Europe’s Reefer Trucking Supply–Demand Shifts Due to COVID-19

Abstract

The ongoing COVID-19 pandemic is creating massive challenges in the road transportation sector and refrigerated trucking is no exception, mainly due to the increasing demands from the food and beverage industry throughout the EU. Until recently, consumers were not ordering many perishables online, but that has changed in the post-COVID-19 environment. The COVID-19 pandemic will likely accelerate the need for reefer logistics, creating long-term impact for the cold storage and transportation sectors. This article aims to provide an overview of the changes in seasonality due to COVID-19 and the respective impact outlook on the reefer trucking industry in Europe through 2020. This article will largely help to analyze the seasonality impact of reefer logistics in Europe and what to expect in terms of demand and freight costs in the near term.

Normal Demand Curve in the EU

In the EU, seasonal demand for refrigerated trucking peaks from June to October and November to March. In Spain, Portugal and France’s demand for reefer trucking surges between November and May, mainly due to the harvest season of winter vegetables, salads, and so forth.

Due to the increased tourism activities between June and October, most of the European carriers will face increased demand for reefer transport. Domestic consumption of food, beverages, and other dairy products also boosts the reefer transport business during summer.

Major Impacts on the Market

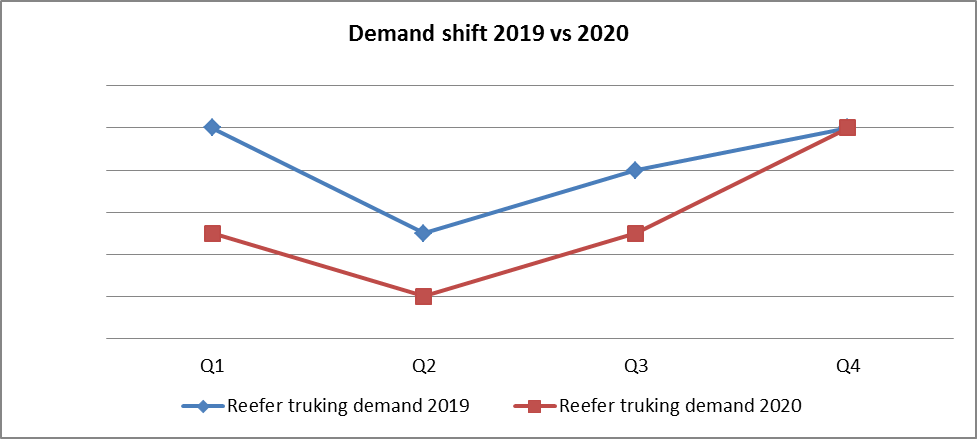

Initially, when lockdown measures driven by the COVID-19 pandemic started in March, consumers began panic buying and stockpiling items, with a focus on shelf stable products. This reduced reefer trucking demands in the EU during Q1 and Q2 2020. The tourist accommodation industry in the EU also saw a sharp decline due to travel restrictions in March and April 2020, which also impacted the normal seasonal demand for reefer goods. However, the situation eased and demand picked up slowly over the next few weeks due to increased sales of alcohol and other beverages.

During an interview with Beroe, Ruben Garcia Lopez, Director of Combino Esaña SL, one of the leading reefer transporters in Spain, said, “About domestic consumption, that’s true that between June and October we have the bigger reefer trucking demand because of the tourism. However, this year because of the COVID-19 that has changed a lot.” “COVID-19 has particularly affected Spain, and the economy is suffering now here,” he added. Tourism has decreased by nearly 80 percent in Spain; it is very important in a country that received nearly 80 million tourists in 2019. The case is similar with many domestic carriers in the EU.

Many retailers hired additional staff to meet the growing demand for the CPG, supporting their local communities with the supply. This year, the season has picked up only from H2 2020 and the increase in demand during this period gives significant relief for reefer carriers.

Fewer Claims from the Reefer Trucking Industry in the EU

One positive impact that occurred during the pandemic was that there were fewer claims. From the beginning, transportation of goods seemed to be handled with more care. Domestic carriers organized themselves better. Due to the decrease in demand, carriers panicked less. They would otherwise not be able to complete all their loads. Due to decreased demand, haulers preferred to haul with their own vehicles rather than call on sometimes less qualified, overseas subcontractors. Previously, some shippers have come across claims for cargo passed on to seven successive subcontractors. As each middleman adds a share of their commission, the actual spend on transportation decreases, leading to a proportional decrease in the product’s quality, especially in frozen goods. This year, there were fewer claims from reefer carriers.

Impact on Polish Truckers

Polish truckers account for nearly 30 percent of the European market and the association includes 4,000 firms with around 400,000 drivers. Pre-COVID-19, Polish truckers were predominant on the roads of Europe. Now, their situation is gloomy. If the coronavirus crisis drags on, it would not be good for the Polish carriers in the region. Europe's decision to relax certain rules, such as the duration of working time or time-off, has helped, but some countries are still not implementing the provisions, which will create a big trucking capacity issue for shippers in the region.

Road Freight Cost Impact

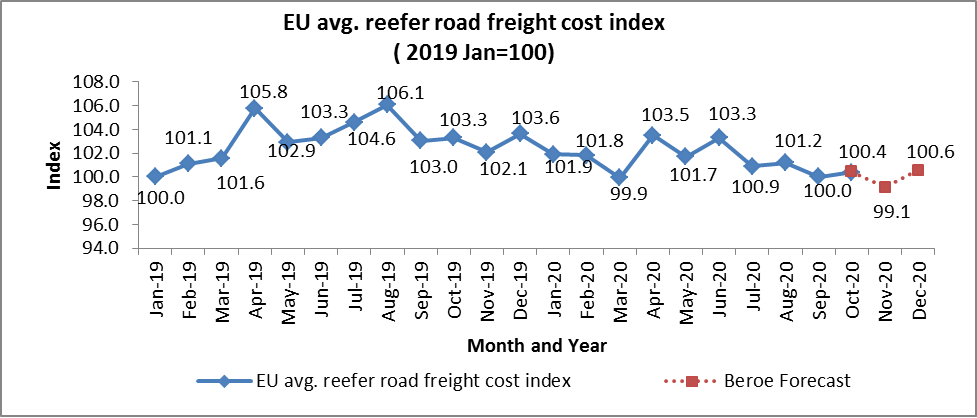

The major cost components for a refrigerator truck is fuel and driver wages; these two factors contribute to more than 50 percent of the overall operating costs for a reefer truck. The fuel cost for a refrigerated trailer includes the fuel for the refrigerated unit.

Carriers and shippers are continuing to face an uphill climb to secure freight capacity for their lots as truck drivers continue to stay out of the workplace amid COVID-19 concerns and pandemic disruptions. Due to the same circumstances, on average across the EU, driver wages have increased by about 10 percent in Q2 2020 compared to Q1 2020. In several European countries, the commercial freight driver shortage is set to increase from 23 percent, recorded in 2019, to more than 35 percent by the end of 2020. This will further increase driver demand and wages in the region. Growing driver shortages coupled with the increasing trend in fuel prices will upsurge the operating expenses of reefer trucks. Fuel prices and driver wages always have a cascading effect from top to bottom. In the wake of a continuous hike, it is becoming increasingly difficult for operators to recover running costs. Once demand picks up, the freight rates be much higher.

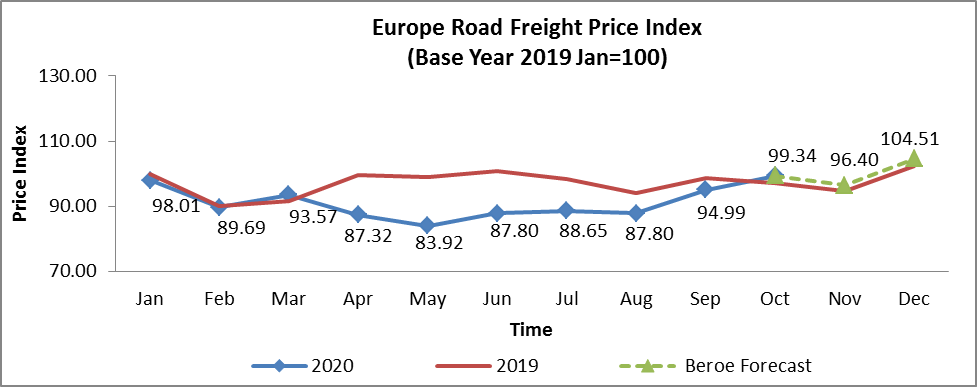

Road Freight Price Impact

According to the Europe Transport Market Monitor Index compiled by Transporeon, road freight prices decreased from 93.57 points in March 2020 to a low of 83.92 in May. The level of the price decrease in Europe over the pandemic period was markedly higher than seen in previous years. The market appeared to falter around late June, leaving behind a limp recovery until September 2020. Starting from Q2 2020, the pandemic has also rapidly changed demand and supply dynamics. Over the last two quarters, volumes fell dramatically as countries entered into tight national lockdowns with factories halting production and retailers closing stores; thus, road freight activity decreased significantly.

The price decrease in Q2 and Q4 2020 was mainly due to the increase in transport capacity and decrease in demand. However, prices are expected to increase in Q4 2020 by about 5–8 percent compared to Q3 2020, which will be above the level of Q4 2019, mainly due to the increase in demand throughout Europe.

How the ECSLA Action Plan with the European Commission Helped Carriers in the EU

To keep food moving along the temperature-controlled supply chain and for temperature-controlled food logistics to continue to work, the European Commission has taken several steps that helped reefer carriers in the region to fulfill the normal seasonal demand. ECSLA requested the below points from the EU Commission:

- To recognize the temperature-controlled logistics sector as a critical service as it keeps food moving along the cold chain

- To guarantee the swift border crossing of refrigerated trucks

- To open proposed “Green Lanes” for essential transport services to refrigerated trucks

- To temporarily relax the driving and resting hours for drivers of refrigerated trucks

- To relax the restrictions on delivery hours and to lift driving bans to allow for the ongoing supply of essential food

What to Expect Next

- E-commerce groceries will become more widely adopted as consumer comfort grows with the practice. This will trigger the aforementioned heightened demand for cold storage capacity and reefer trucking demand.

- Since e-commerce is typically fulfilled by local grocery stores, retail footprints will include more storage and fulfillment space, including a greater need for infill temperature-controlled facilities in proximity to consumers. As a result, light and medium duty reefer trucks will experience increased demand in the region.

- Over the past decade, in most of the EU countries, the cold chain has been extended to customers’ doorsteps as supermarkets and online distribution services competed for business and introduced home delivery services, increasing the amount of smaller delivery trucks in service. This has also increased LTL shipments’ share in MCV.

- In France, more than 20 percent of French consumers have increased the amount of online shopping as a result of the COVID-19 outbreak, and this trend has similarly increased elsewhere in Europe across all age groups.

- The digital shift has also entered the inner workings of the food industry. Brands are now virtually carrying out new product development, and this will continue as travel restrictions remain in place. In the absence of meeting clients and suppliers face-to-face, businesses will need to be able to work digitally for the foreseeable future.

- Many European countries have reopened their borders to carriers. Therefore, everyone is hoping that trade will return to previous levels.

Conclusion

Proper functioning of the temperature-controlled food supply chain is essential to continue bringing food from farms and food manufacturers to points of sale across Europe. Food supply chains, particularly perishable and frozen food chains, must be kept operational, and every effort must be made to ensure that they continue to operate without interruption. In order to guarantee the continuity of food distribution throughout the temperature-controlled supply chain and ensure that the logistics continue operating, the EU has rationalized the temperature-controlled logistics sector as a critical service. As a result, going forward, the border crossing of refrigerated trucks will be smoother, even if other restrictions remain.

On one hand, freight rate volatility has been a prominent feature in the market in 2020. On the other hand, supply was more complicated, with factors such as border controls and a decrease in demand, coupled with increased capacity and decreased prices in Q2 and Q3 of 2020. Since demand picked up by the end of August, freight prices also started to increase. By the end of 2020, prices will increase around 5–8 percent in December 2020 compared to the same period last year, largely due to the expected increase in demand.

The seasonality of reefer trucking is expected to return to normal by mid-2021. However, shorter distance deliveries will increase going forward, primarily due to the change in consumer buying and the flourishing of e-commerce business across the EU.

References

- Beroe analysis

- www.weforum.org

- auto.economictimes.indiatimes.com

- www.freshplaza.com

- www.ecsla.eu

- www.foodnavigator.com

- www.beveragedaily.com

- www.kerry.com

- www.joc.com

- www.transportmarketmonitor.com

- Expert interactions

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe