Burden could ease for dairy derivatives buyers with supply set to recover near term

Abstract

Global net milk supply registered an increasing trend from 2013-2016 which resulted in historical low milk prices in 2015-16. Of late, net supply is witnessing a downtrend due to unfavorable weather conditions and government interventions in major dairy producing and exporting regions. Such downward shift in milk supply is likely to have a significant impact on the supply and price of the dairy derivatives.

The prevailing supply scenario makes category managers ask questions such as

- Will the supply reduce further and keep derivative prices high?

- Will the derivatives market turn undersupplied?

- Which tier/dairy segment is going to be impacted the most?

- When will supply bounce back to the levels seen in 2015/16?

This article evaluates the ongoing trend and highlights the degree of impact on the dairy value chain. Also, the criticality of dairy supply on derivatives sourcing is analyzed in detail.

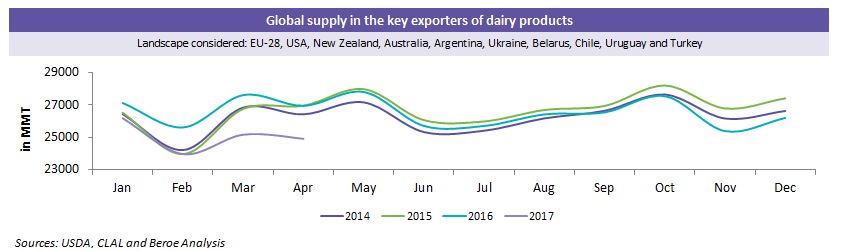

Global milk supply to reduce in 2017

The global milk production has decreased by around 4 percent since Q3 2016 due to unfavorable economic conditions and low/negative farm margins.

Major factors driving global dairy derivatives’ supply

- The Europe milk valorization initiative (Oct2016 – March 2017) at an incentive spend of €500M is reducing milk production by 3 percent y-o-y. Oceania milk production has decreased by 13 percent in H2 2016 due to hot and dryweather in Australia and heavy rainy weather in New Zealand

- Dairy farmers are likely to struggle in increasing production in response to rising prices and this is expected to lead to a sustained price increase in dairy and its derivatives into 2017

- The price recovery is being driven by falling supply rather than by demand factors, so price increases will be limited by still weak global demand, a significant stock overhang and the strengthening of the US dollar

Tightening milk supply in New Zealand due to poor weather conditions during the peak milking season and European milk valorisation are the major factors that would drive the downtrend in dairy and derivative supply in 2017.

Drop in milk supply to affect the dairy derivatives net supply

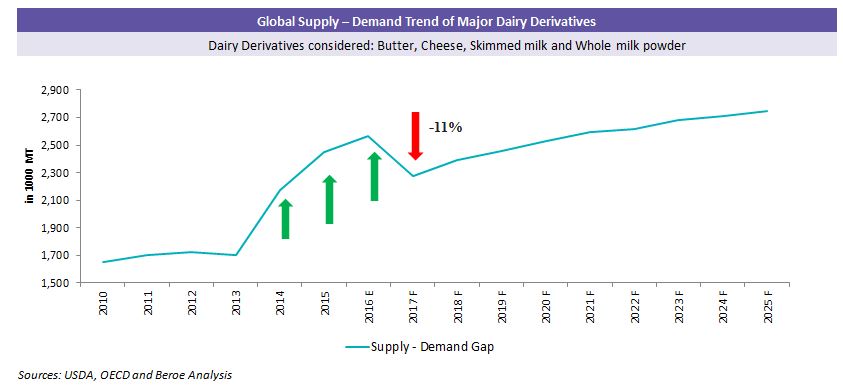

Decline in global net milk supply has affected the dairy derivatives’ export surpluses by 3.4 million tonnes y-o-y amid the demand for dairy products, particularly butter and cheese remaining strong in the U.S. and Europe through 2016.

Decreasing milk supply in major exporting countries is likely to widen the dairy derivatives’ supply-demand gap (-11 percent) and support their prices in 2017. However, the shift in trend seems to be for the short term with supply expected to increase from 2018.

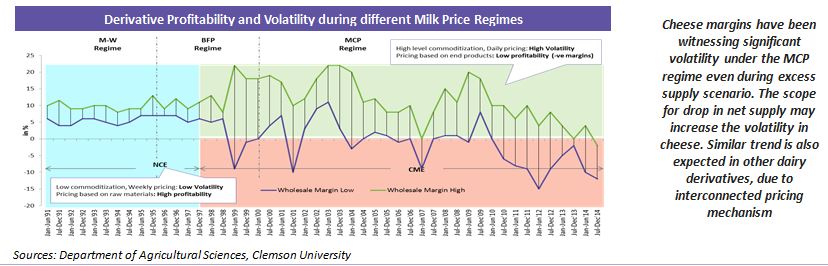

Beyond supply, pricing relation is also set to drive dairy derivatives prices

Milk and its derivative market are interconnected with pricing formulae. For instance, SMP, WMP, Butter and Cheese (the widely traded commodities) are the key variables in the Class III pricing mechanism. This can be noticed in the US milk pricing regime i.e., MCP regime.

Class III milk price calculation under MCP regime = *Class III skim milk price *0.965 + Butterfat price *3.5

- *Class III skim milk price = **Protein price *3.1 + Other solids price *5.9

- **Protein price = (Cheese price – 0.2003)*1.383 + [(Cheese price – 0.2003)*1.572 – Butterfat price *0.9]*1.17

Thus the supply or price volatility in these commodities will be reflected across the dairy value chain. Such interconnected pricing mechanism has also increased volatility in prices and margins.

Dairy and its derivatives to witness more price volatility

Milk and its derivative market witness high volatile prices and margins under MCP regime (formula based pricing) mechanism. Volatility increases mainly due to the daily pricing systems.

Suppliers’ focus increasing towards dairy derivatives

Dairy processors operate at very low margins (below 2 percent) when milk prices reach historical low milk levels as in 2015-16. Under such scenarios dairy farmers are incentivised to reduce milk production (For example: EU intervention).

Dairy processors who are not integrated run at reduced capacity. Processors who are integrated move more milk out of the commodity gate into value added products which is more secure, less volatile and yields higher profits.

Recent trend substantiates the shift, with major dairy processors such as Fonterra (NZ), Arla (EU) and Amul (India) expanding their capacity for cheese, butter and milk powders.

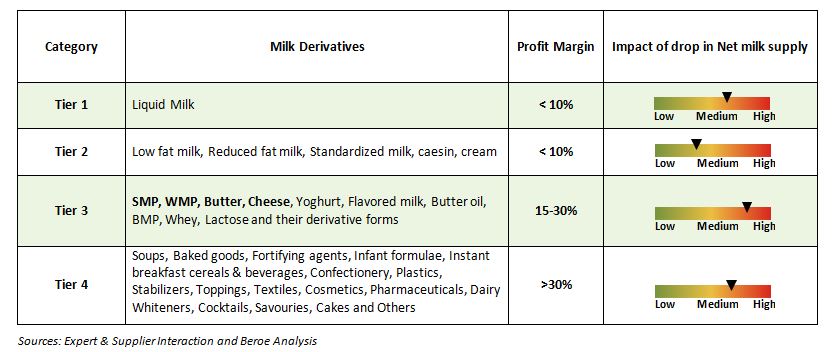

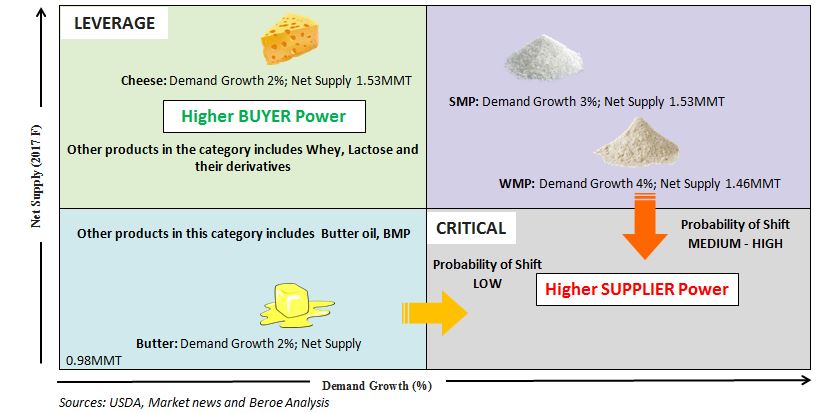

Procurement challenges in dairy derivatives

The scope for favorable net supply in major derivatives such as Cheese, SMP, WMP, Butter and its derivatives are likely to limit the impact of drop in milk supply on dairy derivative buyers.

There are no dairy products in the critical category (tight supply, more demand, and high supplier power) in the current supply situation. However, further reduction in the net supply of milk may lead to the milk powders and their dependent Tier 4 categories like Infant formula to fall under the critical category. Tremendous increase in demand for butter products may lead them to the critical category, which is not likely to happen in short term.

Conclusion

- The dairy and its derivatives net supply is likely to recover from 2018 and slowly progress through 2020 easing the commodity prices

- Increased milk inventories, higher European exports at lower prices, sluggish demand and shifting consumption habits has created a huge cheese reserve in the U.S., pushing the surplus to a 30-year high. This is likely to favor better price negotiation in cheese, its derivatives and by products market

- The decreasing net milk supply might have greater impact on the milk powder category due to steady increase in demand amid moderate supply. The infant formula manufacturers who are major buyers of milk powders may face challenges in controlling raw material costs in the short term. This again may weigh on the operating margins

- The current supply situation is likely to have less impact on dairy and its derivatives’ prices. However, any unprecedented factors (like weather, epidemics, etc.) may weigh on the dairy derivatives’ supply and support steep increase in prices

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe