Chinese acrylic acid supply to get better with change in policies and demand scenario

Abstract:

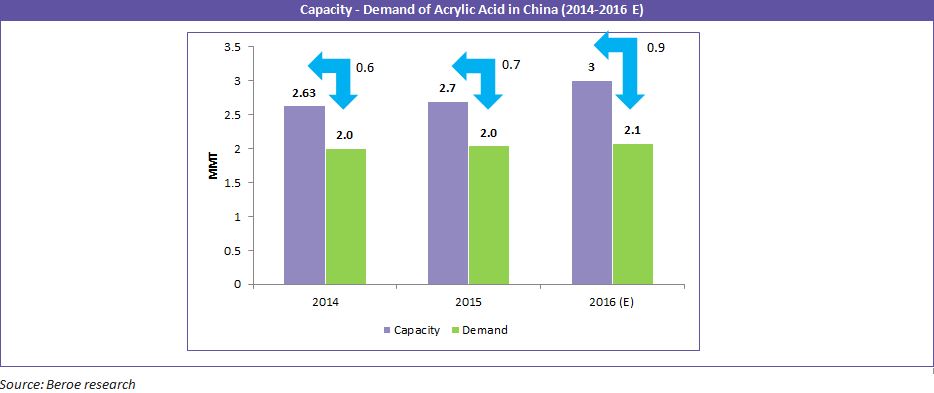

Acrylic acid in China has seen a sluggish growth in the last 3 years, with a CAGR of about 2 percent. While the demand remained low, the capacity additions flooded the Chinese acrylic acid market growing at a CAGR of 6-7 percent. With the difference in capacity and the demand gap being very high at around 0.7 MMT, it is quite evident that the market was oversupplied.

China is currently producing around 35 percent of the global production of acrylic acid. With an already low demand, and with more capacity additions expected in the future, an oversupply of acrylic acid is anticipated in the market.

The current oversupply condition in China is similar to that of the U.S. which was witnessed recently. The U.S. acrylic acid market is oversupplied with several big players deciding to shut down their plants fearing reduction in profit levels. One of the players, Dow Chemicals closed down its acrylic acid plant in the U.S. due to oversupplied market conditions.

With new capacity additions expected to come online, is there a possibility that the Chinese players also go the U.S. way and close down their plants? Or will there be a narrowing down in the capacity-demand gap?

In this article we discuss whether or not the acrylic acid demand is expected to grow in the near future. If yes, then what are the factors that would drive this demand? If no, then what does the future of acrylic acid hold for acrylic acid category managers?

Acrylic acid – a dark history and gifting present!

Acrylic acid demand in China is growing at a rate of 2 percent during 2013-2016 due to over capacity and mediocre demand conditions. Furthermore, with additional capacities coming online every year, the capacity – demand gap is getting wider.

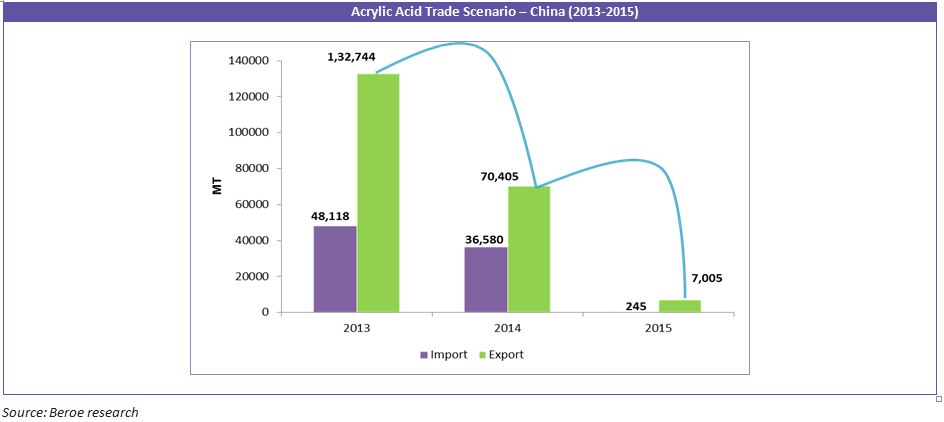

China is a net exporter of acrylic acid, majorly exporting to countries such as Turkey, Japan and Korea. But in recent times, China has witnessed a fall in its exports and also reduced its import of acrylic acid. This fall is due to the pressure to increase domestic demand and lessen dependability on profits from trade activities.

A likely Déjà vu?

The U.S. acrylic acid market is currently facing oversupplied conditions as well. With a production capacity of 1.3MMT and demand of 0.9 MMT, which is expected to grow at a CAGR of 2-2.5 percent, the U.S. players are looking at closing down their plants to reduce losses.

For instance, Dow chemical shut down its Deer Park plant in Texas, citing oversupply conditions as the reason. The Dow chemical’s Deer Park plant was the largest acrylic acid production facility in the U.S., producing close to 580,000 MT/year. So its closure would be taking out about 116,000 MT of acrylic acid from the domestic and export market.

The oversupplied market condition in China is quite similar to the market conditions in the U.S. Does this indicate that big players in China are likely to follow in the footsteps of the U.S. players or will the planned capacity additions in China in the near future see the light of the day? Will there be a supply security scenario for procurement managers of acrylic acid from China?

The answers to the above questions lie in the changing policies and strategies adopted by the Chinese government.

Two better than one – Hopeful boon!

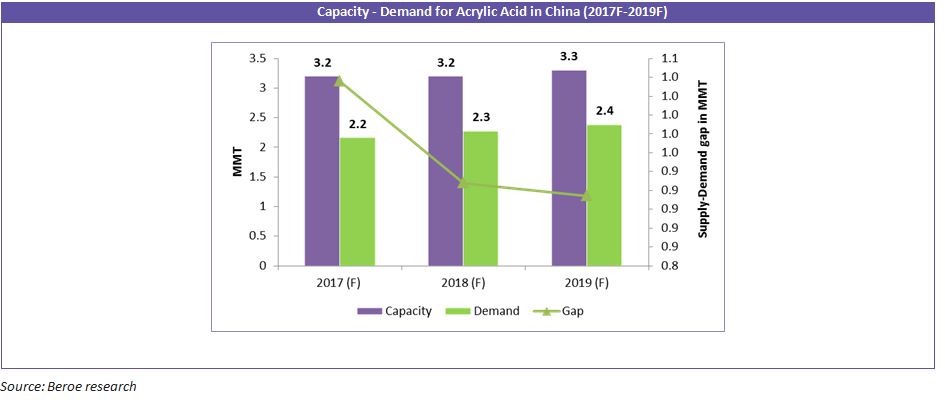

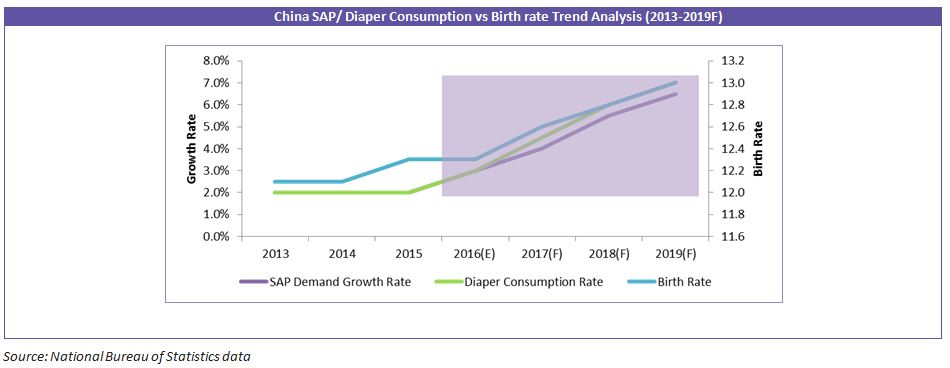

China’s iconic one child policy saw itself being re-written at the end of 2015. The new policy, which now allows couples to have two children, is a welcome decision to not just the couples but also to the industrial sector as well. With the onset of 2017, an increase in child birth rate is expected to drive the demand for baby diapers; thereby boosting up the demand for key tier 1 and tier 2 raw materials such as SAP and acrylic acid respectively. Both these markets are expected to grow at a CAGR of 4-5 percent during 2017-2019. This will have a positive impact on the acrylic acid capacity; the demand gap widening was worrisome in the recent past.

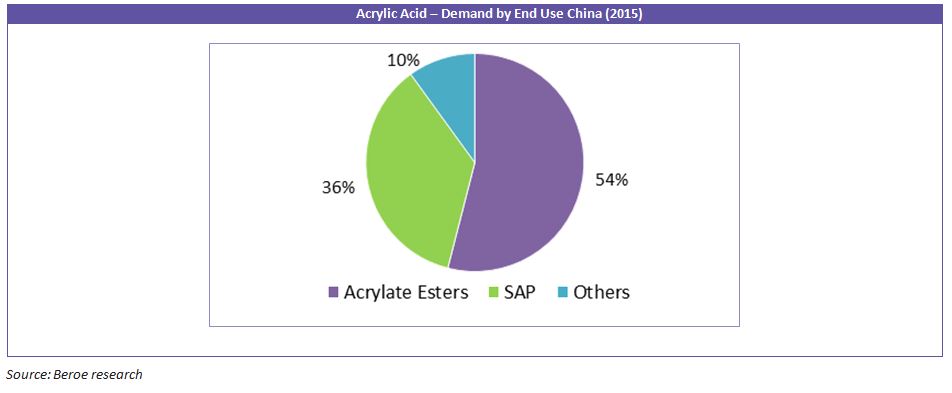

Acrylic acid downstream demand growth is majorly driven by acrylate esters and SAP.

Increasing demand for SAP from baby diaper and adult incontinence segment will continue to drive the demand for acrylic acid until 2017. There is ample availability of acrylic acid for acrylate esters production. Also, the recent capacity additions announced for acrylic acid ensures that there is enough supply of acrylic acid for the SAP segment until 2017. The demand for acrylate esters is likely to rise from the construction segment and automobile sectors.

This increase in the demand of acrylic acid with the removal of the one child policy is expected to be the one of the key factors that is likely to prevent China from replicating the U.S. in terms of acrylic acid market.

Also, big players are keen on setting up their plants in the U.S. or increasing their operating rates so as to have higher stakes in the acrylic acid profit wagon. One such player is Kimberly Clark which has strategically reduced its production in the U.S. to allow itself to divert more towards China, thereby giving it a better market share and larger profit margin.

In addition to all this, the Chinese government’s stand to increase domestic consumption is also likely to contribute to the increase in acrylic acid demand in China.

All in all, as the demand is set to increase in the near future, capacity additions will set up as a welcome boon for players in the market.

Birth Rate – SAP equation!

Majority of the baby diapers are made from Superabsorbent polymers (SAP). With an expected increase in the birth rate in the near future, the demand for the SAP is also likely to go up.

China produces close to around 740,000 MT/year of SAP, which constitutes to nearly 23 percent share of the global production. However, China’s demand share is close to 15 percent in the global SAP market and is expected to increase over 4-5 percent owing to rise in hygiene awareness among the increasing population of China.

The top players nowadays are continuously working on new products or product improvements which include swelling, odor control, speed of absorbency and performance. Several challenges that these products face include meeting the need for softer and thinner diapers to prevent skin irritation and to support better mobility.

Conclusion

With factors such as growth in baby diaper consumption, increase in domestic consumption and reducing capacity, the demand for acrylic acid market is ready for a major boost. The additional capacities that are expected to come online in China will only provide further assistance to cater to the increasing demand for acrylic acid. The Chinese market is very unlikely to mimic the U.S. acrylic acid market as China is ready for an acrylic acid revolution.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe