Revitalized Earnings Growth Can Spur Strategic Procurement

For the first time since the third quarter of 2022, the S&P 500 is on track to report year-over-year earnings growth, a significant financial development following a period of economic uncertainty, according to a recent report by Market Data provider FactSet.

As of the current data, the renowned index is reporting a modest 0.4% increase in earnings for the third quarter of 2023, marking a potential end to the earnings recession witnessed over the past year, FactSet said.

This positive shift doesn't come as a total surprise to those who follow the market closely. Historically, a majority of S&P 500 companies have a track record of reporting actual earnings that exceed initial estimates. This trend, if continued, suggests a likelihood that the index could see actual earnings growth surpass the 0.4% mark for this quarter.

The mechanics behind this uptick are fairly straightforward: when companies report earnings above estimates, it raises the overall earnings growth rate for the index. This is because the higher actual earnings per share (EPS) numbers replace the lower estimated EPS figures in the growth rate calculation.

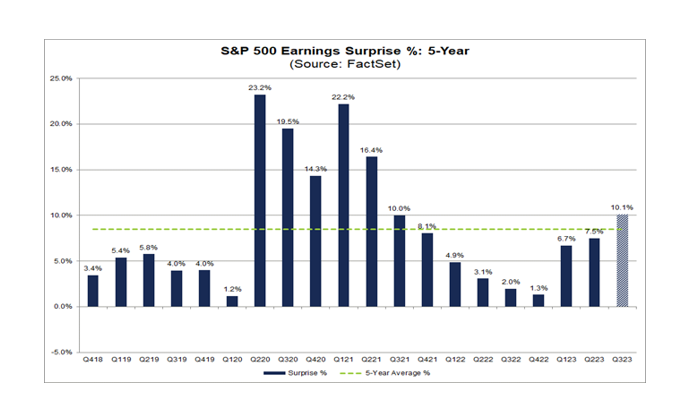

The current earnings season is also off to a promising start. Among the 32 S&P 500 companies that have reported actual earnings for Q3 2023, a substantial 84% have reported actual EPS above the mean EPS estimate. In aggregate, these companies have reported earnings that exceeded estimates by an impressive 10.1%.

While it's still early in the earnings season, both the number of companies reporting positive EPS surprises and the magnitude of these surprises are trending above the 5-year averages. This strong performance raises a critical question: will this upward trajectory continue for the rest of the earnings season? Only time will tell.

Beroe View

The anticipated uptick in the S&P 500's earnings growth signals a pivotal turn in the economic landscape, presenting unique challenges and opportunities for procurement departments across industries.

Enhanced Market Intelligence: The positive shift in the S&P 500's earnings growth underscores the critical role of market intelligence in procurement strategies. In an environment where market conditions are improving, procurement teams must harness market intelligence to anticipate supply-demand shifts, commodity price changes, and supplier market conditions. This foresight enables teams to make data-driven decisions, capitalizing on opportunities for cost savings or avoiding potential price hikes.

Market intelligence goes beyond price tracking; it involves understanding global market trends, geopolitical events, regulatory changes, and technological advancements that could impact supply chain dynamics and costs. For instance, knowing a supplier's market share and financial health can inform negotiation strategies and risk assessment.

In this period of earnings recovery, procurement teams equipped with robust market intelligence can better navigate supplier relationships, manage costs, and optimize inventory levels. They can also identify emerging trends and innovations that could offer competitive advantages, cost-saving opportunities, or more sustainable procurement practices. This proactive approach, powered by market intelligence, positions procurement as a strategic partner in driving organizational growth and resilience.

Strengthened Supplier Negotiation: The resurgence in earnings growth signals a recovering economy. For procurement, this could translate into stronger negotiating positions with suppliers. In a growing market, suppliers are more likely to negotiate contracts to secure consistent revenue streams, potentially leading to cost savings for procurement departments.

Inventory Cost Optimization: The anticipated economic upswing means companies might experience increased demand for their products. Procurement teams, in collaboration with the business operation, need to strike a balance between having enough inventory to meet this demand and avoiding excessive inventory that ties up capital. With a positive financial outlook, companies may have more funds available, but the key is to invest these wisely. Optimizing inventory levels can help avoid both stockouts and overstock situations, thereby efficiently managing costs.

Strategic Sourcing and Cost Savings: If the market rebounds, procurement has an opportunity to reassess their supplier base and engage in strategic sourcing. By consolidating suppliers and leveraging spend, procurement can achieve significant cost savings. This period of growth is an opportune time to lock in favorable contract terms that will provide cost certainty and potential savings in the long term.

Risk Mitigation in Supply Chain: The earnings growth highlights the importance of a resilient supply chain. Procurement teams should use this time to analyze and mitigate risks related to cost volatility, supply disruptions, and geopolitical factors. By diversifying the supplier base and considering partners in different geographic locations, procurement can mitigate risks and stabilize costs.

Sustainability and Cost Efficiency: There's a growing trend to incorporate sustainability into procurement practices. With a healthier financial outlook, companies can consider investing in sustainable products and suppliers, which, although sometimes more expensive initially, can lead to significant cost savings and brand enhancement in the long run.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe