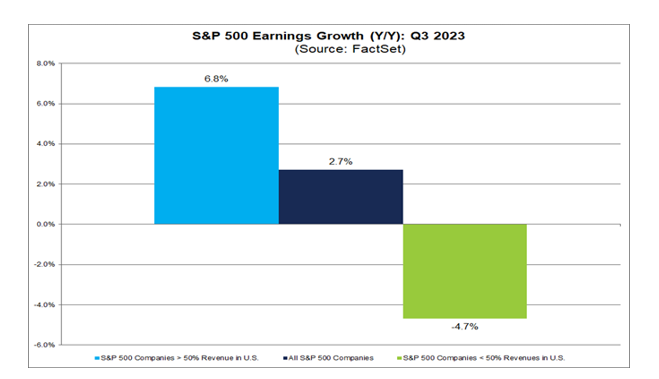

Strong Dollar Leads to 5% Earnings Dip for Global S&P 500 Firms

S&P 500 companies with significant international revenue exposure have reported a 4.7% decrease in earnings for the third quarter of 2023, a decline that underscores the impact of a strengthening U.S. dollar, contrasting with the performance of their domestically-focused counterparts, according to a recent FactSet analysis.

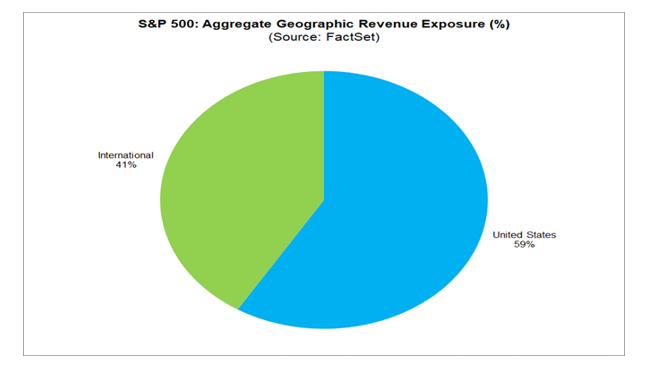

The FactSet Geographic Revenue Exposure data, which is based on the most recent fiscal year reports for each company within the index, was utilized to conduct this analysis. The S&P 500 companies were divided into two segments: those with over 50% of sales within the U.S. and those with more than 50% of sales internationally. The findings show a stark contrast in performance between these two groups.

While the overall blended earnings growth rate for the S&P 500 stands at 2.7% for Q3 2023, companies with predominantly domestic sales have seen a robust blended earnings growth rate of 6.8%. In stark contrast, companies with a majority of sales outside the U.S. have experienced a blended earnings decline of 4.7%.

Revenue growth rates mirror this trend. The S&P 500's blended revenue growth rate is 2.1% for the same period. However, companies with more than 50% of sales domestically report a blended revenue growth rate of 3.6%, whereas those with greater international exposure report a blended revenue decline of 2%.

Procurement teams within these multinational companies need to reassess and possibly recalibrate their strategies in light of currency fluctuations. The strong U.S. dollar, while detrimental to international earnings, presents a potential cost-saving opportunity for procurement when it comes to sourcing goods and services priced in foreign currencies. They could capitalize on the currency strength to negotiate better terms with overseas suppliers, reduce costs on imported materials, and potentially hedge against future currency risks. However, they must also be vigilant about the potential for a currency reversal and its impact on costs. Therefore, strategic planning in procurement must now factor in not just the cost and quality of goods and services, but also the currency trends and their potential impact on international procurement activities.

This trend highlights the impact of global economic dynamics, such as currency fluctuations, on multinational corporations. The stronger dollar has had a tangible impact on the earnings and revenues of companies with significant international operations, reflecting the complexities of global financial markets.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe