Sourcing mannequins regionally enables better cost and service efficiencies

Abstract

Mannequins account for about 8-15 percent of the Visual Merchandising/Furniture and Fixture Spend, and are considered to be a vital visual merchandising element with the potential to drive customer walk-ins. They also reflect a brand’s identity and high end brands spend a significant amount in purchasing mannequins. Mannequins are no longer used for the sole purpose of displaying merchandise as they can operate as a key source of information by leveraging technological advancements such as facial recognition and beacon technology.

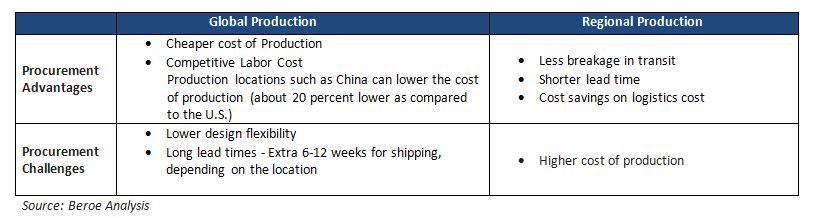

The growing significance and higher spend is a challenge in optimizing spend and procuring best quality mannequins. Apparel retailers in the U.S. consider global production locations such as China as a preferred sourcing destination as it facilitates sourcing at a cheaper cost. However, Shipping and duty can largely increase the total cost of ownership, in addition to other challenges such as longer lead time and higher probability of damage in transit.

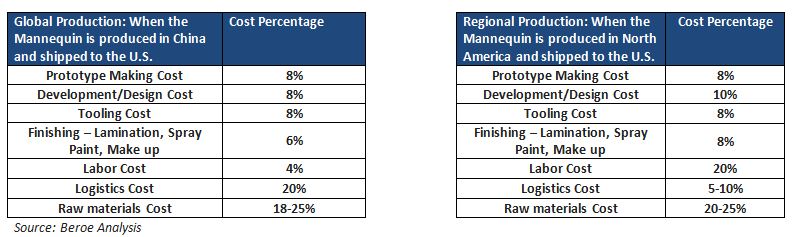

This article focuses on key trends, innovation, and best practices in mannequin procurement for US apparel retailers. The parameters considered to compare global and regional production location includes labor cost, logistics cost, raw material cost and lead time impact.

Introduction

Higher adoption of online shopping and pre-shopping online research have increased the significance of window displays as the most important element in driving walk-ins, in which mannequins play an inevitable role. A highly matured buyer landscape has driven established suppliers from other regions such as Europe and Asia to explore the demand potential in North America.

Key Trends

- Abstract to realistic mannequins - Abstract and semi-abstract mannequins are predominantly utilized by the apparel retailers in the U.S. However, there is an increasing trend of retailers going back to the realistic form to provide a stronger brand image reflecting the end consumer

- Bespoke Solutions – There is a high demand for customization to differentiate brands in the highly competitive apparel retail market in North America. Almost 50-70 percent of the production quantity is contributed by customized mannequins. Suppliers are adopting innovative methods such as 3D printing to replace manual prototypes. This is expected to reduce the price for customization

- Replacing fiberglass with bio raw materials – Many suppliers offer bio raw materials such as poly urethane, papier-mâché in addition to the traditional fiberglass material. There has been an increasing trend of replacing fiberglass by manufacturing entirely from eco-friendly raw materials. The manufacturing efficiency is also enhanced significantly by utilizing Polyurethane, as 4 mannequins can be manufactured in the same time as that of a single fiberglass mannequin

- Technology integration – Mannequins are used to aggregate customer data such as age, gender, and dwell time by utilizing embedded cameras. Mannequins equipped with screens have incorporated software to play graphic displays and communication videos to attract more customers

Engagement Trends

Apparel retailers engage with specialist mannequin suppliers due to bespoke solution requirements. Buyers are exploring opportunities to work only with their preferred list of suppliers who have regional production locations in North America, as it enables quicker turnaround time and reduced shipping cost.

The price of mannequins is generally negotiated based on the volume. However, having a preferred list of suppliers will enable lower maintenance fee and quicker delivery.

Sourcing Destination – Regional vs. Global Production location

The cost structure of mannequins can vary depending on various factors such as technology used for prototyping, raw material used (Polyurethane is costlier as compared to fiberglass), type of mannequin (Realistic, Abstract, Torso etc), manufacturing process (manual, automatic), etc.

Key Takeaways for apparel retailers in the U.S.

- Engagement practices – Engaging with a few preferred suppliers will enable the retailer to negotiate on volume discounts, and receive additional benefits such as lower maintenance fee, and quicker turnaround time. The buyer can leverage on the design cost by replicating the prototype in large quantities utilising the same supplier. Exclusivity of the pose/facial expression can be demanded to avoid replication by other brands working with the same supplier. Inconsistency in color, finish, pose, etc. can be eliminated by engaging with a few preferred suppliers

- Global vs. Regional production location – By engaging with suppliers who have one single global production location such as China, mannequins can be purchased for 35-40 percent less cost, but shipping and duty can largely impact cost savings. Labor cost can be 40 – 50 percent cheaper in China as compared to the U.S., but there is an increased risk of breakage in transit, and higher logistics cost to ship those mannequins to the retail store

Suppliers who have production location in the U.S. will be able to offer high quality mannequins at a quicker turnaround time. European suppliers who are renowned for their design flexibility are expanding their production facilities in the U.S., which makes it easier for the US apparel retailers to utilize their expertise along with cost benefits. Apparel retailers who have stores across the globe can engage with suppliers who have regional production locations in key countries such as the U.S., China, and UK for global requirements. Choosing production locations closer to the retailer’s primary location will enable cost savings and also ensure higher accountability.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe