Governed by imports, anionic surfactants market in South Africa needs a cautious approach

Abstract:

Laundry care market in South Africa is expected to possess more than 60 percent share in Home care segment with expected growth rate of 5 percent to 6 percent till 2020. The rapid increase in the growth of laundry care market is mainly due to the increase in disposable income which is expected to grow by 6.7 percent till 2020 followed by the increase in the household consumption expenditure. Laundry care market in this region is crowded with global top players such as Unilever, P&G, Henkel and some local players such as Bliss chemicals. The growth of detergents in South Africa is expected to increase the demand of anionic surfactants which is used as a key raw material for detergent production. Currently, the anionic surfactants market is highly dominated by couple of players who satisfy the local demand in the region which have created oligopolistic scenario in the market. Will South Africa continue to have an oligopolistic surfactant market with no new players coming in? With growing demand of anionic surfactants, will South Africa expect to increase its dependency on imports in future?

Laundry care market in South Africa:

The Laundry care market in South Africa is expected to possess more than 60 percent of share in Home care segment with expected growth rate of 5 percent to 6 percent till 2020. The rapid increase in the growth of laundry care market is mainly due to the increase in the region’s disposable income which is expected to grow by 6.7 percent till 2020 followed by the increase in the household consumption expenditure. South Africa’s GDP was worth $344 billion in 2015 with service sector being the largest contributor to its economy with more than 70 percent of GDP coming from this sector. In 2016, South Africa population is estimated to be around 55 million with expected grow at the rate of 1.3 percent in upcoming years. This growing population and improved economy gives a boost to the countries growing disposable income and increasing household consumption expenditure.

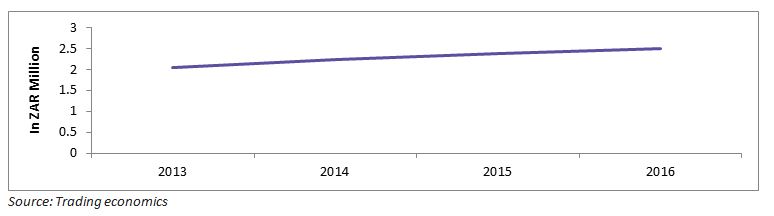

Disposable income (VS) Household final consumption expenditure of South Africa (2013 to 2016):

In South Africa, disposable income is around 2.5 million ZAR in 2016 and it is expected to grow at 6.7 percent till 2020. The Household final consumption expenditure is around 61 percent of the country GDP from 2013 to 2015 and is expected to grow in upcoming years. The growing disposable income and house hold expenditure is expected to increase the laundry care sales in South Africa. The laundry care market in South Africa is highly competitive with the presence of top global FMCG players.

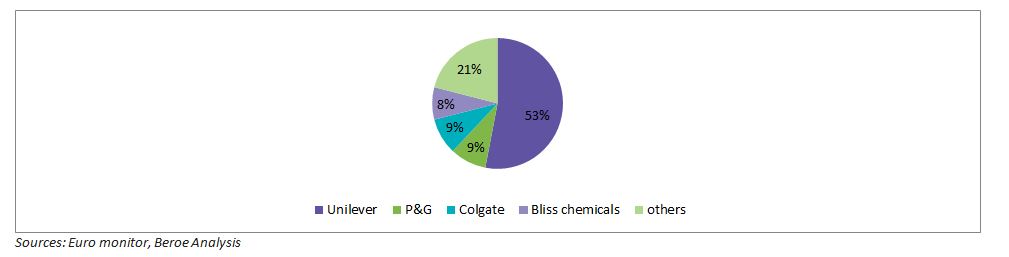

Laundry care market share by players (2016):

Unilever South Africa continued to dominate laundry care in 2016 with 53 percent share. However, competition is heating up with global players such as Procter & Gamble, Colgate and local manufacturer, Bliss Chemicals whose brands are gaining popularity in this category. The consumption of anionic surfactant in the region is increasing with the growth of laundry care and increasing involvement of global FMCG players in South Africa. Anionic surfactant is a major raw material for detergents and it is widely used among other forms of surfactants in South Africa.

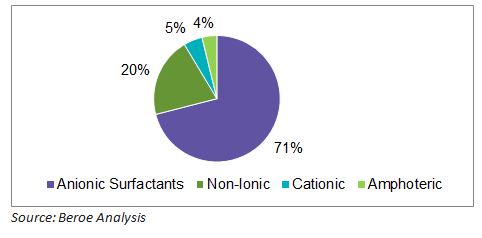

Some of the major anionic surfactants are LAS, SLS and SLES and they constitute more than 75% of the total consumption of anionic surfactants as a whole. The major reasons for the dominating consumption of these commodities are its characteristics, as a good cleansing agent.

Sourcing of anionic surfactants in South Africa

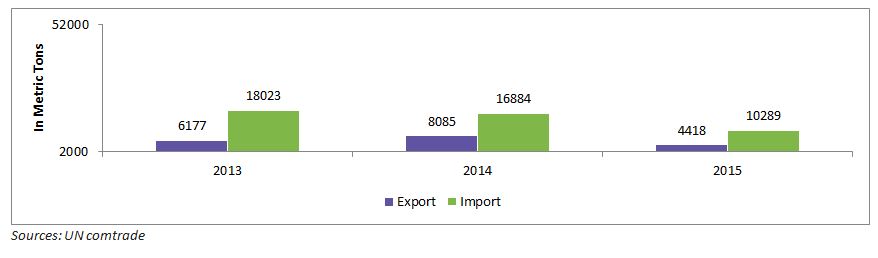

The local demand of anionic surfactants is expected to be around 150000 MT in which more than 10 percent demand is satisfied by imports. From 2013 till 2015, on an average more than 15000 metric tons of anionic surfactants are being imported to South Africa from other countries.

Trade information of anionic surfactants

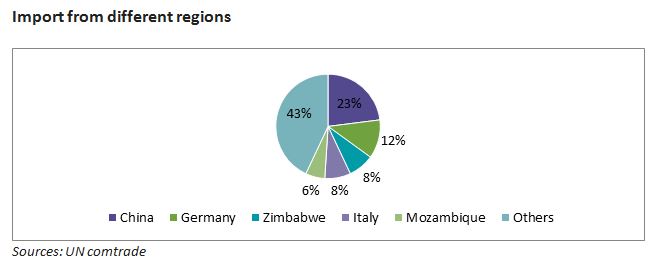

China is the major importing destination for South Africa with nearly 23 percent of anionic surfactant imports coming from this region followed by Germany with 12 percent of total imports. The import of LAS, SLS and SLES is more than 70 percent of total anionic surfactants due to its high applications in detergents and other home care products.

Currently, majority of the local demand is satisfied by Investchem and Akulu Marchon, the only players in South Africa who manufacture surfactants. Invest Chem is one of the major manufacturers of LAS with production capacity of 120000 MT/annum and Akulu marchon with 44000 MT/annum. These companies make an oligopolistic supply in the region.

These local manufacturers have an advantage over imports due to their higher supply security and better local logistics. Besides, these anionic surfactants are supplied and shipped as 28 percent (SLES, FAS) or 60 percent (LAS) solids, aqueous solutions or pastes, which makes overseas shipment from the U.S., Europe, India or China more expensive.

With respect to the growing demand for anionic surfactants, there is no capacity addition been reported for the future by any of these players and no new manufacturers are planning to enter into the production of anionic surfactants in South Africa. The notable reason being the non-availability of the raw material, Linear Alkyl Benzene (LAB) in South Africa. The companies, therefore, have to import raw materials from other countries such as China. Additionally, the high fluctuating exchange rate in the region hinders raw material imports from other countries. These factors are therefore dissuading manufacturers from starting any new plants in South Africa.

The local production has to increase in future to meet the growing demand for anionic surfactants and to reduce dependency on imports. Currently, the buyers use import price as a benchmark to negotiate with the local suppliers. If the dependency on the import increases, the whole region will become vulnerable to currency and supply fluctuations in other regions which could affect the domestic market. As there is no planned capacity addition in future, the dependency of imports in South Africa is expected to increase in future.

Conclusion

South Africa is expected to continue its oligopolistic market in anionic surfactants due to lack of involvement of any new players. The buyers set the import prices as their benchmark while negotiating the prices with the local suppliers in the region. With the raising demand for anionic surfactants and no capacity additions or new plants coming up, South Africa may depend on imports from countries such as China and Germany in future. This makes the whole region vulnerable to overall currency and supply fluctuations happening in other regions. The CPG companies therefore need to be cautious as the increase in cost of imports will increase their manufacturing cost of their products in the future.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe