Opportunities for Corn Starch Packaging in India

Abstract

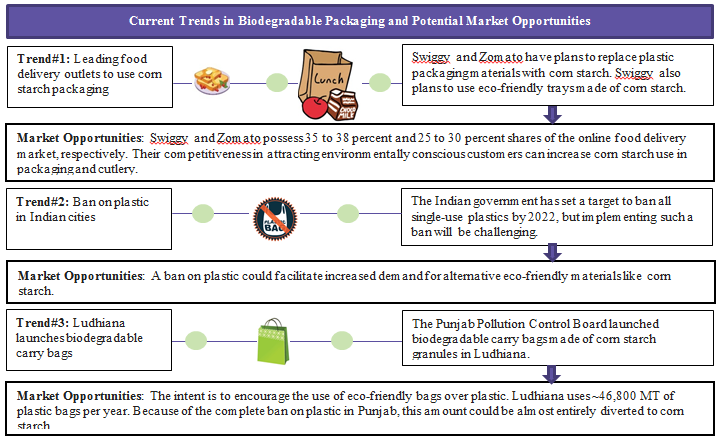

India has announced a blanket ban on the application of single-use plastics in the country by 2022. Awareness among consumers about the negative effects of plastics on the environment is growing. Thus, to cater to such environmentally conscious consumers and to comply with government regulations, manufacturers and other plastic packaging users could seek cost-effective alternatives and substitutes. Corn starch is among the most commonly used substitute for plastic in packaging. Leading online food delivery systems are also switching to corn starch packaging to promote an eco-friendly image. Thus, a potential opportunity for the growth of this niche market has opened up in the country in the wake of current trends.

Some of the largest industrial players are involved in India’s plastic industry, such as petroleum companies that provide the raw materials for plastic bits generation used to make plastic bags. Therefore, the ban could receive lackluster support from major manufacturers and industry players, making its implementation challenging. However, the environmental consciousness among some consumers is discernable; therefore, the potential exists for the entry of substitutes despite the high use of plastic. The promotion of bioplastics as packaging material by popular food delivery outlets and organizations, including Future Group, which owns well-known brands like Big Bazaar, FBB, Brand Factory, Food Bazaar, and Central and Food Hall, constitutes a significant step in overcoming these challenges.

Approximately 5 to 7 percent of India’s corn production is estimated to go into starch. This estimate implies an annual corn starch production of 1.5–2 MMT. Although there is demand from the paper, adhesives, poultry/animal feed, and fireworks sectors, the fact that starch constitutes a minimal proportion of national corn production suggests a broad scope for capacity expansion. Hence, the availability of corn starch for packaging could be sufficient. Other factors supporting the growth of the corn starch packaging market include the regulatory environment and consumer awareness.

Major challenges to the growth of this market include higher input costs and, hence, prices, as well as the presence of impurities in finished corn starch bags such as plastic and metal. These challenges can be overcome by increasing the raw material (corn) supply, which can reduce costs and enhance manufacturing per EN, ASTM, and IS/ISO norms to decrease contamination.

This article brings forth a perspective of the general market outlook for corn starch packaging, determines the drivers and constraints for the market, and assesses the likelihood of the switch from plastic to corn starch.

The Issue: Potential Opportunities for Biodegradable Packaging

India is likely to enforce a ban on plastic in many of its states. Considering the rapid growth of the packaging industry, this situation represents an opportunity for the corn starch packaging sector. Previously, an attempt was made to introduce corn starch bags into the mainstream. However, certain challenges exist related to cost and price, as well as purity, which could impede market growth. This article discusses the potential and outlook for the corn starch packaging market in India.

Corn Starch: Biodegradable Packaging – An Emerging Novel Application in India

Factors Driving the Trend: India’s Fight against Plastic and Substitute Potential

The Plastic Waste Problem

- Approximately 15,000 MT of plastic waste is generated by India on a daily basis.

- Only 60 percent of the waste is collected for recycling, which creates pollution from the waste.

- In light of this situation, a plastic ban has been imposed on 18 states and the government has advocated for a complete ban on single-use plastics by 2022

Challenges to Implementing Plastic Ban

- Some of the largest industrial players are involved in India’s plastic industry, such as petroleum companies that provide the raw materials for the plastic bits generated and used in making plastic bags.

- Therefore, the ban could receive lackluster support from major manufacturers and industry players, making its implementation challenging.

- However, there is a discernable environmental consciousness among some consumers; therefore, the potential exists for the entry of substitutes despite the high use of plastic.

Opportunities for Corn Starch Packaging

- The use of corn starch bags as a replacement for plastic has potential in India given that the market is in a nascent stage.

- Corn starch packaging is 30 percent stronger than existing polythene bags.

- Because they are biodegradable, corn starch bags are likely to appeal to environmentally conscious consumers and represent a niche market for new entrants that could attract a core customer base.

- Although biodegradable bags could be made from a variety of natural raw materials, the most abundantly available raw material is corn.

Challenges for Corn Starch Packaging

- The use of plastic bags is ingrained in the majority of the consumer base; therefore, a switch to corn starch packaging could take time given the potential reluctance of some consumers.

- Low consumer awareness of the bioplastics market (which includes corn starch) is also a factor responsible for its slow growth.

- The promotion of bioplastics as packaging material by popular food delivery outlets and organizations like Future Group, which owns well-known brands such as Big Bazaar, FBB, Brand Factory, Food Bazaar, Central and Food Hall, is a significant step to overcoming these challenges.

Factors Determining Growth of Corn Starch Packaging Market in India

Capacity Potential

- The corn starch industry is fragmented in India with a number of small and medium-sized manufacturers.

- Approximately 5 to 7 percent of India’s corn production goes into starch.

- This implies an annual corn starch production of 1.5–2 MMT. Although there is demand from the paper, adhesives, poultry/animal feed, and fireworks sectors, the fact that starch constitutes a minimal proportion of national corn production suggests a large scope for capacity expansion. Hence, the availability of corn starch for packaging could be sufficient.

Speed of Execution

- An increase in the use of corn starch packaging depends on favorable regulations and the growth of companies promoting such products.

- The impending plastic ban raises consumer awareness of the environmental hazards posed by plastic and the need for alternatives.

- In addition, many bioplastic companies that manufacture corn starch packaging materials have emerged in India. These include Envigreen, Ecolife, Plastobags, Earthsoul India, and others.

- This situation reflects a positive change in consumer behavior, and the speed of execution could be high with government support.

Cost and Price

- The most significant factors that could affect the transition from plastic to corn starch packaging are the cost and price involved.

- Corn—the raw material—is inexpensive given high global supplies relative to synthetic polymer materials produced from petroleum, which are expensive.

- However, corn starch bags in general incur higher input costs than plastic bags because the quantity of the raw material diverted to the sector is low.

- Plastics are lightweight and reduce transport costs, whereas the shipping cost for eco-friendly bags is higher. Thus, the overall production costs for biodegradable starch bags are higher by 20 to 25 percent than for plastic bags.

- Consumers are also more prone to prefer low-cost bags to more expensive, eco-friendly alternatives.

- In India, the price of plastic bags is 125 rupees/kg, whereas the price of corn starch bags is more than 325 rupees/kg.

- Cost and price are major challenges for the growth of the corn starch packaging market. Industry innovation should focus on cost reduction.

Potential Impurities

- In India, instances of contamination have occurred whereby corn starch bags contained some plastic and even metal.

- This issue could discourage manufacturers and consumers from adopting eco-friendly packaging.

Willingness to Adopt

- A vital factor determining the growth of the corn starch packaging market in India is the willingness of manufacturers and consumers to shift from plastic to corn starch packaging.

- In turn, this shift depends on cost and price and the removal of impurities.

- It is possible to lower production costs by increasing the diversion of corn into the sector to cater to demand.

- It is also necessary to ensure quality assurance at every step of the corn starch bag manufacturing process to eliminate contamination.

Conclusion – Outlook for Corn Starch Packaging in India

Market Opportunities

APAC is projected to be the fastest growing region for the use of biodegradable packaging. The growth of the packaging industry, favorable government regulations, and the impending plastic ban in India offer opportunities for the entry of niche products such as corn starch bags.

Major Challenges to Market Growth

The most important parameters for market growth are price, cost, and the presence of impurities. Increases in the raw material (corn) supply can reduce costs and manufacturing as per EN, ASTM, and IS/ISO norms and can reduce contamination.

Conclusion

Considering the drivers and constraints of the market for biodegradable packaging, the application of corn starch bags could remain a niche in India but could still capture a sizeable share of the packaging industry by 2025.

References

- https://eoindia.com/swiggy-zomato-to-use-recycled-packaging-material-to-promote-eco-friendly-living/

- https://timesofindia.indiatimes.com/city/pune/corn-starch-bags-cutlery-a-hot-pick-for-restaurants/articleshow/63586930.cms

- http://www.fnbnews.com/FB-Specials/Untapped-opportunities-for-the-Indian-starch-industry

- http://fmtmagazine.in/starch-industry-india-supply-demand-scenario/

- https://www.thebetterindia.com/77202/envigreen-bags-organic-biodegradable-plastic/

- https://indianexpress.com/article/cities/chandigarh/ludhiana-biodegradable-carry-bags-made-from-starch-granules-launched-5187342/

- https://www.livemint.com/Companies/wvflI3e7yvjUOg8PTkvZMM/Food-delivery-sector-on-cusp-of-revival-as-investments-pour.html

- https://cen.acs.org/environment/pollution/Plastic-bans-India-expand-18/96/i17

- https://www.thenewsminute.com/article/here-are-five-eco-friendly-ways-making-plastic-wont-pollute-49261

- https://www.financialexpress.com/industry/plastic-ban-from-challenge-to-opportunity/1267827/

- https://india.mongabay.com/2018/05/09/will-maharashtra-be-able-to-implement-the-plastic-ban-effectively/

- https://www.thehindu.com/todays-paper/tp-national/tp-andhrapradesh/Starch-bags-an-alternative-to-plastic-ones/article16186266.ece

- http://www.ecoideaz.com/expert-corner/pioneering-bioplastic-companies-india-bring-positive-change

- https://www.heritagepaper.net/pros-and-cons-of-biodegradable-packing-peanuts/

- https://punemirror.indiatimes.com/pune/cover-story/pmc-has-now-set-its-eyes-on-corn-starch-bags/articleshow/64070157.cms

- http://myzerowaste.com/2009/07/is-cornstarch-plastic-packaging-pla-compostable-or-recyclable/

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe