Opportunities for Bioplastics as a Viable Plastic Alternative

Abstract

The current market climate exhibits a degree of environmental awareness of plastic consumers. This could cause a shift towards alternatives. While plastics would still continue to dominate the market, there is a window of opportunity for alternative materials that are perceived as more eco-friendly. Bioplastics are one such commodity, and constitute a niche market.

| Key Highlights |

How would a switch from conventional plastic to bioplastic material impact the market for conventional plastics?

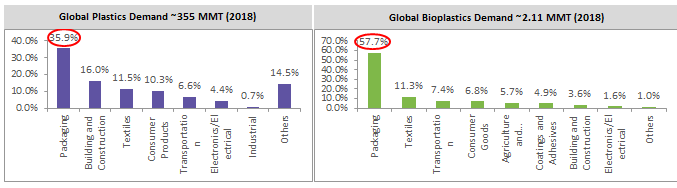

What would be the projected impact on end-use sectors? Packaging sector consumes 127.45 MMT of conventional plastics and 1.22 MMT of bioplastics. It is identified as the market with the highest potential for bioplastics because of high plastic demand and shifting preference for bio-based sources of packaging. What are the optimal procurement strategies for PET bottles to be adopted by liquid dairy manufacturers? The optimal contract duration would be quarterly or semi-annual (3–6 months) |

Introduction

The demand for plastic packaging is rising globally. The current global production of plastic packaging is 337 MMT. The market drivers for plastic packaging include its durability, light-weight nature, and lesser input costs compared with substitutes. However, with the rise in demand, there has also been a corresponding rise in environmental awareness in several key consumer regions. In particular, India is attempting to curb the use of plastic packaging with blanket bans in some states, and a ban on the use of recycled plastics in food packaging. In other countries like the U.S. as well as EU regions, there is a focus on recyclability. All these factors offer an opportunity for a shift towards bioplastics use.

- Regions prohibiting the use of single-use plastic and rising environmental awareness among consumers are the key trend driving the bioplastics market.

- There is increasing use of bioplastics in packaging.

- Key market players are investing heavily in R&D aimed at developing novel biodegradable plastic products.

The article analyses the current position of the bioplastic market, its supply–demand dynamics vis-à-vis conventional plastic packaging, and outlook as well as opportunities for market growth.

Global Conventional Plastics Market vs Global Bioplastics Market

Slowdown in Growth of Plastics Supply:

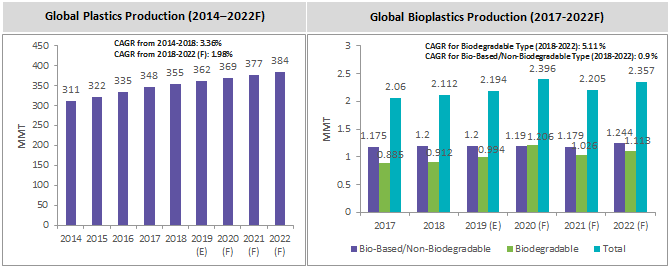

- Global plastics production grew by a CAGR of 3.36 percent between 2014 and 2018. However, a slowdown in growth is projected, with the market potentially growing by a lesser CAGR of 1.98 percent between 2018 and 2022.

Insight: Despite the healthy demand for plastics, especially from the packaging sector, environmental awareness of consumers could cause a shift towards alternatives. While plastics would still continue to dominate the market, there is a window of opportunity for alternative materials that are perceived as more eco-friendly.

Rise in Bioplastics Production:

- The production of bioplastics rose by 2.5 percent from 2017 to 2.11 MMT in 2018, and is projected to rise by a CAGR of 2.78 percent by 2022.

- Within bioplastics supply, bio-based/non-biodegradable plastic accounts for 56.8 percent of the supply, with the remaining constituted by biodegradable plastics.

- The biodegradable type is projected to grow by a CAGR of 5.11 percent to 1.113 MMT by 2022, increasing its share from 43.2 percent in 2018 to 47.2 percent by 2022.

- In contrast, the non-biodegradable type is projected to grow by a far lesser CAGR of 0.9 percent to 1.244 MMT by 2022, decreasing its share from 56.8 to 52.8 percent.

Insight: At present, the bioplastics supply accounts for only 1 percent of the global plastics supply. However, the growth of the plastics market is slowing down, while the growth of the bioplastics market is projected to increase. This provides an opportunity for the bioplastics market to tap into the demand segments for plastics. The projection of biodegradable bioplastics growth being potentially higher than non-biodegradable bioplastics indicates strong consumer preference for eco-friendly and biodegradable products. This trend will dictate the types of bioplastic being produced.

Types of Bioplastics and their Potential

The key bioplastics materials which could afford competition to conventional plastics include the following:

1. Biodegradable Bioplastics

Types and Percentage of Total Bioplastics Supply: Starch Blends (18.2%), PLA (10.3%), polybutylene adipate terephthalate or PBAT (7.2%), polybutylene succinate or PBS (4.6%), polyhydroxyalkalonates or PHA (1.4%), and Others (1.5%).

Potential for Switch from Conventional Plastics:

- PLA is a biodegradable bioplastic material with the highest potential and could be an excellent substitute for PS, PP, and ABS in future.

- Current PLA production is 0.217 MMT, and this is projected to rise to 0.435 MMT by 2023 due to demand.

2. Cost-Effectiveness

Types and Percentage of Total Bioplastics Supply: PET (26.6%), PA (11.6%), PE (9.5%), PTT (9.2%), and Others (0.9%).

Potential for Switch from Conventional Plastics:

- Bio-based PET is the most important non-biodegradable bioplastic material used in packaging applications.

- While production of bio-based PET could increase in the near future, there could be greater consumer preference for biodegradable bioplastics, reducing the market growth for bio-based PET.

3. Product Safety

Besides eco-friendliness and cost-effectiveness, a key requirement for the switch to PET bottles is safety assurance, especially because dairy products are vulnerable to spoilage and contamination.

There are several key attributes of PET bottles that enable product safety:

- Neck and cap tightness ensure food safety and expected shelf life.

- Oxygen barrier properties of PET are 15–30 times higher than monolayer and three-layer high-density polyethylene (HDPE).

- Light protection is enabled through different preform manufacturing technologies (such as injection of monolayer preform, or multilayer preform) and their light blocking capabilities.

4. Insights

- The two most important bioplastics materials, vis-à-vis bio-based PET and biodegradable PLA, are primarily used in the rigid packaging sector.

- This implies that the food and non-food packaging sectors represent the best opportunity for bioplastics to capture a share of the conventional plastics market.

- The only major constraint to market growth is the cost of bioplastics production, which is higher than conventional plastics. Thus, R&D activities of major suppliers are geared towards developing cost-effective solutions.

Demand Outlook and Projections

The impact of the switch from conventional plastics to bioplastics can be assessed in terms of the key demand segments.

Packaging as the biggest potential for demand:

- Packaging is the largest application for both conventional plastics and bioplastics. The sector consumes 127.45 MMT of conventional plastics and 1.22 MMT of bioplastics.

PLA is the preferred bioplastic employed in packaging applications on account of its biodegradable nature. PLA demand in the packaging sector is projected to constitute the bulk of bioplastics consumption in the coming years.

Insight: The packaging sector is identified as the market with the highest potential for bioplastics because of high plastic demand. Further, greater environmental awareness of consumers, particularly for food and pharmaceutical packaging, has also led to a shift towards bio-based sources of packaging. Although the market share of demand for bioplastics is low, there is ample scope for demand growth due to innovation focus, consumer awareness, and manufacturers keen on making the switch to bioplastics packaging.

Conclusion: Optimal Procurement Strategies for Bioplastics Packaging

The market drivers of cost-effectiveness, eco-friendly nature, and consumer perception can necessitate the switch from conventional plastic packaging to bioplastics packaging. The following strategies could be adopted for procurement of PET bottles:

1. Contract Structures

- Bioplastics packaging is a niche market. Prices are likely to be on the higher side due to high input costs. However, there is potential for reduction of conventional plastics in the near future due to R&D on cost efficient technologies and greater competition.

- The optimal contract duration would be quarterly or semi-annual (3–6 months).

2. Supplier Selection

- BASF SE, Evonik, and Toray Industries are some of the top global suppliers for bioplastics packaging.

- However, with demand for bioplastics likely to increase in regions such as China and India, regional suppliers could offer more competitive prices, though the quality of products should be ascertained via certifications.

- Chinese suppliers include Dongguan Renju, Jiangsu Torise, and Sogreen. There are also reputed Indian suppliers such as Envigreen, Ecolife, Plastobags, Earthsoul India, and Truegreen. These suppliers constitute viable alternatives to top global suppliers in terms of competitive pricing.

References

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe