Supply and Pricing of Refractories: A Checklist

Over the past few years, a series of unfortunate macroeconomic events have led to a severe supply disruption of refractory raw materials and related finished products. This imbalance in the market has led to unforeseen price volatility and reduced negotiation potential for prospective large-scale buyers.

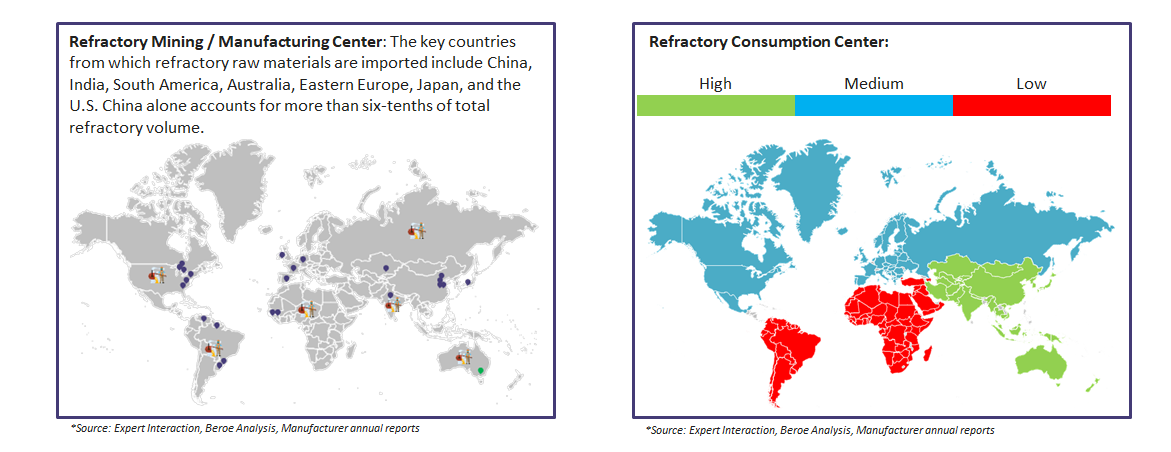

Refractories are used in the manufacturing of iron and steel, petrochemicals, cement, and glass. Though the associated spend is not significant so as to classify it as a “head spend” category, refractories form a strategic component in the manufacturing process. This highly diversified category finds its manufacturing base in the APAC region, which is lately facing disruptions in the form of trade war and Coronavirus outbreak.

Background

-

Category Definition: Refractories are minerals / altered ceramics designed to withstand high temperatures (over 600 degrees Celsius), and are used specifically as an insulation liner over hot surfaces in industrial manufacturing. They are also used in chemical applications due to their ability to withstand physical wear and corrosion caused by chemical agents. Refractories are manufactured from natural / synthetic materials, usually minerals of nonmetal origin, or combinations of compounds and minerals such as calcined alumina, chrome ore, magnesium, refractory grade bauxite, brown-and-white-fused-alumina, graphite, zircon, and silicon carbide.

Refractories (Type)

- Monolithic

- Castable

|

Refractories (Nature of use) |

|||

|

Acidic |

Basic |

Neutral |

Special |

|

|

|

|

-

Refractory Supply Chain:

Most suppliers are involved in manufacturing both bricks and monolithic refractories that are consumed in different industries such as iron, steel, cement, glass, non-ferrous metals, and ceramics; among these, steel is the most predominant, with 60 percent of the total market share.

Refractory Transportation and Storage

-

Transported through truck, rail, ship, and aircraft.

-

Intermodal shipping possesses the best characteristics of these various modes; this is four times more fuel-efficient than truck loads.

-

They “weigh out” before they “cube out.” As containers reach their mass limit before volume limit, they are transported in smaller container sizes in the range of 20, 40, and 45-ft.

-

Breakability factor is controlled by following standard blocking and bracing techniques.

-

Storage is in a cool, dry place, and at a minimum volume as these are a lead time of 10–12 weeks, with an average MOQ of about 5 to 15-ton.

-

Acidic refractories: 5 to 25-ton

-

Basic refractories: 1 to 25-ton

-

Neutral refractories: 3 to 15-ton

-

Special refractories: 1 to 5-ton

-

On an average, contracts are for a duration of 1–3 years with quarterly replenishment of products.

Refractory Replenishment

-

Refractory material failure depends on material selection and manufacture date, plant operations, material storage, mixing, installation, curing, and drying.

-

Refractory is replenished if the cost of energy loss value is not in accordance with the cost of insulating the system. Also called economic thickness, this takes into consideration cost of fuel, annual hours of operation, heat content of fuel, boiler efficiency, operating surface temperature, thickness of surface, cost of insulation, and average exposure to still air temperature.

|

Industry |

Furnace Type |

Replacement Timeline |

|

Steel |

Basic oxygen, Electric arc furnace casting ladles |

20 minutes–2 months |

|

Cement / Lime |

Rotary Kiln |

Annually |

|

Non-ferrous metals |

Copper-converter |

1–10 years |

|

Glass |

Glass furnace |

Up to 10 years |

|

Energy / Environmental / Chemicals |

Secondary reformer |

5–10 years |

*Source: Expert Interaction, Beroe Analysis, Supplier Interaction

| Commodity |

Refractory Consumed (per ton of production) |

|

Steel |

10 to 15-kg |

|

Aluminum |

6-kg |

|

Copper |

3-kg |

|

Cement |

0.6-kg |

*Source: Expert Interaction, Beroe Analysis, Supplier Interaction

Pricing

The price of refractories depends largely on four parameters, namely raw material, fixed, utility, and labor. Fixed and utility are microeconomics variables, whereas raw material and labor vary in accordance with supply-demand dynamics. Pricing for refractories can be locked on input cost (raw material cost plus contracts). Moreover, a cost plus incentive contract is established when the supplier is proactively engaging in technology that increases the life of a refractory product (e.g., developing a ceramic fiber refractory that can replace an existing product of the same specifications).

|

Refractories |

Raw Material |

Concerned Raw Material |

Fixed / Indirect |

Manufacturing Labor |

Premium, Margin and other expense |

|

Acidic |

64 % |

|

12 % |

8 % |

16 % |

|

Basic |

75 % |

|

10 % |

7 % |

8 % |

|

Neutral |

63 % |

|

12 % |

12 % |

13 % |

|

Mitigateable Risk |

Accepted Risk |

*Source: Beroe Database, Expert Interaction, Beroe Analysis

Refractory raw material, mostly minerals, are not traded in open exchanges. However, it is possible to track the price movement of highlighted materials through various databases. This helps in predicting the future once the buyer has a bird’s eye view of historical pricing and market sentiments. Similarly, currency can be hedged in order to avoid losses which may be attributed to unanticipated conversion ups and downs.

Coronavirus (Covid-19) Impact Assessment:

Liaoning province, which accounts for over to 80 percent of Chinese refractory material manufacturing (about 500 enterprises with more than 4000 production facilities ) is witnessing production halts due to reduced demand and logistics constrains post the Coronavirus outbreak.

Extended holidays and subsequent production drop did not have much impact on pricing because available inventory is being used up currently.

Though Liaoning province is accessible by road, exports are expected to resume by end of March mainly through Dalian and Yingkou port.

As some of the key ports affected are Shanghai, Tianjin, Huanghua, Lianyungang, Jingtang and Caofeidian, procurement managers should focus on short term (0-3 months) local sourcing so as to ensure supply security. This may come at a higher cost, but would reduce the risk of a “no-supply” situation. Globally, trading activity is expected to remain low mainly owing to markets being closed in China.

|

Category |

Sub Category |

Impact Assesment |

||

|

Low |

Medium |

High |

||

|

Alumina |

High Alumina |

|

|

|

|

Brown Fused Alumina |

|

|

|

|

|

White Fused Alumina |

|

|

|

|

|

Calcined Alumina |

|

|

|

|

|

Bauxite |

Refractory grade (85%) |

|

|

|

|

Refractory grade (86%) |

|

|

|

|

|

Refractory grade (87%) |

|

|

|

|

|

Refractory grade (88%) |

|

|

|

|

|

Zircon |

Zirconia Refractories |

|

|

|

|

Magnesia |

DBM & FM |

|||

Solution

|

Incident |

Risk Category |

Risk Register |

Mitigation Measure |

|

Negative |

External |

|

|

|

Negative |

Project |

|

|

|

Positive |

Technology |

Innovation |

Buying decisions based on TCO can improve the life cycle of products and reduce overall consumption. |

|

Positive |

Inventory |

Inventory reduction |

Opportunity for VMI/stocking programs. |

|

Positive |

Sourcing |

Tier 2 procurement |

Due to fragmentation in space, there is a large range of applicable price negotiation levers to be employed. |

Conclusion

Trade war and Covid-19 outbreak are unfortunate events that may lead to disturbance in availability and pricing of refractories. However, they are short-term events and does not necessarily translate to long-term price rise. An efficient buyer has insights into the operation of a refractory manufacturer and can thus capitalize on the savings that the manufacturer would realize through alternate measures. Alternatively, buyers must maintain a secondary list of suppliers, mostly regional (local sourcing).

Buyers prefer long-term fixed-rate contracts to ensure an uninterrupted supply of this strategically important material. However, it is beneficial to include a “force majeure” clause to support an interim supplier in case of a macroeconomic risk. The new supplier can be on a “cost plus” mode of contract.

Buyers keep track of input costs (raw material, energy, and labor) to ensure that there is no incident of overpricing by the manufacturer / seller. Negotiation levers could be input cost and margin-focused. Thus, a long-term contract of significant value with a tier 2 supplier would ensure better pricing.

Recommended Reads:

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe

S