Rising M&A activity among law firms to bring down cost of legal sourcing

Abstract:

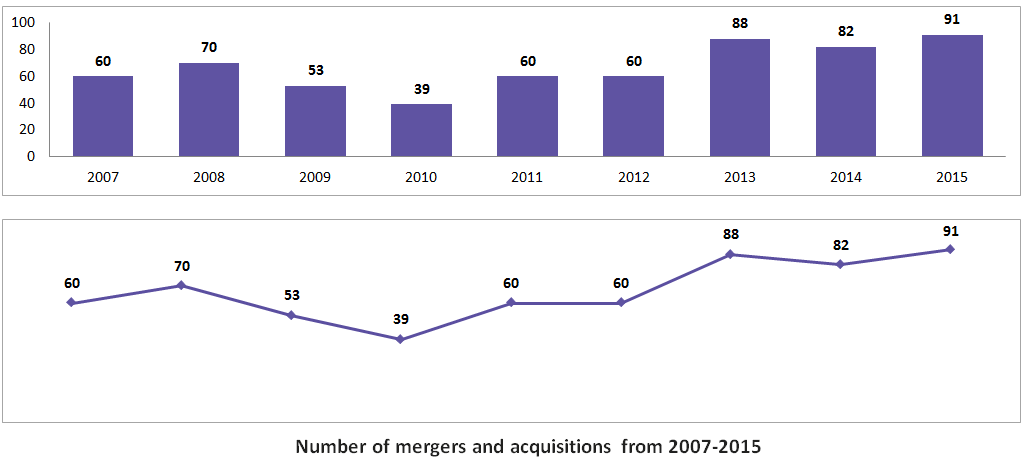

The legal market has seen some pronounced falls and rises in the number of mergers and acquisitions (M&A) over the past nine years (2007-2016). With recession dictating the market dynamics from 2008 to 2009, big law firms brought in several smaller firms under their umbrella taking “the need for financial strength by the midget firms” as a cue. Post-recession years witnessed a drastic dip in the numbers, as the firms started prioritizing their internal cost cutting issues over expansion.

After witnessing a moderate plateau during 2011 and 2012, a ravenous trend of M&A followed, concluding with a record score of 91 in 2015. And the legal soothsayers reckon that 2016 will only see a further rise in numbers.

This article would discuss the following M&A aspects in detail:

- The factual scenario over the past nine years:

- Percentage rise or fall compared to previous years

- Number of cross border mergers in each year

- The probable reasons involved for the yearly consolidation trends in legal market

- The most notable deals in each year

- The possible ways the M&A trend might affect procurement of legal services for the corporate buyers

Introduction: The law firm mergers and acquisitions chronicle

With the changing industry dynamics and demand for better legal services by the corporates, law firms globally are looking to improve themselves in all ways possible -- M&As being one of them. As the law firms respond to the macroeconomic factors and get into M&As in varying intensities, we can delve into the various possible reasons that are behind their moves to collaborate. Following is a year-on-year analysis of M&A scenarios:

Phase 1: Law firm mergers - a dwindling phenomenon

The period from 2007 to 2012 saw some modest numbers in law firm mergers and acquisitions. A visible effect of recession has been noticed from 2009, hitting an all-time low in 2008 and then a gradual recovery from there on.

2007

2008

2009

2010

-

Sonnenschein Nath and Rosenthal (Chicago) and Denton Wilde Sapte (London)

-

Squire Sanders & Dempsey (Cleveland) and Hammonds (UK).

2011

2012

Phase 2: The re-bounce

After a recovery plateau in 2011 and 2012, 2013 saw a bounce back and the streak continued with 2015 ending on a high note.

2013

2014

2015

Comparative analysis:

The period for comparison can be roughly divided into two - a phase of fall and a phase of steep rise following a flat recovery stage. The trend line shows an undulation in numbers over the past nine years with a slump in 2010 and an all-time peak in 2015. The rise in 2011 was not sudden showing that the law firms were a little wary after the recession. The last three years have recorded a higher number of deals with 2015 setting the bar high at 91 M&As.

Reasons for law firm M&As:

Law firms are always on the lookout for strategic M&As to keep themselves abreast with the dynamic legal environment. The main idea behind merging with another firm or acquiring another firm is to gain a competitive advantage over other firms and to set themselves apart from the rest of the law firms.

To go global

To go national or regional

To enter new markets

For Practice area and sector growth expansion

Financial Strengthening

Defense

For setting up a base

Merger with boutique firms

Avenues for procurement to explore

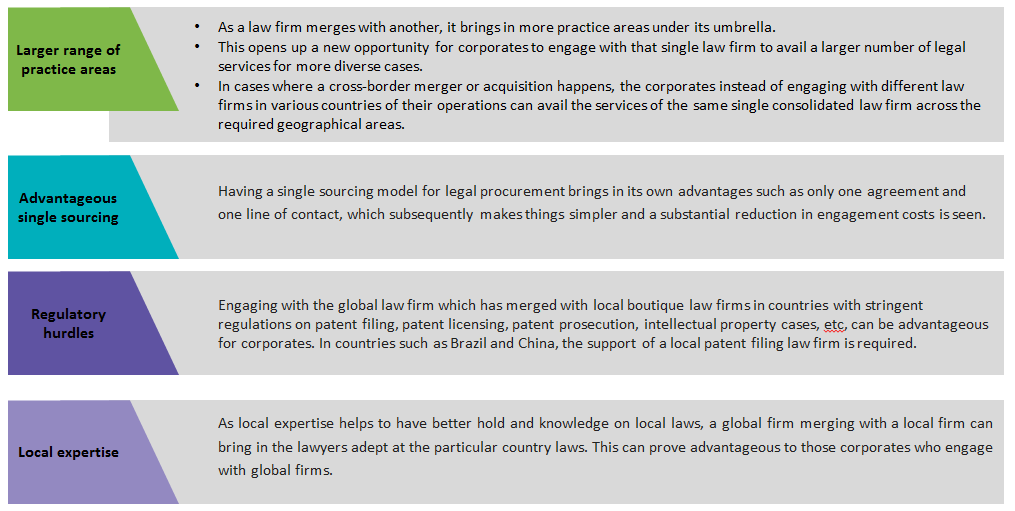

With an escalating number of M&As witnessed in the legal industry, corporates can look at it from a procurement perspective.

Conclusion

The law firms industry is on par with most other industries with regard to M&As. The post-recession scenario saw a dip in the numbers of deals and then a gradual rise to a plateau for two years. The period after the plateau was characterized by a boom in deal numbers for three continuous years. Firms have been undergoing an aggressive coalition after rebounding from the economic downturn. In the nine-year saga of mergers, Dentons stole the show with its audacious streak of collaborations with law firms across the globe and a few more announcements of its potential mergers.

This scenario of aggressive collaboration among law firms provides an opportunity for corporates to improve the cost efficiency factor in their legal procurement. As they replenish their roster after the contract periods, they can consider reducing their total law firm engagements by choosing those law firms that are strategically positioned in terms of their practice area and geographic scope through mergers. This can help reduce costs and increase law firm management efficiency. Corporates looking for expansion in highly regulated countries can benefit from engaging with law firms that have recently acquired the local firms of those countries. It is therefore very important for corporates to keep track of law firm M&As to avail cost-efficient legal procurement.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe