Short-term contracts the best bet to beat molybdenum price trends

Abstract:

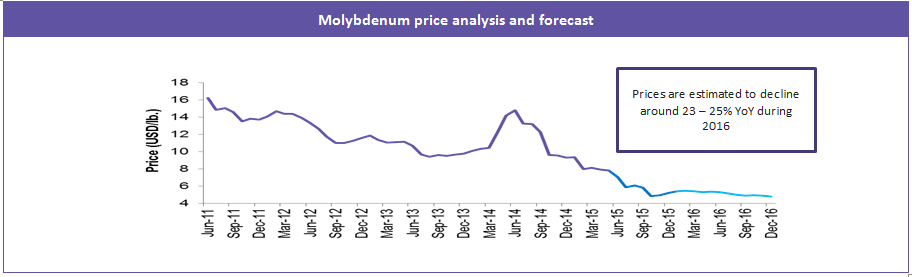

Molybdenum prices sank 40 percent YoY in 2015, which was hit by the oversupply and low demand in the market. Molybdenum consumption declined by 5 percent to 531 million lbs in 2015, the highest drop since 2009. The supply was high as producers failed to react to the changing market condition which resulted in a large surplus market in which the production outweighed demand by 41 million lbs.

Sluggish demand and oversupply are expected to continue in 2016, coupled with other factors including the weak Chinese market conditions, fluctuating oil prices, and dollar which are likely to affect the molybdenum market during this period. Most of molybdenum goes towards steel production, which is driven largely by the Asian market, especially China. Also, the major part of the world demand for molybdenum and around 40 percent of molybdenum production belong to China. If Chinese economic growth does not pick up, molybdenum demand is unlikely to grow, and hence the prices are also unlikely to pick up in 2016.

This article discusses the impact of various market conditions, and end use industries on the molybdenum price this year.

Introduction

Molybdenum, the hard and silvery metal, is primarily used to make alloys with other metals. The most common alloys of molybdenum are those with steel, in which it improves the corrosion resistance, strength and toughness of steel. The other end uses of molybdenum include catalysts, lubricants/pigments, and other chemicals.

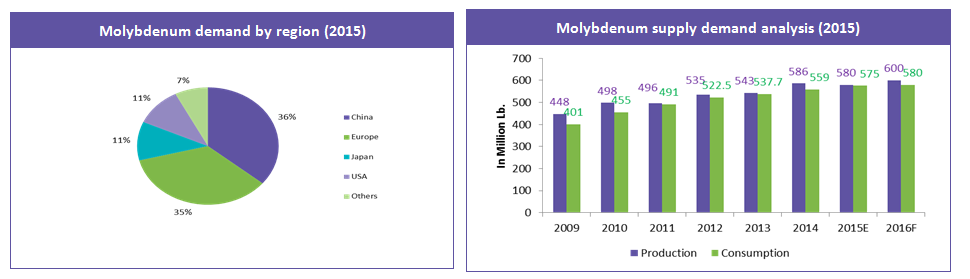

China constitutes more than 35 percent of the molybdenum mine production, mainly as a by-product of copper mining. The U.S. is the second largest producer with a market share of 24 percent. About 36 percent of the global molybdenum demand is from China followed by the European countries (35 percent). In 2015, demand supply gap in the surplus market was 40 million lbs, which was 48 percent higher than in 2014.

Molybdenum demand is expected to decline around 4-5 percent during 2016 as it is closely tied to China’s uncertain economy. About 40 percent of the molybdenum demand comes from the steel industry, which is driven largely by the Asian market, especially China. Hence with the continuing weak economy in China, molybdenum demand is unlikely to pick up in 2016. The molybdenum prices declined 40 percent YoY in 2015, which is not expected to pick up in 2016 because of the sluggish market.

Factors that affected the market in 2015

Supply – Demand

Molybdenum was largely hit by the oversupply and low demand in the market throughout the year. Even though the production declined 4 percent from the 2014 value, it outweighed demand by 40.9 million pounds during this time.

Weak Chinese economy

China is the largest consumer of molybdenum and molybdenum products comprising more than 35 percent of the global demand per year. Weak economy and slow industrial growth in China coupled with ample supply as producers failed to react to the changing market conditions exerted downward pressure for the prices.

Low oil prices

Low oil prices have also played in slowing down molybdenum prices. Molybdenum is the key alloying element in oil drill pipes. As a result of low oil prices, petroleum majors have cancelled or put on hold many exploration projects, which in turn reduced the requirement of molybdenum and hence the prices.

Market outlook – 2016

Low demand and oversupply are expected to continue in the market weighing on molybdenum prices in 2016. About 50 percent of molybdenum is produced as a byproduct of extracting copper or other metals. Suppliers are not likely to respond with production cuts when molybdenum prices fall, as it makes only a small portion of their revenue.

Major portion of the molybdenum goes into steel production, which is driven by the industrial activity in Asia, especially China. In 2016, Chinese economic growth is unlikely to pick up, which will weigh down the demand for molybdenum.

Oil price also has a major role in molybdenum price movements. Oil industry is experiencing the deepest downturn since 1990, and is not expected to recover any time before end-2016. Low oil prices are expected to slow down molybdenum prices further during 2016.

Molybdenum prices are estimated to decline around 23 – 25 percent during 2016 compared to 2015 prices. The current market conditions and existing uncertainties due to the summer slowdown in the western countries are expected to drag down the export demand for the metal during July to September period of the year. These prices are expected to further decline with the year-end sluggishness in both domestic and export market. Altogether, second half of the year is expected to be more slow-moving for molybdenum.

Conclusion

Sourcing recommendation for the end users

Molybdenum prices are expected to decline in the mid to long term due to concerns about the global economy. The weak Chinese economy too is anticipated to negatively impact the commodity prices, including molybdenum. Oil prices are also weakening to multi-year lows in response to excess global supplies, and economic conditions. This is also expected to weigh down the prices.

Given the expected volatility throughout the year, molybdenum end users can enter into short-term contracts while buying the metal. They could schedule large purchases and build inventories when prices decline.

Recommended Reads:

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe