recyclable by 2025.

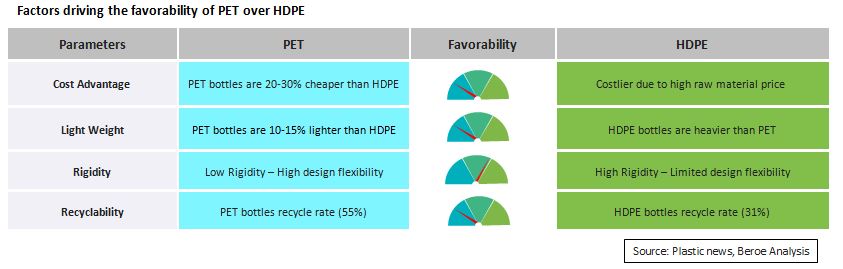

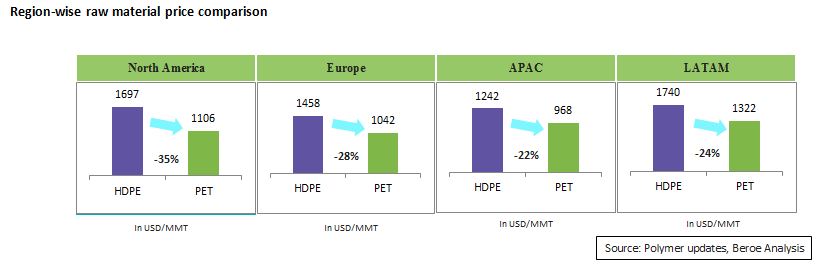

Cost comparison - PET vs HDPE

One of the most important drivers for growth in demand for PET bottles has been their relatively lower cost when compared with HDPE. PET resins are 25-30 percent cheaper than HDPE resins. Given that raw materials form 65 percent - 75 percent of the overall bottle cost which in turn could result in 15-20 percent cost savings in the cost of the bottle. The current trend would continue for the next 10 years, it may be beneficial to adopt PET instead of HDPE. The shift is also evident in the strong growth of PET bottles -- 8-9 percent in personal care segment particularly in shampoo and conditioner product segments.

Also resins from post-consumer recycled materials are evolving as a viable alternative to virgin resins in both PET and HDPE. The demand for recycled resins is significantly increasing owing to better availability with high recycling rate and competitive prices. The prices of post-consumer PET resins are 10-15 percent cheaper than the post-consumer HDPE resins due to reasons such as high recycling rate in PET (55 percent) compared to HDPE bottles (31 percent) globally. Also it is possible to use higher recycled content in PET when compared to other material types.

PET adoption by top brands in personal care products

PET bottles are increasingly preferred by top personal care brands such as L’Oreal, Henkel, Johnson and Johnson. For example, shampoo and conditioner product range in Garnier by L’Oreal uses PET bottles for all their shampoo and conditioner product lines since 2000, as part of their green packaging commitment to reduce environmental impact. The PET bottles used by Garnier to package are produced from 30-50 percent post-consumer recycled content.

There are several other products of top brands that have adopted PET in personal care products such as Syoss hair care products from Henkel, shampoo and conditioners in Baby care products from Johnson & Johnson. One of the key reasons for adopting PET is increasing cost pressure; brands are looking for every possible opportunity to save costs without compromising on the product quality and shelf life. There is also an increased demand for product differentiation and improved aesthetics due to increasing competition. Fruit-based shampoos which contain micro granules are expected to attract consumer attention.

Barriers to PET Adoption

Brand Recognition: HDPE has been the most prevalent packaging material for many years now and the unique colors and shapes have come to contribute to brand familiarity, given that majority of the in-store purchase decisions are made by brand familiarity by sight, change in the packaging material could have a significant impact on sales, this hinders any significant alteration to the existing product.

Visual Appeal: High transparency in PET bottles, though the feature may be desirable for improving the visual appeal, this could also increase exposure to light leading to product discoloration and reduced shelf life. Given that it is challenging to retain the nearly opaque finish of HDPE in a PET substitute, it would be a significant constraint for PET.

Rigidity: Advanced dispensing is becoming a key distinguishing factor in plastic bottles, the low rigidity of PET would make it challenging to adopt these innovate dispensing systems which usually have caps with high rigidity.

Complexity in SKUs: Another important challenge in adopting PET substitutes is the complexity in SKUs, the multitude of brands and the products associated with them are very high and implementing the changes in design and material used would require significant time and incremental costs; however, it may be beneficial in the long run.

Conclusion

Brand owners have to create a strategic partnership with suppliers, especially with PET technology developers who are responsible for driving innovations.

Customers, especially in the developed regions, are becoming increasingly environment conscious and prefer sustainable product options. This has pressurized brand owners to quickly adopt sustainable packaging options thereby reducing their carbon emissions and improve the overall sustainability of their products.

The shift in the preference for PET over HDPE would continue to influence product packaging trends in the personal care products packaging segment. Taking into account the various benefits of cost and light-weight options, PET would contribute more than the traditional HDPE. In the future, as technology develops in the areas of barrier properties, PET could become the dominant resin within the personal care product segment.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe