The Procurement Beige Book: Summary Sheet (Q3 2023, July-September)

The Procurement Beige Book, a quarterly publication from Beroe, evaluates and reports the level of favorability for sourcing a wide range of commodities, materials, products, and services.

Methodology

Category Softness: Beroe monitors movements in price, input costs, supply-demand gaps (or demand for categories with largely elastic supply), and market competition, determining whether each parameter is favorable, unfavorable, or neutral based on its direction (increase or decrease) and magnitude of change. These favorability levels are then amalgamated to form a unique indicator known as "category softness." Higher category softness signifies more favorable sourcing conditions.

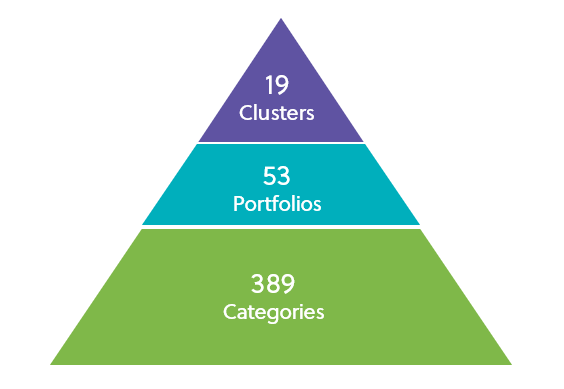

Roll-Up: Each category monitored falls under a portfolio of similar categories, and related portfolios together constitute a cluster. The favorability across the four key parameters for each category within a portfolio is computed to determine the overall favorability and softness at the portfolio level. The relative importance of each category within a portfolio is accounted for in this roll-up. This procedure is replicated with related portfolios within a cluster to deduce the level of favorability and overall softness at the cluster level.

Scale and Scope

The Procurement Beige Book encompasses softness data for 400 categories, 53 portfolios, and 19 clusters, with softness dashboards available for 334 categories. Our analysts track between 30 and 140 data points per category to furnish softness data and dashboards.

Summary

Considering all clusters, the overall category softness remains neutral this quarter. No cluster exhibits signs of unfavorable sourcing conditions. Sourcing conditions are improving across clusters such as Pharma R&D and Corporate Services within the Q3-Q4 2023 timeframe. Notably, conditions are not anticipated to deteriorate substantially in Q3 and Q4 2023 across other vital clusters, including chemicals, metals and minerals, agriculture, packaging, and industrial manufacturing.

|

|

Improving |

Stable |

Worsening |

|---|---|---|---|

|

Categories |

49 |

259 |

81 |

|

Portfolios |

15 |

21 |

17 |

|

Clusters |

2 |

13 |

4 |

|

|

Favorable |

Neutral |

Unfavorable |

|---|---|---|---|

|

Categories |

52 |

303 |

34 |

|

Portfolios |

3 |

45 |

5 |

|

Clusters |

0 |

19 |

0 |

Chemicals

Conditions remain neutral within the chemicals cluster and all its portfolios, albeit with a slight overall worsening. Conditions are improving in the industrial acids portfolio; elastomers, bulk chemicals, and fertilizers remain stable. However, conditions in pigments, resins, silicones, and solvents portfolios are likely to deteriorate from Q3 to Q4 2023. Despite current price stability, adverse input costs and supply-demand gaps suggest a potential worsening through Q4 2023 and into early Q1 2024.

Metals and Minerals

Conditions persist as neutral at the metals and minerals cluster level, experiencing a mild worsening. The metals portfolio is expected to see improvement in Q4, while the minerals portfolio is projected to remain stable. The neutral supply-demand and price indices, along with input costs, suggest a mild softening by Q4 2023.

Mining

Stability is likely to prevail in the mining cluster, with all portfolios poised for a mild improvement despite neutral sourcing conditions. Price and input cost conditions are anticipated to enhance across equipment, consumables, and services in Q3 and Q4 2023, with the supply-demand situation and market competition remaining neutral or favorable.

Industrial Manufacturing

Relatively stable category conditions are forecasted to continue within the industrial manufacturing cluster. The electronic components portfolio is expected to maintain neutrality over the next two quarters, while conditions in the industrial processes and mechanical components portfolios are likely to stay in the neutral to favorable spectrum. The ongoing neutral to favorable supply-demand index for critical inputs in electrical and mechanical components could drive improvements in future periods.

Energy

Category conditions are projected to hold steady at the energy cluster level through Q3 - Q4 2023. Although all portfolios are in the neutral range, the price and input cost indices are unfavorable for electricity and diesel. The price index for Crude Oil is unfavorable, but the enduring favorable supply-demand index, barring any geopolitical shocks, points to a softening in downstream categories in Q4 2023 and Q1 2024.

Agricultural Commodities

The agricultural commodities cluster presents neutral conditions. All portfolios are in the neutral range, with five out of ten portfolios experiencing improved sourcing conditions, and three maintaining stability. The supply-demand situation and market competition are neutral to favorable across nine portfolios, indicating possible enhancements if these conditions persist. However, the seafood portfolio has significantly deteriorated, potentially leading to challenging sourcing conditions through Q4 2023.

Packaging

Conditions remain neutral at the packaging cluster level, with all three portfolios holding steady in Q3 and Q4 2023. There is a deterioration in Paper Packaging due to rising pulp prices, and an unfavorable price index for most resins, likely negatively affecting flexible packaging in Q4 2023 and Q1 2024.

Pharma Research and Development

Although conditions are neutral, they are improving substantially at the pharma research and development cluster level. The price, input cost, and supply-demand indices are unfavorable for Pharma materials and formulations, while the input cost is high for clinical services, and supply-demand is challenging for the biologics portfolio. However, the price index is neutral, and both the demand index and market competition have improved across other portfolios in this cluster.

Exploration and Production

The exploration and production cluster maintains neutral conditions, with the oil and gas services and consumables portfolios experiencing improved supply-demand indices and market competition in Q3 and Q4 2023. This improvement suggests potential enhancements in category conditions in the forthcoming periods.

Indirects

Conditions remain largely stable and neutral across indirect clusters and portfolios. There has been a mild worsening in the IT cluster in Q3 2023 due to rising billing rates. Freight services are also neutral, but a climbing input cost index signals potential deterioration in Q4 2023 and Q1 2024. Conditions are neutral yet declining in Facilities Management, with an adverse Price index affecting key categories like Commercial Real Estate and Waste Management.

Marketing Services: Conditions are stable and neutral across the marketing services portfolio, with demand growing for key categories, and inflation impacts stabilizing.

Corporate Services: Conditions are neutral but improving, expected to continue in the coming periods.

Staffing Services: Conditions are stable and neutral with steady demand.

Employee Benefit Services: Conditions maintain neutrality at the portfolio level.

Banking Services: Conditions are stable and neutral, projected to persist in the following periods.

Freight Services: Conditions are set to remain neutral, edging towards favorable. A sluggish demand for ocean freight is anticipated to continue into Q2 2023.

IT – Software, Infrastructure & Services: Conditions are neutral, with an adverse Price Index due to escalating billing rates.

Facilities Management: Conditions are neutral but deteriorating for some critical categories, though this trend is not expected to continue.

MRO: Conditions are stable and neutral, likely to persist in upcoming periods.

Engineering & Construction: Conditions are stable and neutral, anticipated to maintain this status in future periods.

Engineering & Construction: Conditions are currently stable and neutral, with similar trends expected to persist in the upcoming periods

Category Highlights

During the Q2 2023 timeframe, the category conditions are expected to be unfavorable for corn, rice, salmon, ABS, polypropylene, polystyrene, acetone, propylene glycol, diesel, tin, chromatography resins, cell culture media, records management, physical security services, hazardous/solid waste management, artificial intelligence, IT managed security services, and IT services outsourcing.

Conversely, category conditions are anticipated to be favorable for gum turpentine, vanillin, onions, potatoes, ace-k, aspartame, saccharin, soda ash, copper and copper semis, blister packaging, jerry cans, thermoformed trays, and investment management.

Categories such as guar gum, acrylic acid, orange oil, glycerin, aluminum, aluminum foils, flexible intermediate bulk containers (FIBC), lotion pumps, deep freezers, lab centrifuges, lab supplies, API povidone iodine, bearings, cash-in-transit services, integrated facilities management, business intelligence, robotic process automation, debt collection services, and personal computing are expected to exhibit the most significant improvement in softness.

In contrast, the softness is expected to deteriorate most significantly for Mentha oil, tuna, caustic soda, nylon, polystyrene, glycol ethers, tin, zinc, fluff pulp, liquid chromatography, records management, big data solutions, service integration and management (SIAM), commercial print services, and laundry services

To access the full report, please log on to Beroe LiVE.Ai

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe