Impact of E-Commerce in the Corrugate Market – North America

Abstract

Demand for corrugated boxes in North America is fueled largely by e-commerce. E-commerce is a game-changer in the retail space and has a direct impact on the demand for corrugated boxes and containerboard.

E-commerce accounted for less than 1 percent of total retail sales in early 2000, rising to 4.5 percent of sales in 2010 and 9.5 percent in Q1 2018. Annual growth in e-commerce sales has averaged more than 15 percent since 2010, and the percentage growth has been quite consistent during this period. But starting in 2014, e-commerce hit a critical mass when this double-digit growth led to a tremendous increase in spending. E-commerce spending grew roughly $7.6 billion per year from 2011 to 2013, then jumped to $10.4 billion in 2015 and $15.5 billion in 2017.

The growth of e-commerce not only drives the volume demand for the paper packaging industry but also increases complexity and the need for new innovations—more than before. In the present Internet world, corrugated boxes are the central physical interaction item between the e-retailer and the consumer and have strategic importance for customer perceptions of the brand. Paper enjoys environmental benefits over plastic and helps create a premium effect that is set to enjoy years of growth in demand along with e-commerce.

This article provides insights into how the e-commerce landscape affects corrugated box demand in North America.

Projected Demand by Boxes

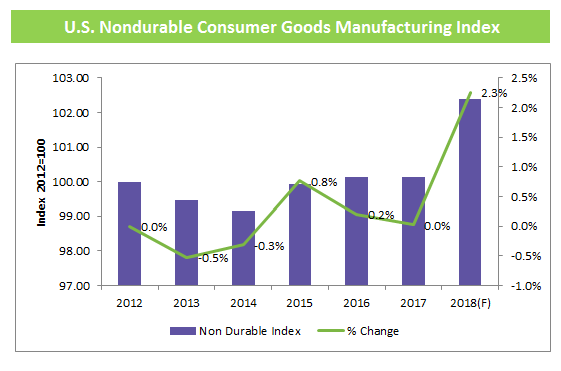

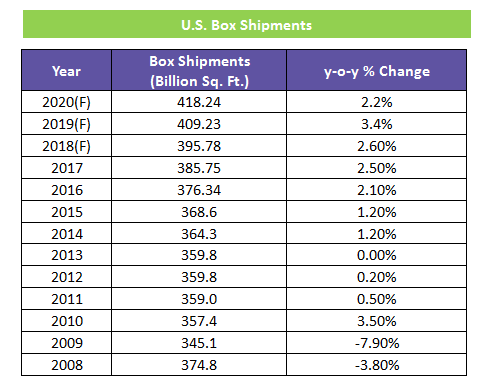

The growth in shipments of corrugated boxes is largely related to the growth of U.S. nondurable goods because it accounts for 80 to 85 percent of corrugated box shipments.

The nondurable consumer goods market during the 2011–2013 period witnessed average growth lower than 0.5 percent. As the economy strengthened in 2014, consumer spending improved and demand started to surge, as did production. This level of increase was reflected in corrugated box shipments that increased to 1.2 percent in the same year.

Since 2015, U.S. box shipment growth gradually ‘recoupled’ with real GDP growth. In 2017, the 2.5 percent increase in box shipments was comparable to the 2.3 percent growth in real GDP.

Apart from the retail and agricultural segments, e-commerce is expected to have a compounded average growth rate of 10 to 20 percent in the coming years, which will drive demand for the boxes.

E-commerce accounted for less than 1 percent of total retail sales in early 2000, rising to 4.5 percent of sales in 2010 and 9.5 percent in Q1 2018. Growth in e-commerce sales has averaged more than 15 percent per year since 2010, and the percentage growth has been quite consistent during this period. However, starting in 2014, e-commerce hit a critical mass and the double-digit growth led to a tremendous increase in spending. E-commerce spending grew roughly $7.6 billion per year from 2011 to 2013, then jumped to $10.4 billion in 2015 and $15.5 billion in 2017.

E-Commerce Boosting Box Demand

E-commerce has added 20–23 billion sq. ft. to corrugated box demand during the last four years. This amount translates into roughly 1.5 million additional tons of containerboard demand on top of the growth provided by the broad manufacturing sector. For anyone who wants to look at the boost in terms of growth rates, e-commerce is adding somewhere between 100–150 basis points to the growth rate for box shipments.

Retail Landscape impacted by E-Commerce

E-commerce is rapidly changing the retail space and has a direct impact on the demand for corrugated boxes and containerboard. E-commerce sales for global fast-moving consumer goods (FMCG) grew by around 26 percent in 2016 and contributed to 35 percent of global FMCG growth.

Globally, e-commerce sales are not only growing rapidly but also are creating more brand loyalty, resulting in higher average spending than traditional offline sales. Distribution/e-commerce showed the fastest growth, increasing to 12 percent of the U.S. box market in 2015 from 1 percent in 1995, with e-commerce playing a pivotal role in driving box shipments. Changes in consumer behavior like ordering products from mobile phones—which never existed two decades ago—are rapidly driving e-commerce growth.

Trends Driving E-Commerce

Consumer trends in e-commerce are anticipated to prevail in the near future given the increasing buying power of millennials and evolving customer expectations in a new environment of convenience. It is estimated that, at present, e-commerce represents only about 5–7 percent of total U.S. retail sales but is anticipated to account for around 11–12 percent of all retail sales by 2025. Double-digit growth rates are estimated for e-commerce during the next decade.

Share of Corrugated Boxes in E-Commerce

Corrugated boxes are anticipated to hold a major share of e-commerce packaging demand, spiking from $680 million in 2015 to around $1.5–2 billion in 2025. By 2020, corrugated boxes are estimated to account for 25–30 percent of overall e-commerce packaging demand.

Challenges faced by Corrugates Industry E-Commerce

The paper packaging industry is one of the big winners from these developments, but it also faces several challenges.

- Corrugated boxes for e-commerce are more personalized and tailored products and, hence, the number of different box sizes with different prints has increased significantly, creating problems on the supply side.

- For many of the large box makers, numerous smaller specific runs go against established industrial scale production systems. But, on the other hand, buyers need more tailored boxes and shorter supply times.

- The strong growth in online retailers also has a negative impact on traditional brick and mortar stores. Also, a substantial amount of consumer goods are imported from overseas, limiting the additional utilization of boxes to distribution centers rather than throughout the U.S. supply chain. Finally, e-commerce retailers are quite aware of the increasing costs for packaging materials and are considering options to control fulfillment costs, which will considerably impact the growth of boxes.

- There is a new dimension in terms of the functional properties of the packaging. Because the corrugated box must go through a longer supply chain, face the customer, and be ready to be returned back, traditional regular slotted container (RSC) boxes with no print are wasted opportunities for the brand because a customer surely spends time looking at the box when receiving it, opening it, and then returning or disposing of it.

- Damaged boxes in e-commerce mean much more than in the offline world because they create multiplied costs and loss of brand loyalty among consumers. Components of the e-commerce supply chain are supplier -> fulfillment center -> sorting center -> logistics partner -> customer, which require a much more complex supply chain than the traditional retail store channel. Moreover, as boxes go directly to consumers’ homes, recovery of old corrugated containers (OCC) will become more of a challenge.

To address these issues, several new solutions and technologies are being implemented to create boxes that fit the exact sizes of the packed products at the e-retailer location. Small and flexible sheet plants with tailored packaging solutions are competing to supply e-commerce demand against large and established peers. Unique composite solutions are being developed for the e-commerce market.

Corrugator widths have increased from 87 inches in the late 1990s to 98 inches in the first half of the early 2000s, and to 110 inches after 2006. Some 130-inch corrugators have been installed. Also, kicks per minute (number of boxes) for flexo-folder-gluers have increased from about 250 in the late 1990s to about 400 presently.

The growth of e-commerce means not only new volume for the paper packaging industry but also increasing complexity and a greater need than before to work together with the packaging buyer. In the online world, corrugated boxes represent the central physical interaction item between the e-retailer and the consumer and have strategic importance for customer perceptions of a brand. Paper enjoys environmental benefits over plastic, helps to create a premium ‘wow’ effect, and is set to enjoy years of demand growth together with e-commerce.

Conclusion:

-

E-commerce is estimated to have added 20–23 billion sq. ft. of corrugated box demand in four years. Despite the downside from e-commerce shippers finding ways to reduce the use of corrugated packaging, U.S. box demand could still grow about 2–3 percent in the coming years.

- Corrugated boxes are anticipated to hold a major share in e-commerce packaging demand, spiking from $680 million in 2015 to around $1.5–2 billion in 2025. Corrugate boxes are estimated to account for 25–30 percent of overall e-commerce packaging demand by 2020.

- To address the challenges faced by corrugated market players in the e-commerce industry, several new solutions and technologies are being implemented to create boxes that fit the exact sizes of the packed products right at the e-retailer location, and unique composite solutions are being developed for the e-commerce market.

References

Industry News – Risi, Supplier Websites, Secondary Sources

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe