Staples, Office Depot merger hangs in balance; awaits court judgement

With inputs from Mridula Sharma, Research Analyst

On Tuesday, closing arguments were concluded in the U.S. government’s opposition to the planned merger between Staples Inc and Office Depot Inc, according to news reports.

The Federal Trade Commission (FTC) has sought a preliminary injunction with the U.S. District Court for the District of Columbia to stop the proposed $6.3 billion deal pending a decision by an FTC administrative judge.

If the federal judge upholds the injunction then it may virtually end the proposed merger between office supply rivals.

Both Staples and Office Depot have been telling the court that for years office supply companies are facing declining revenue and demand, and were facing stiff online competition that includes web retail giant Amazon.

A Staples lawyer argued that the deal was needed, saying that Amazon was entering the office supply market, which may shake up the market.

Amazon’s entry into the office supply market is critical to the case because Staples and Office Depot say that the online retailer will be a formidable competitor to the combined entity.

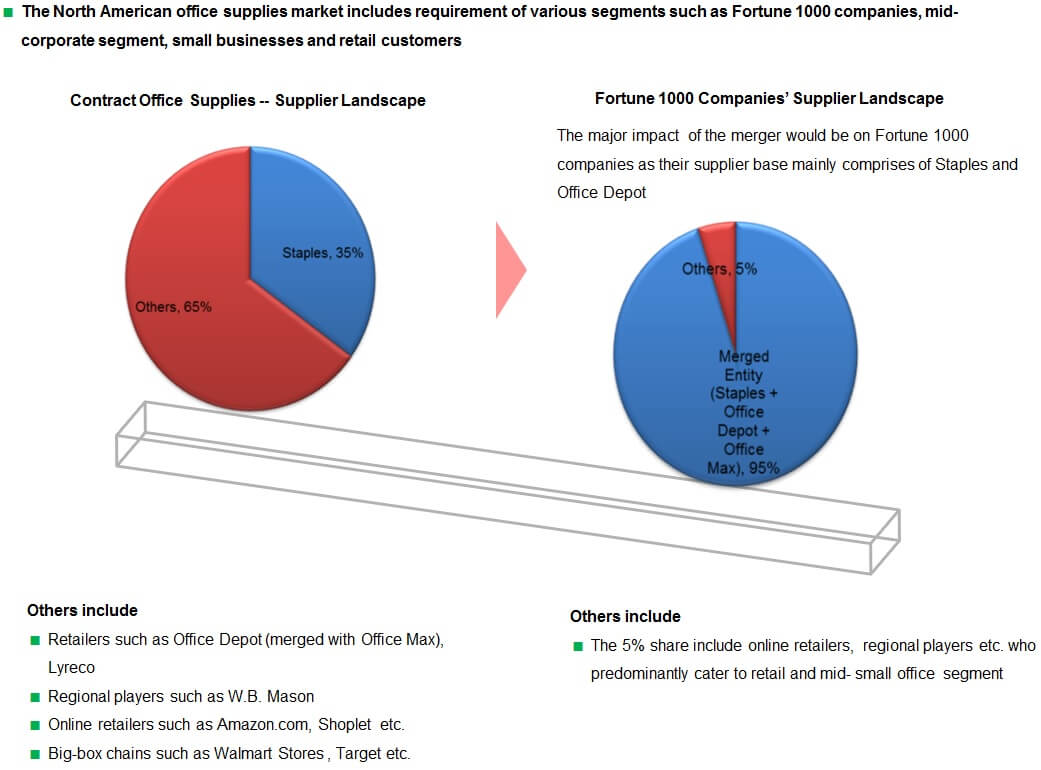

For its part, FTC argued that the two companies are large suppliers and the tie-up would lead to higher prices to corporate customers.

An Amazon executive had earlier told the court that the online retail company’s office supply business is currently not big enough to take on the combined entity of Staples and Office Depot.

However, federal judge Emmet Sullivan criticized the FTC for attempting to elicit false information from an Amazon executive to bolster its case to block the deal, according to Bloomberg News. (http://beroeinc.co/1Scw7IF)

Since the closing arguments concluded on Tuesday, the Wall Street Journal has reported that the judge’s decision on the merger is expected in the next few weeks.

The lawsuit has surely garnered attention in the office products market. As per preliminary Beroe analysis, if Staples and Office Depot manage to combine then large corporate customers can expect an increase of 2- 3% in prices for office products.

At the same time, buyers can benefit from varied product portfolio, better services, and wide geographical coverage by engaging with the merged entity.

Online retail firms or big-box retailers may not be big players in the office products segment for now. However, there is a good possibility that players such as Amazon, Shoplet, Wal-Mart, Target and W.B. Mason may begin to focus more on the contract sales business to Fortune 1000 companies and other corporates – the market dynamics will then begin to change.

What could be the recommendations for corporate buyers in this evolving scenario?

Contract term:

If the merger goes through then the supplier landscape is expected to drastically change due to which the preferred contract term for buyers would be 3 years –since long-term contract (like 5 years) would increase the risk of price rise and post-merger integration issues. On the other hand, a short term contract (like 1 year) would not be attractive for Staples, Office Depot or other suppliers in the industry.

Multiple vendor engagement:

The contract office supplies industry is consolidated with limited presence of online retailers, big-box chains and regional suppliers. However, efficient engagement with multiple vendors (even though with smaller presence) can allow buyers to know industry benchmarks, negotiate prices and ensure key performance and service level parameters across vendors.

Price check and category spend visibility:

The buyers need to have internal price check mechanism and visibility on key spend of office supplies items.

In case prices are trending upward, fixed or cap price contracts can be initiated with more emphasis on negotiations, or alternate suppliers can be approached to facilitate other sourcing functions and objectives like inventory management, cost savings etc.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe