CAR-T Cell Therapy: Strategies that Prevail

Abstract

This article will discuss about the strategies that is currently being followed by manufacturers and contract manufacturing organizations (CMOs) in the market. Manufacturers both small and big have their own technological strength in drug manufacturing. But when it comes to CAR-T cell therapy big pharmaceutical companies have been forced to partner with a technologically strong company, to jump into the race which has already started. The market is moving at such a fast pace that all CMOs have expanded their capabilities in cell therapy and have invested a considerable sum in capacity addition. What drives this market is a different question. But the strategies that manufacturers have taken over to succeed in this market are of interest to us. The contents of this article will help in understanding how manufacturers and suppliers have adapted to sustain in this booming industry of CAR-T cell therapies.

Introduction to CAR-T Cell Therapy

- Global CAR-T cell therapies market was valued at around USD 467 million in 2018 and is expected to grow at a very high CAGR of nearly 44% from 2018 to 2023. Demand for cell therapies is majorly due to the fact that cell therapies can deliver potential cure. They are supposed to have very high therapeutic value as compared to conventional drugs or biologics.

- CAR-T cell therapy in particular has proved to treat recurrent cancer with highest efficiency as compared to the other existing therapies. Each treatment is highly personalized and unique to every patient thus making cell therapy a sought after treatment methodology for various conditions

- In 2016, almost 50% of the cell therapy clinical trials are noticed in advanced therapies driven by CAR-T trials. The share of CAR-T’s trials is estimated to be more than 60% of cell therapy trials in 2017.

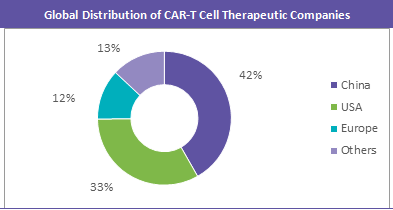

- China and USA host many CAR-T manufacturers and also lead the chart in the clinical trials for CAR-T cell therapies. CAR-T cell industry is currently witnessing a trend in consolidation through acquisition by large companies. However, there are certain start-up companies who have been exploring this market for long.

Cell therapy faces unique challenges when compared to other biologics, pertaining to manufacturing and logistics. But they seem to have flourished in spite of these road blocks. The industry has multiple challenges due to its heterogenic end-users, intensive extraction and transfusion processes, products variability within and between batches and also quality standards. Surge in personalized therapies have further increased the complexity for the producers in integrating the supply chain and patient. Up scaling is one of the key challenging aspects in the cell therapy market, as it is likely to increase the overall cost

Strategies for Contract Manufacturing of CAR-T Cell Therapies

- There is a boom in the CMO market for CAR-T cell therapies due to the sudden traction in this market. Many CMOs have expanded their cell therapy capabilities to accommodate the growing demand. However, the need for technology know-how has limited the entry of new players into the market. The supply pool is very much diverse with established CMOs, small technologically strong players and standalone cell therapy manufacturers

Listed below are some of the major CMOs in the CAR-T cell therapy space:

| Company | Manufacturing Location | Cell Therapy Capacity | |

| No. of Clean rooms | Production Area (m2) | ||

| Lonza | USA, Netherlands, Singapore | Singapore - 4 | Singapore - 1500 |

| MaSTherCell | Belgium, South Korea | Belgium - 5 | Belgium - 1200 |

| Hitachi Chemical Advanced Therapeutics Solutions/ PCT | USA | 8 | 9100 |

| Nikon CeLL innovation | Japan | 3 | 6000 |

| WuXi AppTec | USA | NA | 4100 |

| CCRM | Canada | 10 | 1800 |

| MolMed S.p.A | Italy | 7 | 1500 |

| CELLforCURE – LFB Group | France | 8 | 1400 |

| apceth Biopharma GmbH | Germany | 9 | 600 |

| BioNTech IMFS | Germany | 13 | 500 |

Several CMOs have expanded their capabilities in this space during the past two years, either by acquisition or capacity addition.

Lonza: Lonza announced the acquisition of a controlling stake in Octane Biotech, with the right to acquire full ownership in October 2018.

The company also opened the world’s largest dedicated cell-and-gene-therapy facility in April 2018.

Hitachi Chemical Advanced Therapeutics Solutions: In January 2019, Hitachi Chemical announced plans to acquire apceth Biopharma GmbH, expanding global footprint of its cell and gene therapy contract development and manufacturing services

MaSTherCell: MaSTherCell launched its 600m2 manufacturing facility in Belgium by doubling its capacity with five additional commercial ready clean rooms

Strategies for Big Pharma Manufacturers of CAR-T Cell Therapies

- The approach followed by big pharma manufacturers in this market is acquisition and partnerships. Market has witnessed numerous acquisitions especially after the first CAR-T cell therapy being approved by the FDA in 2017

- Companies focused entirely on cell therapy with a promising pipeline or technologies are ideally being acquired by big pharma companies

| Date | Pharma Manufacturer | Company Acquired | Capital Involved |

| March 2019 | Thermo Fisher | Brammer Bio | USD 1.7 billion |

| January 2019 | Hitachi Chemical | apceth Biopharma GmbH | NA |

| December 2018 | Novartis | CellforCure | NA |

| July 2018 | Sangamo Therapeutics | TxCell | USD 84 million |

| July 2018 | Takeda | TiGenix | USD 608.84million |

| December 2017 | Gilead Sciences | Kite Pharma and Cell Design Labs | Kite Pharma - USD 11.9 billion |

| August 2017 | CSL Behring | Calimmune | USD 91 million |

| May 2017 | Hitachi Chemical | PCT | NA |

| April 2017 | GE Healthcare | Asymptote | NA |

Conclusion

Biopharmaceutical industry in general is facing consolidation in terms of raw material suppliers, contract manufacturers etc. CAR-T cell therapy is also witnessing the early stages of this consolidation where biopharma companies and biologic CMOs are looking for suitable partners to expand. The companies which are being acquired fall in any one of the following categories:

- Strong CAR-T pipeline

- Innovative CAR-T cell therapy manufacturing technology

- Production capacity or clean rooms to manufacture CAR-T Cell therapies

All companies looking to enter into the CAR-T space but do not have the technology, is entering into a long term partnership with smaller technology driven companies. Once there is a need to expand, the smaller company is being acquired. The acquisitions are of varied types where one big pharma manufacturer has acquired companies from all the above mentioned categories. This helps in securing a stable supply chain and ensuring capacity for manufacturing.

This shows the recent trends in the CAR-T cell therapy market and how manufacturers and are moving towards an end-to-end solution. When this technology is mature enough, all CMOs will be expanding rapidly to accommodate more projects. This would involve the addition of clean rooms and innovative technology. This market trend is expected to continue, as long as CAR-T cell therapies perform well with efficient results.

References

- Industry Newsletters

- Company Websites

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe