Key Market Trends in The Canadian Whisky Market

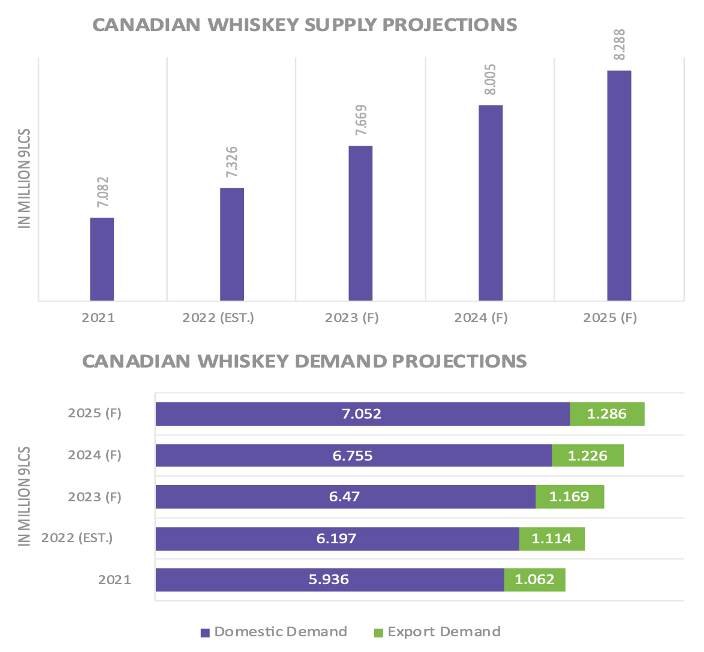

The demand for Canadian whisky is estimated to grow at a CAGR of 3.6 percent between 2021 and 2025. The Canadian whisky supply is estimated to reach 8.288 million 9Lcs, while demand is projected to exceed 8.338 million 9Lcs.

Almost 95 percent of the Canadian whisky production is concentrated in the hands of seven market leaders. However, the steep rise of craft distilleries is an indicator of the growth of the demand for Canadian whisky in the country. Further, increased usage in sports nutrition, functional beverages, nutraceutical products, and pharmaceutical use is expected to drive the demand

Canadian whisky is mainly destined to the U.S. market. However, the emerging secondary markets for the beverage in Europe and Asia are likely to keep its global prospects high.

The Food and Drugs Regulatory (FDR) organization of Canada requires Canadian whisky to be aged at least three years, in small wood, except for domestic or imported spirits that are added as flavouring, which need only be aged for two years. Aging should be done it its native country (Canada).

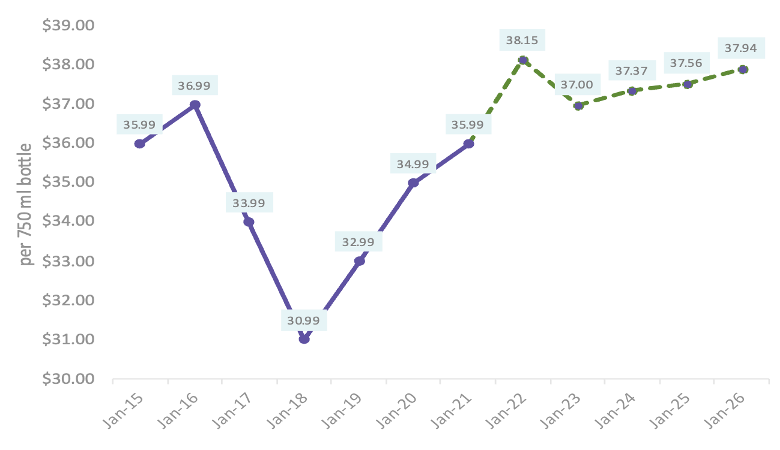

The market price of Canadian whisky has seen a rise since 2018 due to rising demand from the U.S. In the post-pandemic scenario, the demand has outpaced the supply and the prices are likely to edge higher.

Canadian Whisky – Major Distillers and Total Sales

The market for Canadian whisky in 2021 is projected at $2061.55 million, which includes domestic sales of $1766.21 million, and export sales of $295.34 million. In terms of volume, domestic sales are estimated at 5.936 million 9Lcs, and exports at 1.062 million 9Lcs in 2021, taking the total Canadian whisky sales to 6.998 million 9Lcs in 2021.

Two-thirds of Canada’s annual billion-dollar beverage alcohol exports business comprises spirits. The Canadian spirits business consumes 320,000 metric tons of corn, being the largest consumer of Ontario corn and largest buyer of western rye.

Canadian distilleries rose rapidly as the Government eased regulations for small distillers, particularly in British Colombia and Quebec, which witnessed a boom. While smaller distillers add value to the booming beverage industry, almost 95 percent of the Canadian whisky production is represented by a few market leaders:

- Alberta Distillers (Bean Suntory)

- Black Velvet (Heaven Hill)

- Gimli & Valleyfield (Diageo)

- Hiram Walker (Pernod Ricard)

- Kittling Ridge (Campari Group)

- Canadian Mist (Sazerac)

- Highwood Distillers

The Hiram Walker distillery in Windsor, Ontario is touted to be the largest beverage alcohol distillery in North America.

Demand and Supply Dynamics of Canadian Whisky

Sources: Expert Interaction, Market News, and Beroe Analysis

- The supply of Canadian whisky is estimated to increase by 3.2 percent CAGR between 2021 and 2025, from 7.082 million 9lcs to 8.288 million 9lcs, in line with the rise in demand from the U.S., which is the largest buyer of the beverage.

- Demand is projected to increase domestically by a CAGR of 3.5 percent between 2021 and 2025, while export demand is projected to rise by 3.9 percent during the same period.

- Domestic demand is projected to be generated from the craft distilleries as the Canadian market currently has more than 350 craft distilleries coupled with new product offerings from traditional players, such as territory-specific blends, new single malts, ultra-aged bottles, and so on.

- Overseas demand is largely generated from the U.S. market and is likely to witness an increase owing to the market penetration and distribution capabilities by the predominant distillers.

- Meanwhile, the market penetration in the secondary markets of Japan, Australia, France, Germany and Netherlands are anticipated to improve in the successive years.

- USA remains the primary destination for Canadian Whisky, importing nearly 85 percent of the total exported volumes. The U.S. demand is projected at 0.9 million 9Lcs for the year 2022, with a growth projected at CAGR of 4.9 percent until 2025. We anticipate that the Canadian craft distillers will also increase their stakes in the battle for a share in the U.S. markets by then.

Market Price Trend of Canadian Whisky

The market price of Canadian whisky has seen a rise since 2018 due to rising demand from the U.S. In the post-pandemic scenario, the demand has outpaced the supply and the prices are likely to edge higher.

Sources: Expert Interaction, Market News, and Beroe Analysis

To understand the market price evolution of Canadian whisky, we considered Crown Royal De Luxe, a product from Gimli & Valleyfield Distillers based in Manitoba, which is a part of Diageo group.

- The market price of the renowned Crown Royal is set to increase as pandemic demand has led to an unprecedented depletion of stocks.

- Lower availability and higher costs of cereals that go into the production is also likely to add to the prices.

- Also, rising aluminium costs can impact the whisky production cost.

- Meanwhile the increase in shipping and energy costs could also add to the rising prices.

- As barrel ageing is the key, the surge in demand for whiskies as against the shortage of raw-materials, the market prices are very likely to soar in 2022–2023.

- Despite the closing of bars and restaurants amidst the pandemic, the sales at liquor stores, and online channels have witnessed stellar growth.

As per Diageo, despite the supply bottlenecks, the U.S. sales of Crown Royal rose 12% in the second half of 2021, compared with that of a year ago. To meet for the rising costs, Diageo is planning to increase the prices of Canadian whisky sold in the U.S. markets. Canadian whisky brands might take months or even years to reach liquor store shelves, as production cannot be increased rapidly.

Sourcing recommendations for the category

- The availability of labour and density of population make Manitoba and Ontario provinces the preferred locations for distillers.

- The FDR of the Government of Canada requires Canadian whisky to be aged at least three years in small wood, except any domestic or imported spirit that is added as flavouring, which need only be aged for two years. The whisky should be aged in its native country (Canada).

- The market dynamics hint at a disruption, with immense scope beyond the traditional export market. Further, as the raw-material prices appear to rise, it is essential to engage in long-term sourcing of key raw material.

- It is recommended to engage with distillers who have the capacity to scale their production to meet any upside to the production.

- The suggested suppliers to engage with are listed below, with regional sourcing within Canada expected to suffice for domestic procurement requirements

|

Sr.No. |

Supplier Name |

Supplier Address |

Location of Facilities |

|

1 |

Highwood Distillers |

Unit 23, 4948126th Ave. SE. |

High River, Alberta |

|

2 |

Last Straw Distillery |

40 Pippin Rd Unit 9 Vaughan, Ontario |

Ontario |

|

3 |

Ma caloney Distillers |

761 Enterprise Crescent, Saanich, |

Victoria |

|

4 |

Maverick Distillery |

9-2140 Winston Park Dr Oakville, |

Ontario |

|

5 |

Minhas Brewery |

1314 44 Ave NE Calgary, Alberta T2E |

Alberta |

|

6 |

Okanagan Spirits |

267 Bernard Ave Kelowna, British |

Vernon, Kelowna |

|

7 |

Premium Bottlers Inc |

26-150 Bradwick Drive |

Ontario |

|

8 |

Ogham Craft Spirits |

767 Silver Seven Rd. Unit 23 |

Ontario |

Sources: Supplier Website, Expert Interaction, Market News, and Beroe Analysis

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe