The rise of craft beer offer varied procurement challenges for big brewers

With inputs from Nagarajan S, Pushplata Biswal and Souvik Hazra -- Agro Domain

McKinsey said in an article that a perfect storm is brewing across the beer business as more and more people prefer to drink beer that is either at the high end or low end.

Beer consumption has either stagnated - like in the U.S. - or have fallen 10 percent in countries such as Germany, France and the UK between 2007 and 2014.

The advent of craft beer, which has also gained favor among women, and product innovation all along the value chain, has heaped market pressure on big beer makers.

Though there are many business ramifications for large brewers, let us see how this changing trend can impact the procurement of certain Direct materials. And in this blog post, we have not considered the procurement impact on Indirect categories such as Packaging, Logistics and Warehousing, which have their own set of dynamics.

Firstly, beer consumers in mature markets are shifting towards premium beer segment. This would mean that demand for specialty malt is expected to grow at about 10 percent year-on-year.

And owing to this trend, procurement organizations of large brewers may have to gradually shift away from bulk malt purchases, and instead start focusing on sourcing specialty malts from a varied supplier base. The flip side to this would be brewers may also have to move away from a consolidated supplier base, which would entail dealing with a diversified set of suppliers across geographies.

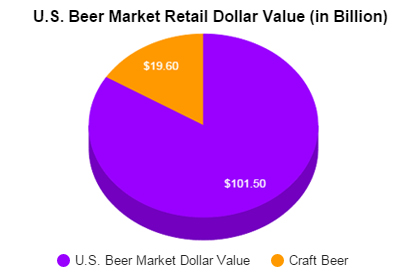

Secondly, Craft beer market has been on song, growing at 15 percent year-on-year. This segment, which is beginning to upend the traditional beer market, has the potential to redraw the procurement map.

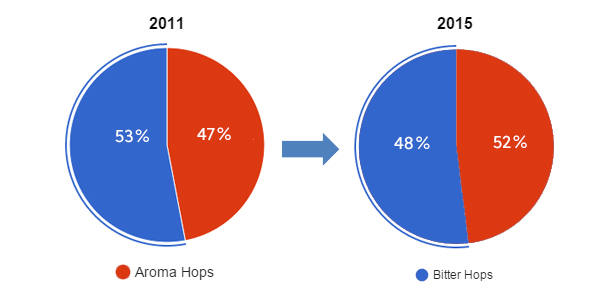

Craft beers are popular for their distinctive taste. There has been lot of innovation in the segment - some of them, for example, even forego carbonation. Most craft brewers prefer aroma hops as it gives a different flavor.

Source: Brewers Association

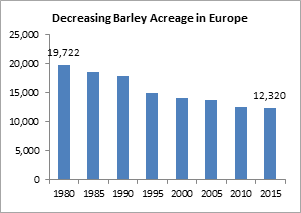

Rising brewing activities in the Craft segment has in turn been driving the demand for aroma hops every year. Since aroma hops enjoy a higher margin when compared to traditional bitter hops, farmers prefer to increase the acreage of aroma hops, which may slowly affect the supply of bitter hops, which are traditionally favored by large brewers.

In terms of numbers, global production ratio of aroma to bitter varieties is expected to change from 47:53 in 2011 to 52:48 in 2015.

From a business point of view, big brewers have already begun reacting to the phenomenon of independently produced beer.

For example, in May, UK's Meantime Brewing Company agreed to a takeover by SABMiller. In January, Anheuser-Busch bought Seattle's Elysian Brewing. They had earlier bought up Oregon's 10 Barrel Brewing, and Chicago-based Goose Island. Only time will tell whether big brewers would go on an acquisition spree or not.

Due to increased competition and diversified portfolio, the third challenge for procurement organizations would be to secure the supply of two major brewing raw materials: malt and hops. And with growing demand, both these materials are expected to become relatively pricey. Procurement teams may have to explore the option of extending their forward contracts and secure the supply of hops and malts, albeit at a relatively higher cost in the near future.

With increase in raw material prices, the need to maintain margins may lead to a significant shift in sourcing strategies adopted by procurement organizations. This may also call for innovative use of by-products.

For example, category managers may have to explore alternate best cost regions to source other raw materials such as yeast, concentrates etc. Also, they may have to look at achieving better returns through sale of by-products (spent grains and spent yeast) generated while brewing.

At different stages of production, a brewery loses an opportunity to recover about 2-6% of total production cost since they don't end up utilizing by-products effectively.

On an average, 135-170 tons of waste is generated when producing 1000 tons of beer. Spent grain consists of about 85% of total by-product of the brewing process. Spent grain, which is made of polysaccharides, lignin and cellulose, has so far been used as an animal feed.

However, owing to high protein and fiber content, spent grain is also beginning to be used for human nutrition. Lately, companies are also using spent grain as biomass for generating energy and fuel. Energy generated through biomass can help reducing total cost of production.

In light of growing competition, increasing costs and crowding out of raw materials, procurement organizations have to be innovative in its approach to reduce the cost of producing beer.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe