Brexit Impact on Cost Structure of Packaging Industry

Abstract

The Brexit panic started with the Brexit referendum held in 2016. Brexit refers to the withdrawal of the United Kingdom (UK) from the European Union (EU), which is legally scheduled to take place on 29 March 2019 at 11 pm UK time. There is an ongoing debate about leaving with a Withdrawal Agreement that has been ratified by both parties as an international treaty between the UK and EU or leaving with no such treaty. The European Council extended the deadline to 12 April 2019 if the UK fails to ratify the Withdrawal Agreement or to 22 May 2019 if the UK ratifies the Withdrawal Agreement. The impact of decision to leave European Union will be seen in higher raw material prices, labor shortages, lower operating rates and increasing red tape and transportation cost. Due to Brexit, cost of production and prices would have a significant impact in the Packaging Industry. It also has adverse effects on the economy and puts pressure on labour wages in the long run. This would also enable organizations to look beyond European Union as their procurement destination. The confusion and panic in supply chain would create rippling effect and manufacturers could mark up their prices to protect their margin. As a procurement organization, they should understand each commodity through a detailed cost model where they can find the fair market prices and margin.

Impact on Cost Structure

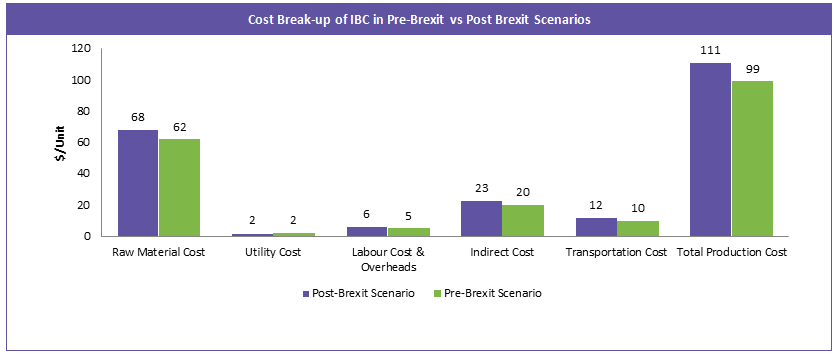

Let’s see how Brexit could impact the cost structure of Intermediate Bulk Containers in the United Kingdom:

- Raw Material Cost: The raw material cost will have a high impact in the post-Brexit scenario. It is mainly due to the tariffs which would be imposed on EU countries after the no-deal Brexit scenario. The feedstock prices are expected to increase at least by ~10 percent. For example, the tariffs of High Density Polyethylene and steel pipes are ~6.5 percent & 3.7 percent, respectively

- Labor Cost: Labor cost is expected to increase by ~15-20 percent due to the labor shortages of skilled and unskilled labors in the UK. In the packaging Industry, almost ~15% of labor force is from European Union countries. Already 81 percent of UK’s manufacturers are not able to find the right skilled staff

- Transportation Cost: Transportation cost will have a medium to high cost impact in the post-Brexit scenario. After Brexit, the trucks will spend more time in the border checks due to red tape, tariffs and other related documentation. This will considerably increase the salary of the driver, vehicle’s idle time, etc. Due to the lack of infrastructure in the border checks, there will be huge confusion and panic during initial Brexit period. The transportation cost is expected to increase by ~20 percent post Brexit

- Utility Cost: Utility Cost will have a low to medium impact on the cost due to less consumption of electricity and natural gas in the production of rigid intermediate bulk containers

- Indirect Cost: The Indirect cost will have a medium impact on the production cost of IBC. The increase in the selling general and administrative expense and other finance cost will be the main reason for the ~ 15 percent increase in the fixed cost

- Total Production Cost: Total Production cost would increase at least by 11 percent when compared to the pre-Brexit scenario. The reason behind the increase is higher feedstock prices, labour cost and transportation cost

- Market Price: With the increasing production cost, suppliers would increase the market price to protect the margin. Based on our study, the market price would increase by ~10-15 percent

Conclusion

- Based on our study, Brexit would result in higher raw material prices, higher labor cost, higher transportation and red tape cost. Majority of the business organizations in the UK expect that Brexit will eventually reduce sales and increase cost. It will have adverse effects on the economy and puts pressure on labour wages in the long run.

- As a procurement organization, they must understand each commodity through a detailed cost model and get greater visibility in the product cost. So that they would be able to find fair market prices and margin

References

- Brexit Is Already Affecting UK Businesses — here’s how? - Nicholas Bloom, Philip Bunn, Scarlet Chen, Paul Mizen, Pawel Smietanka, Gregory Thwaites, https://hbr.org/2019/03/brexit-is-already-affecting-uk-businesses-heres-howy

- Cost Structure – Beroe Analysis & Cost Model

- Tariff rates in case of No Deal Brexit - https://www.gov.uk/government/publications/temporary-rates-of-customs-duty-on-imports-after-eu-exit/mfn-and-tariff-quota-rates-of-customs-duty-on-imports-if-the-uk-leaves-the-eu-with-no-deal#polyethylene

- The Brexit vote has caused a significant rise in prices, especially food - Josh De Lyon, Swati Dhingra & Stephen Machin - https://blogs.lse.ac.uk/brexit/2017/11/03/the-brexit-vote-has-caused-a-significant-rise-in-prices-especially-food/

- Brexit: Costs Up, Prices Up - https://www.oliverwyman.com/our-expertise/insights/2018/jul/brexit-costs-up--prices-up.html

Recommended Reads:

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe