Shipping Routes Shift as Red Sea Crisis Spurs Insurance Hikes

The recent surge in Houthi rebel attacks on commercial vessels in the Red Sea has significantly disrupted global shipping and raised international concerns. Since mid-November 2023, the Yemen-based, Houthi rebel group has been targeting a wide range of commercial ships in the Red Sea. These attacks have not only threatened the safety of maritime operations but also have had broader economic repercussions.

A notable incident occurred on Jan. 16, 2024, when a Malta-flagged, Greek-owned bulk carrier, the Zografia, was struck by a missile. The ship, which was empty of cargo had 24 crew members aboard. Thankfully, there were no injuries reported, only material damage. The Houthi rebels claimed responsibility for this attack, stating it was executed using naval missiles.

The repercussions of these attacks are far-reaching. Major shipping companies, including the global leader A.P. Moller-Maersk, are now considering avoiding the Red Sea and the Suez Canal, which is a crucial maritime route. This shift is not only delaying shipments but also raising transport costs. The cost of goods, particularly into Europe from Asia, is expected to increase as a result. War risk insurance premiums for shipments through the Red Sea are also on the rise.

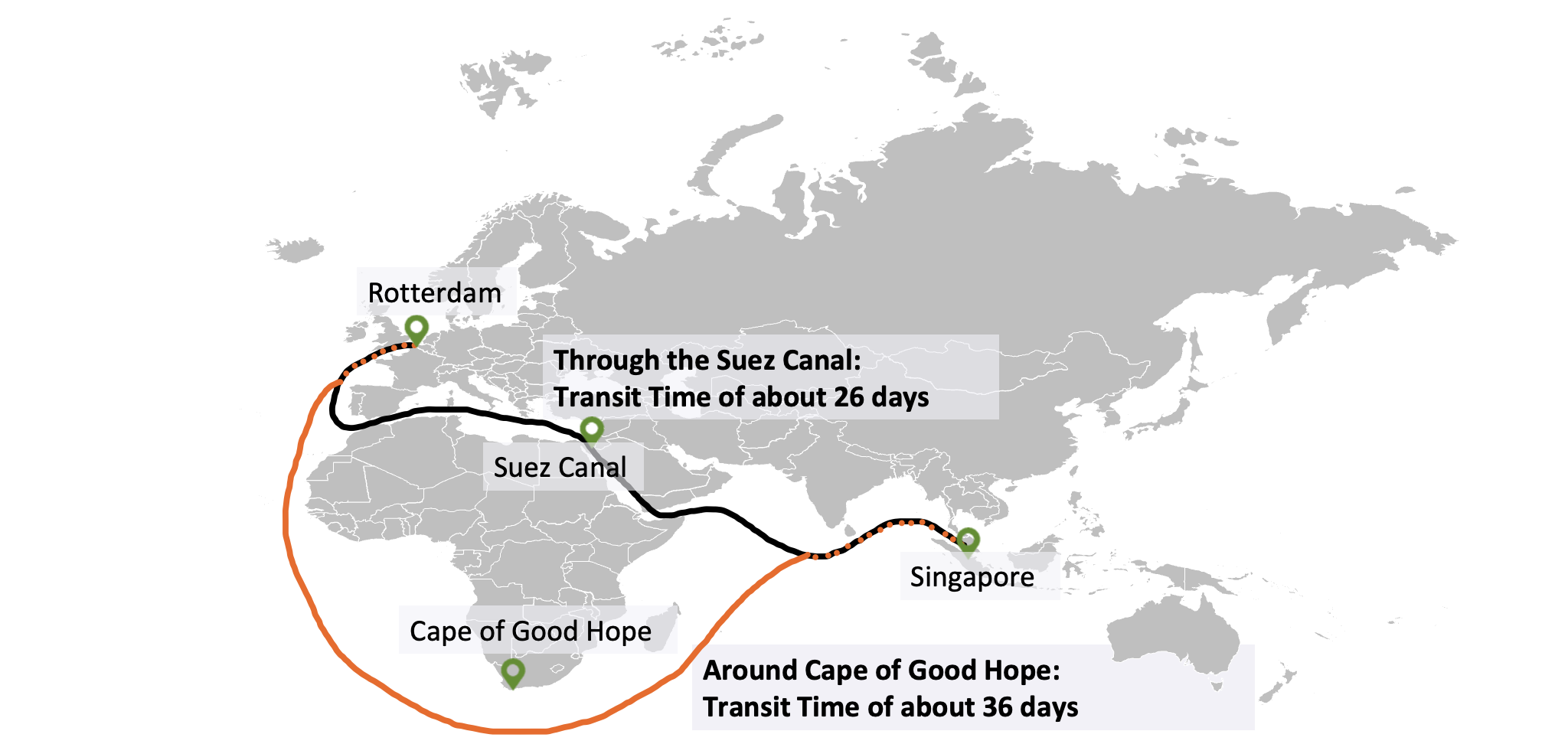

The detours, particularly those around the Cape of Good Hope, have significantly extended transit times for cargo, adding an additional seven to ten days, and in some cases, up to twenty days for vessels that had already navigated across the Arabian Sea.

The scale of this shift has been considerable, with more than 500 vessels, which account for about a quarter of the global fleet's capacity, choosing to avoid the Suez Canal route as of Jan 19, according to data from Flexport.

Furthermore, disruptions caused by these attacks are having a direct impact on global supply chains. For example, Spanish factories owned by the French tyre maker Michelin are planning to halt production due to delays in the delivery of raw materials. Furthermore, electric car maker Tesla, had to temporarily shut down its Gigafactory outside Berlin from January 29 to February 11 due to delays in its supply chain caused by these disruptions.

The ongoing crisis in the Red Sea has led to a significant escalation in shipping rates, especially impacting the Shanghai to North America routes. According to data from Flexport, a noticeable week-over-week surge has been observed in the Shanghai Container Freight Index (SCFI). Specifically, rates from Shanghai to the U.S. West Coast have increased by 43%, amounting to an additional $1,199 per Forty-Foot Equivalent Unit (FEU). Similarly, the Shanghai to East Coast route has seen a 48% hike, translating to an increase of $1,882 per FEU.

Compounding these challenges are the rising insurance costs for vessels navigating through the high-risk areas of the Gulf of Aden and the Red Sea. A report from GCaptain indicates a dramatic increase in these rates, approximately tenfold in recent weeks, largely attributed to the repercussions of military strikes in the region. Current insurance rates are estimated to be between 0.75% and 1% of a vessel's value. This means that insuring a vessel can now cost anywhere from $1 million to $2.5 million, depending on factors like the vessel's age, size, and type, according to Flexport.

Interestingly, these inflated insurance premiums are influencing the cost-effectiveness of different shipping routes. Despite higher fuel costs, the route around the Cape of Good Hope is becoming more economically viable for carriers compared to the Suez Canal route, mainly due to these heightened insurance rates. This shift is a direct response to the increased risks and costs associated with transiting through the troubled Red Sea region.

Given these escalated insurance premiums, a swift return to the usual Suez Canal routes appears unlikely until the threats in the area are substantially mitigated.

The situation highlights the delicate balance in global shipping logistics, where geopolitical events can have a cascading effect on trade routes, costs, and ultimately, the global supply chain.

Beroe View

The evolving situation in the Red Sea, characterized by prolonged shipping routes and escalated insurance costs, presents several considerations for procurement strategies:

Adjustment of Timelines: With the rerouting of ships, notably around the Cape of Good Hope, delivery schedules are extended. This could necessitate re-evaluation of inventory strategies and lead time adjustments.

Cost Implications: The rise in shipping and insurance costs may lead to increased expenses for procured goods. It might be beneficial to explore various strategies to accommodate these additional costs.

Risk Management Considerations: The increased risks associated with shipping in the Red Sea area could prompt a re-examination of risk management strategies. This might involve diversifying the supply chain or reconsidering stock levels.

Supplier Engagement: Maintaining communication with suppliers becomes crucial in navigating these challenges. It can aid in anticipating potential disruptions and collaboratively finding solutions.

Market Monitoring: Keeping abreast of the latest developments in the shipping industry and the Red Sea situation is key. This ongoing awareness can inform timely and effective responses to changes in the market.

Overall, these developments in the Red Sea region could encourage a more dynamic and responsive approach in procurement practices, focusing on balancing cost considerations, supply chain resilience, and risk management.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe