AI in Financial Service Segment

In the near future, artificial intelligence (AI) will become mainstream in the financial services industry. FinTech firms are more likely to utilize AI to develop new products and services, whereas incumbents are more likely to use it to improve existing ones. A growing number of FinTech firms are taking a product-oriented approach to AI implementation—selling AI-enabled services.

Artificial intelligence has the potential to revolutionize financial services and the way they are delivered to customers. It could lead to better-informed and personalized products and services, as well as improved internal process efficiencies, cyber security, and risk reduction.

In the global financial services industry, AI is altering a range of models. Notably, AI is transforming the way financial institutions generate and use data insights, resulting in new types of business model innovations, reshaping competitive landscapes and workforces, introducing new risk dynamics, and posing new challenges to businesses and policymakers alike.

The four core areas where AI is radically transforming the front- and back-office operations of financial institutions are:

Cost centers to profit centers

Financial institutions will be able to turn their centers of excellence into services thanks to AI-enabled back-office functions, while most other functions will be outsourced. As financial institutions move toward a back-office as-a-service model, these processes will learn and improve over time as data from their users are collected. These both accelerate the rate at which capabilities grow while also forcing competitors to become consumers of that capability to stay ahead of the curve.

A new battlefield for customer loyalty

Cost, efficiency, and connectivity have all been used in the past to differentiate financial companies. Essentially, AI is introducing a new set of competitive criteria that financial institutions can use to differentiate themselves from their competitors. Institutions' ability to optimize financial outcomes by personalizing, recommending, and counseling customers, for example, will enable them to compete on value supplied. Customers will be better retained if they can engage users and obtain data through continuing and integrated interactions outside of financial services. Financial institutions will be able to provide differentiated advice and improve performance through curating ecosystems by bringing together data from multidimensional networks that include consumers, corporate clients, and third parties.

Self-driving finance

Financial advice, which is included with every package, is frequently bland and impersonal. It is also unduly reliant on subjective advice from various customer support representatives. A self-driving vision of finance might revolutionize financial advice delivery by focusing client experiences on AI. Individuals will increasingly interact with a single platform or agent who will make recommendations for the types of items they should engage with as well as advisory services around those products, according to this vision. This vision is made possible by AI in three ways: empowered platforms that can compare and switch between products and providers, increasingly personalized data-driven recommendations, and continual optimization through algorithms that will automate the majority of routine customer decisions.

Collective solutions for shared problems

While AI increases competition, it also provides a powerful tool for collaboration, given the enormous value of shared datasets. Cross-institutional collaboration on topics like fraud prevention and anti-money laundering procedures, which are often inefficient and ineffective today, has immense potential. In the future, financial institutions will be built on scale of data and the ability to leverage such data.

Introduction to Securitization and Blockchain in Securitization

Securitization has been one of the most notable developments in international finance in recent decades, and it is expected to grow in importance in the future. The process of pooling and repackaging homogeneous illiquid financial assets into marketable securities that can be sold to investors is known as securitization. Securitization is the process of creating financial instruments that show ownership interest in, or are secured by, a segregated income-producing asset or pool of assets. The securities were secured by this pool of assets.

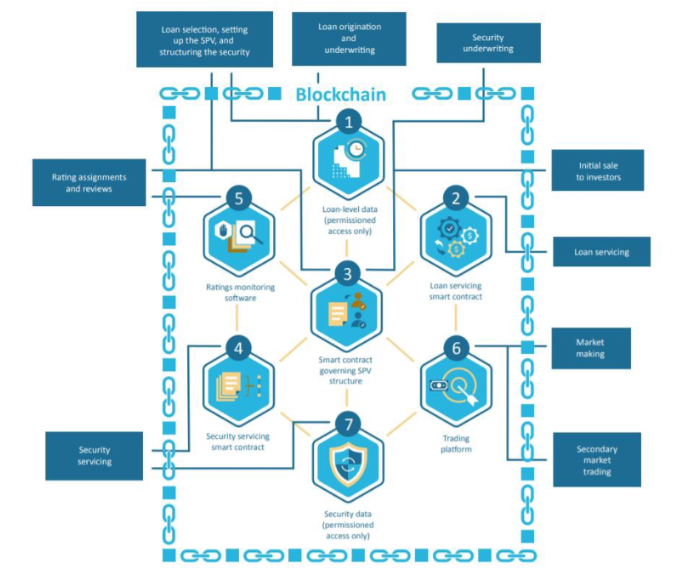

Blockchain implementation in the securitization process

- Step 1

Initially, the borrower and the lender have to agree on the terms of the loan. Thereafter, an electronic asset is created along with the time stamp on the blockchain. Information of the owner and other information like the FICO scores and supporting documents will be attached to the loan. This above mentioned information cannot be altered without the permission of the lender and the borrower.

- Step 2

A smart contract, which helps in governing the automated portions of loan servicing, is fed with all the information about the loan. In the event of the borrower paying or not paying the loan, all these details will be loaded into the loan-level data, which is necessary for the future servicing decisions. The rights of ownership of the assets are therefore reported automatically, immutably, and with the stamp of time.

- Step 3

All the loans are pooled together by the issuer, and it is transferred to the special purpose vehicle (SPV). This is to record the blockchain with the transfer and the related loan details. With all the loans connected with an individual borrower, and with all the modifications and history of maintenance recorded forever, double-pledging and also many other forms of fraud are becoming much more difficult and perhaps impossible. There are few automatable portions of the transaction’s terms like the cash flow model, which can be recorded into a smart contract, and this helps the third parties, issuers, rating agencies, and so on to verify the terms and come to an agreement.

In this step, a single model for governing is created for the transactions. This model can be used as a reference, and also with the help of the underlying loan level data, an assessment can be established for the newly created securities.

Along with this, legal documents and relevant portions of the offerings are made in the smart contracts automatically.

The highly automated framework would be the regulatory framework. The smart contracts are designed in such a way that any potential irregularity will be immediately notified.

- Step 4

A smart contract, which is used to service the securities, is layered on top of the SPV separately and the smart contract developed for the transaction itself. This new contract deals with the collection of the payments from loan servicers; references the cash flow model, which is specified in the contract governing the SPV; and also distributes the payments to the security’s beneficiary holders, with minimal delays for settlement. This information stream is used by both rating agencies and secondary markets.

- Step 5

On top of the blockchain, a ratings monitoring software is placed. Its main purpose is to match the security performance with the expected cash flows and also generate and trigger the rating reviews whenever discrepancies occur.

- Step 6

Blockchain is used to build the trading and market information platform which helps in interoperating with the transactions that are also built using blockchain.

Using market makers, blockchain stock trading is near-instant and low-cost, with regulatory enforcement close to automatic, as asset ownership data are revealed to regulators in real time while staying secret from rivals. Without having to go via broker–dealers, large investors might theoretically trade directly on these platforms.

- Step 7

The process of creation and trading of securities happens, and all the needed and beneficiary information is stored and managed in a different repository. This updated detail on the beneficiary is referenced to promote security servicing.

Regulators have total access to the information. Less sensitive information, such as scores or underlying information data on payments, is made available to both respondents and the secondary market.

The Mechanism of Securitization

The following is the basic mechanism of a securitization-based finance model:

-

Companies post for the need of some of their receivables on the FinTech tool (the "originators").

-

FinTechs, acting as the broker, will ensure that such receivables comply with a list of eligibility criteria similar to those developed for factoring or securitization.

-

FinTechs will find that the bill amount is due and then notify about the offer of such receivables.

-

FinTechs will analyze with any investor wishing to take such receivables, taking all steps needed to formalize any transfer deed purporting to transfer the property of such receivables to the relevant investor, transfer the purchase price to the originator, and finally transfer the collections to such investor.

FinTechs can optimize the benefits of a securitization model like this by following three important conditions:

-

Mechanisms to ensure the security of the platform.

-

An appropriate risk-to-reward ratio that accounts for market volatility and swings.

-

Reporting and information transparency.

Furthermore, given some of the specific tasks that FinTechs will be responsible for as part of this model, namely, structuring and selecting receivables, seeking investors, and, last but not least, managing payments related to the platform, there will be important legal and structuring requirements around local enforceability and taxation, some of which will be unique to the technology-based nature of this financing model.

AI-driven Risk Management

Key benefits of AI-driven security and risk management include:

-

Continuous protection: Constant monitoring of user and application activity.

-

Instant best practices: More than 100 proven enterprise resource planning security rules.

-

Self-learning: Embedded AI and self-learning for precise results.

-

Augmented incident response: Ensures that issues are directed to analysts for tracking, investigation, and closure.

Source

https://www.mig-corp.com/FinTech-Securitizarion-Services

https://www.deloitte.com/us/en/pages/regulatory/articles/applying-blockchain-in-securtization.html

https://www.analyticsindiamag.com/artificial-intelligence-and-its-impact-on-financial-services-landscape

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe