Changing Dynamics of Isopropanol in the Asian Market

Abstract

The isopropanol market is currently witnessing an uptrend in demand. While some regions have realized self-sufficiency, there are still a few regions that rely heavily on imports. One such region in India, which is currently importing more than half its demand.

India’s supply dynamics are, however, expected to change in the coming years. This article aims to present the changing market dynamic scenario in the Indian isopropanol market and how this change is likely to affect India’s current batch of exporters. In addition, this article will also highlight the possible scenarios and opportunities that this change is likely to bring to the Asian isopropanol market.

Indian Isopropanol Market

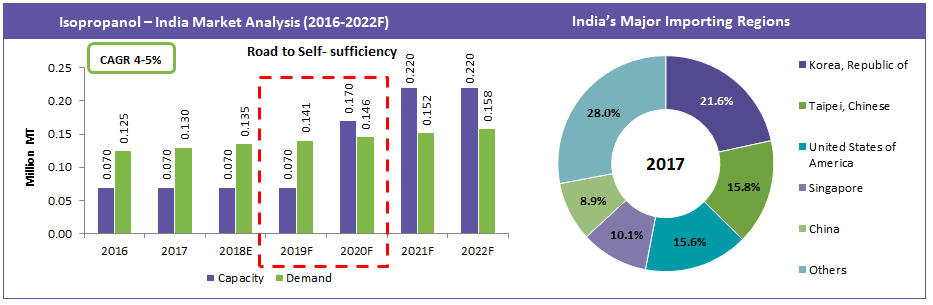

The Indian isopropanol market has been growing at a rate of 4-5 percent for the last couple of years and is expected to continue growing at the same rate until 2022. Driven mainly by the pharmaceutical segment, the supply to this market is import dependent, with the main importers being the Republic of Korea (South Korea) and Chinese Taipei (Taiwan). India is a major exporting destination for these two countries, details of which will be covered later on in the article.

The Indian market for isopropanol is a monopolistic market with Deepak Fertilizers producing 70,000 MT/year. However, this is expected to change soon.

Upcoming Capacities

By the end of the fiscal year in 2020, the capacity of the Indian isopropanol market is expected to increase by 214 percent. The capacity expansion is likely to be put into effect by Deepak Fertilizers and Balaji Amines Ltd. Deepak Fertilizers plans to expand its current installed facility by 100,000 MT/year to reach a total capacity of 170,000 MT/year; while Balaji Amines Ltd. is all set to set up a new acetone based isopropanol producing plant, which is anticipated to have a capacity of 50,000 MT/year, thereby making it the second largest isopropanol producing player in the region.

With these plants set to come online in 2020, the dynamic of the Indian isopropanol market is projected to take a new direction. India is anticipated to walk the path of self-sufficiency, leading to reduced imports from regions like South Korea and Taiwan. So what do these regions do with the isopropanol that now remains unwanted by India?

Dealing with the additional Isopropanol

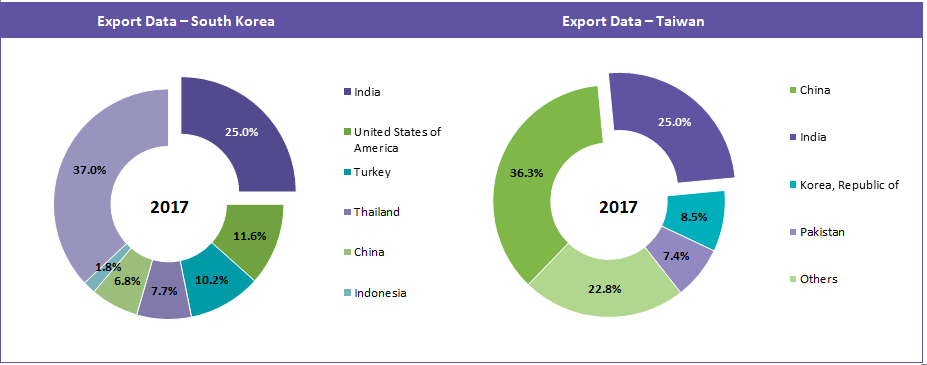

The new capacity additions in India will not only re-shape the Indian isopropanol industry, but also the trade conduct of other regions (namely South Korea and Taiwan). In 2017, these regions exported around 54% and 68% of their total produced isopropanol, respectively. In addition, 25% of their export was shipped to India.

What Next?

There are two possible future scenarios: one from the perspective of buyers who are currently procuring isopropanol from these two regions; and the other for procurement managers who are looking to source isopropanol from China.

Let us look at both these scenarios:

Scenario 1:

In this scenario, we are looking at the purchasing managers who are procuring isopropanol from players like LCY Chemical, LG Chemical, and Isu Chemical Co Ltd. These players are the major manufacturers in the South Korean and Taiwan regions producing close to 90% of the regions’ isopropanol. The major portion of the isopropanol procured from these regions is consumed by the construction, pharmaceutical, and automobile industries which are growing at a rate of 3-5 percent.

Demand from the personal care segment is anticipated to witness an increase caused by a rise in disposable income.

So, with India out of the picture, and surplus isopropanol available from these players, procurement managers can leverage this scenario to lower the prices.

Scenario 2:

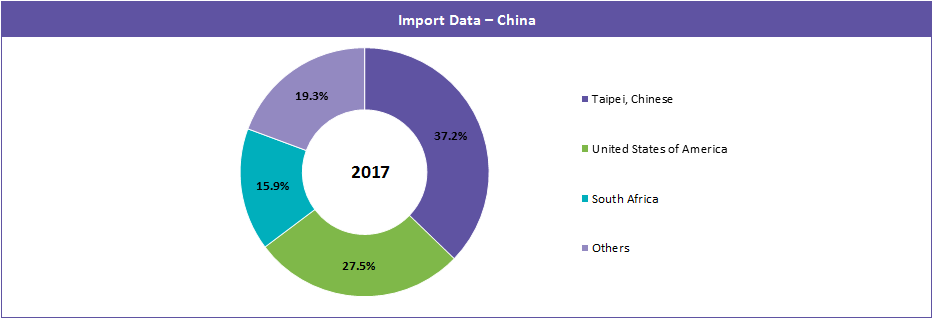

The U.S. – China Trade war has ramped up the import prices for isopropanol being shipped into China, and unfortunately for China, the U.S. is its second largest exporter. According to the ongoing trade conflict, current import duties imposed by the U.S. have increased by 12 percent, only to be further increased to 25 percent by the end of the first quarter in 2019.

The Chinese isopropanol market has witnessed an upstream growth in demand in the last couple of years and is anticipated to continue growing at a rate of 5-6 percent until 2022.

This increase in demand is likely from the growing construction and automobile industries. In addition, growing demand from the pharmaceutical industry is also contributing to the growing demand for isopropanol in China.

Despite sufficient capacity available to cater to the growing demand, China still imports around 113,000 MT of isopropanol to cater to the CPG industry. China’s demand for isopropanol from the CPG industry comes from its use of technical-grade isopropanol compared with pharma-grade isopropanol, as it is comparatively cheaper. The rest rely on imports for the same.

Rising disposable income and materialistic lifestyles have led to an increase in the adoption of cosmetics, thereby leading to an increase in isopropanol demand.

If the hike in import duties stays, then the capacity expansions in India are likely to be a boon for Chinese isopropanol buyers. With surplus supply available in the market from Taiwan and South Korea, purchase managers can look to these regions to safeguard their supply and to ensure that China need not procure isopropanol at higher rates from the U.S.

Conclusion

India’s road to self-sufficiency, once set in motion, is likely to unfold a series of events that are likely to present a plethora of opportunities to purchasing managers.

To begin with, India need not depend on imports the way it does now, thereby reducing its imports from countries like South Korea and Taiwan. This is likely to lead to a market surplus which can be exploited by purchase managers (old and new), thereby making this a WIN-WIN situation for all.

References

- Supplier Websites

- Trade Map

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe