"Make in India" initiative provides the impetus for chemical industry

Abstract:

This article aims to analyze the “Make in India” initiative which focuses on making India a global manufacturing hub and its impact on the Indian economy. Key thrust of the programme is to bring down delays in clearance of manufacturing projects, develop adequate infrastructure and make it easier for companies to do business in India. The 25 key sectors identified under the programme include automobiles, auto components, bio-technology, chemicals, defense manufacturing, electronic systems, food processing, leather, mining, oil and gas, ports, railways, and textiles.

Introduction

"Make in India" is a sales pitch the Prime Minister is making on 25 key industries to attract foreign businesses to India. The objective of this initiative is to ensure that the contribution of the manufacturing sector, which is around 15 percent of the country’s Gross Domestic Product (GDP), is increased to 25 percent in the next few years.

The Government of India’s ambitious initiative aims to transform the country from being Asia’s third-largest economy into a global manufacturing powerhouse. The initiative has set an ambitious goal of creating 100 million additional jobs in the manufacturing sector by 2022.

The initiative has helped India to secure the top spot and become the top destination in the world for foreign investment. Since the launch of the initiative, overall Foreign Direct Investment (FDI) has increased by 39 percent.

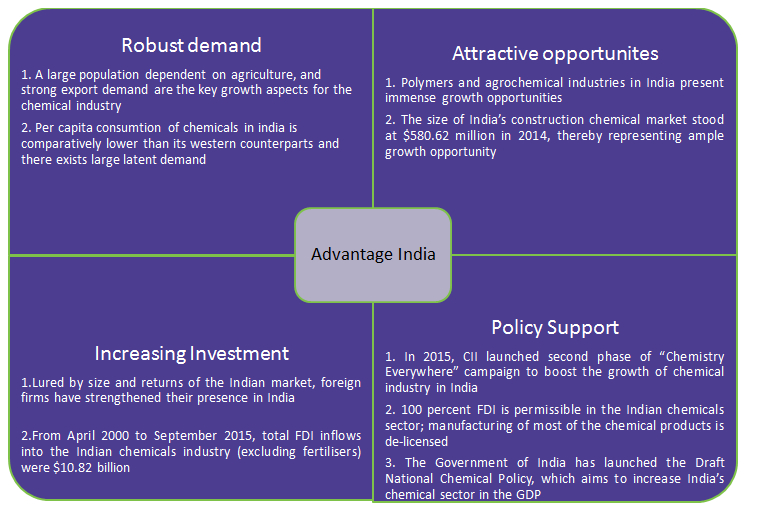

- The chemical industry in India is a key constituent of its economy, accounting for about 2.11 percent of the GDP. In terms of volume of production, Indian chemical industry is the third largest producer in Asia and sixth largest in the world.

- India’s growing per capita consumption and demand for agriculture-related chemicals offers huge scope of growth for the sector in the future. Lured by the size and returns of the Indian market, foreign firms have strengthened their presence in India. From April 2000 to May 2015, total FDI inflows into the Indian chemicals industry (excluding fertilizers) were $10.49 billion.

- The Government of India permits 100 percent FDI in the Indian chemicals sector; while manufacturing of most chemical products is de-licensed. In addition to encouraging research and development in the sector, the government is continuously reducing the list of reserved chemical items for production in the small-scale sector. This facilitates greater investment in upgrading the technology and modernization.

Evolution of the Indian chemical industry

Basic needs (1950-72)

- Chemical products to protect crops

- Agrochemicals, dyes, pharmaceuticals

Establishment (1972-80)

- Public sector companies were set up to develop the petrochemical industry

- Plastic and fibers, petrochemical products

Consolidation (1980-92)

- Consolidation started from largely fragmented firms with small capacities and high cost structures

- Paints, dyes, pharmaceuticals and detergents

Liberalization (1992-95)

- Lower tariff barriers

- Diminishing role of public sector companies

- Petrochemicals, engineering plastic, specialty fiber

Expansion (1995 onwards)

- In 2015, DCPC has announced to design a 16 point plan framework that would encourage the domestic production of chemicals

- Alliances and partnerships to achieve scale

- Licensing requirements removed except in the case of hazardous chemicals

- Increasing investments by foreign players in India through mergers and acquisitions, and joint ventures

- Allowed 100 percent FDI in the chemicals Industry

Note: MNC – Multinational Corporation, DCPC - Department of Chemicals and Petrochemicals

Domestic and external demand driving growth in the sector

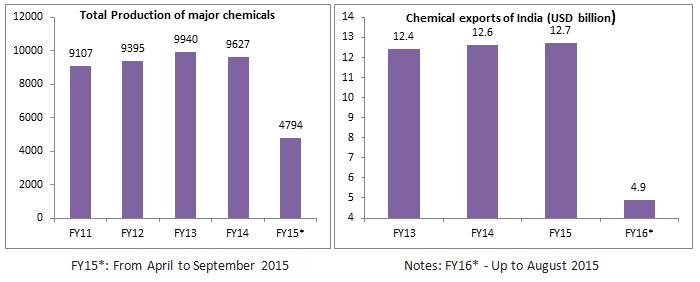

- Total production in the Indian chemical industry was 9107 MT in FY11 and reached 9627 MT in FY14 clocking a CAGR of 1.9 percent from FY11-14; In FY15 (up to September 2015), the production reached 4794 thousand MT

- Favorable demographics and strong economic growth are driving demand for chemicals

- External demand and specialty chemicals have also contributed strongly to the growth of the industry

- India’s growing per capita consumption and demand for agriculture-related chemicals offers huge scope of growth for the sector in the future.

- Exports of the Indian chemical industry stood at $4.9 billion for FY16*

- Exports in the chemical industry grew from $12.4 billion in FY13 to $12.7 billion in FY15, registering a growth of 0.9 percent

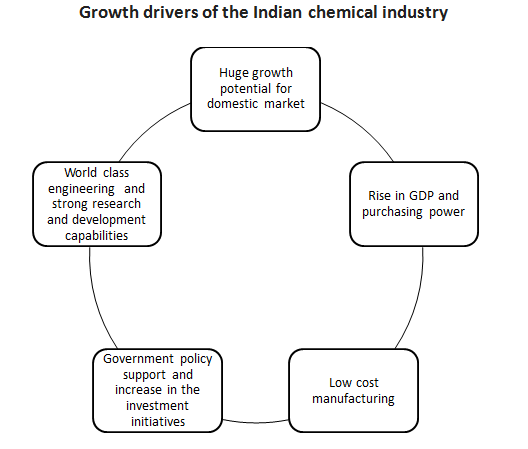

Growth, competitiveness and process initiatives

- The government has announced a number of measures to improve competitiveness in the sector

- Share of manufacturing approved by the Cabinet as per the erstwhile Planning Commission would contribute 25 percent of the GDP by 2025

- Approval is granted for FDI up to 100 percent in the chemicals sector, excise duty reduced from 14 percent to 10 percent, strong laws on anti-dumping to further promote the industry

- Cumulative FDI inflows into chemical industry reached $10,588 million during April 2000-June 2015

- Policies that have been initiated to set up integrated Petroleum, Chemicals and Petrochemicals Investment

- Regions (PCPIR) are likely to be revised by the end of 2015-2016. The land requirement for a PCPIR would go down from 250 square kilometers to 50 square kilometers

- Kerala, Karnataka and Maharashtra are new applicants for PCPIR

Conclusion

- The chemical industry is a key constituent of the Indian economy which accounts for about 2.11 percent of the country’s GDP. In terms of volume of production, the Indian chemical industry is the third-largest producer in Asia and the sixth-largest in the world.

- Bulk chemicals account for 39 percent of the Indian chemical industry, followed by agrochemicals (20.3 percent) and specialty chemicals (19.5 percent). Pharmaceuticals and biotechnology account for the remaining share. By allowing 100 percent FDI in the sector and by launching the Draft National Chemical Policy aimed at increasing the sector’s share in the country’s GDP, the Government of India has been supportive to say the least.

- According to a Tata Strategic Management report released in October 2015, the chemical industry in the country has the potential to grow at 9 percent per annum to touch $214 billion in the next four years. The report also highlights that at $139 billion, the current domestic chemical market constitutes only 3.3 percent of the global chemical market.

- While there are numerous roadblocks ranging from lack of infrastructure to volatile political climate, the story so far tells us that the Government of India is making an honest attempt to make the initiative work. It has introduced several steps to improve the business environment by easing processes to do business in the country, and attracting foreign investments. In 2015, the Government of India cleared as many as 1,671 proposals by investors, double the number of approvals granted in 2014.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe