Electronic Logging Device|Electronic Logging Device Price| Beroe

Abstract:

In December 2015, the Federal Motor Carrier Safety Administration (FMCSA) published a rulemaking document on the electronic logging devices (ELDs). The mandate required every motor carrier with interstate drivers to install the ELD systems. As per the mandate, the trucking companies and drivers were required to install and use ELDs by December 18, 2017. This technology has the potential to drive compliance and facilitate an accurate assessment of the Hours of Service (HOS) rules across the trucking industry. The objective of FMCSA is to significantly strengthen the commercial truck drivers’ compliance with the hours of service regulations. This compliance is expected to reduce driving fatigue, as the ELDs will monitor the driver’s working hours, location, miles, and even vehicle movement. This kind of technology in the transportation industry can be transformative and is expected to be a game-changer for trucking companies and drivers. However, the shippers and carriers are concerned that the ELD will have a significant impact on the truck’s operational cost, and a potential loss of truck capacity and productivity would lead to an increase in the freight rates. The mandate might also strain the weekly earnings of truck drivers because it will require the drivers to conform to providing a maximum of 55 hours of service in a week. These weekly logging hours will reduce the flexibility of the drivers.

A lot of people in the transportation industry are worried about the effects of the ELD and the pressure to meet shippers’ demands in coming months. This article describes the challenges and advantages of equipping long-haul trucks for freight movements with ELDs within the U.S.; it also focuses on how the U.S. trucking industry is expected to shape up in the near future due to the introduction of this rule to use ELDs, from a shipper’s perspective.

| Key Highlights |

|

Quick Facts on ELDs

- An ELD is an electronic solution that enables professional truck drivers and commercial motor carriers to track compliance with the Hours of Service (HOS) rules easily. By December 2017, all the Commercial Driving License (CDL ) drivers were required to maintain a Record of Duty Status (RODS) and use an ELD to document their compliance with the HOS rules

- Trucking companies had until December 2017 to implement certified ELDs to record their hours of service. Those who already equipped their vehicles with the electronic logging technology but did not meet the above criteria have until December 2019 to ensure compliance

- As it is a mandatory safety regulation, enforcers will have the authority to drop the safety rating of non-compliers to “unsatisfactory,” granting the non-compliers 60 days to comply with the rule or be shut down.

- Electronic logging devices range from an annualized price of $165 to $832, with the most popular device used today priced at S495/truck

- The total annual cost of ELD adoption will be $975 million, which includes all equipment for carriers and commercial truck inspectors as well as the cost of inspector and driver training

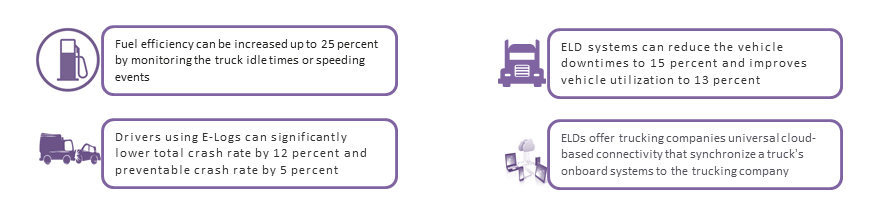

Advantages of Using ELDs

| ELD Exemptions |

|

ELD Mandate’s Impact on Truck Drivers

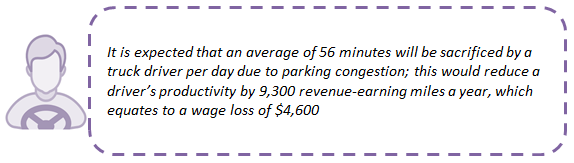

- Truck drivers drove, on an average, up to 60 hours per week before the ELD mandate. Since the implementation of the mandate, drivers can legally drive up to 55 hours per week. This might potentially reduce the number of hours, thereby limiting the capacity in the short-term until all carriers, drivers, and shippers have adjusted to the ELD rule

- ELDs will facilitate enforcement of tight time constraints. Additionally, a truck’s delay at a shipper/receiver for more than two hours would lead the driver to lose revenue for the day. Shippers who move freight with a “just-in-time” model will have enormous pressure to meet loading times as ELDs will mandate drivers to take a 10-hour shutdown.

- A transition to ELDs has led some truck drivers to exit the industry. Additionally, some carriers reported losing truck drivers after the implementation of the ELD mandate. In fact, 51 percent of carriers indicated that they lost drivers who did not want to operate under ELDs

|

Expert Opinion: ‘Many drivers feel that the waiting times incurred at the premises of shippers that were unlogged until now will now be logged. This can reduce their earnings by 2 to 3 percent per week. Thus, it is a shipper’s responsibility to focus on maximizing the driver’s time to ensure that loads can be loaded and unloaded on-time.’ |

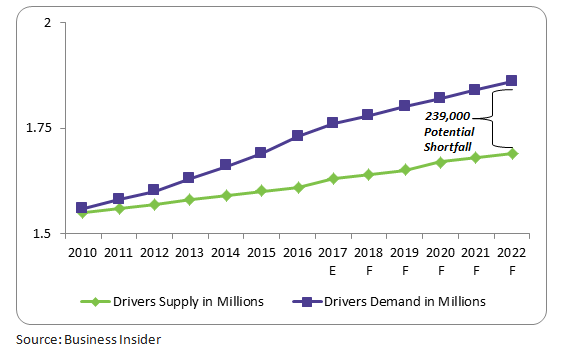

Estimated Shortfall of Truck Driver in the U.S. (2010-2022)

ELD Mandate’s Impact on Trucking Companies

|

Impact: Drivers between the age group of 45–49 years are willing to quit their jobs before the implementation of the ELD mandate; this would lead to the attrition of more than 25 percent of the drivers from the market. It will be challenging for shippers and carriers to find qualified drivers; the potential shortfall of tractor-trailer drivers is estimated to be around 239,000 by 2022.

|

|

|

|

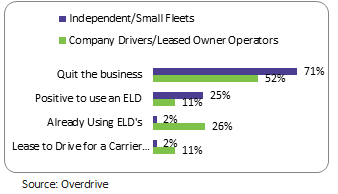

Impact: The 71 percent of independent truckers are averaging with a fleet size of 5–10 trucks. Thus, the overall loss for shippers is estimated to be about 2,60,000 to 3,00,000 trucks in the future. This would result in a severe shortage of trucks, approximately 5–8 percent of loss in the market, and lead to higher freight rates

|

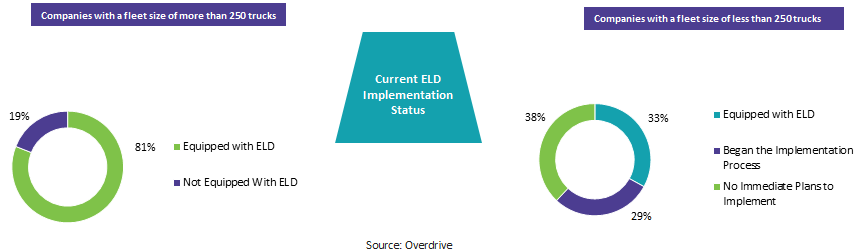

Response of Trucking Companies on ELD Mandate

|

Expert Opinion: ‘Shippers should consider alternative modes of transportation. Intermodal transport is emerging as a very viable alternative to traditional truckload trailers. The rail lines can double the capacity of one truckload by stacking containers onto one car, which would reduce the costs for shippers. Using rail lines could help offset any capacity shortages and increase rates.’ |

ELD Mandate’s Impact on Road Freight Rates

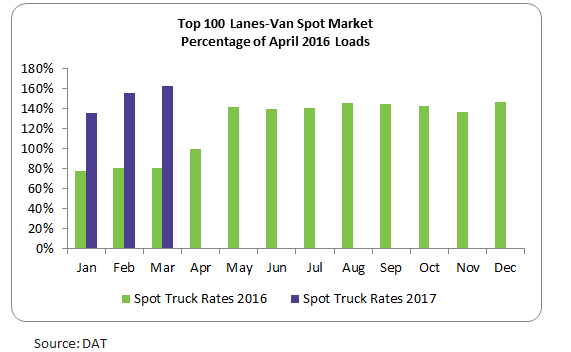

- Similar to trucking capacity, the ELD implantation will also impact freight rates. Currently, carriers are facing a shortage of drivers to haul freight; consequently, they will be forced to raise rates to compensate for the unused overheads.

- The spot van linehaul rates without fuel surcharges are 2.2 percent higher year-over-year. Flatbed truck linehaul rates are 2.9 percent higher. Spot rates, which are individually negotiated between small carriers and independent truckers and brokers, are be volatile. The movement of contract rates, which are long-term agreements between carriers and shippers, has slowed further.

| Impact: Overall freight rates were forecasted to increase approximately by 5 –10 percent in 2017–2018 due to a shortage of drivers and trucks in the market. Currently, shippers have begun to face a shortage of trucks in the ongoing ELD implementation phase and will continue to face this dearth during the peak period (October to December) |

|

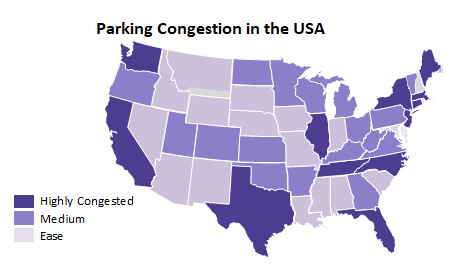

Expert Opinion: ‘ELD requirement will compound the problems that drayage operators face when they wait at the terminals due to congestions. These delays could cost approximately $400, which will be passed on to the shipper.’ |

Shipper’s Approach toward ELD Mandate:

- The current loss in truck capacity due to ELD mandate can be partially attributed to excess inventories; it can result in a relative freight standstill. An inaccessible inventory of approximately $7 billion is expected in the coming months. Hence, shippers are advised to increase the storage capacity of current warehouses to maintain the excess inventory for couple of months until the truck capacity resumes normalcy.

- With the ELD mandate in place, shippers may observe an increase in the lead time taken to deliver a shipment from origin to destination; this can be attributed to the effective enforcement of the HOS rules. Hence, carriers and shippers must ensure that transit expectations align with legal driving hours; additionally, asking drivers to exceed legal requirements could be considered driver coercion, according to the Federal Motor Carrier Safety Administration

- Trucking rates are becoming volatile in recent times because of the ELD mandate and other factors. Many shippers are using platforms like TransRisk to hedge the future freight rates to avoid the risk of volatility in coming months. Similar to derivatives markets in other industries, contracts with TransRisk will be settled financially rather than in exchange for actual goods or services

- Shippers should control the pickup and delivery times to increase the flexibility of carriers; as a result, 45 minutes of an average pickup and delivery time can be reduced and carriers can accommodate improved shipping schedules while maintaining compliance with HoS regulations

- Shippers should maintain the consistency in volumes as it leads to an increase in productivity of the carrier handling the trip on a daily basis. Additionally, there are several immediate actions that can have better driver utilization and effectively increase the productivity. These actions are as follows:

- Allow flexible appointment times (9,375 miles gained per driver per year)

- Expedite loading and unloading times (12,500 miles gained per driver per year)

- Provide onsite driver accommodations/parking (12,500 miles gained per driver per year)

- Accommodate drop and hook (10,000 miles gained per driver per year)

- Expanding the relationship with a 3PL can provide solutions to pain points like capacity shortages and an increase in rates. 3PLs provide valuable expertise and enable more productivity, better customer experiences, and transportation cost reductions

| Industry Update: ’The retail giant Walmart noted that a “high variance in rates” was submitted for its truckload bid. In response, Walmart announced that it would invite additional non-incumbent parties to participate in a third round to get better rates. Historically, Walmart has conducted only two rounds of bidding before awarding lanes.’ |

Conclusion

- Shippers are advised to stick with the carriers familiar with the ELDsand understand how to maximize their potential as a planning tool. The other carriers those who wait until the last minute will lack understanding of ELDs and may not use them as efficiently.

- Shippers will face a shortage of trucks during the implementation process of ELD; however, in 2018, trucks’ capacity is assumed to be normal, but there will be a shortage of drivers in the market

- ELDs mandate may force some shippers and consignees to alter their shipping and receiving policies. Shippers may have to reconsider their distribution operations. For instance, they will have to review appointments and stick to them, preload trailers, and explore alternative means of transport

- Losing experienced drivers is not good for the industry; however, drivers under the age of 40 years, who comprise approximately more than 50 percent of the industry, and those who need the income are likely to stay in the industry and accept the changes that are taking place.

- ELD mandate would not change the rules under which drivers perform their jobs, but it will enhance the ability of carriers and shippers to analyze the daily operations and will help them to plan accordingly to reduce the overhead costs

- Drivers who have already adopted for ELDs often report satisfaction, with short-term increases in productivity, fewer human errors, and less paperwork. More significantly, ELDs allow for more real-time data on trucks and loads, which, in the long run, will lead to better asset utilization and more available capacity. Over a period of time, shippers would see savings as a result of better load visibility, planning, and dispatching, among others.

- 3PL partner will help shippers in managing the short-term capacity challenges. For example, the right 3PL will be able to help shippers with the following:

- Vetting shipper lanes for ELD vulnerability and understanding whether typical lengths of hauls are still possible with full cmpliance

- Helping ease concerns of smaller/independent carriers by arming them with important information and tangible solutions (e.g., less expensive options available)

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe