Analysis on Containerboard Price Trends–North America

Abstract

The North American containerboard industry continues to show strong growth, with continued solid box demand, high mill operating rates, record linerboard prices, and low old corrugated container costs. Major producers are reportedly sold out and operating rates have touched 100 percent in some instances. The U.S. corrugated box demand is expected to remain strong through 2019 and possibly longer, with containerboard mill operating rates in the 97-98 percent range with no price drops anticipated in the future. The overall U.S. containerboard market is expected to grow tighter in the coming months; however, the proposed capacity expansions that are expected to ease off demand have not led to a major uptick in prices. Containerboard prices are expected to remain stable until Q4 2018 as there are many capacity additions coming up in 2018 anticipated to ease demand. The containerboard market is next expected to witness a price hike of around $45/ton in Q1 2019. This article will provide insights on the demand, supply, and price dynamics in the North American containerboard market by addressing the following points:

- The current supply-demand scenario on containerboard in the U.S.

- The factors contributing to recent price hikes

- Price forecast analysis

- The proposed capacity additions and future market dynamics–U.S. containerboard

Containerboard Market Supply—Demand Analysis

Projected Demand

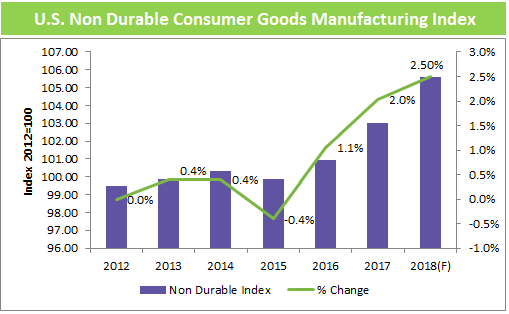

The growth in shipments of corrugated boxes is largely tied to the growth of U.S. non-durable goods as it accounts for 80-85 percent of corrugated box shipments.

During 2011-13, the non-durable consumer goods market witnessed an average growth of less than 0.5 percent. As the economy began to get stronger in 2014, consumer spending improved, and hence, demand surged and so did production. This increase was reflected in the corrugated box shipments during the same year that climbed to 1.2 percent.

Since 2015, U.S. box shipments growth has gradually ‘re-coupled’ with the real GDP growth. In 2017, the 2.5 percent rise in box shipments corresponds with the 2.3% growth in real GDP.

Apart from the retail and agricultural segments, E-commerce is expected to grow at a CAGR of 10 to 20 percent in the coming years, which will be driving the demand for boxes.

|

U.S. Box Shipments |

||

|

Year |

Box shipments(billions sq.ft) | y-o-y% Change |

| 2018 (F) | 399.25 | 3.50% |

| 2017 | 385.75 | 2.50% |

| 2016 | 376.34 | 2.10% |

| 2015 | 368.6 | 1.20% |

| 2014 | 364.3 | 1.20% |

| 2013 | 359.8 | 0.00% |

Tightened Supply

The U.S. containerboard mills have been running at full capacity, with operating rates in the first two months if 2018 averaging 94.7 percent for linerboard and 98.5 percent for medium. In 2017, the market also witnessed operating rates close to 101 percent.

Factors Contributing to Recent Price Hikes

Tight supply: The U.S. containerboard mills are running at full capacity, with operating rates in the first two months averaging 94.7 percent for linerboard and 98.5 percent for medium with some mills being two to three weeks behind on deliveries. In 2017, the containerboard market in the U.S. did not witness any significant capacity expansion. Hence, the demand growth has outpaced the supply growth.

Export allocations have also been drastically reduced due to high domestic demand. This tight supply in the market along with mill downtimes owing to the spring season has been a major factor in increasing prices.

Demand spike: The overall U.S. containerboard market experienced high demand in the recent months with U.S. box shipments increasing from 32.4 billion ft2 in January to 32.6 billion ft2 in February. Further, the U.S. economic indicators remained strong, with the PMI in February at 60.8 percent, a peak not seen since early 2011, driving box demand.

Price Forecast

Containerboard prices are expected to remain stable until Q4 2018 as there are a number of capacity expansions coming up in 2018 that are anticipated to ease demand. The containerboard market is next expected to witness price hikes of around $45/ton in Q1 2019.

|

Kraftliner |

SCM |

|

|

May 2018 |

USD 755/Ton |

USD 670/Ton |

|

June ’18(E) Vs. June ’18 |

USD 755/Ton |

USD 670/Ton |

|

May ’18 Vs. May ’17 |

7% |

14 % |

|

May ’18 Vs. Average (April '17-April '18) |

7 % |

10% |

|

May 2019 |

6% |

7% |

OCC Prices and its Impact on Linerboard Prices

In 2017, in the U.S., export shipments to China reduced significantly owing to continued lack of import licenses being released by the Chinese government that left U.S. exporters looking for domestic mill buyers or other export customers outside of China.

The low demand from China, which purchases around one-fourth of the U.S.’s 52 million tons/yr of recovered paper, caused a drastic price drop in the domestic OCC prices.

Despite OCC prices reaching a low, prices of high-performance linerboard witnessed hikes of $50/Ton in March 2018 owing to high demand and prevailing tight supply.

|

Commodity |

April 2017 |

April 2018 |

Percentage Change (April 2018 Vs. April 2017) |

|

Old Corrugated Containers, Domestic, FOB - US Southeast |

$170/Ton

|

$83/Ton |

|

|

High Performance Linerboard, 35-36 lbs, Open Market, U.S. East |

|

$775/Ton |

7

|

Conclusion

Present Scenario

- Supply tightness in the U.S. due to strong domestic demand conditions. Box demand continues to remain solid, which is 2.6 percent higher (year to date) than 2017 resulting in high mill operating rates that continue to run at 97 percent year to date.

- Major producers stated in a recent conference that they were completely sold out and they operated at 100 percent in May 2018.

- Independent converters have stated that they did not face issues in ordering enough paper except for white top linerboard due to maintenance and operational problems in several major mills—WestRock's Tacoma, Wichita and West Point, Virginia mills and International Paper's Mansfield, LA, mill—in the first quarter.

- Few converters have reported that they faced issues with paper ordering due to a two-week spring maintenance downtime at mills. Deliveries were in the range of 4-6 weeks, which is 3 weeks later, in general.

- Some integrated producers hit the market with Packaging Corp of America (PCA) scheduled to start up the first 220,000 tons/yr phase at its Wallula, Wichita facility.

Future Projections

Drastic Box Demand

- Box demand is expected to grow at close to 3 percent rate annually over the next two years and containerboard consumption at 3.5-4.0 percent growth because of increased demand for non box uses of corrugated sheets, such as display packaging and fanfold for box-on-demand systems.

- E-commerce is estimated to have added 20-23 billion ft2 of corrugated box demand in four years. Despite the downside from e-commerce shippers finding ways to reduce use of corrugated packaging, the U.S. box demand could still grow about 2 percent in 2020.

Capacity Additions in Response to Projected Demand

- More than 2.1 million tons of new North American containerboard capacity has now been announced for the 2017-2019 period, with four major projects and some smaller ones.

- The projects include Kruger's conversion of a newsprint PM in Trois Rivieres, Quebec, to 400,000 tons/yr of recycled liner in the spring of 2017. PCA is converting an uncoated free sheet (UFS)/specialty PM at Wallula, Wichita, to 410,000 tons/yr of kraft liner in a two-phase startup beginning in June 2018.

- In 2019, International Paper is converting a UFS PM to 450,000 of white top and other containerboard at Selma, Alabama. Pratt Industries is building a new 400,000 tons/yr greenfield recycled containerboard mill at Wapakoneta, Ohio.

- Two smaller projects include Midwest Paper's conversion of a coated free sheet mill at Combined Locks, Wisconsin, to an estimated 280,000 tons of recycled containerboard and Verso's conversion of a coated paper PM at Androscoggin, Maine, to 200,000 kraft liner, both in 2018.

References

Industry News – Risi, Supplier Websites, Secondary Sources

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe