Recession ahead? One contrarian doesn’t think so

I had the pleasure of hearing Professor Jason Miller from Michigan State University speak to the Center for Advanced Purchasing Studies (CAPS) members a few weeks ago, sharing with us a variety of fascinating charts and figures that he pulled from all of the publicly available data produced by the federal government -- most of it is census data. After hearing Miller’s presentation of the economic data from a number of overlooked, publicly available, government sources, I agree with this sentiment. I don’t think a recession is ahead -- but be ready for more shortages and more inflation.

Miller started by opining that the University of Michigan consumer sentiment index is an unreliable economic indicator for several reasons -- but most of all because the sentiment data seems to be entrenched with people’s political affiliations -- democrats were upset with Trump and Republicans upset with Biden. Customer sentiment seems to vary too much on political issues, and what people DO is not always the same as what they SAY.

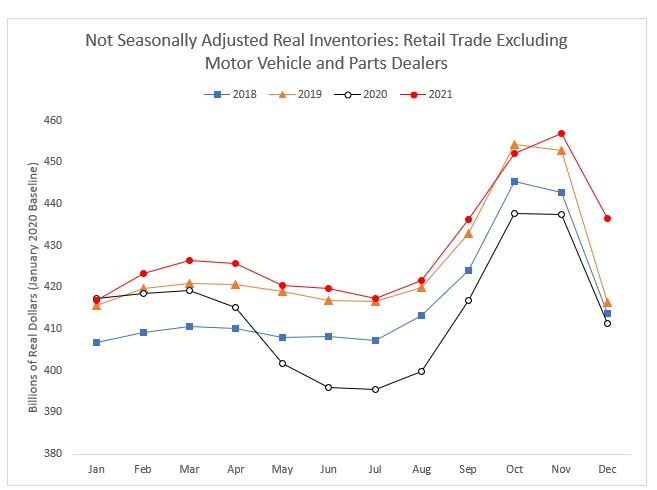

For instance, take retail data. Miller showed how retail sales are still running well ahead of pre-COVID spending. Specifically, we are 6.1 percent above the trend line for retail spending -- and we are still having record imports and buying a lot of stuff! The March 2021 stimulus led to massive spending -- and although we are a bit down from that, we are still well above the long-term trend.

Unlike many economic pundits who are warning of a recession (not to mention the Wall Street analysts selling stocks when the Fed posts a rate increase), Miller does not believe we are anywhere NEAR a recession -- thus making him a bit of a contrarian. Here are some legitimate data points to support the idea that a recession will not occur.

- 2019 was down from 2018 but has increased along with the consumer spending. Containerized imports are up 30 percent still from 2019. If we were in a recession -- we would see this falling off.

- Tons of Air Freight is up 20 percent -- based on the physical weight of products. We are not headed off a cliff.

- Manufacturing revenue with inflationary pressure is at the highest ever since 2004 -- but what does this mean for profits? Good news there as well -- manufacturers’ profits are up 10 percent -- meaning we are not yet seeing profits squeezed by inflation. Sectors with higher profits are oil and gas, and lower is transportation. Wood products have the biggest increase in profitability, as lumber prices have not increased as much. Primary metal products are higher, and so are computers.

- In addition, manufacturers are holding on to a ton of cash, and are now sitting on about $850 billion in cash. But inventory is not up a lot more. Many are actually running a little low! In general, what we see is automotive companies in particular are holding lots of inventory waiting for their chips to arrive, but in general are not seeing enough chronic issue to cause a massive concern.

- Industrial production output looks at physical units produced, which excludes computers and electronics. We see growth in 2017 and 2018 -- and then COVID shuts it down -- and then a quick recovery -- a straight line up. In fact, June data actually went up but didn’t increase when seasonally adjusted. If you only look at seasonally adjusted, you miss the whole picture. For instance, output increased 1.1 percent from May -- but we expected 1.6 seasonally adjusted, a half-point reduction -- and economists saw this as a big deal. However, Miller pointed out that traditional seasonal cycles are not holding up since COVID, and we could see a gain in July, even though output drops, or vice versa.

- For make-to-order manufacturers, the gap between new orders and shipments is moving closely. New orders are outpacing shipments, which suggests that the backorders are likely increasing. The chip situation also seems to be doing better as automotive sales are up.

- Non-seasonal manufacturing employment, which is the number of people working in establishments that are considered primarily in manufacturing activity, is up. The June 2022 reading shows we are back to the same peak employment levels we enjoyed in 2019 -- meaning there are 12.8 million people in real manufacturing jobs. In other words, employment levels have rebounded to where they were in 2019. But the rate of job openings is still at unprecedented levels compared to 2018, and the strength of the manufacturing sector is such that many companies cannot find enough people! Also, the job QUIT rate is up -- pre-covid, we were at 1.6, and now at 2.6 percent -- much higher.

- Quarterly survey of plant capacity utilization answers an interesting question: if you didn’t operate at full capacity, why didn’t you? One of the major reasons is the insufficient supply of labor -- 45 percent of plants didn’t operate at full capacity because of insufficient labor! This would be a problem if there was a slowdown in demand -- and given the strength of demand -- labor shortage issues may also be responsible for rising wage rates and contributing to inflation.

- Regarding Inflation, the price index for final demand products compared to June 2021 (e.g., the price manufacturers receive for final products, not intermediates) is up 18.4 percent. This represents tremendous inflationary pressure, and it is also evident that this will not slow down but will remain at this level over time. There is no evidence we will see a pooling of final demand for finished goods prices. Year-over-year increases for Stage 4 final demand for finished goods capture the price of inputs for food manufacturers, motor vehicle assemblers, and machinery assemblers.

- While this inflation measure is trending, the rate of slowing suggests it will be many months of additional price increases being passed to finished goods companies. So, expect many months for inflation -- best case -- 6 to 9 months of inflation going forward.

- Another source of inflation is primary metal manufacturers: manufacturers of steel, copper, and foundries. This index is a weighted average of price increases. The index in January 2021 is 100, and we are up 64 percent since January; we may have reached a peak period in terms of pricing, but that is still 60 percent higher than 2021.

- Trucking is also seeing strong inflationary trends. Full Truckload has started cooling and has dropped a little bit, but is still up about 25 percent YOY. Carriers are disciplined with pricing and getting unprofitable freight out of their network -- so expect little price relief this year.

- Air freight prices in June are 80 percent above 2019 (Asia) and 40-50 percent above 2019 for Europe. These, too, are not going down.

- Container spot prices went up to $12,000 in October 2021, but last week we were at about $7,500. This is down from the peak in 2021, but remember when it was $1,800 before COVID? It won’t be going back there any time soon. So where will it level off? It likely will go to $6,000 and stabilize.

To summarize: we are not going into recession, but you can still count on continued supply disruptions, ongoing price increases, and ongoing labor shortages. We are in a new world -- one in which we need to let the data tell us what is going on and not rely on prior economic theory, which has never seen conditions like this before.

(Note: Dr. Rob Handfield is a Co-Founder and Director Emeritus of Beroe Inc. A version of this article first appeared in NCSU’s Supply Chain Resource Cooperative website)

Recommended Reads:

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe