Beroe Survey: Procurement Worried About Energy Shortage and Recession

Data Collection and Compilation by Mirza Zack

Inflation, the war in Ukraine, the threat of recession, and energy shortages are the four big worries of Procurement and Supply chain professionals across the globe.

Below are the latest developments on these four fronts:

Peaking Inflation

In an interview with Bloomberg TV from the Cop27 climate summit in Egypt, Kristalina Georgieva, the IMF’s managing director, said there were signs that the global price inflation is nearing its peak.

“It is very possible that we are peaking,” she said in an interview with Bloomberg TV. “We now see central banks very united on fighting inflation as a top priority and rightly so. If we don’t succeed, it would de-anchor and then the foundation for growth which is price stability is dented”.

However, the IMF chief warned that a fragmentation in global manufacturing supply chains could make it harder to push measured inflation rates back down to the levels seen in recent years before the Covid pandemic.

Energy Shortage Avoided For Now

On the energy front, things look a bit less gloomy for now. While the bills may be high, Europe will survive this winter: EU countries stocked up on enough oil and gas to get through the heating seasons.

Europe’s gas storage is more than 90 percent full, according to the International Energy Agency, providing some assurance against a major shortage. However, a large proportion of that is made up of Russian gas imported in previous months, which likely won’t be available at all by winter of 2023.

“We are in good shape for this winter,” Eni chief Claudio Descalzi recently told CNBC. “But as we said, the issue is not this winter. It will be the next one, because we are not going to have Russian gas – 98% [less] next year, maybe nothing.”

Guard Against Nuclear Escalation

The Wall Street Journal has reported that U.S. National Security Adviser Jake Sullivan has held confidential discussions with his Russian counterpart, Security Council secretary Nikolai Patrushev, and senior Kremlin foreign policy aide Yuri Ushakov, over the past several months.

Senior officials told the paper the officials had discussed ways to guard against the risk of nuclear escalation in the war in Ukraine, but had not engaged in any negotiations around ways to end the conflict.

Recession Threat

As central banks across the world hike interest rates in response to inflation, the world may be edging toward a global recession in 2023 and a string of financial crises in emerging market and developing economies that would do them lasting harm, according to a comprehensive new study by the World Bank.

Supply chain disruptions continue to haunt the global economy and the study shows that unless supply disruptions and labor-market pressures subside, those interest-rate increases could leave the global core inflation rate (excluding energy) at about 5 percent in 2023 -- nearly double the five-year average before the pandemic.

“Global growth is slowing sharply, with further slowing likely as more countries fall into recession. My deep concern is that these trends will persist, with long-lasting consequences that are devastating for people in emerging market and developing economies,” said World Bank Group President David Malpass in a statement published by the institution in September. “To achieve low inflation rates, currency stability and faster growth, policymakers could shift their focus from reducing consumption to boosting production. Policies should seek to generate additional investment and improve productivity and capital allocation, which are critical for growth and poverty reduction.”

Beroe Survey

Beroe recently ran a survey to figure out the current situation as far as energy and inflation worries are concerned. Procurement professionals from about 70 companies across the globe participated in the survey.

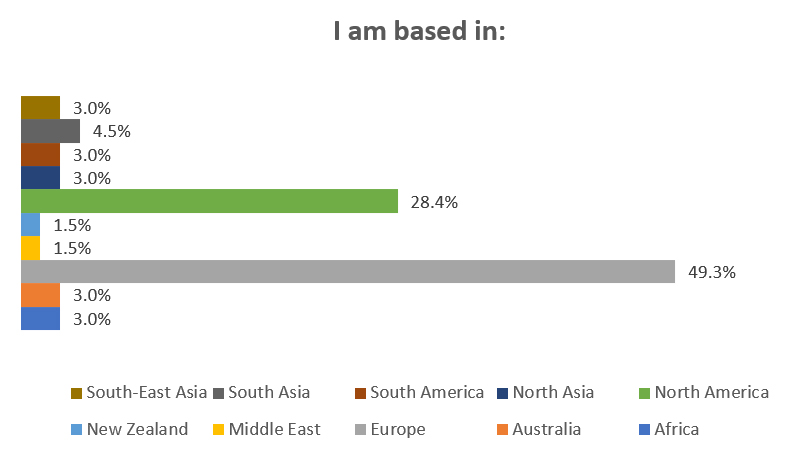

- A majority of survey respondents were based in North America and Europe.

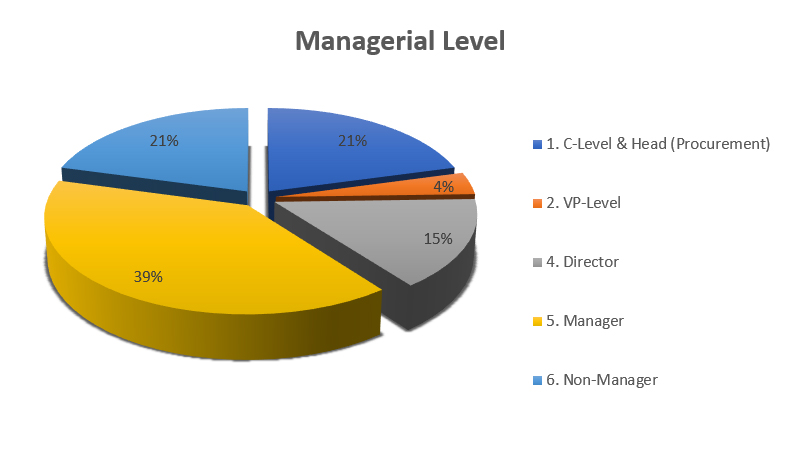

- One in five respondents were C-Level and Head of Procurement. A majority of them were managers.

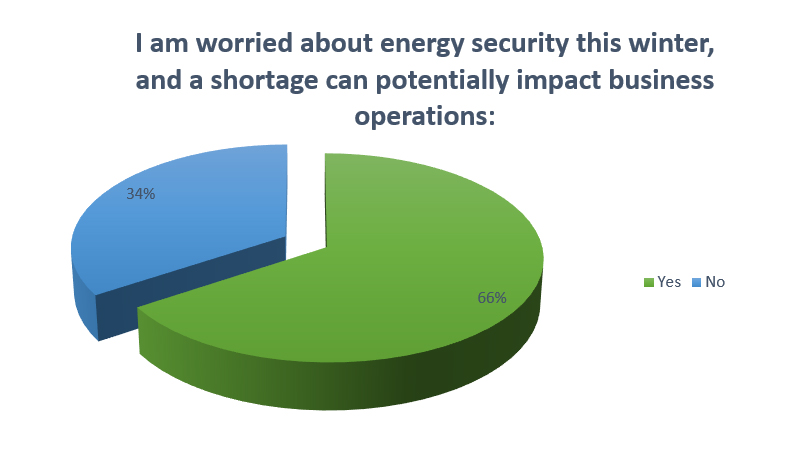

- Most respondents said they are worried about energy security this winter, and a shortage can potentially affect business operations. This is interesting because despite the data which shows Europe is well positioned this winter in terms of energy supply, people are still worried about shortages and disruptions.

- More importantly, people said they are more worried about recession than price and cost inflation. This shows that planning becomes crucial to encounter the economic storm.

-

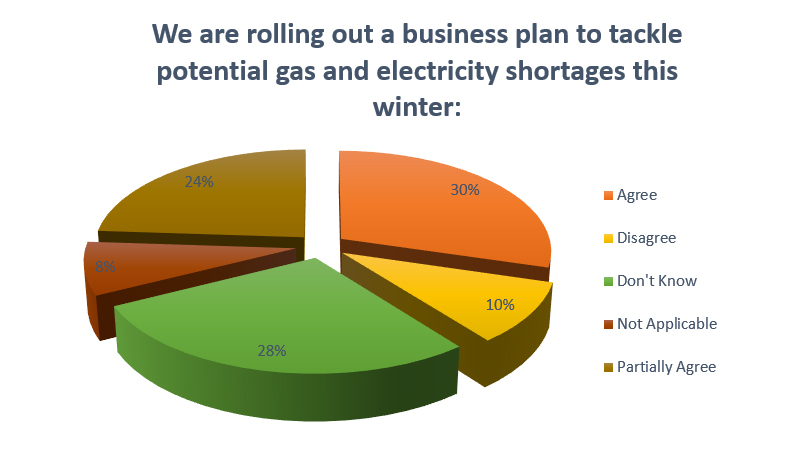

Most respondents agreed that their company is rolling out a business plan to tackle potential gas and electricity shortages this winter.

Select comments from respondents. We are not revealing the names as they are not authorized to speak on behalf of their companies.

-- “We are working with our sites and our suppliers to understand risk, plan mitigation activities and determine potential impacts”.

-- “Have already identified areas of risk and, where risks exist (where gas is used) preemptively instructed key locations purchase for example, electric heaters or other equipment in anticipation of this issue”.

-- “Energy reduction initiatives, acceleration of renewable source at sites + PPA, VPPA”.

-- “Have already contracted last year and hedged the remaining earlier this year with minimal impact”.

-- “Inventory and request that our 3PLs have implemented necessary measures and BCPs”.

-- “All our products are manufactured by Contract Manufacturers. However, we discuss this topic in the regular Business Review Meetings”.

-- “We are aiming to fix prices, and where possible procure in advance”.

-- “We are taking aggressive steps to mitigate energy risks to European operations”.

-

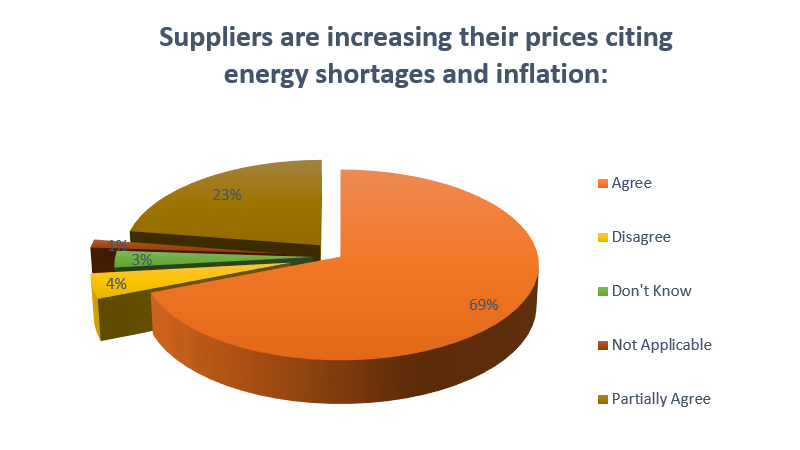

A majority of respondents told Beroe that suppliers have increased prices citing inflation and energy shortages. It will be interesting to note how this dynamic will change when recession hits home.

Select comments from respondents.

-- “Yes it’s becoming a constant issue, takes me back to the 80s”.

-- “Logistics shortages are a key issue, especially the availability of ship cargo prepared to go to the Asia Pacific region when shorter voyages can be more profitable”.

-- “Our Natural Gas price is indexed to Suppliers' formula as per contract”.

-- “Primarily in Europe, however capacity shutdowns in Europe due to high energy prices are now impacting prices in North America as trade flows reverse on some commodity chemicals”.

-

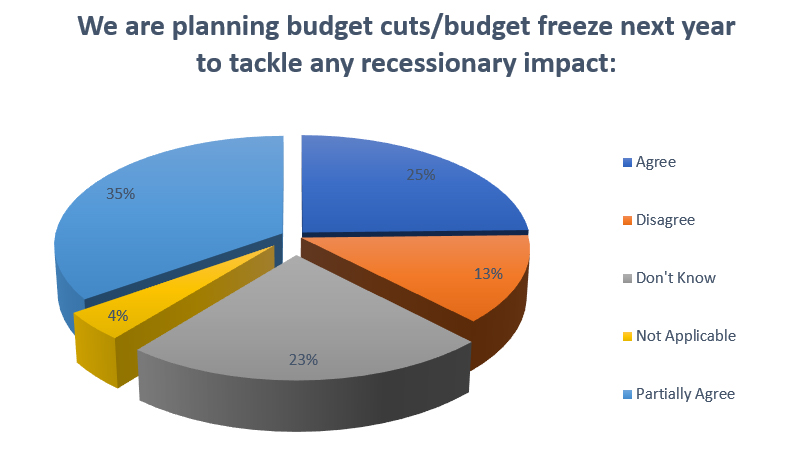

Suppliers who are running a hard bargain must take a step back for now because most respondents told Beroe that they are planning a budget cut or budget freeze next year to tackle any potential recessionary impact.

-

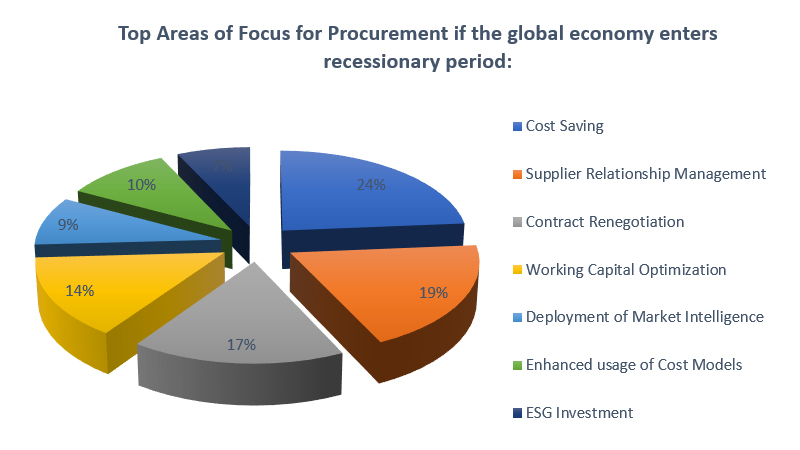

Cost Saving, Supplier Relationship Management, and Contract Renegotiation are the top three Procurement priorities if the global economy enters a recessionary period.

Select comments from respondents.

-- “Shorter cycles between RFPs to quickly capture falling rates”.

-- “Strong supplier relationships have carried us through the last two years and will be even more critical in the looming supply environment”.

-- “This is already affecting us downstream”.

Conclusion

Ever since the outbreak of the Covid-19 pandemic, global supply chains are facing one crisis after the other. However, these times of crisis have also highlighted the importance of having a strong, professional procurement team. It will be interesting to follow how Procurement teams across the globe recalibrate their strategy and tactics when the global economy enters a recessionary period.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe