The Procurement Beige Book Summary Sheet -- Q1 2023, January-March

The Procurement Beige Book is a quarterly report from Beroe that analyzes the availability and pricing trends for a wide range of commodities, materials, products, and services, helping procurement professionals stay up-to-date with market developments and make informed sourcing decisions.

Category Softness: Beroe tracks movements in price, input cost, supply-demand gap (or demand, in the case of categories where supply is largely elastic), and market competition, and identifies whether each of these parameters is favorable, unfavorable, or neutral based on the direction (increase or decrease) and magnitude of change. The favorability levels of the four parameters are combined to provide a unique indicator called "category softness." A higher category softness indicates more favorable sourcing conditions.

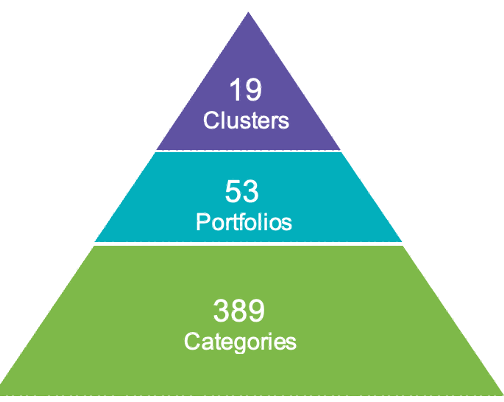

Roll Up: Each category tracked is part of a portfolio of similar categories, and a collection of related portfolios constitutes a cluster. The level of favorability across the four key parameters for each category in a portfolio is used to determine the level of favorability and overall softness at the portfolio level. The relative significance of each category in a portfolio is considered in this roll up. This process is repeated with related portfolios within a cluster to determine the level of favorability and overall softness at the cluster level.

Scale and Scope:

The Procurement Beige Book covers softness data for 400 categories, 53 portfolios, and 19 clusters. Softness dashboards are available for 334 categories. Our analysts track a minimum of 30 to a maximum of 140 data points per category to provide softness data and dashboards.

Summary:

The overall category softness -- when all clusters are considered together -- remains neutral in this quarter.

No cluster exhibits evidence of unfavorable sourcing conditions. Sourcing conditions are improving across clusters like Chemicals, IT, Pharma R&D, and Facilities Management in the Q1-Q2 2023 timeframe. Conditions are not expected to worsen considerably in Q2 and Q3 2023 across other critical clusters, such as metals and minerals, agro, packaging, and industrial manufacturing.

Sourcing Conditions Snapshot

|

|

Improving |

Stable |

Worsening |

|

Categories |

93 |

250 |

46 |

|

Portfolios |

15 |

26 |

12 |

|

Clusters |

4 |

15 |

0 |

|

|

Favorable |

Neutral |

Unfavorable |

|

Categories |

73 |

296 |

20 |

|

Portfolios |

7 |

45 |

1 |

|

Clusters |

0 |

19 |

0 |

Chemicals

The conditions in the chemicals cluster remain neutral, with conditions improving in three portfolios and the rest remaining stable in the Q1 to Q2 2023 timeframe. The entire cluster and portfolios fall in the neutral or favorable band. Prices and input costs have increased and are unfavorable in the elastomers portfolio, and close to unfavorable in the industrial acids portfolio. The supply-demand situation is neutral to favorable across all portfolios, indicating further softening in the near future.

Metals and Minerals

The conditions remain neutral at the metals and minerals cluster level and have experienced mild worsening. Conditions in the metals portfolio are likely to improve in Q2, whereas the minerals portfolio has witnessed a slight worsening towards unfavorable sourcing conditions. Though price movement is unfavorable in this portfolio, the neutral input cost and supply-demand indices indicate mild softening by Q3 2023. Favorable supply-demand index coupled with neutral price and input cost indices suggest potential softening in the metals portfolio as well.

Mining

The conditions are likely to remain stable in the mining cluster. All portfolios are expected to witness mild improvement, although the sourcing conditions were neutral. Price and input cost conditions are likely to improve across equipment, consumables, and services in Q2 and Q3 2023 as the supply-demand situation and market competition remain neutral or favorable across these portfolios.

Industrial Manufacturing

The fairly stable category conditions are expected to continue in the industrial manufacturing cluster. The supply-demand scenario in the electronic components portfolio is anticipated to remain in the neutral territory for the next two quarters, while conditions in the industrial processes and mechanical component portfolios continue to be in the neutral to favorable territory. A stable to favorable supply-demand index for critical inputs in electrical and mechanical components can drive improvement in subsequent periods.

Energy

The category conditions are likely to remain stable at the energy cluster level during Q1 – Q2 2023. Although all portfolios fall in the neutral band, the price and input cost indices are unfavorable for natural gas, electricity, and diesel. The stable to marginally favorable supply-demand conditions in many of these categories indicate potential softening in Q3–Q4 2023.

Agricultural Commodities

The conditions are neutral in the agricultural commodities cluster. All portfolios fall in the neutral band, with 5 out of 10 portfolios experiencing improved sourcing conditions and three remaining stable. The supply-demand situation and market competition are neutral to favorable across 9 out of 10 portfolios, signifying potential improvement if these conditions prevail. Conditions have improved in the food additive portfolio in Q1 2023, and this trend is likely to continue into Q2 2023 as well.

Packaging

The category conditions are neutral at the packaging cluster level, with all three portfolios in the neutral to favorable territory in Q1 and Q2 2023. Input cost conditions for paper and plastics raw materials are mostly neutral, however, aluminum and polypropylene prices are expected to increase in Q2 and Q3 2023, which may result in a slight deterioration in the rigid packaging portfolio.

Pharma Research and Development

The category conditions are neutral but improving considerably at the pharma research and development cluster level. The input cost index is unfavorable for pharma materials and formulations, as well as drug manufacturing services. However, the price index is neutral across portfolios, and the demand index and market competition have improved across most portfolios in this cluster.

Exploration and Production

The conditions remain stable and neutral in the exploration and production cluster as the oil and gas services and consumables portfolios witness improved supply-demand index and market competition in Q1 and Q2 2023. However, price and input cost indices are unfavorable in the consumables portfolio, whereas the supply-demand index is likely to remain stable through Q2 2023. Improving market competition and supply-demand indices across both portfolios indicate potential improvement in category conditions in the upcoming periods.

Indirects

The conditions are largely stable and neutral across indirect clusters and portfolios. There has been improvement towards neutral conditions in the IT cluster in Q1 2023, which is likely to continue into Q2 2023 with stable billing rates. Freight services also continue to be neutral with highly favorable price and supply-demand indices for ocean freight, which is likely to favorably impact most industries.

Marketing Services: The conditions are stable and neutral across the marketing services portfolio. Demand continues to grow for key categories in the portfolio, and the impact of inflation appears to have stabilized.

Corporate Services: The conditions are stable and neutral, and they are likely to continue in subsequent periods.

Staffing Services: The conditions are stable and neutral, and demand remains stable.

Employee Benefit Services: The conditions continue to be neutral at the portfolio level.

Banking Services: The conditions are stable and neutral, and they are likely to continue in subsequent periods.

Freight Services: The conditions will continue to be neutral and border on favorable. Sluggish demand for ocean freight is expected to continue in the Q2 2023 timeframe.

IT – Software, Infrastructure & Services: Conditions have improved, and the impact of inflation appears to have stabilized.

Facilities Management: The conditions are stable and neutral, and they are likely to continue in subsequent periods.

MRO: The conditions are stable and neutral, and they are likely to continue in subsequent periods.

Engineering & Construction: The conditions are stable and favorable, and they are likely to continue in subsequent periods.

Category Highlights:

The category conditions are expected to be unfavorable for onions, rapeseed oil and meal, crude oil, electricity, urea, penicillin, rare earth elements, API povidone iodine, acrylic acid, epoxy resins, tin, pork, diesel, zinc, polypropylene, ABS, and aluminum during the Q2 2023 timeframe.

Category conditions are expected to be favorable in sodium cyanide, ocean freight, eggs, propylene glycol, base oil – group II, toluene, sulfuric acid, ammonia, strawberries, hops and adjuncts, rice, fluff pulp, pulp, active components, guar gum, corn, glycerin, polystyrene, cocoa, potatoes, vitamin C, and vitamin B.

Base oil – group II, sulfuric acid, lactic acid, eggs, high fructose corn syrup, natural rubber, dimethicone, silicones, vitamin B, vitamin C, and guar gum are expected to show the greatest improvement in category softness.

The category softness is expected to worsen the most in gum turpentine, onions, oranges, saccharin, and urea.

(Note: The Procurement Beige Book report will be available for subscribers on the Beroe LiVE.Ai platform on May 24. Not a subscriber? Please write to contactus@beroe-inc.com)

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe