How High Oleic Sunflower Oil (HOSO) is Making a Statement in the QSR Industry

Abstract:

Increasing focus on regulatory norms such as FDA’s requirement of labeling trans-fat content in nutrition labels,and more recently, the elimination of PHO (Partially Hydrogenated Oils) for manufacturing foods has increased the demand for healthier oils to be used in cooking.

This article focuses on the trend being created by high oleic sunflower oil in the quick service restaurant (QSR) industry and the competitive advantages that QSR industry suppliers are developing for the future.

Increasing global awareness on a healthy diet has shifted the use of high oleic sunflower oil (HOSO) in the QSR industry;in the U.S.andthe EU, palm oil is being replaced by HOSO. This process is being supported by new regulations on package declarations and forbidding trans-fatty acids.

As HOSO is fitting to the healthy food segment, demand is steadily growing and,in turn, forcing producers to keep up with the supply.The expectedgrowth rate of HOSO consumption is above 8percentCAGR until 2023. As Asian countries are also joining the demand trend, new solutions are being implemented to provide intermediate solutions, such as mixing HOSO with other oils for several processes.

However, there is a potential risk of shortage, due to high demand and low acreage of high oleic soybean cultivation, specifically the higher oleic content HOSO variants.

Oleic content of the sunflower can be different;above 75 percent oleic acid in the sunflower seed is accepted as HOSO. However, some buyers may ask for more than 80 percent for their processes, while others accept oleic acid content even if it is above 65 percent. Shortage risk is not associated with countries, even though all importing countries can be affected. It is mostly related to small-and mid-scale buyerswho do not have long-term contracts. Since these typesof buyers need to purchase either on the spot or on short-term contracts, they are most vulnerable to possible shortages. So, a buyer might be required to purchase lower oleic (still high oleic when compared to normal sunflower) content oil in case of any shortage of HOSO.

Supply of HOSO in Europe and Factors that Drive its Availability

Demands from major buyers (buyers who require more than 1000 MT/year) are already secured, as contracts are mostly fixed from Sep–Oct 2018, for a 12-month period.

The issue comes from small-scale buyers (local companies which want to introduce new products with HOSO and ho-re-ca channel)as most of the QSRchains, hotels, and fast food restaurants are gravitating toward the trend of switching to HOSO mainly for fried products. New product launches with HOSO are 15 percent above the previous year. A similar growth figure also comes from the ho-re-ca channel. Therefore, suppliers face availability issues for smaller-scale buyers, especiallyfromWesternand Northern Europe.

Major buyers still have secured prices via their long-term contracts from Q4 2018 (around 1020–1030 USD/MT). However, for spot buyers, prices are much higher due to lowered availability in the open market where prices are marked around 1100 USD/MT.

For Q2 2019, the estimated gap between demand (driven by small scale buyers) and supply is approximately 2200 MT. This gap is increasing spot prices and also pushing some local FMCG players to stay with conventional oils, such as sunflower or rapeseed.

Price Trend Analysis

In the market, you can see some manufacturers claim their product as HOSO, with Oleic acid content greater than 65 percent with lower prices. This should not be misled, as HOSO should have a minimum of 75 percent of Oleic acid in general. For food processing, higher oleic content gives better results. Therefore, buyers (like PepsiCo–Frito-Lay) ask for HOSO with greater than 80 percent oleic acid, due to its stability in the frying process.

HOSO Prices are Affected by Several Factors:

- Sunflower oil prices (as HOSO price is calculated with a premium on the regular sunflower oil price)

- Premium on sunflower oil (the premium depends on the yield of high oleic sunflower seeds for the given year, total acreage of the high oleic seeds, etc.)

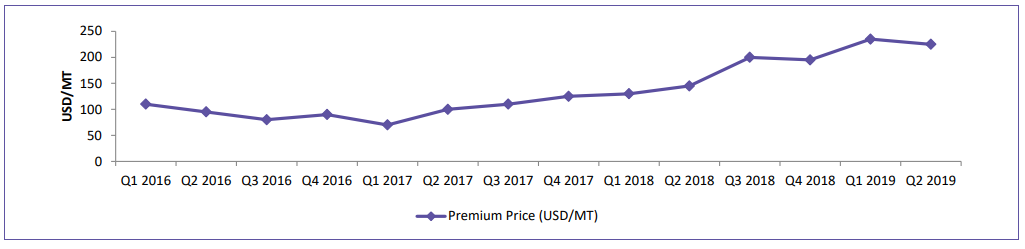

- Demand (which is also a factor for the premium) The premium has been significantly high in 2019, approximately 225–235 USD/MT. Although supply growth is still stagnant, the sudden increased demand from the ho-re-ca channels and snacks industry with new product launches slightly increased the prices. However, the demand for sunflower oil did not grow at the same pace, so the premium between HOSO and regular sunflower oil went above 200 USD/MT in the initial two quarters of 2019.

Premium Difference between HOSO and Sunflower Oil

*The above preliminary premiums for HOSO (the preliminary premium is the premium effective if the purchase is made directly from the manufacturers of HOSO)—an additional premium can be applied (by the traders) depending on the demand momentarily (the secondary premium can be an additional 50– 110 USD on top of the primary premium)

How Premiums are Charged for High Oleic Sunflower Oil (HOSO)?

HOSO premium (over standard sunflower oil) is based on several factors mainly affecting the supply/demand ratio:

- The first factor comes from the seed crop (High Oleic sunflower seeds have a premium over regular sunflower seed, which is generally 30–40 of the premium on the oil). So, the higher the crop ratio of hi-oleic sf seed, the lower the premium on the seed, which finally effects the premium on the HOSO.

- Demand growth on the HOSO for the period (calculated based on the buyer contracts/positions and order forecasts for each quarter)

- Production quantities and stocks (both at manufacturer and trader sites)

- In short, both the preliminary and final premiums on HOSO (over crude SF oil) depend on high-oleic seeds crop quantity, HOSO stocks are manufactures/traders and demand growth.

Cost of Converting Sunflower Oil to HOSO

Production of HOSO is very similar to crude sunflower oil. The difference lies in the seeds. The average estimated cost of converting sunflower oil to HOSO is at 200–225 USD/MT.

Conversion from sunflower oil to HOSO requires planning from stage of seeding/cultivation. HOSO production requires high-oleic seeds, which should be planted in the previous season.

So, the conversion cost includes the plantage, harvest, handling, and processing (processing faults can reduce the oleic content). Based on recent conversions from few companies in Europe (Cargill, AAK, Fuji, Euralis, Orkide), the estimated conversion cost is around 200– 225 USD/MT. This cost was much higher before 2017, and most seeds were protected and patented. As patents expire, the availability of seeds increases.

Moreover, higher yield seeds are introduced every season. As the demand for HOSO is constantly increasing, and the supply of high oleic acid sunflower seeds is still less than that of ordinary sunflower seeds, there is a price difference (premium) on HOSO prices over crude sunflower oil prices—approximately 10–18 percent higher on regular sunflower oil prices.

Our expectation is that the conversion cost stabilizes at a rate of 180 USD/MT for 2020 and beyond.

Conclusion

Major buyers have already secured their volume in Sept–Oct 2018; however, increase in demand is witnessed amongst small- and mediumscale buyers who are introducing new products manufactured using HOSO, where new product launches with HOSO are 15 percent above the last year. Buyers who are keen on using HOSO with oleic content above 85 percent are inclined to contract the volume for the following year, or even two years in advance, so that suppliers can also book/contract seed crop accordingly. This advance booking protects the buyer from higher premiums, as the volume/price is fixed on time. Further, manufacturers are moving to be flexible with the oleic acid content of the HOSO.

If the buyer is strictly using HOSO with oleic acid content of above 80 percent, this would limit the supply options. So, they tend to adopt a better option with a range of oleic acid content (i.e. 65 percent, 75 percent and >80 percent). This would also allow the buyer flexibility to switch to lower cost HOSO options during high price/low supply periods. From the buyer’s perspective, critical buyers (companies which require more than 10000MT/year HOSO) tend to have long-term contracts to secure supply. For instance, a buyer, such as Frito-Lay, makes the contract with the supplier (such as Cargill, ADM, etc.) for a fixed volume for following year. (The volume of 2019 purchase is already fixed in 2018, so the supplier accordingly secures the crop of high oleic seeds).

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe