Global Cotton Market Scenario for 2022

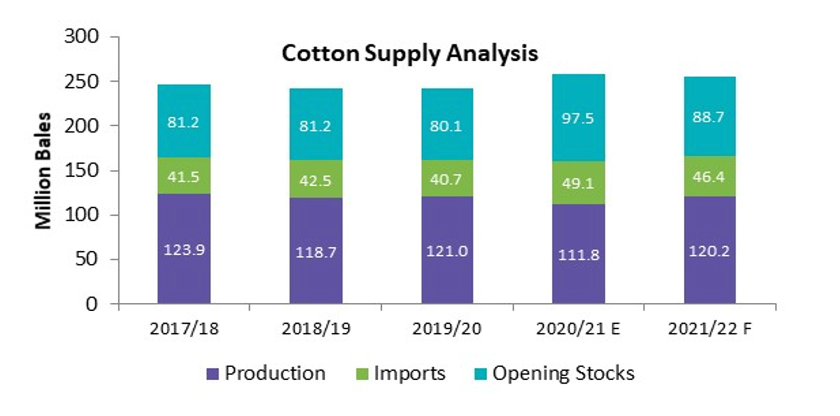

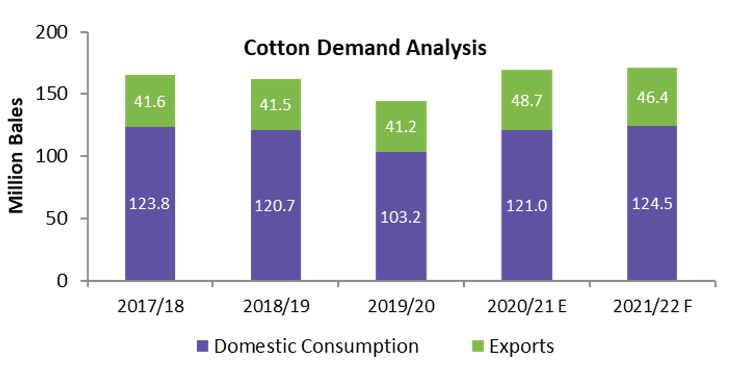

The global cotton market is projected to experience tight supply in 2021/22, with supply estimated to decline 1.2 percent, coupled with a 4.9 percent contraction in stockpiles. Global cotton demand is projected to rise 2 percent in 2021/22, driven by a revival in consumption from downstream industries such as textiles and apparel; however, shipping container shortages, shipment delays, and high ocean freight rates are expected to dampen imports

A strong recovery in global demand amid lower production in key producing regions such as India, the U.S., Pakistan, Brazil, and Turkey during the previous season has tightened carry-over stocks for 2021/22, which is expected to keep prices elevated, whereas the recent yield concerns in the U.S. and India has raised concerns of tighter global availability.

Lower-than-anticipated U.S. cotton supply is likely to reduce export volumes, thus restricting global availability, with shipments already facing disruptions due to logistical issues. This would force mills in key consuming regions to utilize their domestic stockpiles

Recent escalations in the Russia–Ukraine conflict is seen to negatively impact the cotton market. Meanwhile, a cutback on consumer spending and mill demand for cotton is expected to exacerbate the adverse impact of prevailing deterrents to demand such as high inflation, rising interest rates, and withdrawal of stimulus packages. Further, mills are expected to adopt a cautious approach and are likely to hold back on orders for cotton amid the global uncertainty in demand, which may raise stocks.

Source: USDA, Cotlook, Beroe Analysis

Market Outlook

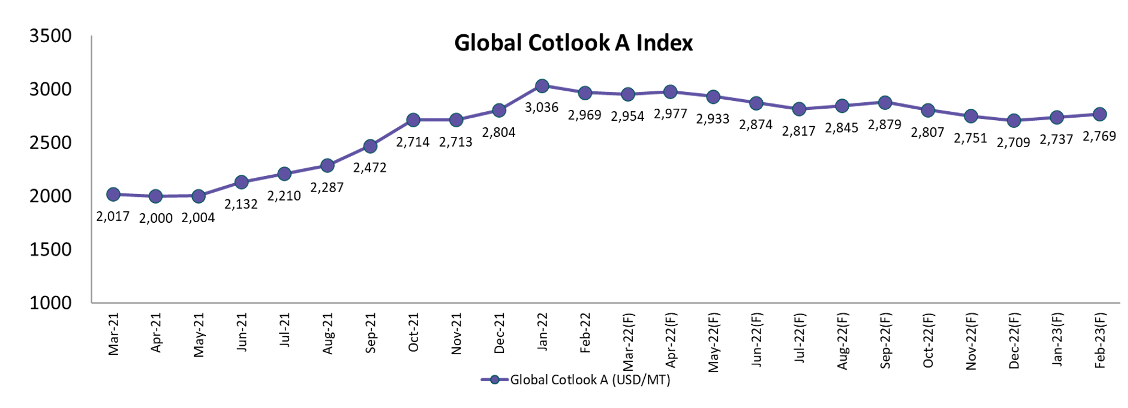

The global cotton market it projected to witness high inflation over 2022, driven by tighter cotton stocks on account of greater mill use and lower global supply; while rising input costs, higher energy prices, and continued supply constraints are expected to keep prices elevated.

Tighter carry-over stocks for 2021/22, coupled with rising concerns of lower output in the U.S. and India is expected to tighten market availability. Lower-than-anticipated U.S. cotton supply is likely to reduce export volumes, thus restricting global availability with shipments already facing disruptions due to logistical issues. This would force mills in key consuming regions to utilize their domestic stockpiles. India’s cotton output estimates for the 2022 season have been reduced due to erratic rainfall and pest infestations, with Indian cotton production projected to decline 4 percent for 2021/22.

Further, higher input costs, driven by increasing fertilizer and energy costs, is likely to exert upward pressure on prices. Meanwhile, an increase in the minimum support prices to incentivize cotton sowing is expected to raise prices in Asian regions.

Source: Bloomberg, USDA, Beroe Analysis

Short Term

-

Cotton prices are likely to be negatively affected by the Russia–Ukraine war. A cutback on consumer spending and mill demand for cotton is expected to exacerbate the adverse impact of prevailing deterrents to demandsuch as high inflation, rising interest rates, and withdrawal of stimulus packages.

-

Further, the rise in crude oil prices is seen to raise ocean freight rates, which—along with prevailing container shortages—is likely to deter fresh overseas orders for cotton; meanwhile, the strengthening U.S. Dollar is further expected to suppress demand for cotton and in turn lower prices. Mills are seen to adopt a cautious approach and are likely to hold back on orders for cotton amid the global uncertainty in demand, which may raise stocks.

Long Term

-

A surge in commodity prices such as wheat, corn, sunflower on account of the Russia–Ukraine crisis is likely to shift spring sowings of cotton to other crops in lieu of higher returns, with the initial estimates indicating a 4.4 percent increase in the global cotton harvested area for 2022/23, which is likely to have downside risk

-

Further, more clarity in global demand will determine cotton’s price levels in the medium term – with initial estimates projecting an increase of 1.7 percent Y-o-Y for 2022/23. Rising input costs such as increasing fertilizer and energy prices is likely to keep prices supported in the long term; meanwhile, rising crude oil prices is likely to raise prices of substitute polyester fiber, thereby elevating global demand for cotton

Growing Demand for Sustainably Sourced Cotton

With the uptrend seen in compliances and accreditations to sustainable standards, the supply of sustainable cotton is projected to rise, with a continued increase in market share for sustainable sources of natural fiber against conventional sources.

Demand is expected to surge in the coming years due to the rising sustainability commitments of major brands or retailers, coupled with the growing consumer awareness for environmental responsibility. This is thereby likely to tighten overall availability and in the near term, maintain the current elevated prices compared to.

The market for sustainable cotton has several standards within which the Better Cotton Initiative (BCI) comprises the highest market share. It encompasses both the BCI and other standards such as the ABRAPA (Brazilian standard), cotton made in Africa, and MyBMP (Australian standard). altogether, these denoted a market share of approximately 24 percent of the total global cotton output in 2020, making it the most widely used source of sustainable cotton.

Organic and recycled cotton are the other major sources of sustainable cotton. Organic cotton is estimated to have witnessed tighter supply in 2021 driven by lower output in India, the key producer, due to erratic rainfall and pest infestations, the 2022 market supply is estimated to recover; meanwhile, recycled cotton is projected to continue the uptrend in output, supported by the increasing environment-friendly commitments by downstream industries.

Other sources of sustainable cotton—Fairtrade, REEL Cotton, Regenerative Organic Certified, International Sustainability and Carbon Certification, BASF e3, Field to Market, Cleaner Cotton, and the U.S. cotton trust protocol—contribute less than 5 percent of the market share in total.

Key Highlights of the 2022 Global Cotton Market from the Procurement Viewpoint

-

China’s cotton production is estimated to decline 8.5 percent in 2021/22 on account of a lower acreage and yield of 4.6 and 4 percent, respectively, for the current crop of domestic cotton. Further, a contraction in imports due to the prevailing tightness in U.S. export volumes is likely to result in domestic stockpile depletion in China – where cotton stocks are projected to fall 7.8 percent

-

Indian cotton supply for 2021/22 is projected to decline 6.9 percent due to tighter domestic production on account of lower acreage coupled with erratic monsoons during 2021 and pest infestations in key cotton growing regions, which is likely to lower yields

-

U.S. cotton supply is estimated to contract by 4.9 percent for 2021/22 on account of a significant fall in opening stock balance by 56.6 percent and a lower recovery seen in domestic cotton output. U.S. cotton production is expected to recover by 20.6 percent in 2021/22 amid higher acreage for the crop. However, following a 26.6 percent fall in output in the previous year, the expected current-season output volume remains well below the 5-year average for U.S. cotton. Further, dry weather and extreme heat conditions in the key cotton producing region of Texas is expected to lower yields for the current season, further restricting output

-

Global cotton prices are likely to witness inflation over 2022, driven by tighter cotton stocks on account of greater mill use and lower global supply; while rising input costs, higher energy prices, and continued supply constraints are expected to keep prices elevated.

-

With overall global cotton availability expected to remain tight in 2022, it is recommended to engage in long-term contracts with suppliers encompassing both regional and global markets to safeguard supply and account for mitigating inflation. Moreover, whereas conventional sourcing regions such as India, Brazil, and the U.S. are seen to witness a contraction in export volumes for 2021/22, it is projected that Australia is a prospective alternative sourcing location, as cotton exports are set to rise by 182 percent to 4.4 million bales in 2021/22

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe