Managed learning services to resolve complexities of learning and development activities

Introduction

Learning and development (L&D) activities are widely outsourced by global multinational companies; however, as the extent of outsourcing scaled up, the difficulties involved in managing multiple service providers have increased. Key challenges include fragmented structure of outsourcing, engaging and managing multiple suppliers, lack of spend visibility, inconsistency in the content delivery, and time invested by the internal team on non-L&D activities such as supplier identification and administration.

MLS (Managed Learning Services) is identified as a potential solution to overcome most of these challenges. Fortune 500 organizations have found MLS as an effective solution to streamline the entire L&D activities and efficiently reduce the L&D spend.

What is a Managed Learning Service?

MLS is strategic outsourcing of end-to-end L&D activities to a service provider who can manage all the training requirements and vendor management centrally at a global level.

The concept of MLS is still at a nascent stage in L&D space. Outsourcing end-to-end process to a third-party vendor is observed in payroll, recruitment and IT sectors, whereas the L&D activities are generally outsourced based on the requirement. For example, outsourcing selective training activities such as off-the-shelf e-learning materials or curriculum design and delivery.

In L&D market, 80 percent of the training activities are outsourced ranging from instructional design, learning technology, and content design and delivery. Engaging with multiple service providers locally and regionally is observed across different industries.

Services offered by Managed Learning Services Providers (MLSP)

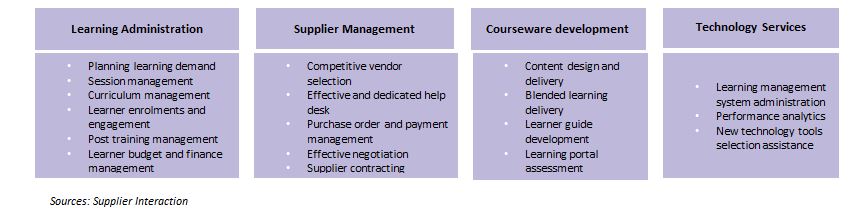

The gamut of services managed by MLSP is learning administration, supplier management, courseware development and technology services.

In general, courseware development and technology tools are most likely outsourced to third parties, whereas the learning administration and supplier management is managed by in-house L&D team. 30-40 percent of the internal L&D team time is spent on non-training activities such as learning administration.

In the entire L&D process, there is considerable amount of spend involved in L&D administration and vendor management which is currently managed internally by most of the large organizations. Complexity involved in managing multiple vendors can be reduced drastically by engaging with MLS.

Organizations can also achieve effective training and reduce training spend through process optimization.

MLS Trending

Globally, 60-70 percent of companies engage with L&D suppliers for specific activities such as learning technologies, solutions, content design and development, cloud solutions, and performance management services.

End-to-end L&D process outsourcing to MLSP is predominant in the U.S. and European countries such as UK, Germany and France. The L&D market is highly matured and most of the top services providers are headquartered in these regions. The trend is also slowly emerging in developing regions (South America, MEA and APAC countries).

Few examples of managed learning engagements:

- A leading life insurance company in the UK engaged with managed learning provider called Knowledge Pool with the contract value of GBP3 million for 3 years contract length.

- Renowned US-based global health care company signed a 5-year contract with GP strategies for full length L&D services.

- Electricity and gas utility supplier engaged with GP strategies (3 years contract) for managing global learning services in UK and the U.S.

- QA helped one of the global IT companies to achieve 30 percent of cost saving by managing and streamlining the fragmented L&D activities.

Cost saving by process efficiency:

Consolidation of supplier base is very crucial to obtain cost saving. A step-wise approach can help the organization to reduce the training spend as well as aligning the L&D to business needs.

Supplier Management (5%) - Bulk purchase discount with suppliers and automating the POs and payment process

Learning Administration (5-10%) – Dedicated help desk and streamlining work flow

Intelligent Project Scheduling (5-10%) - Learning forecast, demand planning, adopting efficient learning delivery methods and learner performance tracking

Courseware development (5%) – Content design, reuses of internal modules in effective delivery methods by leveraging technology platforms. (e-learning, open online courses and informal learning)

This strategic shift will help the L&D team to spend productive time on content development, module designing and performance analysis, also the organization can attain spend visibility and training cost reduction by up to 20 percent.

Benefits of MLS:

- Centralizing L&D functions globally

- Automation of workflow

- Clear demand plan

- Selecting effective delivery method

- Performance analytics

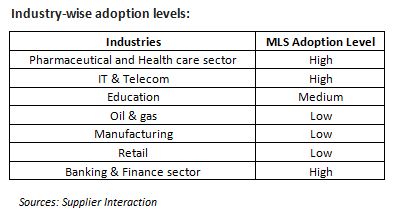

Industry-wise adoption levels:

Supplier Landscape:

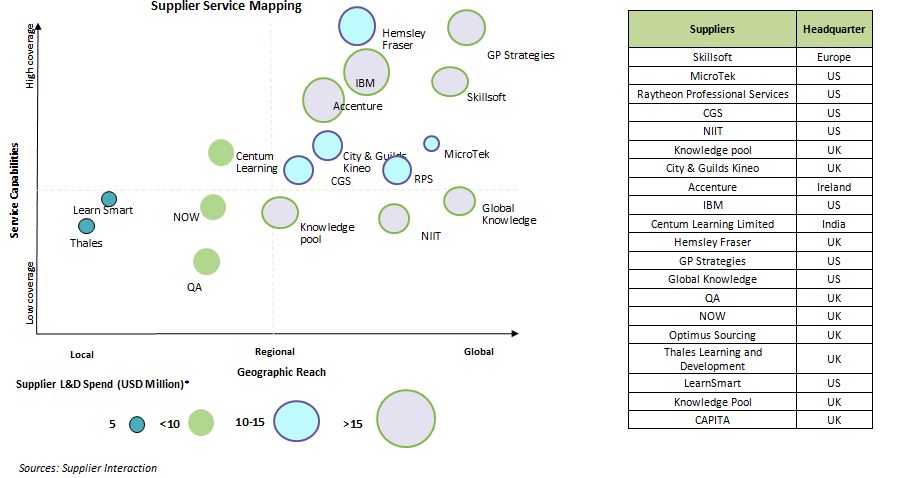

The L&D market is highly fragmented. There are more than 600 suppliers who offer training services. However, only few suppliers offer end-to-end L&D services.

Key suppliers such as GP Strategies, Accenture (Non-core L&D), IBM (Non-core L&D) and Raytheon (Non-core L&D) are leading service providers in MLS with strong buyer base across all the industries and backed by financial stability and brand reputation.

Core L&D suppliers such as GP Strategies, Hemsley Fraser, Skillsoft, Knowledge pool, City & Guilds Kineo and Global Knowledge offer MLS across the regions.

North America and European markets are much matured with several top training suppliers. Most of the training suppliers are headquartered in the U.S. and UK.

Conclusion:

On analyzing the L&D market outsourcing scenario, it is evident that engaging with MLS provider is currently not a widely adopted practice as the market is highly fragmented. However, this trend is expected to increase in the next four years as organizations are emphasizing on attaining spend visibility and cost savings.

Owing to the benefits associated with MLS outsourcing, many of the global organizations have shifted to engaging with global integrated training suppliers to automate the L&D life cycle. MLS outsourcing can be beneficial to an organization that is engaged with multiple suppliers and operating with fragmented L&D spend (>$10 million) across different regions. Consolidation of supplier base, centralizing the L&D functions, automating and streamlining the L&D process would help organizations to achieve cost savings of about 20 percent on L&D activities and vendor management.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe