Upcoming projects to ease lithium supplies

Abstract

Lithium is considered to play a crucial role in fueling the green energy revolution of the world through the Lithium ion battery technology. Rapid decrease in the cost of batteries in the last decade has opened up the demand from the automobile and power sector. Though the demand of lithium is expected to multiple around 5 times of the current demand by 2025, the supply side is considered to be a bottleneck. Lithium reserves are limited and in addition the top four suppliers constitute around 83 percent of the total supply market which has increased the prices in recent years.

This article discusses on the lithium supply chain market and its impact on the price and end user industries with focus on batteries market.

Introduction

Globally, greenhouse gas emissions have been on the rise rapidly due to the overexploitation of the fossil fuels in the last century, thus leading to climate change. This has led to a demand for increase in the share of clean energy in the primary energy consumption. Automobile and energy sectors are among the biggest greenhouse gas emitters and also the major sectors where application of lithium is expected to play a major role in cutting down the greenhouse gas emissions through battery storage technology.

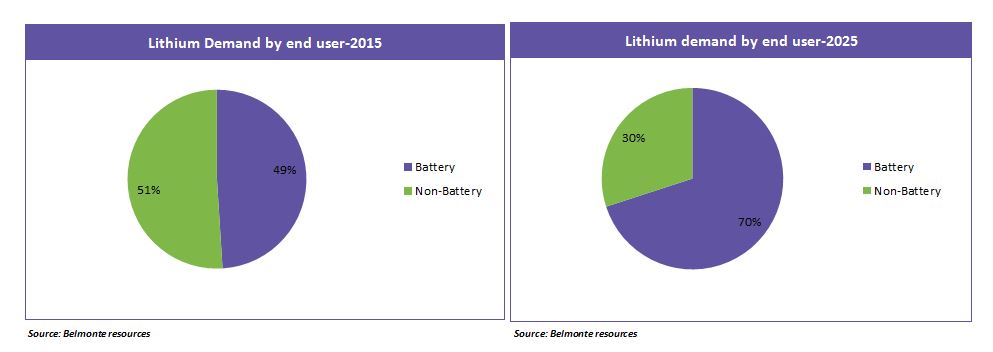

Lithium ion-batteries are considered to be the most efficient batteries due to their high electrochemical potential. The evolution of lithium ion-battery technology in last decade was one of the key factors in accelerating the demand of lithium. Batteries which accounted for less than 5 percent of the consumption in 2001, has increased to 39 percent of the consumption in 2015. Ceramics or glass is the second largest consumer with 24 percent. By 2025, the battery market alone is expected to account for 70 percent of the total consumption.

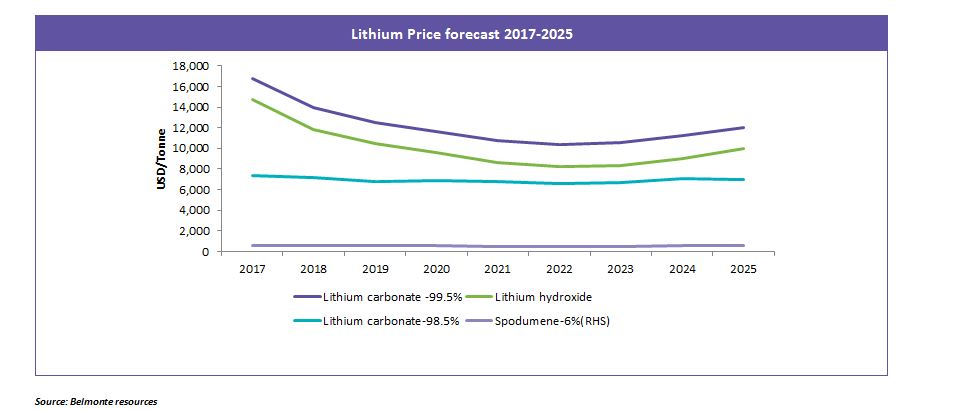

Though there is huge demand and opportunities in the lithium mining, there are bottlenecks in the supply chain which might increase the price of the metal in the short term. The prices of lithium remained stagnant from 2013 till mid 2015 due to oversupply and stagnant demand. However, since 2015, the price of lithium increased owing to increased demand from the batteries market that grew at 45 percent yoy in 2015. Rapid decrease in the price of batteries, from $900/Kwh in 2010 to $225/Kwh in 2016, was one of the key factors in accelerating the demand. Regulatory hurdles are one of the major challenges in lithium mining; in countries where it is abundant, it is owned by the government which delays the regulatory approvals. In Chile and Argentina, the industry is slowly reacting to the demand, and the companies have started to expand their production capacity.

Supply Outlook

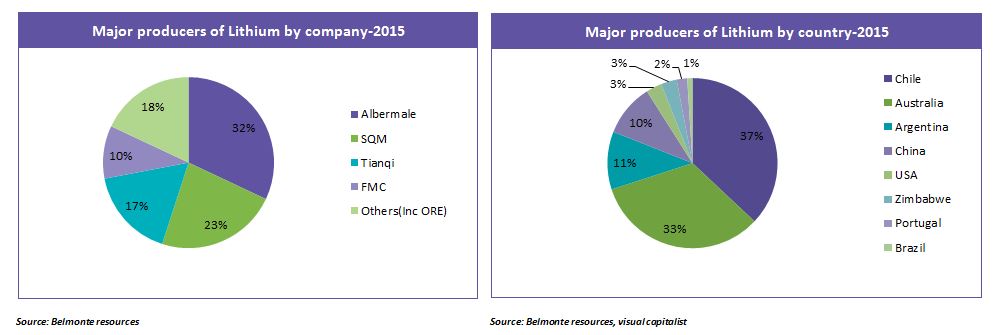

Lithium is naturally present in two forms -brine solution or hard rock. Brine represents majority of the global deposits accounting for 66 percent of the global lithium resources and is found in the salt flats of Chile, Australia, Bolivia, Argentina, Tibet and China. Lithium supply market is consolidated with top four producers accounting for around 82 percent of the supply. Albemarle which is the largest producer of lithium in the world owns high quality lithium assets in Spodumene and brine. ALB has planned to almost triple its capacity in Chile from 25ktpa LCE to 70 ktpa LCE in the next 6-7 years. SQM and Lithium Americas have entered into a joint venture to develop a 40ktpa LCE project in Argentina. FMC operates in Argentina.

By Country, Chile is the largest producer of lithium accounting for 37 percent of the world production in 2015 followed by Australia and Argentina with 33 percent and 11 percent respectively. Salar de Atacama at Chile has the world’s largest and purest active source for lithium reserves representing 50 percent of the global reserves. A continuous lithium demand is expected to occur over the next few years as the electric car battery market expands in line with demand for low emission vehicles. The main component of the electric vehicle motor and many rechargeable storage devices are lithium-ion batteries.

Future demand and price forecast

The current demand of lithium from the batteries alone is expected to increase around six times by 2025. Demand is expected to increase across all end user segments such as electric vehicles, bikes, battery storage for electricity, laptops and smart phones. In the case of vehicles manufacturing, Nissan Motors and Tesla are two significant electric cars manufacturing companies in the U.S. with a market share of 45 percent and 42 percent respectively. Companies including Tesla, Nissan and General Motors are involved in capacity additions for their hybrid cars. They use lithium-nickel-cobalt-manganese cathode combination in their lithium-ion batteries.

Nissan is expected to increase the battery capacity for its popular Nissan Leaf which is expected to reach the end market before 2018. BMW is also planning for additional hybrid model cars in the near future through its electric hybrid car project “Megacity Vehicle”. Tesla Motors started construction at its ‘gigafactory’ which is the world’s largest lithium-cobalt-ion battery factory with an expected production of batteries for 500,000 cars with a battery power of 35GWh per annum in cell level by 2020. The capacity additions and the research and development of electric car majors can lead to a high demand for lithium and hence supply risk is expected to increase as the battery production ramps up in the future. This would naturally put a strain on the lithium industry since these cars depend on lithium batteries.

There are numerous lithium mining projects that are expected to begin production in the next three years. Additionally, the current lithium producers have planned to ramp up the production to cater to growing demand. New hard rock projects in Australia and brine projects in South America which are expected to start production from 2018 may stabilize the price of lithium in the long term.

Lithium projects which are brine-based require capital and takes time to react to the supply market but have lower production cost and high economies of scale. Once these projects come up online, the price of lithium may remain stagnant leading to further fall of the price of Li-ion batteries.

Conclusion

Current market conditions favor lithium producers as there is supply deficit and the new projects may start by the end of 2017 or early 2018. Once the planned projects such as the hard rock sites in Australia and brine sites in South America begin their production, there will be improved supply scenario thus leading to stabilization of lithium prices.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe