Contracts and collaboration help mining companies in Australia improve savings

Abstract:

METS (Mining Equipment, Technology and Services) suppliers in Australia are facing the consequences of mining industry meltdown across the globe. Also, mining companies with budget constraints are looking at reducing costs to maintain the profitability of mines. In such a scenario, long term contracts and collaboration are some of the options that mining companies can consider to increase savings with METS suppliers in Australia.

The saving levers are more and the negotiation power is high for the mining companies as supply surplus has built up during 2015. Technology services such as mine modeling software can help the mining companies to reduce physical effort and the entire operational period.

Mining companies can negotiate least with technology companies and comparatively more with mine equipment suppliers in Australia.

Introduction

China, commodities and currency were on the agenda for most of the mining companies’ board meetings since the beginning of 2015. Slowdown in China, commodity price crash and currency devaluation spared no entity remotely associated with mining companies. METS (Mining Equipment, Technology and Services) sector of Australia was also crippled due to the slowdown in mining demand.

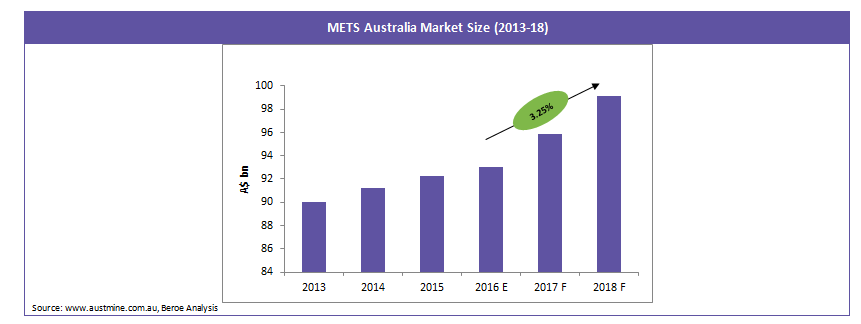

The METS sector in Australia is expected to grow at a CAGR of 3.25 percent during the 2016-18 period majorly owing to increasing growth in technology and services sector. However, mining equipment is expected to drag down the market growth. Current mining slowdown has impacted the capital expenditure budgets of mining behemoths.

Mining companies can find opportunities in this cycle of adversity. There are opportunitites where the companies can renegotiate with the mining equipment suppliers to bring down their cost and can potentially save about 3-6 percent depending on the product and service they procure.

Current Scenario

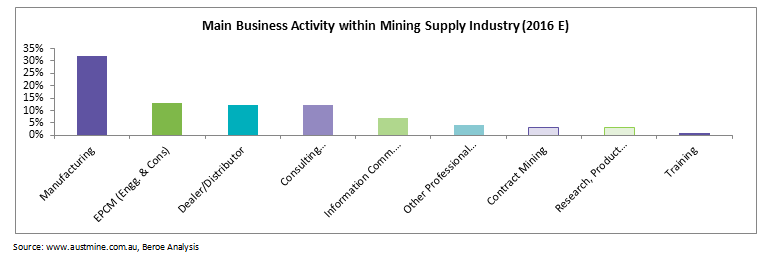

METS sector is a combination of several segments and sub sectors catering to the continuously changing mining industry’s needs. To accrue cost savings from various METS’ sub segments, it is important to gain insights into their business activity.

Around 30 percent of Australian METS companies’ revenue is met by exports. The key export regions are Southeast and Northeast Asian regions. However, the revenue growth from China is expected to slow down due to the expected shut down of coal mines in China.

Supply chain mapping of METS suppliers

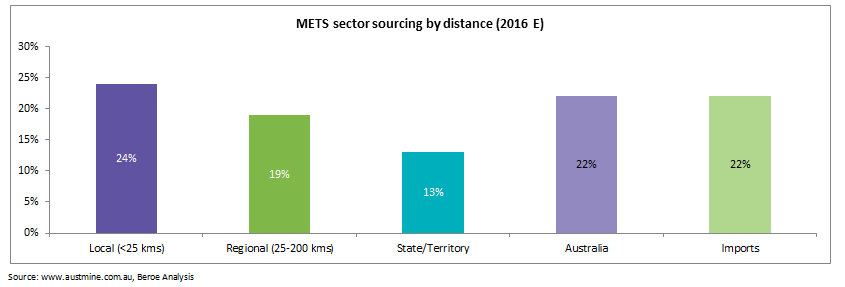

Gaining insights on the source that METS suppliers rely on for their requirements helps in negotiation. The insights would also help in understanding the cost structure of the METS suppliers.

In terms of distance, Australians source around 1/4th of their requirements from suppliers in a range of 25 kms.

Upper hand to the mining companies

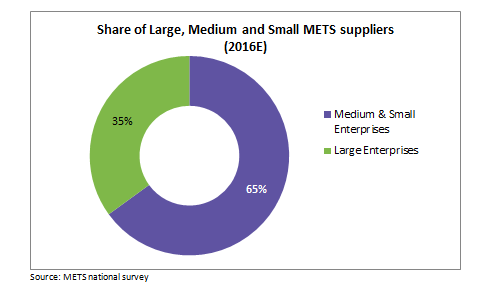

Due to slowdown in China, currency and commodity catastrophe, mining companies are doing everything possible to cut costs and improve their revenue earnings. Mining companies have large room to negotiate with suppliers to bring down cost as most of the mining companies, small and medium enterprises, have employee strength of less than 100. Large METS suppliers have revenues of more than A$30 mn annually. This gives them room to negotiate with small and medium METS companies as they are more battered by slowdown and ready to supply. It should however be noted that, suppliers with weak financial statements should not be preferred even if they give cost effective products or services as supply security becomes risky. The opportunities are not limited to Australian mining companies but also to Non-Australian mining companies as around 2/3rd of the METS companies have export capabilities.

In technology sub-segment, the scope to negotiate with METS suppliers is low as mining companies are resorting to software and automation to reduce costs and improve efficiency. Though 60-65 percent of resource industry software is made in Australia, it is not a big positive for Australian mining companies compared to other global mining companies as software is not heavily impacted by physical infrastructure such as road, rail and ports. As a result, the logistics and other associated costs are negligible.

Collaboration is the key

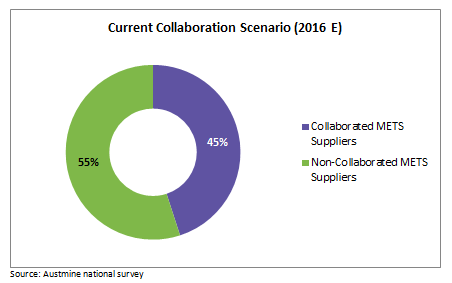

Mining companies can collaborate with Australian METS suppliers to reduce costs and improve productivity. This not only builds a long term relationship between the supplier and the mining company but also helps in creating a customized solution, product and service for the mining company. With only 45 percent of the Australian METS suppliers collaborating with mining companies, there is ample scope for building relationships with them.

METS services to other industries – a dampener to miners

Though mining industry forms one of the key end use industries, METS companies serving other industries reduces the significance of mining industry among the METS vendors. Around 79 percent of the METS suppliers engage in industries other than the mining sector, with 60-65 percent of them having buyers from oil and gas sector.

Some of the other industries served by the METS sector include

Conclusion

- Due to the bust cycle in mining industry, METS (Mining Equipment, Technology and Services) sector in Australia has been heavily impacted. Most of the METS sector companies reported decline in earnings in 2015 with respect to 2014.

- Mining companies can engage in long term contracts and negotiate to achieve 3-5 percent savings depending on the products or services. Apart from long term contracts, mining companies can also collaborate with METS suppliers to develop customized solutions for their mining operations.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe