Demand from commercial sector drives office fit out in Bonifacio Global City

Abstract

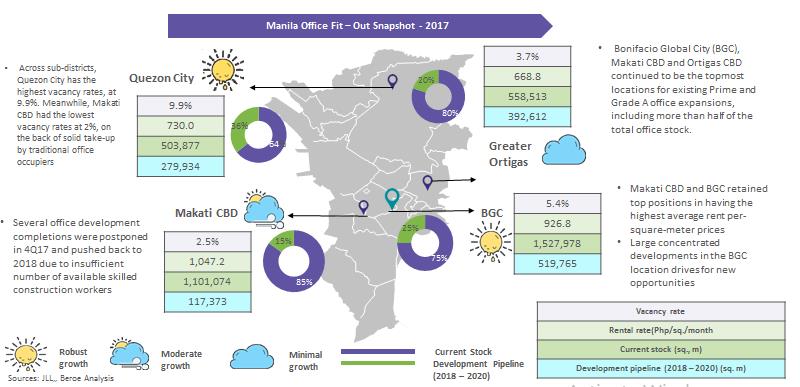

As one of the latest business districts in Metro Manila, Bonifacio Global City (BCG) has been the migration location for companies wishing to change office, expand, and offer a better work environment to their employees. The BGC submarket is expected to remain active in 2018, with a projected 294,200 sq. m of new office GLA. While the rental growth in the Bay Area was high in 4Q/2017, the average rents in Metro Manila grew at a more reasonable rate of 3.5 percent Y-o-Y. However, the rental growth in BGC was subpar in 4Q/2017 due to the changing market dynamics, with rising vacancies coupled with ample office space in the pipeline.

This paper focuses on the office fit out construction, cost factors responsible for choosing BGC in Manila as location, and the recent demand trends on office fit out construction. These are successfully implemented in the Philippines by companies focusing on corporate demand while continuing to expand quickly.

|

Key Highlights |

|

Introduction

Bonifacio Global City (BCG) has wide, open spaces that companies can make use of. Its open spaces allow professionals to harness their creativity and come up with vivid ideas while enjoying the innovative technological features of their office. The buildings are new and contemporary, and set up with impeccable state-of-the-art engineering and architectural technologies designed for large companies and enterprises.

Manila: Office Fit Out Market Analysis

The Manila office fit out market continues to have a positive outlook regardless of the persistent delays in project construction from the pent up demand in the office sector. The BGC submarket is expected to remain active in 2018, with an estimated 519,765 sq. m of projects in the pipeline for 2018–2020.

Furthermore, 2018 has been a challenging year for the office market with another 805,000 sq. m of GLA estimated to be online. More than one third of the project pipeline will be in BGC, while Quezon City will have almost one quarter of Metro Manila’s new stock. Quezon City may once again strain the overall market performance this year, but this should be balanced by other submarkets with impressive absorption rates. The coming quarters can expect mixed results from the various submarkets in Metro Manila due to the spreading pool of occupiers. Thus, some occupiers may encounter varying degrees of difficulty in obtaining affordable rates in certain areas, such as the Bay Area. On the other hand, occupier demand is still intact despite another record year of office completion in the market.

Corporate Demand Trends for Office Fit Out

Flexibility: Short-term contracts allow organizations to alter headcount and shift to primary business strategy without the constraints of longer-term leasing commitments. Some occupiers move on to a ‘core/flex’ strategy by taking a customary office space lease for their core staff and renting workstations from a flexible space operator, ideally in close vicinity to their core space, to lodge headcount changes.

Cost: Flexible space appears highly cost-effective relative to traditional office space. For example, estimates show that a workstation in a typical flexible space in Singapore could be up to 50 percent less expensive than a workstation in a traditionally leased office. However, coworking space is often much more impenetrable than traditional office space. When accustomed for density and like-for-like costs, the cost differentials decline substantially or disappear altogether. In Singapore, for example, when density is taken into account, old-style leases cost only about 5 percent more than flexible space leases.

Simplicity and convenience: In addition to lower costs, flexible space offers exciting plug-and-play simplicity and convenience, particularly for larger companies. The capability to move in and out of an office space at short notice and avoid difficult contract negotiations, fit out work, and dealing with brokers, landlords, and property managers is an eye-catching proposition.

Cost Benchmarking of Office Fit Out in Manila

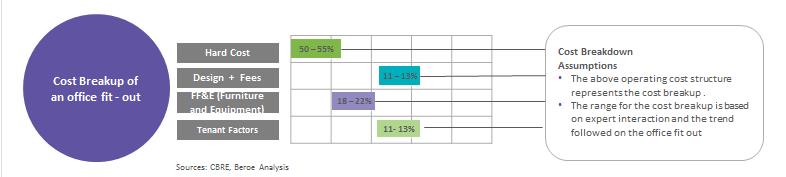

The fit out cost for an office depicts the typical expenses of building a comparable office space across the country. The factors affecting the cost of an office fit out includes the final budget, material selection, existing space conditions, and layout design.

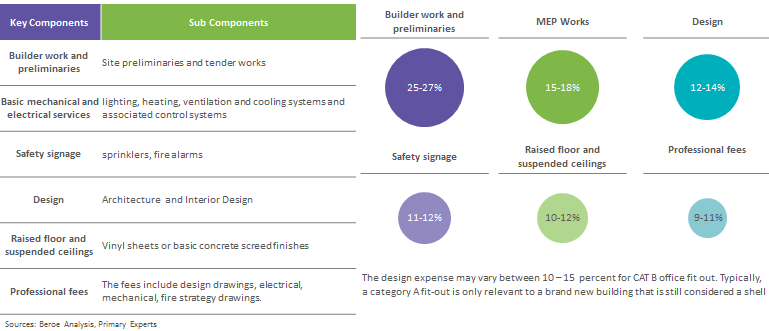

The cost structure of a CAT A office fit out includes finishing the base building works up to shell and core level and comprises the fitting out from the shell and core option to the point at which the interior components must be planned according to end user’s requirement.

CAT A Fit-Out Cost Components

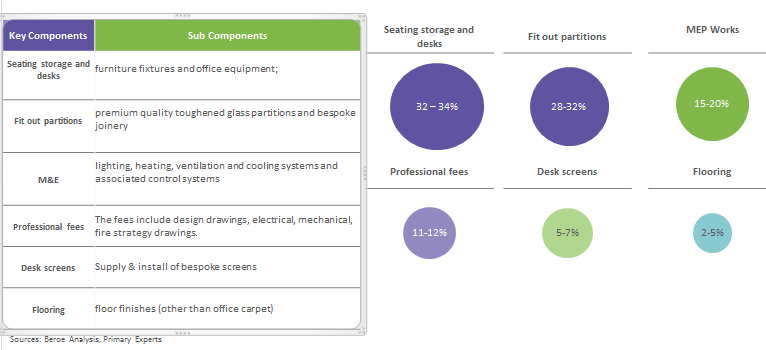

A CAT B office fit out generally follows completion of CAT A works, but may occasionally be incorporated into the CAT A construction program to reduce construction time and avoid repetition of material use and handling.

CAT B Fit Out Cost Components

Cost Analysis of Office Fit Out in Manila

The Manila office fit out market remains the highest in terms of cost for premium office at approximately $139 in South East Asia.

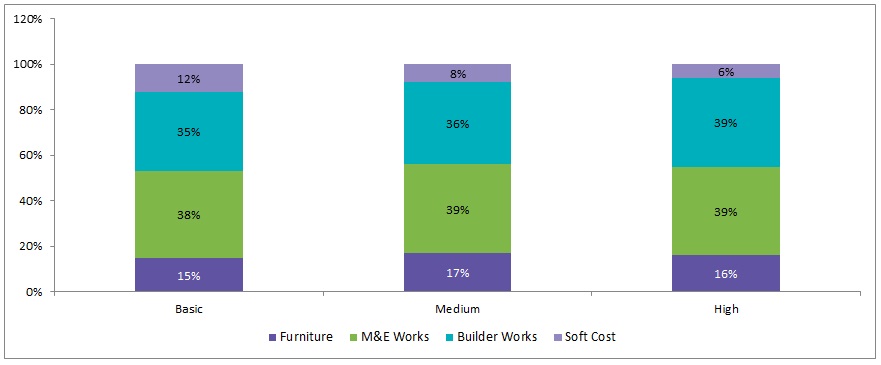

The cost for mechanical and electrical works is expected to remain in the 35–40 percent range for basic, medium, and high type fit outs. During 2017–2018, the cost for builder works remained between 35 and 40 percent for the three types of office fit out; this is expected to increase by 2–3 percent in the years to come.

Increasing occupancy cost is a major cost driver. The demand for labor, material, freight, and logistics is the other driver for office fit out cost. There is significant demand for senior professionals to bring specialized expertise owing to scarcity of supply.

Construction firms need to continuously invest in hiring and retaining the best experienced talent. In the Philippines, market suppliers are choosy and labor scarcities are testing their ability to provide at short notice. As the Fortune 500 companies spread their geographical footprint, their occupancy expenses are increasing from the large number of offices in BGC. The robust demand has caused a slight drop in vacancies by 5.3 percent in 2017. In some markets, the measures in key trade and supply chains are leading to inflation, stretching budgets, and postponing delivery.

Conclusion

To have the perfect location in Metro Manila for your company headquarters, look no further than BGC. This city has redefined the way people live and work, making it the perfect choice for both start-ups and large enterprises. BGC, Makati CBD, and Ortigas CBD continue to be the top locations for prime and Grade A office expansions, accounting for more than half of the total office stock. Makati CBD and BGC retained their top positions in having the highest average per-square-meter rental price.

The large concentrated development in BGC drives for new opportunities. The city saw the maximum influx of new supply in 2017, with around 375,700 sq. m of GLA. However, the market growth in the submarket was still robust, with a net absorption of 314,200 sq. m. As a result, the vacancies in BGC continued to remain at 5.4 percent of the total stock at the end of 4Q/2017. More office spaces in BGC will give rise to new buildings with state-of-the-art engineering and design. Thus, there are low threats of high operational and maintenance expenses in BGC.

References

Kmcmaggroup

JLL

http://www.select-interiors.com/blog/offices-definitions-of-cat-a-cat-b-fit-outs/

http://donpincorp.com/services/interiors/

https://www.jcli.com/project-management/corporate-office-fit-out-works

https://www.bcms.com.ph/portfolio/portfolio

http://www.ellcad.com.ph/projects/bpo-fit-outs/bpo-fit-out-5/

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe