Changing Dynamics in Sourcing Financial Market Data

Abstract

The Financial Market data industry is dominated by terminal businesses like Bloomberg and Thomson Reuters. These suppliers play a major role in banking and financial companies’ business data gathering to gain knowledge on market rates, indices, exchange fluctuations, and credit pricing, among others. They also play a significant role in analytics and chat support. Hence, the demand for financial market data is driven by investment bankers, corporate financers, and portfolio managers who are some of the top contributors to the annual demand increase during the past five years.

The majority of leading banking and financial buyers face challenges that are common in market data sourcing, like single supplier dominance, lack of cost saving opportunities, lack of proper strategy, and limited knowledge on internal demand for market data. However, buyers have recently started focusing on framing a strategy for market data sourcing by focusing on key areas such as vendor management, demand management, contract compliance audits, and inventory management platforms. This is because an effective strategy would enable buyers to proactively address challenges and objectives in market data sourcing. Currently, the terminal business of top suppliers is declining, and buyers are looking at alternatives that enable them to not only save cost, but also manage and control the category effectively. Global financial market data buyers prefer data sources like proprietary data providers and specialist data analytics rather than using costly terminals with a wide variety of functions where only a few functions are actually utilized.

This article introduces the financial market data industry within a changing supply market landscape and its impact on buyers’ sourcing approach. It also highlights leading buyers’ typical sourcing approach for market data and the key components involved in developing an effective strategy.

Introduction:

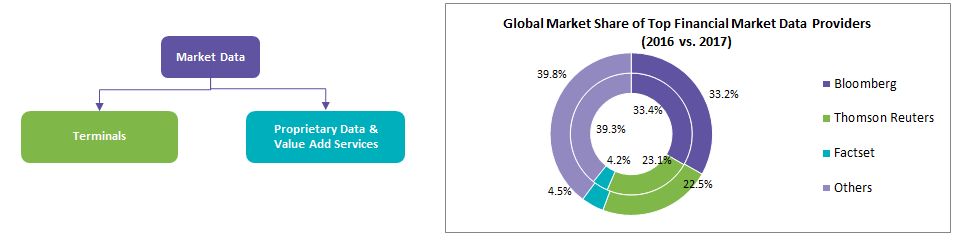

Financial market data is a key part of the financial professional’s workflow, as this data equips the user with real-time quotes and up-to-date and accurate financial information. The financial market data industry can be broadly classified into Terminals and Proprietary Data & Value Add Service Providers.

The terminal business is dominated by four large providers: Bloomberg, S&P (Capital IQ + SNL), FactSet, and Thomson Reuters Eikon. All of these aim to offer a ‘one-stop-shop’ platform that provides all types of financial data services (with a massive price tag). However, most terminal users only use a handful of the thousands of functions offered.

While the Bloomberg terminal is widely used in financial services, it is used predominantly by portfolio managers, buy-side analysts, and sell-side finance professionals within the sales and trading and asset management functions. Additionally, bankers do a lot of data scrubbing and company profiles, and Capital IQ is designed specifically for this. FactSet offers users the ability to increase financial modeling efficiency via helpful formatting and custom macro shortcuts, a service that Capital IQ has not quite caught up to yet. Eikon offers similar financial data to Bloomberg but is generally considered to be the less prominent option in terms of data breadth.

Decline in Terminal Business

Top market data providers—like Bloomberg and Thomson Reuters—have been witnessing a drop in their market share since 2015, mainly due to cheap and value-added services offered by their competitors. Also, 2017 brought an increased demand for tools or services to promote buyers’ compliance with MidfidII legislation in Europe. Both Bloomberg and Thomson Reuters have diverted their focus from its core terminal business to other non-terminal business and data feeds. This is evident in the proportion of Bloomberg’s terminal business revenue which has fallen from 85% in 2010 to 74% in 2017. Despite the drop in their terminal business, Bloomberg managed to increase their revenue by 3.4% in 2017 due to the raw data feeds business.

Industry Leaders’ Shift in Focus

Top suppliers are changing their strategy to embrace modern technologies like cloud storage. This is mainly due to challenges involved in maintaining legacy technology with substantial resources and time. For instance, S&P is switching their focus from market intelligence to indices, credit ratings, and market data sets. This highlights their investment in offering proprietary data in future. Also, ICE Data Services has purchased Super Derivatives to improve their analytics and valuations offerings, IDC for evaluations, and S&P’s fixed income evaluated pricing. This also indicates the supplier’s strategy to shift from aggregation business to offering proprietary data services and value-added services.

The Rise of Proprietary Data and Analytics Providers:

The Most Successful Suppliers since 2010 based on revenue growth

- ICE Data

- IHS Markit

- Moody’s

- MSCI

- S&P

This illustrates that the industry growth is driven mainly by suppliers who are investing and focusing on proprietary data services, either organically or through M&A (Mergers & Acquisitions), rather than data aggregation. However, start-ups usually fail in two aspects; customer service and uptime, which they find difficult to match with the performance of top suppliers like Bloomberg and Thomson Reuters, who have global presence.

Therefore, companies are finding that it often makes more sense to go to a specialist provider for their market data or analytics requirements. In some of those cases, they can get more accurate and insightful information for less money than they would with an entire terminal package.

Buyers’ Typical Sourcing Approach:

In a shifting supply market landscape, buyers are also focusing on developing an effective strategy for market data sourcing. Until now, only a few of leading buyers have been able to implement an effective strategy that allows them to proactively address the changing landscape of market data industry. These buyers typically focus on three parameters while sourcing market data:

Data & Coverage:

This involves understanding data definition both internally and externally. Knowledge concerning different data attributes—such as asset class, geographic location, and the market breadth and depth of every market in terms of instruments—is essential to develop an effective sourcing strategy.

Cost:

There is no standard cost structure available for market data services. For instance, some suppliers may account fees for application in data feeds, while others may not charge for application. This makes it difficult for buyers to compare costs between vendors. Confronting vendors with peer group pricing enables better optimization in pricing and helps to reduce vendor costs.

Contract Checklist:

Contract agreements should be transparent and detailed, differentiating buyers’ and suppliers’ usage rights, responsibilities, contract terms, current and future needs, and data usage and distribution

Challenges in Understanding Data Usage

Conclusion

The Market Data industry is changing rapidly and continuously with new entrants and small suppliers gaining a market share from top suppliers. This is driven mainly by buyers’ increasing interest in cheap data and value-added services. This is also enhanced by top suppliers’ high cost terminals and fixed contracts for leading buyers. Hence, it is essential for buyers to include new entrants or small suppliers in market data sourcing strategy to reduce the dependency on top suppliers and manage expenditures effectively. Furthermore, inventory management tools currently available in the market will pave the way for buyers to gain knowledge on demand and to optimize this expense category effectively.

References

Quartz; Bloomberg; Financial Times; Marketdata.guru

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe