Russia-Ukraine Conflict-Impact on Fertilizers Market

Impact of the Russia-Ukraine conflict has already started showing on the global Fertilizer market. Russia is the second-largest producer of ammonia, urea, potash and the fifth-largest producer of complex phosphates. It is also one of the largest exporter of DAP/MAP with more than 4 Million tons exported in 2021.

|

Russia Share in Total Global Exports |

|

|

Total Fertilizers |

13% |

|

Ammonia |

22% |

|

Urea |

15% |

|

Mixed Fertilizer |

30% |

|

Nitrogenous Fertilizer |

12.9% |

|

Potassium Fertilizer |

20% |

Major Challenges

-

The Black Sea ports of Yuzhny and Odessa are major fertilizer handling ports with pipeline transport facilities for ammonia from Russia. Ammonia Supply was disrupted in Europe, with two Russian plants Toaz and Rossoh reducing their output due to the war. Toaz is running only 3 out of its 7 ammonia lines while Rossoh is operating only 1 out of its 3 ammonia lines. Supply of ammonia at the Yuzhnyy port also has been temporarily shutdown as the pipeline from Russia to Yuzhnyy port which runs through Ukraine has been closed. Yuzhnyy port has been closed and there are no shipments reported post Feb 22.

-

Production plants of ammonia was halted in France and Germany. Still, small volume of ammonia was exported from Uralchem plant into parts of EU, which met the domestic demand. However, supply seems to be in a declining trend from the last week of February.

-

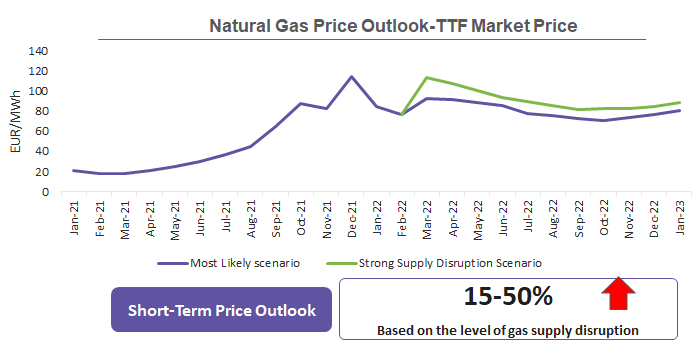

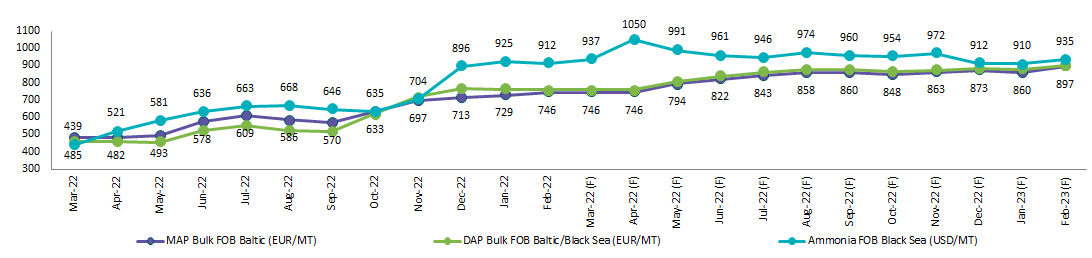

Ammonia prices are slated to increase globally with Europe set to witness a significant price increase as the Russia-Ukraine crisis is expected to worsen the already tight natural gas supply in the region.

-

About 13-14% of world’s ammonia supplied by Russia via the world’s longest ammonia pipeline -- Togliatti Azot from Russia to Yuzhny port in Ukraine -- likely to be impacted. Ammonia via Yuzhny port is majorly exported to the key fertilizer producing countries like Morocco, Turkey, and India.

(Sources: Beroe Analysis)

Price Outlook and Risk Mitigation

Disruption closure of plants in Europe, Ukraine and Russia will result in an increase in fertilizer prices across the world. Prices of Ammonia have reached new highs in Q4 2021 due to rise in energy costs in Europe. With further constrains in natural gas supply and prices, ammonia prices are expected to further rise by 8-10% in the near term. In the medium term, looking at alternative regions like China and Africa for sourcing would make sense. With sanctions announced on imports from Russia by many countries and Russia halting exports of fertilizers, all the major fertilizer prices are likely to increase by nearly 10% in the short term once the seasonal demand begins.

|

Possible Mitigation Strategy |

||

|

Timeline |

Action |

Expected Impact |

|

Short Term |

Wait and Watch |

Prices are expected to remain high in the short term |

|

Medium Term |

Portfolio Diversification |

Look for alternate sourcing regions such as China, Africa etc. |

|

Long Term |

Pivot out of Sources based/ dependent on Russia |

Engage with suppliers who do not have production base in Russia nor dependent on raw materials imported from Russia |

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe